January was supposed to be the month of great expectations for the housing market but it turned out to be a month of great disappointments instead.

Sales volumes and selling prices were both lower than expected, providing what is, perhaps euphemistically, being referred to as a subdued start to 2026.

January is always a pretty rubbish month as far as housing sales go, because for the first half of the month the market is still in hibernation mode for the Christmas/New Year break.

New listings begin flooding in during the second half of the month, but by the time the listing arrangements are completed and the marketing campaigns have run their course, it's usually February before listings start turning into sales in any meaningful way.

According to the Real Estate Institute of New Zealand, January's sales were down 5.4% compared to January last year, while the REINZ House Price Index was down 0.7% over the same period.

So although January is usually a rubbish month, this January was a bit more rubbishy than last year.

What made it especially rubbishy was the fact that sales and selling prices were down while new listings and total stock levels were up. You can read more about that here.

One of the key features of the housing market last year was the high levels of stock for sale relative to the number of properties being sold.

That created a buyer's market, which in turn maintained downward pressure on prices.

Two of the key indicators of that are the number of dropouts and the size of the market overhang each month.

Dropouts are the number of properties withdrawn from sale each month, either because they have been delisted completely, or because they remain technically for sale, but are no longer being actively marketed.

Interest.co.nz estimates there were around 2400 dropouts in January, up 10% and the highest number of dropouts in the last 10 years.

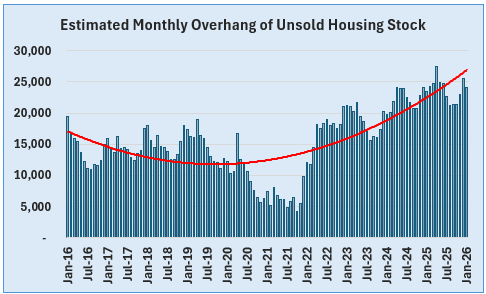

The overhang is the number of properties that have been on the market for at least a month but remain unsold.

Interest.co.nz estimates there was an overhang of just over 24,000 properties in January which was also a decade high for the month of January. See the graph below for the trend over the last 10 years.

While we shouldn't read too much into the January figures, with it being such a rubbishy month and all, what these figures do suggest is the buyer's market that persisted for most of last year is continuing into 2026.

Whether that remains the case as the year progresses we will have to wait and see.

6 Comments

🥂

MEET THE MARKET!

NZ economy is based on consumption, underpinned by decades of massive immigration from third world countries. The three main ecomonc drivers is our ability to grow grass, attract tourist because of our weak currency and the other, and most important economic driver is our reliance on selling poorly made houses to each other at ever increasing prices. That ship has sailed.

The 40 year period of forever increasing property prices ended dead, cold, kaput in 2021.

Some idiots think this stupid merrygoround will start running again. Fools and their money, will be parted.

'Rubbishy' oh the eloquence, the linguistic sophistry! 😅

Gangbusters at Bayleys Auckland Central this morn.

🥂 🐎

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.