Residential rental yields have shown very little movement in the second quarter (Q2) this year compared to a year earlier, due to relatively flat house prices and rents, but cash flows have improved due to lower interest rates.

However the overall attractiveness of residential investment property at current prices and rents is relatively lackluster in the absence of capital gains.

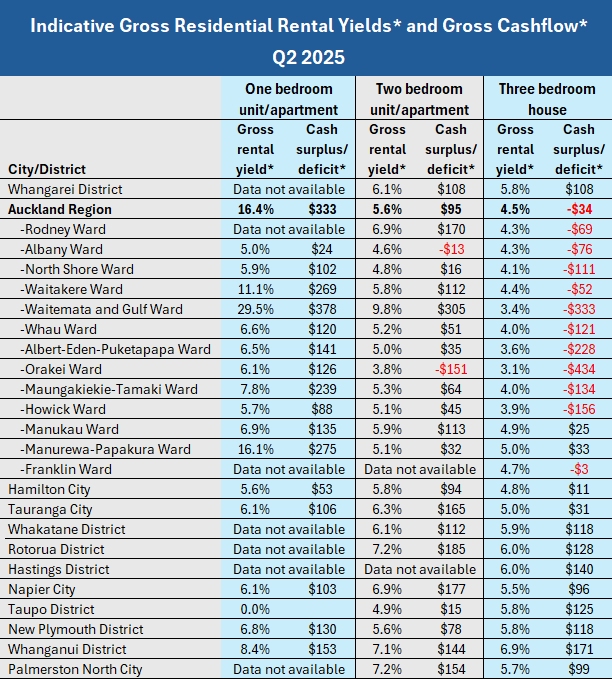

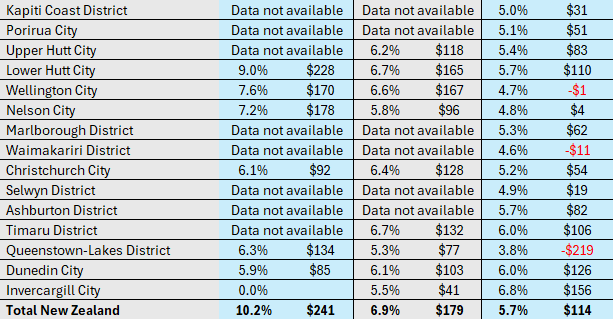

Interest.co.nz tracks the theoretical gross rental yields that would be achieved in 39 urban districts around the country where there is a high level of rental activity, based on the Real Estate Institute of NZ's lower quartile selling prices and median rents from Tenancy Services' bond data.

Interest.co.nz also estimates the likely mortgage payments on the same properties and compares that to rental income, to calculate the gross cash surplus or deficit available to investors after the mortgage has been paid - see the notes below for a more detailed explanation of these calculations.

The information is updated quarterly for the three main types of rental properties - one and two bedroom units/apartments and three bedroom stand alone houses in each urban area - with the results for Q2 this year displayed in the table below.

Three bedroom houses remain the worst performing class of residential property investment, in terms of both yield and cash flow.

Across the entire country these provided a gross rental yield of 5.7% in Q2, down slightly from 5.8% in Q2 last year, while the free cashflow after paying the mortgage increased to $114 a week, up from $47 a week in Q2 last year.

The improvement in cashflow was largely the result of the mortgage interest rate used in the repayment calculations declining from 6.50% in Q2 last year to 4.96% in Q2 this year.

The potential returns from three bedroom houses were particularly poor in the Auckland region with an average gross rental yield of 4.5% and negative cashflow of $34 a week once the mortgage was paid.

Looking at council ward areas within Auckland (see the map below for ward boundaries), the gross yields ranged from 3.1% to 5.0%, while gross cashflow ranged from a deficit of -$434 a week in Orakei Ward to a surplus of $33 a week in Manurewa-Papakura Ward.

However these cashflow figures are gross, and do not account for the effects of periods of vacancy on rental income, or for outgoings such as rates, insurance, maintenance and any property management fees.

Once those costs are factored in, likely cashflows for three bedroom houses in Auckland would almost certainly be strongly negative in all Auckland Council wards and the rent received would be nowhere near enough to cover all of the costs, meaning investors would have to dig deep into other income to cover both the mortgage payments and other outgoings.

One and two bedroom properties in multi-unit blocks such as home units and apartments continue to provide better returns for investors compared to three bedroom houses.

Across the entire country, the average gross rental yield was 6.9% for two bedroom units/apartments and a respectable 10.2% for one bedroom units/apartments in Q2 this year.

Gross cashflows were also much stronger for one and two bedroom units, at an average $179 a week surplus for two bedroom units and a $241 a week surplus for one bedroom units.

Even in Auckland, the average gross yield was 5.6% for two bedroom units and a whopping 16.4% for one bedroom units, while gross cash surpluses were $85 and $333 a week respectively.

However the strong yield and cash surplus numbers for one bedroom units in Auckland need to be treated with caution.

That because a lot of the one bedroom properties sold and rented are located in the city's CBD and included in the Waitemata and Gulf Ward figures.

Many of these apartments are on leasehold titles and/or have remediation issues, and these types of properties generally sell at substantial discounts compared to freehold units and those without defects.

The much lower prices push up their yields, which looks good on paper, but investors will pay much higher outgoings for ground rent payments and/or future capital expenditure to cover remediation work.

So investors will need to do their sums carefully when considering buying these types of properties.

Overall, the figures suggest that in the absence of capital gains, investors may struggle to find worthwhile returns from three bedroom houses.

The pickings will likely be better in multi-unit dwellings such as home units, apartments and terrace housing.

However cash flows on these types of properties may also be tight once outgoings are factored in, which suggests investors will need to be choosey in the hunt to find something that offers an adequate return in the current market.

The comment stream on this article is now closed.

Notes: Gross rental yield is based on the REINZ's lower quartile selling price for each type of property in each urban district in Q2 and median rent figures from Q2 bond data from Tenancy Services for the same property types/districts.. Mortgage calculations are based on a mortgage for 60% of the lower quartile price over a 20 year term. Mortgage rate used for Q2 was 4.96%. Where a property type in the yield table above is marked as "data not available," that is because there was an insufficient number of properties of that type sold and/or rented in that area during the quarter to produce a reliable yield figure.

Auckland Council Ward Areas

13 Comments

Almost a third of landlords are now cutting their rents to get tenants. If the government really wanted to destroy property values they could easily do it by stopping immigration for a few years. It becoming apparent that it's really rampant immigration keeping the investment property scheme alive.

https://www.rnz.co.nz/news/business/573370/landlords-cutting-rent-to-ge…

Its not a Capital Gain game

Its not a yield game

Its a bag holders game

The property bag gets soggier by the day....... the overleveraged should have quit their positions by now. Many are hanging by their fingertips.

Holding, only guarantees a bigger loss, when the bank intervenes.

Did you miss

cash flows have improved due to lower interest rates

IE net yield increasing. Obviously NOTHING beats gold, silver, diamonds, bitcoin, so you're safe

One factor, maybe

It becoming apparent that it's really rampant immigration keeping the investment property scheme alive.

TBH, nowhere near as bad as Aussie, mainly because young Aotearoans are jumping ship. The irony is that REA and auctioneer are on Aussie's Skilled Occupation List and migration programs. Immigration consultant are apparently listed as well.

I've invested for a long time and I've never made a decision based on average price and average rent. Property works when you buy something that is thoroughly poked, do the work to sort it out, and do some basic maths. If you're buying a nice home just around the corner then your numbers are going to look terrible. Do these investors actually exist or are we just trying to make people angry online again.

The investors who are truly up the creek are OPES/Williams townhouse buyers from the last 4 years and counting. Going backwards without any land value to show for it, with a lot more supply due the minute conditions improve.

DuVal investors are all looking for their paddle as well.

It's easy to improve your yield in this type of market.

Just value your property at its true non speculative value.

Fair cop. That's exactly the reason given for upping rents for so many years.

Drop the asset price a large amount and the NEW yield pops up nicely.....for the NEW BUYER!

Suggest the key action here is pay that true price, and if mortgaged, have that in balance to the income. Clearly the lolly scramble of the last twenty years plus has not been this.

Chris Joye did mention asset prices needed to be valued by yield, funny commercial property is always sold vs yield, but residential listings stopped mentioning it about 2013

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.