Moving into a home of their own became slightly less affordable for first home buyers in November, with a small increase in house prices at the bottom of the market partially offset by a small decrease in mortgage interest rates.

According to the Real Estate Institute of NZ, the national lower quartile house price increased by $20,000 (3.3%) to $620,000 in November from $600,000 in October. The average of the two-year fixed mortgage rates charged by the main banks declined to 4.49% in November from 4.51% in October.

Although the increase in the lower quartile price, the price point at which 75% of prices are above and 25% are below representing the most affordable end of the market, wasn't dramatic, it was the third consecutive monthly increase in the lower quartile price. This has risen to $620,000 in November from $580,000 in August, a 6.9% increase over three months.

Over the same period, the average two-year fixed mortgage rate has decreased to 4.49% from 4.77%.

So how have first home buyers fared between the two seemingly opposing forces of higher prices and lower interest rates over the last three months?

Unfortunately they are worse off.

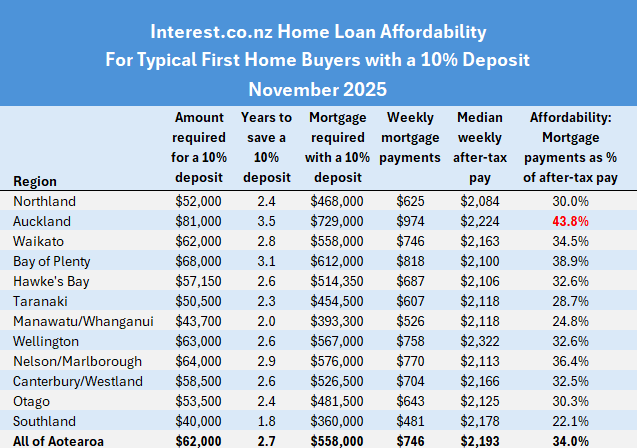

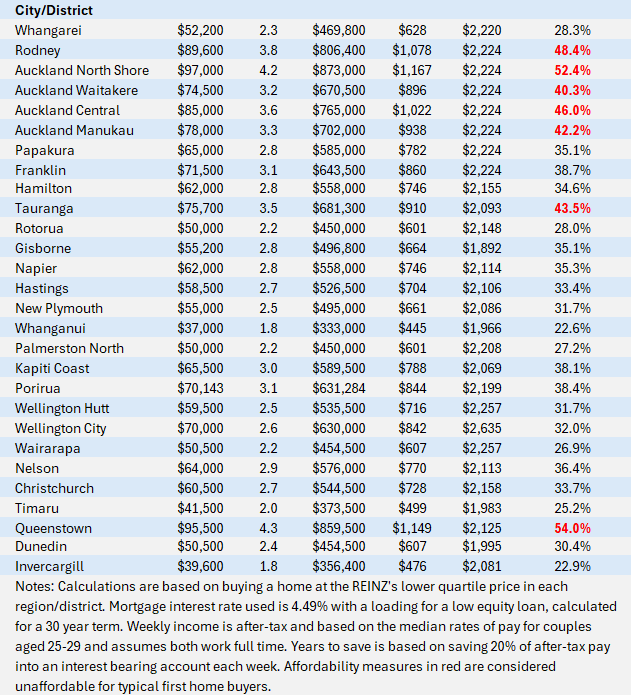

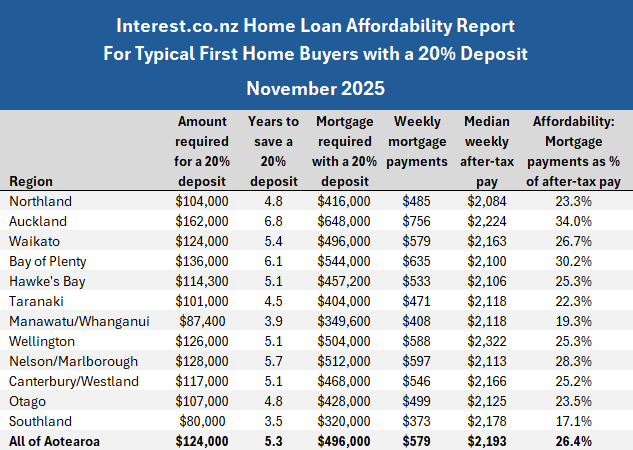

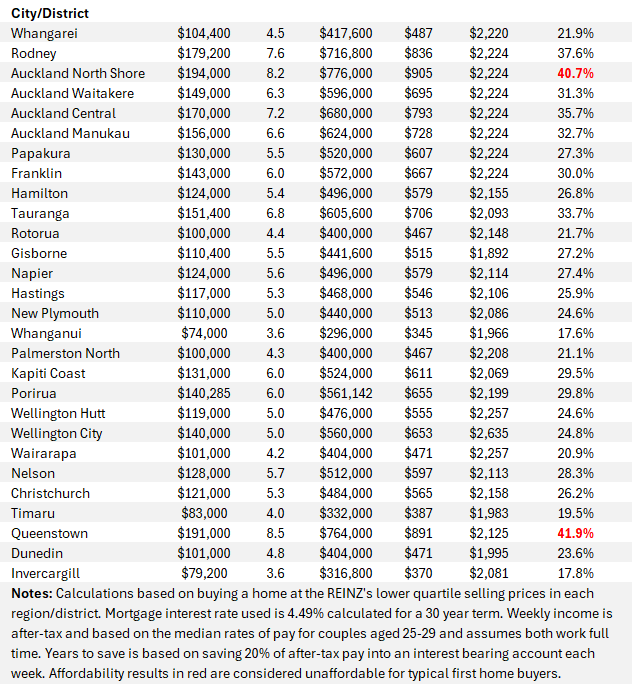

Interest.co.nz estimates the mortgage payments on a home purchased at the lower quartile price with a 10% deposit would have increased from $720 a week in August to $746 a week in November, or from $560 to $579 a week with a 20% deposit.

When changes in after-tax rates of pay for typical first home buyers are taken into account, the percentage of a couple's take home pay being eaten up by mortgage payments would have increased to 34% in November from 33% in August with a 10% deposit, or to 26.4% from 25.6% with a 20% deposit.

While the latest changes to affordability levels are small, they do highlight that falling mortgage interest rates do not necessarily benefit aspiring first home buyers when they simply flow through to higher prices. That's because buyers will need to scrape together a bigger deposit and borrow more to get into a home of their own. Although the banks wouldn't be complaining.

The tables below show the main affordability measures in all major urban districts for typical first home buyers with either a 10% or 20% deposit.

4 Comments

6.9% increase in 3 months.

Are investors back in this quartile creating competition?

Wonder what % of FHB v Investors actually buy in the lower quartile.

Regular readers would know that I've been looking to relocate back to ChCh / North Canterbury & kept a close eye on the market the 2nd half of this year. I missed out on a couple of serious offers & am over reading EQC, LIM & building reports however have this week had an offer accepted (subject to my due diligence).

Original, ~35 years old & needs renovation. I paid 5%% > RV & 55% > vendors cost 6 years ago. Waimakariri district.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.