A significant drop in house prices at the bottom of the market drove a substantial improvement in affordability for first home buyers at the start of the year.

According to the latest Real Estate Institute of New Zealand data, the national lower quartile selling price declined to $580,000 in January from $609,000 in December last year.

That's the second month in row the lower quartile price has declined, and it's now down $36,000 since November last year.

The lower quartile price is the price point at which 25% of sales are below and 75% are above, representing the most affordable end of the market.

Lower quartile prices declined in all regions except Nelson/Marlborough and Southland in January, with the biggest declines occurring in Auckland -$42,000, Taranaki -$35,300, Hawke's Bay -$35,000 and Wellington Region -$25,000.

Auckland's lower quartile price in January was the lowest it has been in any month of the year since September 2020, while Wellington's lower quartile price dropped to its lowest point since August 2020.

It is probably no coincidence but the latest decline in prices at the bottom of the market comes at the same time as mortgage interest rates have started tracking up.

The average of the two year fixed mortgage rates charged by the main banks appears to have bottomed out in the current cycle at 4.49% in November, rising to 4.72% in December and 4.74% in January.

However the effect of the modest rise in interest rates on mortgage payments was easily eclipsed by the decline in prices.

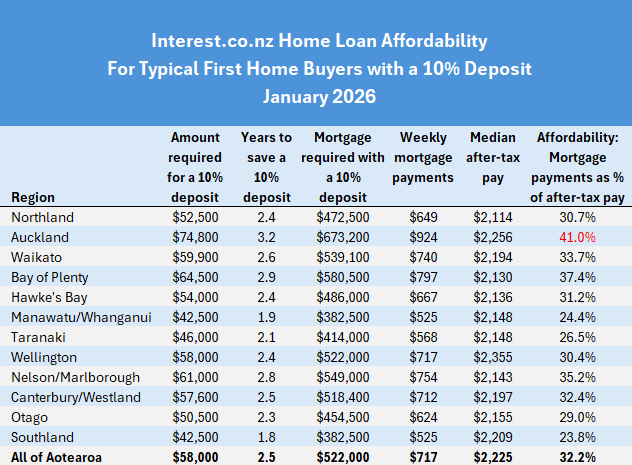

Interest.co.nz estimates the mortgage payments on a home purchased at the national lower quartile price with a 10% deposit would have declined to $717 in January from $751 a week in December, a reduction of $34 a week.

In Auckland the mortgage payments on a lower quartile-priced home purchased with a 10% deposit would have declined to $924 from $974, a reduction of $50 a week.

That represents a substantial improvement in affordability at the lower end of the market, which is even more pronounced when compared to incomes.

Interest.co.nz estimates the combined after-tax pay for a couple working full time at the median rates of pay for 25-29 year olds would have been $2225 a week, so mortgage payments of $717 a week would have eaten up just under a third (32.2%) of their take home pay.

Well within affordable limits

Mortgage payments are generally considered unaffordable if they take up more than 40% of after-tax income. So by that measure, housing at the national level is now well within affordable limits for typical first home buyers.

Using the above measures, housing at the national level is now the most affordable it has been since June 2021.

Even in Auckland, which has long been the most unaffordable region in the country and the one where it has been the most difficult for first home buyers to get into a home of their own, there has been a huge improvement in affordability.

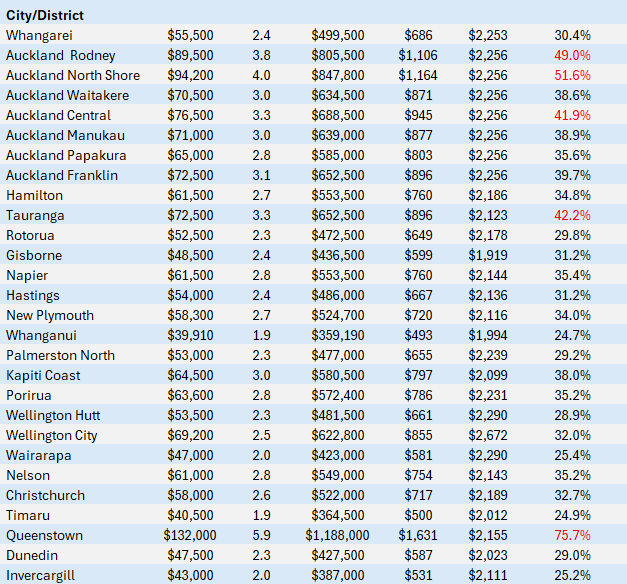

Lower quartile mortgage payments in Auckland were 41% of first home buyer income in January, within striking distance of dropping below the 40% affordability threshold.

Some parts of Auckland are already well within affordable territory such as Waitakere, Manukau, Papakura and Franklin.

Overall, housing in Auckland is now the most affordable it has been for aspiring first home buyers since September 2020.

However there are still challenges to overcome for aspiring first home buyers, including scraping together enough money for a deposit.

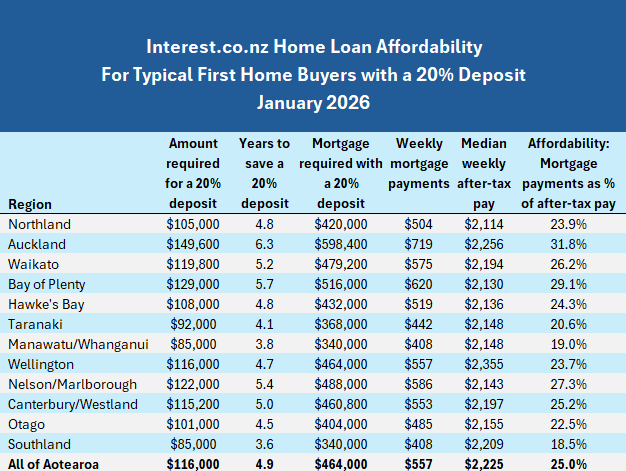

They would need to find $58,000 for a 10% deposit on a home at the national lower quartile price, or $74,800 for one in Auckland. And of course you can double those figures for a lower risk 20% deposit, which would avoid having to pay low equity fees on the mortgage.

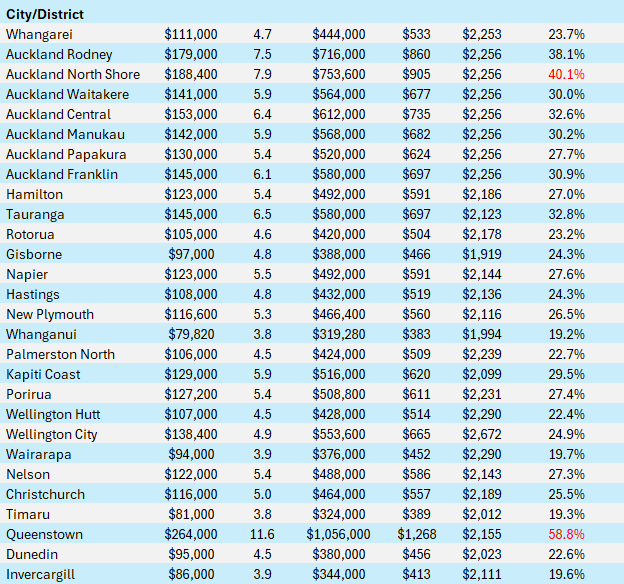

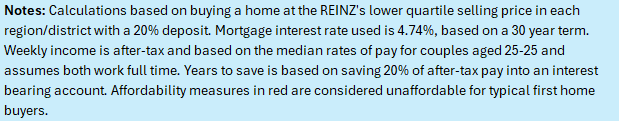

The tables below show the main home loan affordability measures in all urban centres around the country, for buyers with either a 10% or 20% deposit.

10 Comments

Let the home value slide continue, so a more healthy, less than 25% of income goes to service, much lower mortgages.

Great to see NZ ditch the forever more expensive housing mindset.

Many home hoarders will get burnt and financially fried. Thats what buying on speculation gets you - A great financisl lesson!

The value slide should slow once rental yeilds hit the 8 to 10% levels

You know, that old fashioned "income thing".......something totally ignored over the last 20 years of the 40 year NZ Housing investment frenzy. Glad this frenzy busted in 2021 and it continues to deflate for many years still.

Thanks for confirmng NZ has gone from abysmal to poor yeilds.

Some idiots think 2 or 3% yields are great......waiting for the capital gains gravy train to roll up.

The whole paradym changed in 2021. A few plebs are still betting it all on property and will be wiped out.

Those who did not take note if the few here, giving the warnings, well they will get their financial haircuts.

Thanks for confirmng NZ has gone from abysmal to poor yeilds.

Just highlighting that there's not a lot of precedent for 8-10% yields as a rule.

The whole paradym changed in 2021.

Taking any COVID era trends is fraught with danger. Harley Davidson thought their 2021 sales were the start of a new trend, upped production. Now they have 80,000 bikes sitting unsold. This has happened across many industries.

The paradigm is shifting but it extends far further than property.

Because property is an asset class, yields will always adjust relative to other asset classes based on risk. If prices continue to fall, rents will likely fall with them.

Are prices sliding at the lower end or simply a greater number of inexpensive town homes being added to the market by Developmers who need to unload their stock and are dropping prices. Would be great if REINZ would inform by doing a split on the bottom end between: Apartments, Townhouses, and Single Family Dwellings.

That'd be pertinent information.

We know there's been a big explosion in intensive house building in the cities

But on the flip side, out on the fringes and jn the regions, older people have been building large, expensive homes, and much of the middle class, greenfields subdivision housing is barely ticking over.

Splitting hairs you mean?

It's interesting that the average mortgage for investors and first home buyers is continuing to go up despite stagnant / reducing house prices. Also frustrating that folks don't recogise that the real constraint on house prices is the labour market. House price growth relies on family units earning more. Hence, nothing predicts real house price growth like the employment rate.

100% this

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.