More properties were on offer at the latest residential auctions but fewer were sold under the hammer.

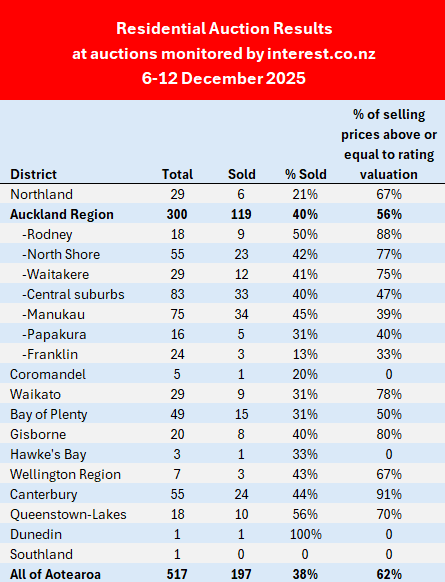

A total of 517 residential properties were up for grabs at the auctions monitored by interest.co.nz over the week of 6-12 December, up from 486 the previous week but down from 599 the week before that.

Of the 517 properties on offer, 197 sold under the hammer, giving an overall sales rate of 38%, the lowest sales rate since mid-August.

Although the decline in the sales rate was not huge, it does suggest buyers are remaining cautious. That feeling would likely have been reinforced by news this week that some banks have started raising mortgage rates.

It will be interesting to see whether that quieter tone to proceedings carries into the auction rooms over the next week and a bit before the market goes into hibernation for the Christmas/new year break.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the selling prices of those that sold, are available on our Residential Auction Results page.

10 Comments

Very low sales volume and poor acheived prices, compared to much lower CVs, in what is approaching peak selling season. Sellers still languishing and withdrawing from a flopped market.

With what has been a very expensive low point, in the recent mortgage interest rate down cycle......and mortgages now rolling in a hiking cycle, expect this market crash, to roll on couple more years, at least.

So anyone buying now, has to figure in the possibility of interest rates of 6, 7, or 8% plus, at the peak of this new hiking cycle.

Its bound to throw cold water on a market barely limping along on crutches and the weakest flame or heat seen in a market, that's seen a normally positive tailwind of decreases in mortgage rates. We just crashed further, even with the tailwind!!

Now tailwind BE GONESKI

SpruikerSpecInvestors must be puking on bad and getting worse capital losses, with now no further hope in sight?

Figures certainly suggest the Auckland market is still falling. Some will no doubt argue otherwise. For them, the market is clearly fooling.

Seeing some decent sales in and around Auckland...50%+cv prices reflects that, places like northshore 75%+.

So of the total houses auctioned, just under 24% sold at or above CVs.

Your really scratching around the scattered and whizzened Oneroof chicken bones, for postitives!!!

Enjoy this "Peak Market" optimism, desparado!

Never seen more desperado comments than yours Gecko... every single day without fail. Atleast you're winning at something...shame it doesn't pay.

Don't worry about the Gecko's paydays, my belly overfills with great abundance.

Just not on the now faulty and negative returning game of land lording and decades of tenant bloodsucking.

It is of great interest, to now see tenants with rent price lowering power......how does this paradigm shift feel for the swaggering LL class? Must be great financial sadness, heaped upon current house bag holding, desperation?

Canterbury; ~ half sold, 91% > CV

There is a market. It's just lower than sellers want.

So sell are choaking on the way down, but was all bollie and fluff unicorns on the way up. Perhaps the inbound foreign buyers will bail everyone out when their house is somehow suddenly worth $5m....tui.

Popcorn.

Popcorn or Bollie, not together.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.