The housing market got off to a slow start to the year in January, with sales volumes and prices both lower compared to January last year.

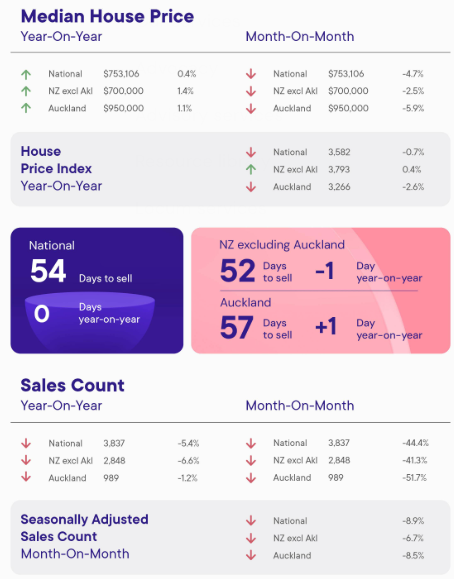

The Real Estate Institute of New Zealand (REINZ) recorded 3837 residential sales across the country in January, down 5.4% from January last year.

In the Auckland Region sales were down 1.2%, and in the rest of the country excluding Auckland sales fell 6.6%.

The sales volume fall occurred as new listings increased by 1.3% in January, while the total stock of properties for sale was up 2.3%.

Prices were also softer, with the REINZ's House Price Index dropping 0.6% compared to December, to be down by 0.7% compared to January last year.

The HPI is now down 16.2% from its previous market peak.

The national median selling price was $753,106 in January, down 4.7% compared to December.

The Auckland median price was $950,000, down 5.9% compared to December.

On an annual basis the national median selling price was up 0.4% compared to January last year, although the trend was mixed around the country, with nine regions posting annual increases in median prices and seven posting declines.

"Interpreting the market over summer can be challenging, as activity between November and February often reflects seasonal patterns rather than fundamental shifts," REINZ Chief Executive Lizzy Ryley said.

"Once seasonal trends are taken into account, the data shows the January market held up well," she said.

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

10 Comments

Auckland City up 8.7% yoy.

Would be good to own properties in this area...oh wait!

😅🥂

HPI for Auckland city is down 1.9% for the year, making it one of the best performing Auckland regions.

Silver linings though, only down 0.1% month on month. Must be nice to see the blood loss slowing.

Most Auckland regions have now flipped to a negative annual return over five years, as was obvious to see coming in the data a few months ago.

Is it a train wreck waiting to happen? All I see is a lot of properties still advertised at 2021 peak prices, not selling and that shows in the figures: growing pile of listings/unsold properties while days to sell longer and longer (remember when it was ~30 days a few years ago?).

I see prices going sideways for another 12 - 18 months, especially in the places that went crazy during Covid (Auckland, Wellington etc). Other parts (South Island mainly), prices are more likely to edge up (modestly) this year.

The crash continues and z bottom may occur in 2028.

The home collecting addicts dont like the situation, but thats the risk specutown has taken on and getting burnt by!

Thanks Greg, can you please do a article on the median days to sell over past five years by region? Be good to see the data...

Less sales and softer pricing with everyone on holiday or paying all the Tax the IRD requires at this time. So...a normal Jan event unless the RBNZ is stupidly spraying free money everywhere. Accordingly Jan is always an odd time to sell a house.

Nothing to see. Move on.

January has always been a strategic month for house sales with a high proportion of serious buyers(relocations) in the market.

Going to be tricky for the vested interests to spin this into a positive story to support their chants that our: "economic recovery which is well underway" and the "economy is humming."

This countries economy is almost entirely reliant on house prices rising, and it's simply not happening, but we continue to get economists and commentators blowing smoke up our backsides, playing us for fools.

QV numbers last week were also v solid, dont think they were reported here.

🥂🏠✅️

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.