This article is a re-post from yieldreport.com.au and is here with permission.

A metaphorical bomb hit the UK preference share market last week when insurance company Aviva announced, on the back of strong profits and the proceeds of asset sales, that that it would consider cancelling its “expensive” preference shares.

Nothing unusual in that, you might say, except the particular preference shares referred to were issued in 1992 as “cumulative and irredeemable” and they have a coupon rate of 8.75% per annum.

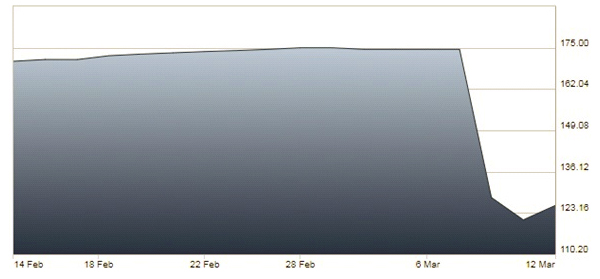

Most investors would interpret this as meaning the preference shares will pay a high rate of interest in perpetuity, with the word “irredeemable” (in the ordinary meaning) indicating the securities will never be redeemed by the company. However, “irredeemable” or “cancellation” or “return of capital” may technically be different things and this pedantry saw the price of the securities plunge from around £175 per security to around £118 before they recovered above £120.

Aviva’s 8.75% preference share price over the last month:

source: LSE

No decision has yet been made but investors are rightly nervous and they may be suffering significant losses as a result of the market’s reaction to the announcement. The company may seek legal advice which, let’s face it, is likely to be favourable to the company given the looseness of definitions and the possibility the issuing documents may be interpreted in a multitude of ways.

Aviva is also likely to seek approval from shareholders for the cancellation of the preference shares. In this case, shareholders have the most to gain as a cancellation would see the company save around £40 million in interest payments each year. Ordinary and preference shares holders are both eligible to vote but ordinary shareholders’ votes would likely outweigh votes of preference share holders.

The preference shares are still trading above par which suggests the market believes the company will have to reach a compromise position but it is far from certain and losses to date have been significant.

There is also potential collateral damage for the company itself and for the preference share market in general if companies seek to use loopholes or technicalities to get out of certain obligations when market conditions change.

One thing for certain is that investors will be scouring through issuing documents looking for other technicalities that may “rob” them of predicted interest payments. Future issues, particularly in stressful times, may need to pay higher interest payments to satisfy investors that perceived trickery or legal contortions will not be used to deny them future payments when business conditions improve.

The developments over the next few months will be watched very closely and perhaps some of the Australian perpetual-style hybrid instruments are likely to be scrutinised a little more closely.

For those interested, the original issuing document from 1992 can be read here.

This article is a re-post from yieldreport.com.au and is here with permission.

3 Comments

Of the 4 Aviva preference shares it is the 2x General Accident( GACA and GACB) ones which are at greatest risk as it requires a 75% vote to cancel them.General Accident is 100% owned by Aviva so they can just vote it through. With the Aviva Plc ones it is unlikely imho they would get the required votes for such a contentious issue.

Anyway it is scandalous although I note others such as Ecclesiastical Insurance have said they have no such intentions and will buy back in the open market.

Wow that is just abysmal behaviour. I would hope the judge / jury would take the view of what was the spirit and intention of issuing these shares and not release them on a technicality.

The Directors and their advising Lawyers need to be publicly outed so Policyholders/Shareholders and other stakeholders can communicate their opinions and take whatever action they deem appropriate to express their displeasure.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.