Earlier this year, predictions that a recession would soon grip the global economy were rampant. But, more than halfway through 2023, China is the only major economy that appears to be at significant risk of a prolonged slump. In New York and London, and across Europe, stock markets are soaring. In Tokyo, the Nikkei hit a 33-year high in June. While some economies are struggling, a global recession now appears highly unlikely.

An economic downturn can have many causes. For example, excessive consumer and investor confidence or very high levels of public spending can drive up aggregate demand to the point that inflation begins to rise, forcing policymakers, especially central banks, to intervene to cool an overheating economy. If they overdo it – say, by raising interest rates, and thus borrowing costs, too aggressively – they can push the economy into recession.

A recession can also arise from the supply side. When a particular sector or the economy as a whole is booming, suppliers ramp up production. But if demand begins to fall, supply can begin to build up, hampering and even halting growth.

Neither of these factors is in play today: though the US Federal Reserve and the European Central Bank have been pursuing monetary tightening, demand has not collapsed, and supply is not piling up. Instead, recent recession forecasts were derived largely from statistical analyses of past data – analyses that did not adequately account for the impact and legacy of the COVID-19 pandemic.

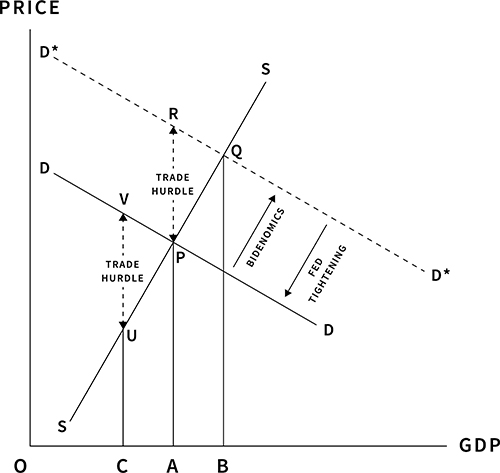

Figure 1 offers a simple depiction of the effect of the pandemic on a national economy. Under normal circumstances, the intersection (P) of aggregate supply (SS) and aggregate demand (DD) determines the equilibrium price (AP) and traded volume (OA), which can be interpreted as the aggregate output. Demand inflation is triggered by the rightward movement of the demand curve, and cost-push inflation is brought about by the upward movement of the supply curve.

But the movement of the SS and DD curves fails to capture a key feature of the pandemic: trade was highly desirable, on both the supply and demand sides, but less safe. People wanted to dine out, and restaurants wanted to serve them. But neither could do so – at least not to the same extent as usual – because of pandemic risks and restrictions. The same goes for countless other activities and industries, from travel to in-person meetings with business partners and service providers.

So, the pandemic did not create an imbalance between supply and demand so much as a disconnect, which forced buyers and sellers to incur extra costs, from wearing masks to moving dining tables farther apart, to make their exchanges possible. These barriers – captured in Figure 1 by the vertical distance between the curves – meant that actual output was no longer determined only by the intersection between the DD and SS curves; the size of the trade hurdles also mattered. The higher the barriers, the greater the distance between the DD and SS curves, and the bigger the decline in output.

This drop in output triggered powerful policy responses. In the United States, for example, President Donald Trump’s administration launched a massive stimulus package, augmented by his successor, Joe Biden, to boost demand – that is, shift the demand curve rightward. The trade hurdles were still there, but the adjusted position of the demand curve (D*D*) meant that they no longer dragged output far below normal, or pre-pandemic, levels. Indeed, thanks to so-called Bidenomics, US output returned approximately to its original equilibrium point.

When pandemic restrictions were lifted, the “wedge” created by trade hurdles was eliminated. But the demand curve remained in its adjusted (D*D*) position. The supply and demand curves thus intersected at a higher equilibrium point (Q), implying more output and – crucially – higher price levels. The Fed’s tightening has aimed to counteract these effects, by pushing the demand curve closer to its original position (DD).

While the Fed’s monetary tightening does increase the risk of a growth slowdown, or even a recession, in the US, recent economic indicators – not least strong employment figures – suggest that a soft landing is perfectly feasible. In fact, both the Biden administration’s demand-boosting policies and the Fed’s inflation-cooling interventions were entirely appropriate.

Perhaps more important, by strengthening the US dollar, higher US interest rates stimulate other economies’ exports. This makes the kind of global recession that so many predicted even less likely.

Koichi Hamada, Professor Emeritus of Economics at Yale, was a special adviser to Japan’s prime minister. This content is © Project Syndicate, 2023, and is here with permission.

23 Comments

Don't count your chickens too soon. There's a lot of issues happening in the background. From having revised the employment numbers down for the last 7 releases, banks sitting on billions of $ of unrealised bond losses, commercial real-estate being empty and will need to be marked to market at some point (and is highly illiquid), US savings rates at an all time low, and credit card debt hitting $1T. Not to mention the student loan amnesty ending at the end of the year and the US housing market getting out of balance due to no one wanting to break their low rates to buy a new place at 7%.

This is just to name a few issues that have started coming to light. Its not all sunshine and rainbows out there just because the stock market is going up. Oil is coming up too and the USA SPR is still empty so Biden can not raid that to artificially lower prices while coming up to the elections.

Yes all great and valid points!

For Biden to raid and drain the critically world important and utterly strategic USA Oil reserves, for totally self serving political ends - was reprehensible!

Now with the world having the biggest war in Europe for over 70 years and flashpoints now bubbling in many places in the world, for the USA to not have the SPR filled to spill, is a dangerous thing.

So why is the 2/10 year yield gap still inverse?

I continue to base my own investment decisions on a recession here. Thus, I think the OCR will be on its way down by late next year. How far, I hope the descent is gradual and takes it back to no less than 4%. The last thing we need is very low rates again-ever.

Europeans are coming off an amazingly hot summer, I'd imagine winter will force the majority of Europeans to hunker down and spend less / pay for the summer splurge

I wonder if this optimism extends all the way down to NZ with the worst current account deficit relative to GDP in the OECD?

A relative told me today that real estate is running hot, so I suppose we can sustain unlimited deficits like a rockstar enjoying unlimited blow.

Just not surprised about the real estate to be honest but I thought the madness wouldn't start until AFTER the election. What has changed is now pretty much everyone except die hard Labour supporters with blinkers on already knows the election outcome.

An election outcome which is largely irrelevant as far as monetary policy.

Higher for longer…

Nice try with the FOMO tho 👍

P.S China says hi 👋

Our GDP doesn't appear to be a problem - in fact our GDP per capita is ahead of UK and France, and just below that of Germany. The problem is our current account deficit, with our reliance on gas and oil and cars from overseas. This year has seen a huge amount spent on EVs (all of which has, of course, are manufactured overseas) - sales are up massively, but also each car is nearly double the cost of what we used to pay for an ICE car.

The broader OECD inflation picture looks very mixed to me. You have some countries that are still on-track for a soft landing like the US, Australia and New Zealand etc.

However you have some real problem children where they are not showing continuous improvement like the Eurozone, Canada, South Korea, Sweden etc.

People who believe we are going to have a soft landing are indulging in textbook "this time is different" self delusion.

I get that stock markets should have imbedded views from all angles in them but I think there are two main influences here. The first being cash and the second being inflation, unfortunately there is tons of both and that is supporting the stock markets.

The other driving factor is the concentration of power and the listed companies are not going anywhere anytime soon.

I think the real world faces significant issues which I struggle to understand how they get resolved.

Most country’s now face the same issues with residential and commercial property as well as the cost of living issues.

Overall, the stock market going up does not mean a lot.

Maybe they don't get resolved. Maybe the dividend enjoyed by some workers since the industrial revolution plateaus, now the labour market is billions of people, and largely isn't constrained by national borders.

Agree, maybe AI upsets the apple cart even more, not long before it replaces most call centres...... I think I could easily program an AI bot to replace you Pa1nter

I guess there's enough posts by me you could use as a sample.Thankfully though we're a good ways from an affordable android to load it into to fully replace me.

But yeah, could be an interesting decade to be middle management.And invariably lawyers won't need to be a thing.

Although at that point there won't be a market for some of what I do, either. Fun times.

I think the bigger driver is being missed is the war by the west on traditional energy. This is driving supply side issues, increased costs and geopolitical instability or vulnerability. The covid money flood simply exasperated the trend. If this does not stop worse is to come.

Writer fails to mention what the real GDP growth rate is in the 3 trading blocks which dominate world: China is in deflation and its figs are BS as gov is corrupt. EU economies PMI under 50. Exports from China are flatlining. stock markets rep top 10%. Rest of pop are worse off than a year ago. Forecasters in uk say that average income earner will be no better off in 2027 than in 2007. But all good. What a joke

I forgot that meeting we all went to when they promised exponential living standards and incomes for perpetuity.

Our governments don't have a good way to break the news to us that we're just as disposable as most of the items we buy.

We're no more important, in the scheme of a things, than a single potato in a sack.

300% debt to GDP in China

123% in USA

Interest payments swallowing 35% tax revenue in USA. Their national debt will be $40 trillion by 2030. But that is ok right? Things don’t need paying for. As National figs prove RE tax cuts.

Invest without borrowing and no need to tax rich. Just keep letting them screw interest out of rest in rent or on debts.

Ageing pop in West and China means tax must rise or more cuts. But no one is bothered so onwards to the buffers

LOL where did you get the 300% from ? Western USA based media ? Graphs projected to 2023 look more like 80% to me.

The USA is in deep shit and in a standoff with China they are going to blink first. The 2024 Election over there could be the end of them. They are so politically divided they are totally screwed.

Absolute desperation in the USA to bring Trumps court cases forward so they can jail him before the election.

Try reading more widely.

Capital economics group to start

Also Wolf Richter

Also Roubini

And finally Michael Pettis on China

When Marshal and the early mathematicizers of Economics put this concept of an equilibrium into the language of economics, it was an assumption based on early systems theory to try explaining the economy.

The figure there showed nothing. It is as helpful as the marxist idea of input output tables which are rubbished today. The demand supply curve is as helpful as saying there is day and night, which affects the weather. It shows nothing relevant.

So rich people still have plenty of money to buy shares and cheap resources are infinite so all is good.

Meanwhile the rest of us being strangled by cost of living, but the averages look ok. Definitely sustainable. This is fine, no "recession".

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.