By David Skilling*

This is my last note for 2023. Thanks for reading, I hope that you have found these notes useful. I look forward to continuing the conversation early in the New Year.

If this has been forwarded to you, please do subscribe to receive my weekly insights on global economic & geopolitical dynamics.

The small world note from two weeks ago offered a summary view on the economic and political dynamics that will shape 2024. Mike O’Sullivan and I argued that 2024 would be characterised as a ‘scramble for supremacy’, as economic and political competition intensifies across and within economies. From strategic competition between geopolitical rivals; to growing competition between 'friends'; domestic political competition in a big election year (notably the US); competition between monetary & fiscal policy in a high debt, high rates world; and growing competition between labour and capital.

The 2024 outlook, and my weekly notes, provide a sense of the risks that we have our eye on: from the intersection of high rates and high debt to the potential for escalation in the Middle East and the looming US Presidential elections. It will be another consequential year.

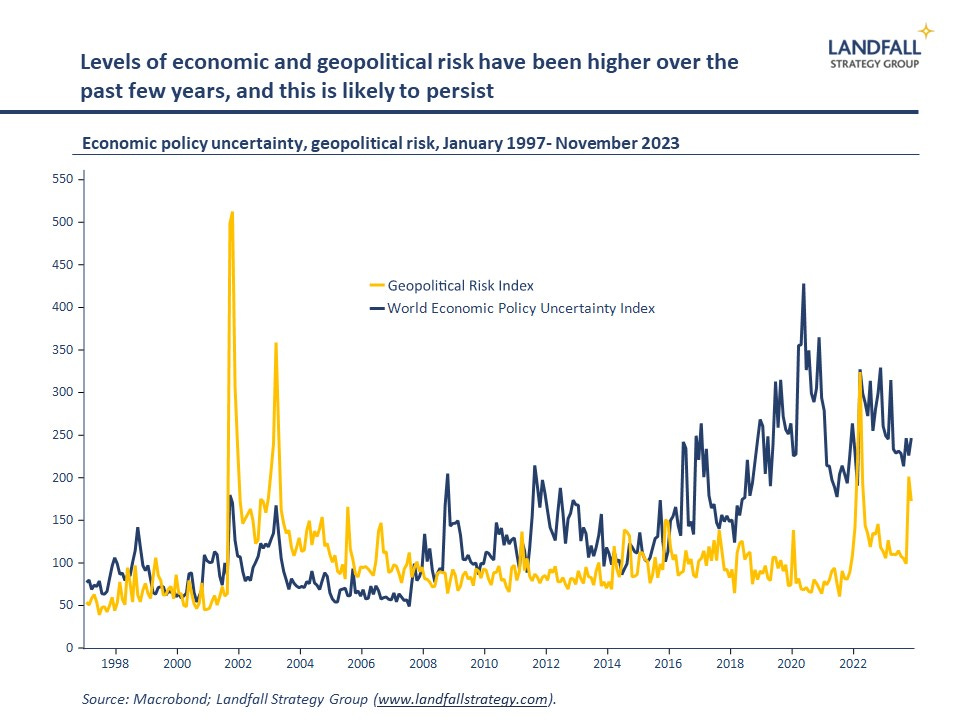

But the global economic and political environment is characterised by deep uncertainty. In a more fluid global economic and geopolitical environment, tail risk events become much more likely: few picked the Russian invasion of Ukraine in 2022 or the scale of the Hamas attacks on Israel in 2023. The changing global environment fattens the tails of the probability distribution function, with outlier events increasingly likely.

This means that governments, firms, and investors should prepare for the unexpected in the year ahead. Predictions are challenging at the best of times, and these are not the best of times. So our 2024 outlook concludes with some ‘wildcards’. These wildcards are not predictions, but (in our view) plausible events that are worth considering. We also identify several risks that we don’t think merit too much concern.

Wild cards

Autocratic regime change: The regimes in China and Russia look stable enough, but these regimes are opaque and are under significant economic and political stress. And history shows that regime change is often a surprise; 2024 will be the 35th anniversary of the fall of the Berlin Wall. These regimes may look stable, but both Mr Putin and Mr Xi are working hard to keep domestic politics under control. Senior officials are being replaced with remarkable frequency in China – the Foreign and Defence Ministers over the past few months, as well as multiple military officers. Regime change is possible, with implications that would shake the world.

A viable third party US Presidential candidate emerges: The unpopularity of a likely-convicted Mr Trump and an older Mr Biden creates more space than for some time for a third party candidate to emerge. Of course, the barriers to entry are very high in the US system, and the election is less than a year away. But nothing is usual in US politics, and there is a high level of dissatisfaction along with polarisation. This time might be different, and a late surprise candidate is possible – probably through the centre.

Technology breakthroughs: AI has garnered most of the headlines this year since OpenAI released ChatGPT in November 2022, and AI will likely continue to continue to surprise in 2024 as it develops exponentially. Technology surprises in 2024 may come elsewhere: two areas we have our eye on are rapid developments in nuclear fusion (given the amount of private capital flowing) and quantum. Both are a distance away from commercial deployment, but the timelines may be reduced.

Mass climate change event: 2023 is expected to be the warmest year on record. But the world seems to be getting accustomed to record temperatures on a daily basis. The risk is growing of a climate change event that directly kills tens of thousands of people in a G20 country, perhaps reinforced by El Nino. This would reshape the global debate. Although progress is being made in reducing emissions intensity, policy settings are increasingly prioritising economic objectives over the green transition (COP28 made progress, but not enough).

Cyber shock: The coronavirus was a major global shock from 2020, but a cyber virus could also be a first order global shock. There have been recent events, from Russia’s attacks on Ukraine to the massive disruption from DP World in Australia in November. The risk of a cyber-attack on a broader scale, e.g. impacting financial institutions worldwide, should not be discounted.

Things not to worry (too much) about

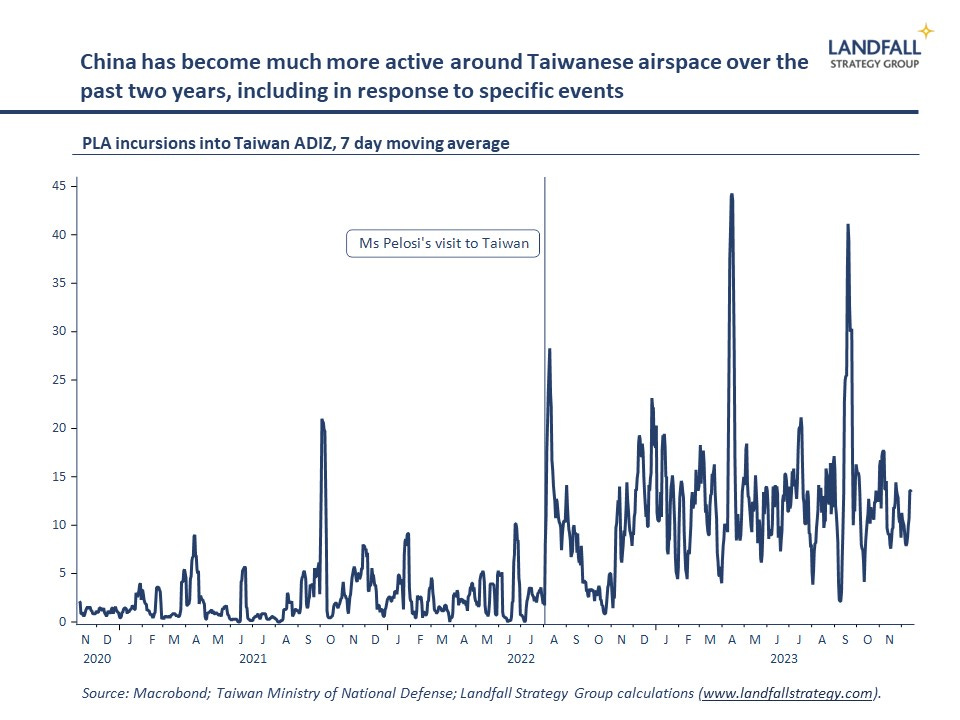

Taiwan invasion. We continue to believe that an invasion of Taiwan is unlikely to occur in 2024 (or for the next few years): it is risky militarily, there would be very substantial costs imposed on China, and there are many alternatives to squeeze Taiwan short of war. And military failure would be fatal to Mr Xi’s leadership. A distracted, stretched US may raise the risks of Chinese adventurism (note recent action in the South China Sea around the Philippines), and Taiwan remains a central issue for Mr Xi and the CCP, but the near-term risk still seems low. However, we expect ongoing provocation by China (fighter jet incursions), particularly around the elections in Taiwan in January.

China economic crisis: China’s economy is slowing structurally, in addition to a range of near-term headwinds: notably, the challenges facing the real estate sector, the high levels of debt across the economy, and negative FDI inflows. However, the Chinese government has a broad range of policy levers that it can deploy to stave off a crisis – and there are pockets of growth in the Chinese economy: note that China has recently become the world’s largest car exporter. Slowing growth is much more likely than an economic or financial crisis. It is Chinese politics more than economics that is the bigger risk.

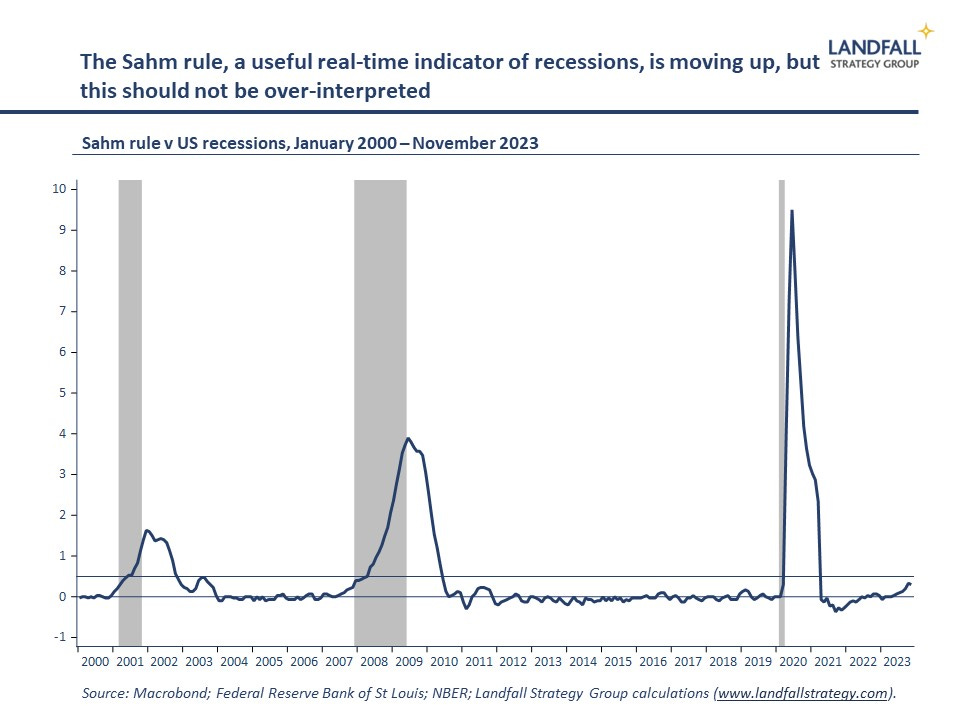

Recession: Calls for a recession in the US have been made consistently over the past year. We continue to think this unlikely, particularly in election year in the US when macro policy is likely to remain accommodating. Even the creator of the Sahm rule is unpersuaded that the indicator is accurately warning of a US recession. A recession in Europe is more likely, but this will not be severe.

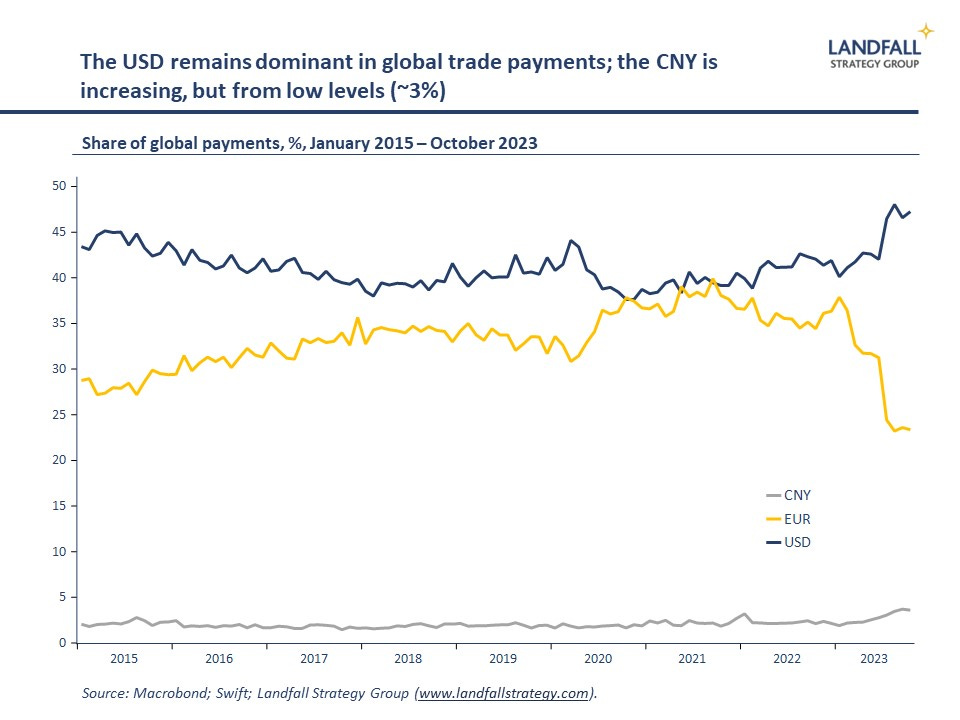

De-dollarisation: Initiatives like BRICS+ and announcements of more transactions being denominated in CNY attract headlines, but a replacement of the USD remains exceedingly unlikely. There will be some diversification, but no currency offers the same advantages that the USD does. Any transition will take decades not years.

VC funding: In the last two years the technology/venture capital industry has suffered as the easy supply of funding has dried up. Venture valuations have been cut down and in segments like fintech, are undergoing a brutal consolidation. However, we think however that the VC sector is bottoming out, and funding is beginning to return. 2024 may be the year when venture funding returns, including into deep-tech.

Implications

So what to do in periods of deep uncertainty, with an increasing frequency and intensity of political and economic shocks? Firms, investors, and governments need to be able to adapt and respond quickly to these shocks. Resilience and agility will be sources of competitive advantage in a more turbulent environment. And although organisations cannot live in a permanent crouch, there is a need to deliberately manage exposures: ‘Only the paranoid survive’ as Andy Grove famously said.

Organisations should invest in building resilience to shocks (e.g. managing leverage) and diversifying risk exposures (markets, supply chains). And scenario planning will become a more important input into capital allocation and strategy development, so that institutions can better understand and position for potential exposures. Brace for another turbulent year.

Thanks for reading small world. This week’s note is free for all to read. If you would like to receive insights on global economic & geopolitical dynamics in your inbox every week, do consider becoming a free or paid subscriber. Group & institutional subscriptions are also available: please contact me to discuss options (more information is available here).

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. The original is here. You can subscribe to receive David Skilling’s notes by email here.

16 Comments

Good read, well balance assessment.

'...More data is available for the events of 774 and 993 CE. They seem globally coherent with evidence. In many trees in both the northern and southern hemispheres. The event of the year 774 is even more prominent, with the most available ring data.

It appears to be more than 10 times as powerful as the Carrington Event of 1859. The Carrington Event was a powerful geomagnetic storm that caused Telegraph lines to burst into flames. It even led to planet wide auroras.

The Carrington Event remains the most intense geomagnetic storm to date in recorded history. It occurred just a few months before the maxima of solar cycle 10. So as the sun approaches the peak activity of its current solar cycle in July of 2025, geomagnetic storms can become more frequent."

https://twitter.com/ExploreCosmos_/status/1735343301098684719

Robbo's tail:

"Looking back over recent recessions in New Zealand, real GDP per capita has already fallen by almost as much as it did in the 2008/09 recession. It isn’t that headline GDP is plummeting, but record non-citizen immigration inflows means the population has been growing at a rate not seen since 1947.

...bar Iceland, all the countries with a worse performance than New Zealand were severely hit by the gas price/supply shock after the invasion of Ukraine (I’m not sure what the Iceland story is, but I checked the Icelandic statistics office website and the numbers appear to be correct).

It is a far cry from the stories we used to hear - backed by data - a year or two back about the initial post-Covid rebound having been fairly strong, by international standards, in New Zealand."

https://croakingcassandra.com/2023/12/16/gdp-per-capita-growth/

As I previously pointed out, many in Nu Zillun seem to think Japan is a basket case compared to our economy. I can understand why they think this and really there are many subjective elements to consider. The same people who think Japan is a basket case seem to think our property-ponzi-with-bits-tacked-on economy is antifragile. To me, that is terribly misguided.

As Michael Reddell's data sets show, Japan has been doing far better than Nu Zillun' on real GDP per cap since 2019. Wouldn't surprise me if that comparative performance in Japan's favor went even further back.

In fact, given that the CPI construct largely mutes the property ponzi in terms of asset price changes, our real GDP growth is quite possibly far worse. All our credit creation has been pissed up against a wall - bidding up prices of existing housing stock as opposed to using the credit for productive purposes.

The Japanese I know complain about their much lower wages (thatve stayed low for decades), devalued Yen, shoebox accomodation (which less of them own than your average kiwi), and increasing cost of living.

They've certainly got some advantages over NZ, fantastic infrastructure, safer society, deeper culture. But it's still objectively better being the average kiwi, and the outlook for Japan heading one way as their population ages faster and they have to bite the migration bullet.

The Japanese I know complain about their much lower wages (thatve stayed low for decades), devalued Yen, shoebox accomodation (which less of them own than your average kiwi), and increasing cost of living.

Wages have lowered and never recovered to what they were at the peak of the bubble. JPY has strengthened since the Plaza Accord (do your homework) and JPY emerged as a safe haven until quite recently (you can Google why this is). Shoebox apartments exist and fulfill a function for singles and students. And the cost of living is arguably the lowest in the developed world.

Your troll comment was a waste of time. Seems like you're desperate for something to say whatever thinking about saying anything of value.

Reality is that Japan's real GDP per capita growth from Q4 2019 has been twice as strong as that of Nu Zillun'.

Well, the Japanese I know still struggle travelling, and can't afford to travel to most markets like they could, even 20 years ago. The ones I know who reside in NZ, can definitely attest to doing better going home with their NZD, than what their Japanese domestic colleagues can afford from comparable jobs.

If you have to call everyone else ignorant, or a troll, just for having your view countered, perhaps the view isn't as robust as you're trying to make out. Really strong positions don't need to do that.

Maybe our views are different, because there's something to be said about actually talking to people, rather than about them.

If you have to call everyone else ignorant, or a troll, just for having your view countered, perhaps the view isn't as robust as you're trying to make out. Really strong positions don't need to do that.

The data is what is - real GDP growth per capita has been twice as strong for Japan compared to NZ.

So yes, I am correct. And trumps your troll.

But it's not actually being felt, per Capita. It's just a measure.

It's actually worse that the average Japanese worker hasn't benefitted from it.

And it's not just a lack of post 80s recovery, Japanese take inherently low wages. Fear of asking for a raise, and a blind adherence to company culture.

You should move there, find yourself a waifu who can't understand what you say well enough.

But it's not actually being felt, per Capita. It's just a measure.

Correct. All data has limitations. However, accepting the data for what it is, I am correct. Your reckons don't change that. If you feel that NZ's GDP growth data, CPI data, and population data is somehow understated compared to other developed nations, feel free to explain. You won't because you can't.

I have lived in Japan and worked there at a corporate level for a global FMCG manufacturer based out of Cincinnati. I know the retail markets and relevant pricing strategies very well. Brands such as Ariel hadn't been able to increase their prices for 10+ years. Maintaining market share is the key business strategy. At the end of a day, a win for Japanese consumers. And this is common across the whole economy.

Yeah, so applying context to data, makes it more real than fixed points on a line (although there's definitely data to reinforce what I've said). Otherwise you could say Dubai is a greater place to be, if you overlook the army of indentured servants almost held captive there, and the more fragile aspects of the experiment they are conducting.

I too have lived in Japan. Although not as an expat worker, and more of a resident. Lived amoung them, got an education there, worked for Japanese corporations, speak the language, and have a tertiary education with a strong component towards their history, economics, and other social sciences.

It's a great place, but that grass isn't as green as you often make out.

I too have lived in Japan. Although not as an expat worker, and more of a resident. Lived amoung them, got an education there, worked for Japanese corporations, speak the language, and have a tertiary education with a strong component towards their history, economics, and other social sciences.

Well it seems you have a limited understanding of Japan for someone who claims to have lived there. And you still haven't been able to debunk the data.

You're rolling around in your own troll poo.

UK election?

The Aussies call a spade a bloody shovel again

Juicemedia Honest Govt Ad: Visit the UK

Caution: NSFW or young people

Thanks David. Looking forward to your next one.

Just quietly, I'm no where near as sanguine as your good self is with regards some major economies entering a recession in 2024. To escape the excesses of covid and the Pootin inspired energy shock without one would almost be a first. And when shareholders put pressure on big companies to continue making covid style profits - payrolls tend to shrink fast.

I agree GF. Unemployment could be a real issue in 2024. It could be the issue. Not just here, but many places.

My pick for the next developed country to enter anarchy would be South Africa. They are not that far off a real civil collapse. The ANC are strangling it through corruption.

Q: What's worse, communism or radical Islam? They are both tyranny.

Almost everyone in SA experiences a power cut, every day. Borderline not a developed country.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.