There’s a long history kiwi emigration to Australia. But it’s very up and down.

For many years annual net migration across the ditch exceeded 20,000, peaking at nearly 44,000 in 2012. However, it dropped off dramatically from 2014-2020 and even reversed briefly during the height of the Covid-19 pandemic.

Since then, the net migration loss to Australia has been rising again. It was about 6,000 in the year to March 2022 and more than 17,000 in the year to March 2023.

Of course, New Zealand has had an election since then. The fall of an unpopular government may stem the rising tide of kiwis crossing the ditch. Or perhaps the identity of those leaving will just change from National and Act supporters to Labour and Greens supporters.

One of the key determinants of trans-Tasman migration is whether Australia offers kiwis the hope of better jobs and/or higher pay. This is linked largely to relative economic performance.

So what’s the economic outlook for Australia at the start of a new year?

Inflation has peaked and is on the way down. The Midyear Economic and Fiscal Outlook (MYEFO) released by the government last month forecast CPI growth of 3.75% in the year to 30 June 2024. Importantly, the latest figures from the Melbourne Institute recorded a continuing fall in the inflation expectations of consumers.

Interest rates are also at or near their peak. Commentators are divided as to whether the Reserve Bank of Australia (RBA) will raise the cash rate one last time. However, there is a consensus that the RBA will begin cutting rates later this year or early next year. While the thirteen rate rises over the last two years have had serious consequences for some borrowers, the dire prophecies about the ‘mortgage cliff’ have not eventuated.

A key contributor has been the resilience of the labour market. Unemployment remains at historically low levels despite high immigration. According to the latest data from the Australian Bureau of Statistics, unemployment was at 3.8% last November. Forecasts in the MYEFO show unemployment rising to 4.25% this year and peaking at 4.5% in 2025.

Significantly, real wages are growing again.

Recent GDP growth has been reasonable relative to comparable countries, but it’s been driven primarily by mining exports (Australia’s perennial saviour) and massive immigration. Indeed, on a per capita basis GDP has fallen in the last year.

Going forward, the forecasts are satisfactory but not inspiring. The MYEFO projects GDP growth of just 1.75% in the current financial year, rising to 2.25% in 2025. Again, immigration and mining exports will contribute much of that growth.

The resources sector is the gift that keeps on giving to the Australian economy. It underpinned the government budget surplus last year and looks like doing the same in the current year.

However, even the revenue windfalls generated from iron ore and coal, gold and gas, may not be enough to save the Australian budget in the medium term. The pressures on the expenditure side are mounting.

As in New Zealand those pressures include servicing the debt taken on during the Covid-19 pandemic and the rising cost of caring for an ageing population. But two other items loom large in the Australian budget – defence and the National Disability Insurance Scheme (NDIS).

Australia will spend more than $50 billion on defence in the current year. The MYEFO forecasts average annual growth above 6% for the next decade. And beyond that the country has committed to spending hundreds of billions of dollars on the acquisition of nuclear-powered submarines.

Advanced weaponry is an expensive business as Winston Peters will discover if the new NZ government carries through on its commitment to enhance the country’s defence.

The irony is that much of Australia’s defence spending is directed at the perceived threat of China, and much of the revenue to fund that spending comes from exports to the Chinese.

Australia’s NDIS is a scheme to provide funding for people with permanent and significant disabilities. Since its establishment just a decade ago, it has grown to a $40 billion item in the budget. The MYEFO projects NDIS average annual growth of more than 10% for the next ten years. That rate of increase creates obvious sustainability issues.

The government’s major expenditure commitments highlight the importance of economic growth. And relying on immigration and mining exports for that growth is risky. The best long-term solution is increased productivity. As Paul Krugman said, ‘Productivity is not everything, but in the long run, it’s almost everything.’

And Australia doesn’t have a good story to tell about productivity.

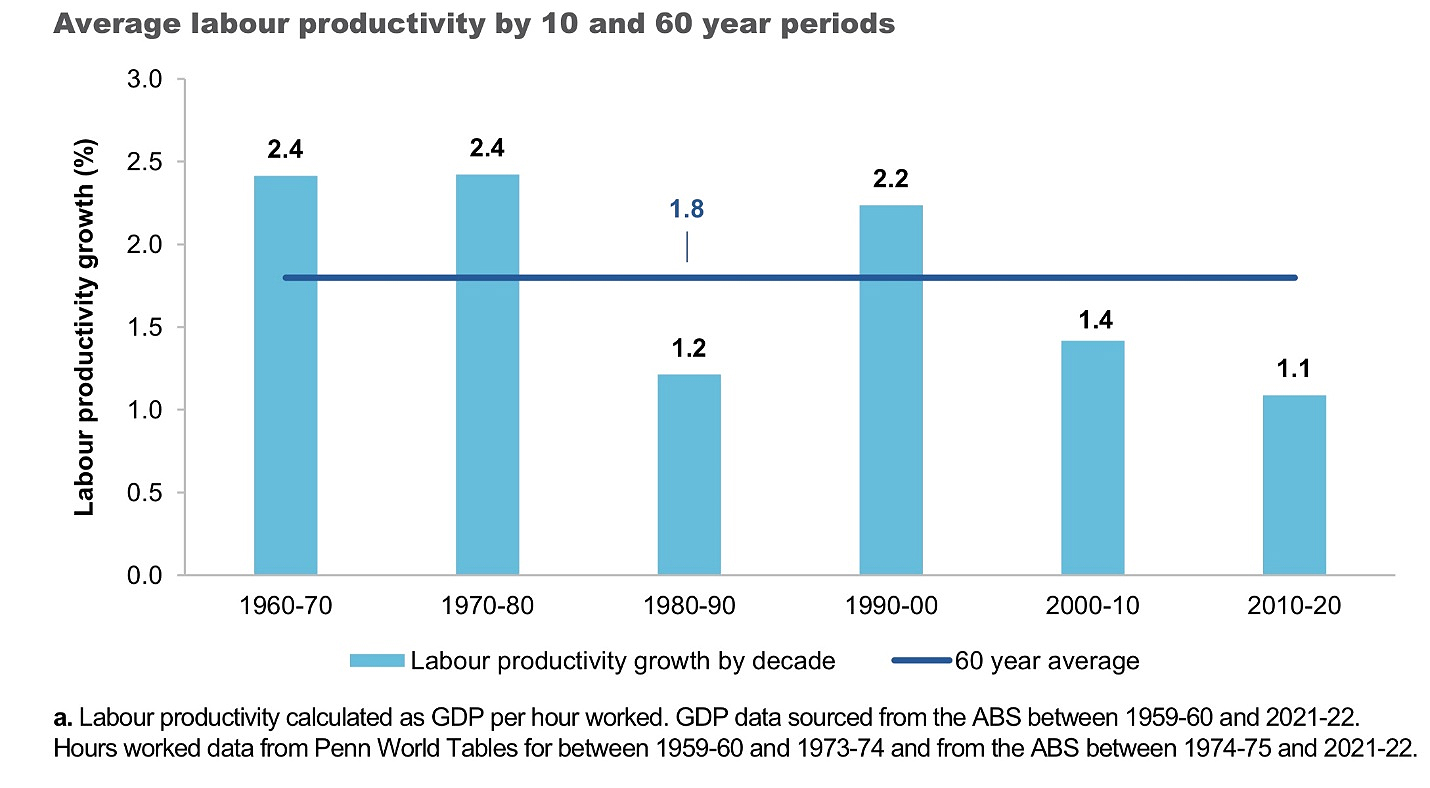

Last year, the Australian Productivity Commission released a report entitled 5-year Productivity Inquiry. That report included the following graph showing productivity growth in the last six decades.

Source: Australian Productivity Commission

The period since 2000 has witnessed a disturbing decline in productivity growth. The trend is ominous and recent governments have done little to reverse it. Except for the introduction of GST in 2000, there has been no major economic reform since the 1983-96 Hawke/Keating government. The graph illustrates the consequences.

Another recent report, Barriers to collaboration and commercialisation, from Industry Innovation and Science Australia, stresses the productivity problem and also the lack of complexity in the Australian economy. It cites a fascinating and troubling analysis from the Harvard Growth Lab (HGL).

That analysis compares the level of ‘economic complexity’ across a range of countries. It notes that ‘Australia is less complex than expected for its income level’. That’s a polite way of saying that compared to similar developed nations the lucky country is too dependent on digging stuff out of the ground. It needs more sophisticated value-add manufacturing activity.

The consequence for Australia, according to HGL, is that ‘its economy is projected to grow slowly.’

Remarkably, HGL ranked Australia 93rd for economic complexity out of the 133 countries analysed in 2021. That was down from 55th in 1995.

By comparison, New Zealand was ranked 52nd in economic complexity, down from 33rd in 1995.

Most kiwis considering a shift to Australia don’t concern themselves with such medium-term developments. Their focus is on current pay rates and house prices.

On that basis, unless the Luxon government can turn things around quickly, there’s a risk of a return to the days of a net 20,000 plus kiwis moving to Australia each year.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

52 Comments

The Aussie enigma. JPM Asset management recently reported about Aussie:

- H'hold savings rate plummeting at greatest rate in its history (from +24% in early Covid to near zero now - and on it's way negative)

- H'hold debt service ratio near 185%

- Lowest consumer sentiment since 2003 and yoy retail sales fallen off a cliff (consumers tapped out)

Zeihan's comments on the Aussie property ponzi kind of sum up their woes (don't scoff. we're similar). He's protecting at least a 5-yr depression for Aussie.

You guys remember subprime? Well the Australians had something that was much worse.

The problem is they never fixed it. So you can say what you want about the American approach to subprime. We forced people who had made decisions whether they were banks or homeowners to eat some of the losses in order to qualify for restitution funds from the federal government.

The Australians didn’t. They just guaranteed everyone’s loans and so everything has just gotten deeper and has festered for the last 15 years.

Arguably, I think conservatively you could say that their subprime problem now is at least a factor of five in relative terms worse than what the United States went through.

So when that finally cracks, and I would argue that a sharp de-globalisation shock or de-Chinafication would be more than enough to trigger a financial crisis in that sort of environment.

They’re going to have something that’s at least a factor of five worse than what the United States went through with subprime.

Sounds like the same old arguments we have seen here for 16 years now. One day it might be right.

I hear you. General water cooler consensus is that everything is dandy. CBA's stock price at all-time high. Iron ore price is raging.

I’m not even confident a black swan would start it all unravelling. There appears to be such a weight of money on the sideline ready to go.

Unlike the GFC we have had money printing. That is a massive factor in whatever shape this “crash” is.

Also, when it comes to property, people are seeing Ponzi schemes where there are none. There is no Mr Ponzi. There's a lot of money to invest. There are legitimate returns. Life and investment must go on.

Also, when it comes to property, people are seeing Ponzi schemes where there are none. There is no Mr Ponzi.

How can it not be a Ponzi? Without greater credit created to marginal buyers, it cannot be anything but.

What's more, Aussie has relied on the China Ponzi. China has a hyper-financialisation system which basically prints money and confiscates bank deposits in order to fuel industrial development. China has paid prices for commods at any prices driven by political goals - usually to build infrastructure and industrial plant. As the largest supplier to China, when Aussie has to deal with price sensitivity, they will be screwed and mkts will potentially collapse.

You would be the last person I would ask to spot a Ponzi.

Sure. You always have Granny Herald as a source of reference.

Real estate by definition is not a Ponzi scheme.

Ponzi wonzi. Maybe a better term is a bubble. And if it isn't, maybe it's a start of a drift back to feudal times.

Ponzi wonzi. Maybe a better term is a bubble. And if it isn't, maybe it's a start of a drift back to feudal times.

Ponzi is a better term because while it is not strictly correct in its usage as it relates to residential housing, it highlights how the property market relies on credit created out of thin air. That always gets plenty of scoffs at the neighborhood BBQs even though it is accurate. F'more, without a steady stream of new marginal buyers, prices would arguably break down.

In Auckland, there's way more buyers than sellers. Immigration, more local body restrictions, flooding making buyers gun-shy of problem areas, roading logjams that need to be resolved, cost of building......it all adds up to higher property prices.

I'll make a killing. Cant wait. Anyone want to get rich?...check out Riverhead.

Why riverhead, It doesn’t seem sensible to me to build intense housing on or near a floodplain. The prices as it is are way above their valuations

That would be because wingman has land there and is spruiking the area with a vested interest

People seem to regard property as if it is a lump of gold when it is something that changes value according to geographic, economic and demographic factors. This makes it rather special.

Yes, I have no problem with the word bubble. The word Ponzi when applied to the property market aggravates my Asperger's. Mr Ponzi took advantage of normal market behaviour like the creation of credit, new entrants, profits and so on to deliberately deceive investors. The term is used to troll and in J.C's case is also projection.

Property ownership is perceived by the masses as important in order to not slip back into a form of feudalism hence its durability and attractiveness.

Quite possible.

I think both us and them are in for 3 years of flatness or contraction. Of course, within that context some people and businesses will do well and others won't.

What happens after 3 years? BAU? Scratch wound ya reckon?

BAU with a climate change twist :-)

Are you thinking inflation will be sticky? Or that lower interest rates won’t create growth?

The latter. There's a lot of debt to be digested before lending picks up again.

"Ross Stitt says...lower house prices"

No he doesn't say that. He talks about higher wages attracting Kiwis across the ditch, and Australia's economy being dependent on mining.

Australia's housing "Ponzi" is actually worse than Auckland's.

In fact, recently Sydney was found to be the 2nd most expensive place to live in the world in terms of median income to median house price ratio.

Sydney isn't all Australia though. Outside of Sydney and Byron you do better with their higher incomes and lower general cost for fuel & food etc.

91 cost $NZD 2.00 over there currently.

After 3 weeks in Japan I was strongly reminded what a rip off NZ is. Horrid cost of living

How good is Japan?! Eating out one night doesn’t account for a middle class earners entire weekly disposable income

So much cheaper on multiple fronts. I got two sandwiches and a drink for about $8 for lunches at convenience stores there. First weekend back here I visited a beach and paid $18 for pretty much the same from a superette.

I am going to be very tight with my disposable spend here this year, I am sick and tired of paying stupid prices!

I took myself and 5 others out for a dinner at a high end unagi restaurant. Multiple courses, multiple drinks. $150

Nice! Love unagi!

Not saying Japan isn’t cheaper, but every country has something cheaper than another. I found beer expensive in Japan - not so much when out but when buying in a store. Ended up drinking some fake beer which was half the price (beer flavoured vodka or something). And I imagine my 200m2 house on 1000m2 section wouldn’t be cheap either.

When living in the UK the food was real cheap, but it wasn’t until I returned home that I realised how bad the quality was over there. Fruit and veg here tasted insanely good. You get what you pay for.

Not quite correct.

350ml cans for about $2.30 each in convenience stores, 500 ml cans just over $3.

It’s been about 8 years since I was last there so things may have changed (probably the exchange rate). Those prices seem on par with NZ.

Cheese cheaper over there ?

"The irony is that much of Australia’s defence spending is directed at the perceived threat of China, and much of the revenue to fund that spending comes from exports to the Chinese" This reminded me of this Aussie defense policy skit on utopia which has been uploaded to you tube. Defence Policy In 2023 Explained | Utopia (youtube.com)

Australia needs to start gearing up defence spending on their Navy, They are going to have huge problems in the future with illegal immigration, forget about China they will not be the problem.

Yep it has been foretold for decades, the impending crises that are water scarcity and mass migration.

Recently moved to Australia as after living in NZ under 18 years of National and 14 years of Labour, I wasnt willing to go backward again, financially, under the current short term thinking of this crop of NACTFirst. Got ahead financially from 2005-2008, went backward under Key, and finally getting ahead under Labour 17-23. Labour’s universal incrementalism saw a further $80/week in my pocket. NAF’s reversals with nothing to replace it with until July 1 would have seen that disappear.

I owned my own home, purchased in 2008. Have a rental property also. So I was very much the “target market” for NAF. But interest deductibility doesn’t affect me as I don’t overload the mortgage onto the rental expecting the tenant to pay off my own mortgage. Long term happy tenants who look after the property with no rent increases in the next 3 years because I fixed for 2.99% for five years in 2021. Rates and insurance have increased but the rental amount set in 2022 is adequate to cover those costs, and they are a deductible expense.

Selling the OO home in NZ so that we can buy a house here. Having to contend with stamp duty and state govt duties is neither here nor there given that what can be purchased for $700k here is truly well beyond what you would get for an equivalent house in NZ. Double garage, 4 bedrooms, media room, pool, entertainers kitchen, would be over $1.5m in the upmarket third world country that is NZ. The first world prices charged there to those earning 3rd world wages is ridiculous.

Food is cheaper here ($8/kg lamb steaks vs $33/kg NZ) and 91 is 1.67/L currently.

Public transport is everywhere, but Aussies don’t understand the concept of “direct route” for buses but a tiki tour through the suburbs is ok during the mornings.

The weather takes some getting used to. Acclimating involves being outside as much as possible before 11am and after 3pm as otherwise its like being in a blast furnace. Air conditioning is everywhere and well needed.

looking at what is happening in NZ now, Im glad not to be there. Still keeping an interest as I still have a property interest there, but its highly unlikely Ill be back anytime soon.

Oh, and with the higher wages here (thanks to Awards (FPAs), penalty rates for weekend work, and the 25% employer super contribution), my student loan will be paid off within 3 years compared to the 7 years on the 3rd world wages NZ paid me - a double degree educated white collar professional in the private sector.

No rent increase over the next 3 years?! Mad - haven’t you heard of inflation?

Like I said, fixed for 5 years and rates and insurance will be the only increases but as they’re deductible there’s no reason to increase the rent for those

Odd way to look at the numbers. Refreshing but odd

Im in it to house a family that are prepared to stay there for 5 years before they move overseas again once the kids have finished school. I see no point in increasing the rent unnecessarily while I can manage the mortgage and deductibles on the current rent amount. Didn’t bother with a parasite manager who would just harass me to put the rent up annually just to increase their own return. I put my aunty down as my “agent” in NZ thanks to National’s 2017 amendment requiring absentee landlords to have a NZ agent and have a direct line of contact with the tenants which works out well.

@ Rampart ;

Refreshing and wise . Well done .

Last year I was looking seriously at the option of moving to Australia prior to the NZ election (opened an Oz bank account as a start); I also have close elderly & other family who have been living there for a couple of decades. I am mostly retired except for some professional consultancy work that can be done remotely & own an unencumbered property here which I intended to retain & rent out to fund another property in Oz. Therefore, from an income & investment perspective these are primarily derived in NZ (I would have moved substantial TDs to Oz) & also I would not qualify for means tested Oz Super.

In discussion with my accountant he also confirmed my understanding that retaining an investment income/"abode" in NZ would almost certainly mean that I would continue to be deemed a NZ tax resident even though owning a house plus some investment income in Oz & despite that my domicile residency would be in Australia..

It may not be a directly comparable scenario however I'd be interested in which state you've settled in & if you have been able to avoid such residency complexity (assuming that you're a NZ citizen).

The LTC is a tax resident of NZ, but I personally am not.

There is some jiggery pokery with the NZS being paid to Aussie resident Kiwis, but you’re right the income/asset test applies here before any offsetting of NZS is applied.

Thank you.

...Australia doesn’t have a good story to tell about productivity.

It's like New Zealand where excess immigration has suppressed wages and delayed companies investing in tools, automation, AI etc. There has been a major disincentive to raising productivity.

If you want productivity you need to give companies a reason to plough capital into productivity improvements: https://ourworldindata.org/grapher/capital-intensity-vs-labor-productiv…

In Australia now. Following news and talking to friends through Victoria and Queensland it is very similar to NZ. Huge cost of living issues, housing shortage, health system overwhelmed, crime up, hospitality struggling, spike in businesses in receivership etc etc. NZ issues probably felt wider across the board but to assume things are fine and dandy across the ditch would be a mistake.

Still a cool place though 👍

Victoria is pretty dire, Dictator Dan really did a number on the place. But getting regular reports from those who have moved to Brisbane/GC/SC and they all report a really booming place. Olympics work will start soon which will fuel jobs and businesses there. While things have certainly increased in price there, they are still coming off a lower base than in NZ, so people are also reporting cheaper groceries, cheaper housing, cheaper petrol. The main gripe at the moment is the rental crisis - its very hard to find a rental property, and rents have gone through the roof (although still not as expensive as Auckland).

The housing problem in Australia is bigger compare to NZ

Both countries are attractive for immigrants (more safe, finance problems in China), so prices will continue to rise in 2024-2025

The economy seems to be doing fine over there, there is a flood of earnings upgrades coming through the ASX at the moment. Lots of local companies exposed to that defence spending for example. But seems most B2B companies are bouncing back from the pandemic shutdowns just fine - the B2C ones might be struggling a bit more but I'm also seeing good upgrades coming from listed retailers over there.

AFR suggesting Aussie millennials were conned into cheap debt and now Gen Z is screwed. These kind of articles do get a bit boring and usually have boomer thinking.

Millennials, assisted by the internet, made an exceptionally fine art of intergenerational ranting. For the past 10 years they have been saying that earlier generations not only had it easier, but they also robbed Millennials of resources.

They’re wrong about that — wealth creation across generations is not a zero-sum proposition — but they do have a point about how different generations face different challenges.

that In this case, however, the generation that has it harder is Generation Z — and Millennials are to blame. Ultra-cheap mortgages over the past decade helped millions of Millennials buy homes, and now the housing market is distorted, which will make it harder for Gen Z to buy.

https://www.afr.com/property/residential/generation-z-is-getting-a-bad-…

Remarkably, HGL ranked Australia 93rd for economic complexity out of the 133 countries analysed in 2021. That was down from 55th in 1995.

By comparison, New Zealand was ranked 52nd in economic complexity, down from 33rd in 1995.

So both countries are falling down the economic complexity ladder, with Australia falling faster than us.

Looking at the Harvard table, the countries with the most complex economies are no surprise; Japan, S. Korea, Switzerland and Singapore being the top 5. I would like to see the government encourage much more R&D here and yes, that would mean tax-breaks, but we must somehow broaden the economy.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.