What are the Sustainable Development Goals?

A total of 17 goals designed as "a blueprint to achieve a better and more sustainable future for all by 2030". Within these 17 goals there are 169 underlying targets, each with specified indicators which help to measure progress towards the goals. The goals were adopted by all members of the United Nations in 2015 as a core part of the 2030 Agenda for Sustainable Development.

What are the investment merits of the SDGs?

The SDGs were developed for global policy makers, so applying them within the investment industry is not straight forward. The most useful aspect is that the SDGs are a globally accepted framework. Fund Managers can map investments against the 17 SDGs and articulate to investors how an investment portfolio is aligned with the goal of a more sustainable future. Alignment with the goals is the easy part; linking the tangible impact of an investment to the SDGs is the hard part.

Fund Managers need a tangible way of measuring the impact to the SDGs. Ideally a Fund Manager should target and measure investments alongside the ‘indicators’ relevant to each SDG. The indicators provide a quantifiable point to measure an investment’s impact. However, some SDGs are more investable than others. Take for example SDG #17 and one of its underlying indicators. This would be more applicable for central government.

| Goal | Target | Indicator |

| 17. Partnerships for the Goals |

17.1. Strengthen domestic resource mobilization, including through international support to developing countries, to improve domestic capacity for tax and other revenue collection. |

17.1.1. Total government revenue as a proportion of GDP, by source. |

On the other hand, the underlying indicator for SDG #7 related to an increase in renewable energy would have far more investment merit.

| Goal | Target | Indicator |

| 7. Affordable and Clean Energy |

7.2. By 2030, increase substantially the share of renewable energy in the global energy mix. |

7.2.1. Renewable energy share in the total final energy consumption. |

An investment into a company such as SSE would be aligned with SDG #7 given it is a leading developer and operator of renewable energy across the UK and Ireland. Similarly, in NZ, Genesis Energy would be aligned given the development of wind farms, despite its current exposures. So, you could tick the box on ‘alignment’. However, what is the actual impact on the indicator from investing in the company’s shares? What measure of “total final energy consumption” is appropriate? If a Fund Manager promotes alignment with the SDGs, do some Fund Managers make more of an impact on the SDGs than others?

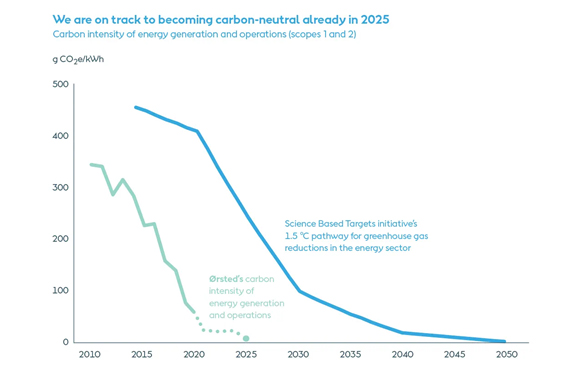

A great example of the transition is the Danish company Ørsted. It was once one of the most coal-intensive energy companies in Europe. Today, they claim to be the world’s most sustainable energy company, and a global leader in the transition to green energy. The transition is almost complete, but has taken over a decade.

Figure 10 Ørsted carbon intensity of energy generation and operations

A lack of data, inconsistent metrics, timeliness, and an absence of benchmarking leads to difficulties when comparing the application of SDGs across managed funds. However, this area of data and standard setting is constantly evolving and will help ensure more impact can be demonstrated through investment. The Impact Management Project and Global Impact Investing Network are two organisations at the forefront of these developments. Furthermore, the development of big data methodologies could see significant advancement in the application of SDGs by Fund Managers. Any efficiencies developed could lead to an increase in the number of accessible investment strategies for a wider range of investors.

Prudent comparisons of investment strategies require a deeper understanding of the Fund Manager’s investment philosophy and how it is applied through the investment decision-making process and eventual portfolio construction. The following comparison shows differences between the investment management approaches from two different Fund Managers that apply the SDGs:

Figure 1 Comparison of managed funds that consider SDGs

|

Fundamental Approach |

Discrete approach used by Manager ‘B’ |

Discrete approach used by Manager ‘G’ |

|

Integration |

ESG Integration ESG Integration Engagement |

ESG Integration ESG Integration Corporate engagement |

|

Screening |

Negative Best-in-class Norms-based |

Negative Best-in-class Norms-based |

| Thematic/ Impact |

Impact The Manager invests in bonds and loans of emerging market development banks, financials and microfinance institutions that focus on advancement of UN SDGs, with a particular focus on SDGs 1, 7, 8, 9 and 10. The Manager prepares regular updates to stakeholders on material impact & ESG parameters. |

Sustainability Themed The Manager invests in companies addressing sustainability challenges in three areas which are aligned with multiple SDGs: Climate Change, Economic Empowerment and Healthy Living. An Impact Assessment report is disclosed quarterly. |

The information in Figure 1 was taken from publicly available fund manager disclosures on responsible investing. Evaluating a Fund Manager’s overall strategy is critical when trying to understand the investment merits of SDGs.

The breadth of investments aligned with or targeting the SDGs will differ between Fund Managers. Whether or not a Fund Manager pursues multiple SDGs or single SDGs should be considered. A more focussed approach may allow the Fund Manager to make more of an impact, though this will depend on the type of managed fund and stated investment objectives. For example, a diversified global equity fund may align itself with multiple SDGs, whilst a green bond fund may focus solely on financing projects that aim to mitigate the effects of climate change. The corollary of this is determining investment materiality, and ultimately impact.

Investment materiality will play a determinant role in achieving tangible outcomes in the progress towards a better and more sustainable future. The intentions of a Fund Manager versus actual contribution to the SDGs should be examined. A Fund Manager can articulate intent towards the SDGs within their investment philosophy, however, demonstrating the contribution to the SDGs is where the rubber hits the road.

The important consideration regarding contribution is how material an investment is. In this context materiality refers to the influence on outcomes, which in practice relates to the size of an equity investment or the agreed bond covenants. Materiality is a key element that differentiates a Fund Manager in public markets versus one in private markets.

Research IP seeks to answer the following questions when assessing a Fund Manager’s commitment to the SDGs:

- What is the size of an individual investment in reference to the issuer? How much influence does the Fund Manager have on decision-making? How much can you attribute to a Fund Manager the impact to non-financial objectives?

- Where in the investment process are the SDGs considered by the Fund Manager?

- Which SDGs does the Fund Manager seek to address? And how?

- What examples does the Fund Manager have of specific SDGs already being addressed in the portfolio?

- What metrics is the Fund Manager using to assess the impact on the SDGs? Internal metrics or external data providers?

- How often and where is the Fund Manager reporting the impact on the SDGs?

How does company reporting and transparency fit into the equation? Which reported metrics relate to the SDGs? What level of continued engagement and analysis is the Fund Manager applying to ensure the focus on the SDGs is relevant?

The latest version of Beneath the Surface of Responsible Investing can be found here.

Andy Mahony is an investment consultant at Research IP. You can contact him here. As a resource for investors, the RIPPL Effect reports for over 200 funds are available here.

4 Comments

50% of the UN SDGs, are incompatible with real sustainability. They are 1,2,3,6,7,11,12,16.

No 8 is a total bollocks.

and 9 and 10 are incompatible...

Consumption needs to be reduced by several orders of magnitude, which really means population needs to ditto. Brundtland fell short for political reasons, so too do the SDGs.

Investment assumes growth (or what's a profit to be spent on?).

So, ignoring the incompatibility between 9 and 10, that leaves those SDGs that are, in your opinion, in tune with "real sustainability" objectives:

SDG 4 - Quality education

SDG 5 - Gender equality

SDG 13 - Climate action

SDB 14 - Life below water

SDG 15 - Life on land

So, wouldn't it be great if the industry developed a tool that allowed you to select your favoured SDG goals, which then would inform you which investment fund(s) specifically targeted their investment in furthering the achievement of those specific SDGs?

I think (improving our knowledge of these investment vehicles) is a great initiative.

Just as more knowledge on country-of-origin on foodstuffs is a really useful idea (although that information needs to be tied to look- up/understand the sustainability of each countries extraction and production processes)..

The way I look at it: the SDG framework may have flaws, but at least it is an international framework on action toward a better world that is gaining currency. Perhaps in future, they should be numbered in accordance with planetary-health priority.

Sorry, that was penned on-the-run; somewhere I have done a coupe of more nuanced appraisals; will dig them out.

No, we're out of time. We had to be there by now.

What I was splitting, was the 'can have in a sustainable world' from the 'çan'ts'.

:)

Trying to save wildlife in Africa, they found the best approach was eduacation of the locals. followed by employing them to look after the animals , making sure they can afford food , and see the animals as a income , not a nuisance/ food source.

Point is, what may not seem directly related to the problem been fixed , usually is .

Aka the link between education and high birth rates.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.