Amanda Morrall worries about old age and the likely extinction of NZ Super. She compares John Key to a mole. Your view?

By Amanda Morrall

When I reach my "golden years," the age of entitlement for the purposes of retirement won’t likely make a wit of difference.

Whether it’s 65 or 67, or even 70 won’t change the two depressing realities:

1) that I’ll be old and

2) that the New Zealand Superannuation will be dead.

Mind you, it could be the other way around. That is I’ll be expired and the NZ Super is still limping around marking time until it too gives up the ghost. Not sure which one's more preferable. Depends on how well I provision for my retirement.

How can I be sure of these bleak projections?

Unless we can find a time machine and an economic panacea that will solve the problem of too little money and too many old people, both death and the end of NZ Super are inevitable I reckon.

The Ministry of Social Development (MSD), in its latest report "The Business of Ageing" seems to hold a more optimistic view.

While the MSD highlights an unprecedented explosion in the number of seniors age 65 and older between now and 2031, the suggestion is that oldies working well past the current age of retirement will sufficiently replenish (through the extended shelf-life of their tax contributions) the NZ Super.

Problem is the math isn’t there to back it up.

I’ve been accused before of being an alarmist, but it’s not just me who has these nagging concerns that the days of fabulous social safety nets are a luxury that so called developed nations can no longer afford.

As a percentage of GDP, New Zealand Superannuation costs are expected to double by 2050, from its present 4% to 8%.

Retirement Commissioner Diana Crossan confesses she has serious doubts as to whether an older workforce (NZ already has one of the most mature labour pools in the world) will make up for the massive drain that will take place in coming decades.

Crossan doesn't quarrel with the idea of people working past 65, she supports it completely, along with the MSD's attempt through its recent report to the raise the issue and prepare the nation for a dramatic demographic redesign of its workforce.

By 2031, the number of New Zealanders aged 65 and over is expected to exceed one million, almost double the current number.

Ignorance is not bliss

NZ Super costs have been a dark cloud shadowing New Zealand politicians for decades but it would appear most would rather go blind staring at the sun than face up to the harsh reality that something has got to give and someone has to make what's bound to be an unpopular (possibly career crucifying) call on it.

Either we bump out the age of retirement (as have most other OECD nations in a similar old age rut), we rework the formula (as the Retirement Commission has proposed in its 2010 Review of Retirement Income Policy) or we introduce a means test and reserve it for society’s neediest. (For more on OECD’s 2011 Pensions at a Glance report click here). Also see related article by Amanda Morrall here.

John Key when asked about the thorny age of eligibility issue by our reporter Alex Tarrant, reminded me of that mole character in the Fantastic Mister Fox film, you know the one whose eyes go all swirly whirly when asked a question he doesn't know the answer to.

It’s fine for Mr. Key to continue dodging the question. He's sufficiently cashed up that long after he’s retired from public life, he won’t be competing for jobs at McDonalds with thousands of other grey hairs looking for income.

Personally, I’m not leaving anything to chance.

I don’t aspire to work at McDonald’s at age 67 nor do I fancy serving cups of tea to Mr. Key whilst reading aloud hand-written notes penned by candle light and delivered on foot by penurious old folk asking him why it wasn’t a bigger priority when he had the chance to face the dark cloud straight on and potentially stormproof the nation.

I’m squirreling, I’m scrimping, I’m sacrificing my privacy to a rent paying stranger and more importantly trying to reframe my economic existence so that working into my 70s is something I do out of choice rather than necessity.

The changing face of NZ

The year 2011 will see “baby boomers” (born between 1946 and 1964) begin to turn 65.

This heralds the start of a demographic and social change in New Zealand, which projects that:

• people aged 65 and over will comprise 13 per cent of the population in 2011, rising to 23 per cent by 2051

• by 2031, the number of New Zealanders aged 65 and over is expected to exceed one million, almost double the current number.

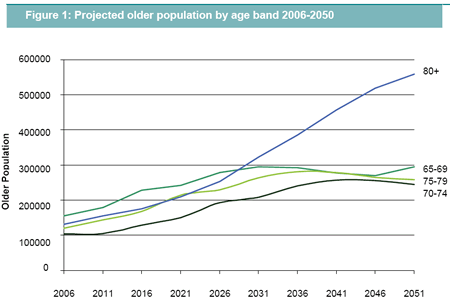

Significant changes in the age composition of older people will occur between 2011 and 2051:

• in 2016, nearly 33 per cent of older people will be aged 65–69, but by 2051 this proportion will have fallen to under 22 per cent

• people aged 80 and over will comprise 27 per cent of older people in 2011, rising to 41 per cent by 2051.

• between 2026 and 2031 the number of people aged over 80 will surpass the number aged 65–69 for the first time, and will continue to increase.

19 Comments

Here's a thought...how fat is Retirement Commissioner Diana Crossan's pay pack.....! suck on that....

Well - I should thank in advance you wonderful taxpayers who will be supporting me in 4 years time. It will go nicely with cash from a property sold at the peak of the boom, and those lovely subsidies that Mr Key is putting in my kiwisaver account.

Nice piece, Amanda there def won't be super when Im 70, boomers will have spent it all :)

I'm planning to be self sufficient and not need Govt Super

Thanks. If memory serves me right, I won't be seeing you at the job fair as you're already mortgage free and well on your way to financial freedom. You stand apart from Gen Y and my dismal cohort group Gen X. Will re-read Douglas Coupland's collection and weep.

cheers

Yeah but don't look at superannuation in isolation to other demands/purposes for spending/tax levels. We can choose to pay for super as it is albeit that is at the cost of something else, we can introduce compulsory retirement savings (although there re issues with that where people don't work all their lives), etc ...

One of the benefits of the Cullen fund is to put aside money to give us time to discuss all this (i.e. what level and type of taxation, what should we be spending it on, dealiing with aging, dealing with climate change ...) in an integrated way.

It is a big big tragedy that Key and English don't want to go there.

It's pointless borrowing money from one place to save it in another, which is what the Government would be doing if they were still contributing the the Cullen fund - all they'd be doing would be changing the nature of the burden on future taxpayers, who'd have to pay off the debt. They need to get back into surplus first.

Amanda, could we have some stats please about how much money there is in the Cullen fund and how that compares with NZS costs? thanks

I'll try to chase em down for you.

Good,pertinent article but is anyone listening. Most believe in now,don't worry about tomorrow,it may not happen.Why do we always expect a handout at the end,or near to it? Perhaps we should lower our sites & try a bit of self responsibility instead of "they owe it to me,I have worked so hard".

"Most believe in now,don't worry about tomorrow"

Many of us are too busy worrying about today. Bit hard to save for retirement if you have lost your job, have zilch job security, are on the receiving end of collapsing or flatlined wage levels for a generation + . Add to that hyper inflated house prices, general inflation, low returns on savings, an endless global financial crisis etc etc.

'try a bit of self responsibility instead of "they owe it to me,I have worked so hard"'

Try visiting Planet Earth one day soon, Wrat.

Not to mention everyone is paying taxes into it! It's our own money we're getting back, it isn't coming from thin air.

I agree. It is too hard. We have savings and nowhere that we can place it without concerns that the purchasing power will be lost due to inflation/taxation. Our employment situation is dicy, 'secure as can be in a recession'.

I can't see people being motivated to save in this environment.

Government has to cut it's bureacratic costs and stop handing money out like it is a wealthy uncle.

Have been visiting planet earth South Paw,done my three score years & ten,yes I get Super but am still working because I have to not because I want to,never earnt over $25,000 gross a year in my life,never had to worry about interest rates,dodgy Financial Advisors or shady investment options. To old for Kiwi Saver. However I live in paradise & am enormously grateful for the priviledge.

Kiwis are proven abysmal savers,hence Kiwi Saver & various other incentive schemes. We live for now. Look at the proliferation of cafes,coffee shops & salads etc in hermetic condoms of hygiene.Someone is spending or they would not be there.That to me is proof of disposable income.Spend now but do not expect to have it later.

I hope it's still there for everyone.

Dear Amanda, (smile and wave)

I cannot a solution to the "super" question without losing my job....not that I need it, but then it's nice to be PM (even for a while) with all that flying around and shaking hands with similar and likes ...you get what I mean.

I seriously believe that any KIWI who believes that their "super" is coming to them in the next decade or so is also seriously delusional...but by next decade i won't be around to talk (and smile and wave) about this anymore....

But wonder what my plan would be (if I had one) if I had to sort out this problem??

1. Raise the retirement age....afterall a whole lot of Kiwis WILL BE CRYING FOR A JOB EVEN AT 65 SOON !!

2. Increase Kiwisave contribution and make it compulsury...

3. reduce "super" entitlement after a few years from 2. above and claim that "your Kiwisaver account should see you through the rest of the years, and if it don't than its all your fault"...or words to that effect..

cheers

Jon Quay

There's probably more than a grain of truth in this, but note that there is no "retirement age" in New Zealand. 65 is the age at which you are eligible for NZS, but there's no obligation to stop work.

I take the view that the tax I pay won't be used to provide me with an income when I reach retirement age. The sooner the government reduce super payments to the level of the benefit the better. Obviously there will need to be a phasing of reductions but lets do something about this now.

The idea that we are entitled to a retirement income strikes me as bizarre. People bang on about not having enough money but most of these people no doubt think things like sky tv the internet ipods smart phones etc are essential. If people live within their means most people should be able to fund a % of their income with an income tested pension as a top up for the people who dont' earn enough and the full time beneficiaries.

I think most western countries will be forced to give up on the unaffordable 'cradle to the grave' welfare state at some point and we'll all be looking after our parents/grandparents in the future (like they use to do in the old days). Probably better for all really, bit of company for the old folks and some free daycare and baby sitting. Maybe, this will increase demand for bigger houses or houses with granny flats. In anycase, be good to your kids, because they could be looking after you in your golden years!

Projected (mine) cost of New Zealand superannuation over the next 30 years assuming a 150% increase in those aged 65+ by 2041, and a 2% annual cost of living increase, but not allowing for an increase to the age of eligibility.

$NZ 908.5bn

Value of the Cullen Fund over that same period assuming no draw down on Funds and no further contributions from Govt, but assuming an annualised return of 3.5%, compounded.

$NZ 1,079.5 bn

Question. When should the Cullen Fund be used to subsidise New Zealand Superannuation payments and how?

Should the Govt. begin contributions to the Fund again? And if so when?

oops, I just realised the Cullen Fund figure I posted was incorrect. I've entered the wrong figure. The Cullen Fund will be worth about $54 bn in 30 years givern the assumptions above.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.