Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below. This is the first Top 10 for 2010 and I welcome any suggestions for Tuesday's Top 10 at 10 to bernard.hickey@interest.co.nz (Corrected to say RBNZ liquidity rules require banks to raise secure funds both locally and for longer terms internationally).  1. Strategy questioned - Tim Hunter at the Sunday Star Times questions the relationship between Strategic Finance and Bank of Scotland International (BOSI) and concludes debenture holders have been the losers, particularly when a last minute deal gave a prior charge to BOSI.

1. Strategy questioned - Tim Hunter at the Sunday Star Times questions the relationship between Strategic Finance and Bank of Scotland International (BOSI) and concludes debenture holders have been the losers, particularly when a last minute deal gave a prior charge to BOSI.

Clearly, Strategic's management made desperate efforts at the eleventh hour to stay afloat, but hindsight suggests investors would have been better off had Strategic called in receivers rather than hand over so much value to the bank. Furthermore, it looks like Strategic was more concerned about its relationship with BOSI than its obligations to debenture holders. At the time the prior claim was signed off that July, management would have already known there was not enough cash to repay debentures. If the prior claim was the price of BOSI's participation in a management buyout, it should have been conditional on completing the deal. If it wasn't, debenture holders were simply sold down the river. Strategic's announcement on Friday of $106m in further provisions and write-offs as first mortgage holders "undertake aggressive enforcement and recovery activity" underlines the poor quality of management's decision-making. There are good reasons to call in the receivers.

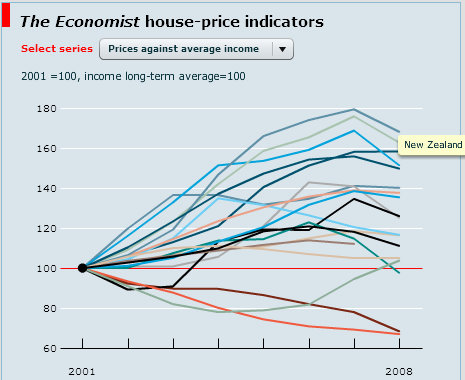

2. Rebounding - The market for Kangaroo bonds (Australian dollar bonds sold to international investors) has bounded ahead in the last couple of weeks, Bloomberg reported. Five year swap rates, which is the cost in wholesale markets of swapping interest payments in Australian dollars for payments in US dollars, are only 35 basis points above the bank bill swap rate. This will increase demand for Australian dollars and raises the potential for increased demand for Uridashi and Eurokiwi bonds. Are we about to get back on the higher rates, higher currency, easy foreign money bandwagon again? Maybe not. The new prudential liquidity rules from the Reserve Bank are forcing banks to raise funds domestically (and for longer terms internationally) and stopping them from diving into the wholesale markets for 'cheap' foreign (short term) money. 3. Good value - This excellent interactive chart on housing markets from The Economist is well worth playing with. It shows New Zealand is the world's second most expensive housing market (after South Africa), when you look at prices as a multiple of average incomes after 2001. Different time periods and different measures give different answers, but New Zealand is usually right up there among the most expensive. Fair enough?

4. Anybody left? - It seems there won't be many large independent fund managers left soon in the wake of NAB's takeover of AXA Asia Pacific. ANZ is reported by The Age to be in talks to buy Australia's IOOF Holdings for more than A$1.3 billion worth of shares and cash.

IOOF nearly doubled in size last year after it merged with Australian Wealth Management. This turned it into a key mid-ranked player, with more than 700,000 customers, and funds under management, administration and advice of more than $71 billion.

5. Hail the conquering Ralph - Commonwealth Bank of Australia CEO Ralph Norris (former ASB and Air NZ CEO) surprised analysts and investors on Friday by announcing the bank's first half profit would be higher than analyst expectations because of strong volume growth. Norris has masterminded a Kiwi-led management turnaround at Australia's biggest bank (by customers and branches). It is monstering the mortgage market in particular.  6. Rising rates and less lending growth - All around the world regulators are tightening up capital requirements for banks, forcing them to slow their lending growth rates and put aside more capital for the next rainy day (financial crisis). That is switching the focus of banks from growing lending to growing deposits. Bloomberg reports here on ANZ's views on how changes to Australian capital requirements will increase costs for the banks.

6. Rising rates and less lending growth - All around the world regulators are tightening up capital requirements for banks, forcing them to slow their lending growth rates and put aside more capital for the next rainy day (financial crisis). That is switching the focus of banks from growing lending to growing deposits. Bloomberg reports here on ANZ's views on how changes to Australian capital requirements will increase costs for the banks.

The Australian Prudential Regulation Authority outlined potential changes to bank capital requirements in September, saying it found lenders had reduced the quality of the asset buffers they must keep to protect depositors. The regulator said Dec. 18 that it will complete the new rules by mid-2011. Regulators worldwide are pushing for tighter controls on bank risk-taking after the U.S. subprime mortgage collapse triggered a global recession. The Basel Committee on Banking Supervision issued proposals last month aimed at making the banking industry more resilient. Among its suggestions was improving the quality of capital that banks hold. Commonwealth Bank of Australia, Westpac Banking Corp. and ANZ Bank raised home loan rates by between 35 basis points and 45 basis points last month, more than the Reserve Bank of Australia's 25 basis point increase to the benchmark cash rate of Dec. 1, blaming higher funding costs.

7. Don't give money to Haiti - Felix Salmon at Reuters writes a brave headline to say avoid giving money to the usual Haiti earthquake charities. He says give it to Medicins Sans Frontiere, who have been in Haiti for 19 years. He rightly points to some dodgy charities and the problems involved with Haiti being a failed state before and after the earthquake. He also points to problems with Wyclef Jean's Yele charity.

Yele is not the soundest of charitable institutions: it has managed only one tax filing in its 12-year existence, and it has a suspicious habit of spending hundreds of thousands of dollars on paying either Wyclef Jean personally or paying companies where he's a controlling shareholder, or paying his recording-studio expenses. If you want to be certain that your donation will be well spent, you might be a bit worried that, for instance, Yele is going to be receiving 20% of the proceeds of the telethon.

8. Goldman's Bug spray - Goldman Sachs has taken a swipe at gold bugs, arguing their whingeing about the demise of the US dollar as a reserve currency is just plain wrong, ZeroHedge reports (but doesn't buy it).

8. Goldman's Bug spray - Goldman Sachs has taken a swipe at gold bugs, arguing their whingeing about the demise of the US dollar as a reserve currency is just plain wrong, ZeroHedge reports (but doesn't buy it).

Yet, things are now different, because while the financial system did not collapse in September 2008 as it should have in order to get a fresh start, the moment of reckoning has been delayed for as long as the US can churn auction after non-failed treasury auction. In that sense, yes, it is different this time. And with that one can easily assume that all of Goldman's assumptions about a linear future are incorrect. The only question is how long into the future will the current "adjustment" period of pretend reality extend, and what happens when the emperor can not issue another $40 billion in 3 Year Bonds to buy some more non-existent clothing.

9. Peak Oil - Jeff Rubin, the former Chief Economist of CIBC World Markets, speaks in the video below at The Business of Climate Change conference, predicting US$225 per barrel oil by 2012 and with it the end of globalization, a movement towards local sourcing and a need for massive scaling up of energy efficiency. It is 45 minutes long, but well worth watching. HT Blair Rogers via Twitter. 10. Totally irrelevant video - It really is completely irrelevant and frivolous. A cat is surprised. It's now an Internet megastar.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.