Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please email your suggestions for Friday's Top 10 at 10 to bernard.hickey@interest.co.nz  1. Taskforce tax reform - Brian Fallow comments wisely in his NZHerald column on the Capital Markets Development Taskforce's recommendations, pointing out many are really about tax reform.

1. Taskforce tax reform - Brian Fallow comments wisely in his NZHerald column on the Capital Markets Development Taskforce's recommendations, pointing out many are really about tax reform.

The Capital Markets Development Taskforce makes a cogent case for tax reform to restore neutrality to the investors' world. The tax system, it declares, should not create incentives to invest in one class of asset over another, or through one kind of vehicle over another. Yet the tax laws are riddled with such distortions. Some are of long standing, like the lack of any comprehensive taxation of capital income, which has the effect of encouraging investment in residential property. Others arise from political ad-hockery, like the previous government's introduction of a new top income tax rate of 39 per cent (now reduced to 38 per cent) and portfolio investment entities (PIEs).

2. 'Normal again' - The Reserve Bank of Australia seems to have changed its tack on interest rates, arguing now that interest rates are nearly normal again because of the higher margins now being forced on banks by the global financial crisis. Kevin Mitchelson at our sister site interestratenews.com.au has the story. The chart below showing how Australian bank margins over the OCR have changed is useful, although it doesn't show how banks' own funding margins have widened.

3. Middle-eastern dollar? - Ambrose Evans Pritchard at the Telegraph strikes again with an article about the Arab States in the Gulf banding together to form a single currency, 'hoping to blaze a trail towards a pan-Arab monetary union swelling to the ancient borders of the Ummayad Caliphate.' HT Troy Barsten via email.

3. Middle-eastern dollar? - Ambrose Evans Pritchard at the Telegraph strikes again with an article about the Arab States in the Gulf banding together to form a single currency, 'hoping to blaze a trail towards a pan-Arab monetary union swelling to the ancient borders of the Ummayad Caliphate.' HT Troy Barsten via email.

"The Gulf monetary union pact has come into effect," said Kuwait's finance minister, Mustafa al-Shamali, speaking at a Gulf Co-operation Council (GCC) summit in Kuwait. The move will give the hyper-rich club of oil exporters a petro-currency of their own, greatly increasing their influence in the global exchange and capital markets and potentially displacing the US dollar as the pricing currency for oil contracts. Between them they amount to regional superpower with a GDP of $1.2 trillion (£739bn), some 40pc of the world's proven oil reserves, and financial clout equal to that of China. Saudi Arabia, Kuwait, Bahrain, and Qatar are to launch the first phase next year, creating a Gulf Monetary Council that will evolve quickly into a full-fledged central bank. The Gulf states remain divided over the wisdom of anchoring their economies to the US dollar. The Gulf currency "“ dubbed "Gulfo" "“ is likely to track a global exchange basket and may ultimately float as a regional reserve currency in its own right. "The US dollar has failed. We need to delink," said Nahed Taher, chief executive of Bahrain's Gulf One Investment Bank.

4. Painful - The Washington Post reports the US government 'quietly agreed to forgo billions of dollars in potential tax payments from Citigroup as part of the deal announced this week to wean the company from the massive taxpayer bailout that helped it survive the financial crisis.' Oh boy. This is political dynamite.

The Internal Revenue Service on Friday issued an exception to long-standing tax rules for the benefit of Citigroup and a few other companies partially owned by the government. As a result, Citigroup will be allowed to retain billions of dollars worth of tax breaks that otherwise would decline in value when the government sells its stake to private investors. While the Obama administration has said taxpayers are likely to profit from the sale of the Citigroup shares, accounting experts said the lost tax revenue could easily outstrip those profits.

5. Helicopter Ben wins (we lose) - Time Magazine has awarded Federal Reserve Chairman Ben Bernanke the title of Man of the Year for 2009. Barack Obama got the gong last year. Many other leaders to receive the award include; (in highly selective fashion) Hitler (1938), Stalin (1939, 1942), Nixon (1971, 1972), Deng XiaoPing (1978, 1985) and George Bush (2000, 2004). He is the first Fed Chairman to get it.

5. Helicopter Ben wins (we lose) - Time Magazine has awarded Federal Reserve Chairman Ben Bernanke the title of Man of the Year for 2009. Barack Obama got the gong last year. Many other leaders to receive the award include; (in highly selective fashion) Hitler (1938), Stalin (1939, 1942), Nixon (1971, 1972), Deng XiaoPing (1978, 1985) and George Bush (2000, 2004). He is the first Fed Chairman to get it.

Professor Bernanke of Princeton was a leading scholar of the Great Depression. He knew how the passive Fed of the 1930s helped create the calamity "” through its stubborn refusal to expand the money supply and its tragic lack of imagination and experimentation. Chairman Bernanke of Washington was determined not to be the Fed chairman who presided over Depression 2.0. So when turbulence in U.S. housing markets metastasized into the worst global financial crisis in more than 75 years, he conjured up trillions of new dollars and blasted them into the economy; engineered massive public rescues of failing private companies; ratcheted down interest rates to zero; lent to mutual funds, hedge funds, foreign banks, investment banks, manufacturers, insurers and other borrowers who had never dreamed of receiving Fed cash; jump-started stalled credit markets in everything from car loans to corporate paper; revolutionized housing finance with a breathtaking shopping spree for mortgage bonds; blew up the Fed's balance sheet to three times its previous size; and generally transformed the staid arena of central banking into a stage for desperate improvisation. He didn't just reshape U.S. monetary policy; he led an effort to save the world economy. In 2009, Bernanke hurled unprecedented amounts of money into the banking system in unprecedented ways, while starting to lay the groundwork for the Fed's eventual return to normality. He helped oversee the financial stress tests that finally calmed the markets, while launching a groundbreaking public relations campaign to demystify the Fed. Now that Obama has decided to keep him in his job, he has become a lightning rod in an intense national debate over the Fed as it approaches its second century. But the main reason Ben Shalom Bernanke is TIME's Person of the Year for 2009 is that he is the most important player guiding the world's most important economy. His creative leadership helped ensure that 2009 was a period of weak recovery rather than catastrophic depression, and he still wields unrivaled power over our money, our jobs, our savings and our national future. The decisions he has made, and those he has yet to make, will shape the path of our prosperity, the direction of our politics and our relationship to the world.

6. Really? - Felix Salmon from Reuters lays into Time's Michael Grunwald over the award.

Grunwald himself has clearly decided that Bernanke is a hero, dismissing serious criticism of say the decision to let Lehman fail by simply saying that "it's not clear how the Fed could have saved Lehman without a buyer". (Of course there was a buyer "” Barclays "” and it's precisely by stepping in with some short-term Bear-style financing that the Fed and Treasury could have allowed a smooth acquisition to proceed.) Most interestingly, Grunwald never mentions the Fed's massive loss of independence over the course of the crisis. While it's understandable as a policy response "” the last thing you want in a crisis is the fiscal and monetary authorities pulling in different directions "” it also carries much greater risks than some of the other things that Grunwald worries about.

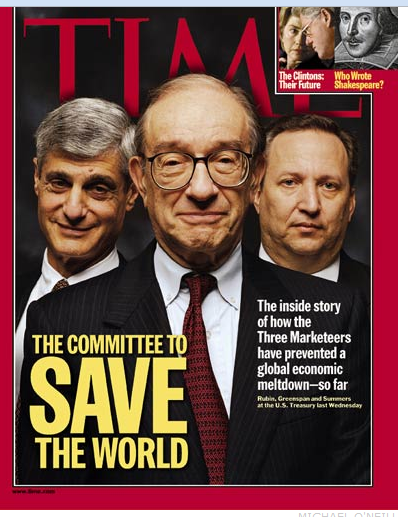

7. Be afraid - Paul Krugman declares at the New York Times that Bernanke should be very afraid because the Time Man of the Year award is cursed. He points to the cover story to the left.

7. Be afraid - Paul Krugman declares at the New York Times that Bernanke should be very afraid because the Time Man of the Year award is cursed. He points to the cover story to the left.

The magazine cover curse is a well-known phenomenon: you should always short the stock of a company whose CEO is the subject of a glowing cover story in a major magazine. Plus there's the specific Time effect. Let's not forget the 1985 joint portrait of Madonna and Cyndi Lauper, which concluded that Ms. Lauper was the one who'd remain a star.

8. 'Don't worry about Greece' - Simon Johnson at Baseline Scenario reckons investors shouldn't worry so much about Greece because the Europeans (and the Germans in particular) will do anything to save the euro. This is not necessarily a good thing in the long run, he points out (rightly in my view)

The global funding environment (thanks to Mr. Bernanke, Time's Person of the Year) will remain easy for the foreseeable future. This makes it very easy and appealing for a deep pocketed friend and ally (Abu Dhabi; the eurozone) to provide a financial lifeline as appropriate (a loan; continued access to the "repo window" at the European Central Bank, ECB). Of course, there will be some conditions "“ and in this regard the Europeans have a big advantage: the Germans. Everyone knows the German authorities are tough and hate bailouts (aside: except for their own undercapitalized banks). And the Germans can punish the Greeks with hostile bluster that the bond markets will take seriously "“ further pushing up Greek bond yields and credit default swap (CDS) spreads. But, in reality, there are many voices at the ECB table and most of them are inclined to give Greece a deal "“ put in place a plausible "medium-term framework" and we'll let your banks roll over their borrowing at the ECB, even if Greek government debt (i.e., their collateral) is downgraded below the supposedly minimum level. So Greece has a carrot and a stick "“ and refinancing its debt is so cheap in today's Bernanke-world, they will not miss the opportunity.

9. The full spectrum - Rolfe Winkler at Reuters points to this useful bar chart showing the budget deficits in world's major economies (except ours of course...) and how Norway has a huge surplus. Despite this Norway put its Official Cash Rate up overnight by 25 basis points to 1.75%. I sure their gas and oil revenues help... This chart does show though that New Zealand's budget deficit at around 5% of GDP by 2011 puts us in the middle of the pack. The UK is totally borked.

10. Totally relevant video - John Hodgman and Jon Stewart at the Daily Show have a solution for America's debt problem. America can pay its debt off to China by turning lead into gold, holding a panda for ransom and pretending to be dead... They also make the point America can get away with printing money because it is nuclear powered, which is sort of true....

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| You're Welcome - Debt Ceiling | ||||

|

||||

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.