Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please email your suggestions for Wednesday's Top 10 at 10 to bernard.hickey@interest.co.nz Our project costs never blow out...  1. Nitty Gritty to come - John Key has confirmed the government will look at changes to the tax system in the lead-up to the 2010 budget, NZPA reported. Here are the quotes, which are mildly encouraging.

1. Nitty Gritty to come - John Key has confirmed the government will look at changes to the tax system in the lead-up to the 2010 budget, NZPA reported. Here are the quotes, which are mildly encouraging.

"I think some of the challenges they have raised and the solutions they have proposed have merit," Mr Key said at his post-cabinet press conference. "I think you have to accept there are some holes in the tax base and I think you have to accept we have to make sure our tax system is fair and equitable to all." "We haven't got down to the nitty gritty yet. That will be early in the new year as we look to put together the 2010 budget."

2. It's getting ugly now - Here's a little snippet from Staten Island News about the tactics many US debt collectors are using on delinquent home owners. This one is painful because it freezes bank accounts and grabs pay cheques before they are paid. HT Troy Barsten via email.

A new foreclosure tactic, whereby lenders or debt collectors holding second mortgages freeze bank accounts or garnish pay checks of already struggling homeowners, is emerging and making it even more difficult for people to hold onto their homes. Lawyers for troubled Staten Island homeowners say they are beginning to see examples of clients who go to the bank to take out money and find that their accounts have been frozen or wiped out by other banks or debt collectors -- the entities holding second mortgages on houses already in default on the first and primary mortgage. Some are learning the lender or debt collector has already gone to court and secured a judgment to garnish paychecks. It's a move more in line with the traditional debt collection industry, which typically targets credit card debt, and it's dragging the house and what little cash reserves people often have into the foreclosure battleground. Experts say it's an end-run by second lien holders around the traditional foreclosure process, which involves only the first mortgage holder and provides important legal protections for the homeowner. "It's a fast and dirty process," Margaret Becker, lead attorney with the Homeowner Defense Project of Staten Island Legal Services in St. George, said of the new trend.

3. Managers rule - James Kwak at Baseline Scenario points out Bank of America's decision to repay its bailout loan early has a lot more to do with managers trying to escape the restrictions on bonuses than with any real sign of bank stability or desire to serve shareholders.

Buying back stock costs money "” real cash money. Why would a company ever do such a thing? The textbook answer is that a company should do it if it doesn't have investment opportunities that yield more than its cost of capital. The cash in its bank account, in some sense, belongs to its shareholders, who expect a certain return. If the bank can't earn that return with the cash, it should return it to the shareholders. In this case, though, the interest rate on the preferred shares is only 5%, which is far lower than usual cost of equity. In fact, Bank of America just issued $19 billion of new stock in order to help buy back the government's preferred stock. The cost of that new equity (in corporate finance terms) is certainly higher than 5%. In other words, Bank of America just threw money away. Paying back its TARP money also has the effect of making Bank of America weaker. From a liquidity perspective, it now has about $20-25 billion ($45 billion minus $19 billion raised from new equity minus a few billion from other asset sales) less cash than it did before paying the money back. From a capital perspective, using cash to buy back preferred shares reduces your Tier 1 capital ratio. So why? The answer is to avoid executive compensation caps (so it can find a new CEO) In retrospect, the executive compensation caps inserted by Congress into the stimulus bill back in February are having a perverse effect. Because the caps applied only to financial institutions that took TARP money "” and they applied much more heavily to institutions that received "exceptional assistance," like Citigroup and Bank of America "” it tilted the paying field even more heavily against them. This gives them an incentive to take steps that weaken their financial condition, even as conditions in the real economy (to which Bank of America is highly exposed) remain bleak.

4. New bailout? - It seems Barack Obama and his Democratic colleagues in Congress are keen to spend the US$200 billion left over in the TARP bank bailout fund on a new stimulus package, ZeroHedge points out. Heaven help us. The cartoon below is more appropriate. HT Gertraud via email.

5. Sovereign debt crisis - Deutsche Bank's strategists say 2010 could be the year of the sovereign debt crisis, FTAlphaville points out. The charts below are fun. Here are the quotes from Deutsche's Jim Reid:

In late 08/09 the authorities had little to lose in aggressively attempting to stave off a Depressionary cycle. So far they deserve extremely high marks. However 2010 could be a transitional year between heavy intervention and the paying of the bills. A return to positive global growth should help but we would expect more volatility in 2010 than in H2 2009. Back to Sovereign risk, history is littered with examples of inflation, devaluations and Sovereign defaults after financial crisis. One might wonder why this time should be any different. Sustainability is the key word. As soon as markets doubt the sustainability of a country's deficit then we have a problem. This is why it's important that in 2010 the authorities provide a credible path for future fiscal discipline, even this path involves many years of adjustments. One of the largest challenges will be funding the still large global government issuance in a world with less QE. QE limited the discussion on the impact of crowding out in 2009. Will we be as fortunate in 2010?

6. Cracking yarn - Matthew Goldstein at Reuters has uncovered an investigation by the FBI into one of the world's most powerful and secretive hedge funds (SAC Capital) that is full of juicy (and salacious) detail that I will do my very best to repeat. The story focuses on one cop, BJ Kang, and his battle with SAC's Steven A Cohen. The detail about how this hedge fund operates and the take-no-prisoners attitude is startling. Here's a ...er...taste, citing court documents Goldstein got hold of:

Kang interviewed former SAC analyst Andrew Tong, who had already become a tabloid sensation -- not to mention an embarrassment to SAC. In a lawsuit earlier that year Tong had charged that his male supervisor, Ping Jiang, then a top SAC trader, forced him to perform oral sex on him before completing a trade, according to people familiar with the investigation and court papers. Tong also alleged Jiang ordered him to take female hormones to turn him into "the ideal analyst/trader," combining both male and female characteristics, the court documents note. The strategy didn't work and SAC took a $3 million hit, which Tong claims Jiang ultimately blamed on him. Tong alleged that Jiang used the loss as a justification to fire him and that the real reason for his dismissal was his decision to stop taking the female hormones and engaging in "sexual conduct with Mr. Jiang," the documents say. "Steven Cohen only wants us to make money, he doesn't care or want to know our secrets to make money -- SAC doesn't need to know and doesn't want to know," Tong said in the filing, quoting one of Jiang's instructions to him.

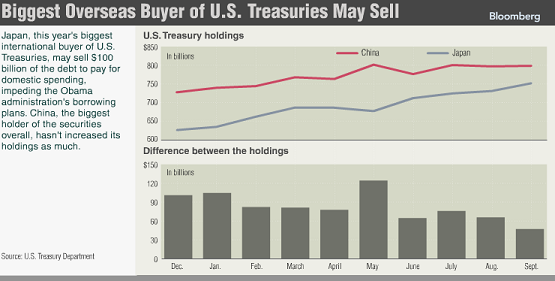

7. Bailing out - Could the cash-strapped Japanese government sell US$100 billion of US Treasury bonds to help pay for its own heavy domestic spending? This rumour has been doing the rounds in recent days. The Japanese have denied it, but they deny everything until they announce it. If true, this could prove the catalyst for the mother of all selloffs in the US Treasury market, which would push up interest rates around the world. The Japanese have been the biggest buyers of Treasuries over the last year, dwarfing even demand from China, Seeking Alpha pointed out with a Bloomberg graphic below.

Market News yesterday reported speculation that Japan, the world's second-largest holder of Treasury debt, will tell the U.S. it plans to sell $100 billion to finance domestic spending. Prime Minister Yukio Hatoyama is set to announce his first stimulus package today, and has said he won't increase domestic bond sales to fund it because of record government debt. "There's absolutely no such plan right now," Hirano told reporters today in Tokyo. "That kind of talk often surfaces at this season." Japan bought $20.3 billion in Treasuries in September to raise its holdings to $751.5 billion, while China purchased $1.8 billion to increase its total to $798.9 billion, the U.S. Treasury Department said on Nov. 17. "Japanese investors -- public and private -- have bought $125 billion of Treasury bonds in the first nine months of the year," New York-based Brown Brothers Harriman & Co. global head of currency strategy Marc Chandler wrote yesterday in a note to clients. "While we too suspect the rumors are likely unfounded, the Japanese fiscal situation is in poor shape and the government wants to curb new JGB issuance."

8. Grecian 2010 - Greece could be the next sovereign to default and cause grief inside the European monetary and banking system. The FT.com points out the growing nervousness around Greece's parlous budget situation.

The spread between the yield on the 10-year Greek bond and the benchmark German 10-year note widened to 182 basis, up from 174bp late on Friday, as investors remained concerned over the outlook for Greece's economy. On almost every measure, Greeks have been living beyond their means. The current account deficit reached almost 15 per cent of gross domestic product last year, making the US deficit of 5 per cent look modest. External public debt now exceeds GDP. With hindsight, it is clear that a lax fiscal policy was also pumping up an economy based largely on just two sectors "“ shipping and tourism. Now, "Greece's mix of problems is unique in the eurozone "“ a large budget deficit, rising debt and an unsustainable pension system", says George Pagoulatos, a professor at Athens Economics University. Since joining the euro, Greece has regularly flouted the deficit and debt limits set in the zone's "stability and growth pact" that is meant to correct for the lack of a single eurozone fiscal authority. Scant progress has been made in reforming the country's public sector, which added 50,000 mostly low-skilled employees in 2004-09. Public sector wages are again set to rise, by 5-7 per cent in 2010.

And here's the anecdote to go with it.

Sotiria rarely complains about her workload. At the office where the Greek public sector employee aged in her forties records value added tax payments, supervisors take a relaxed view of breaks for coffee and shopping, she says. If a family member falls sick, she stays home. "I don't feel bad, because there are always plenty of other people around to cover for me," she says. "Nobody here has too much to do."

9. Totally relevant video - It seems a bunch of unemployed Americans are spending all their time making YouTube videos about how the unemployment statistics are misleading. Fair enough. 10. Totally irrelevant (and possibly fake) video - A van drives in the wrong place at the wrong time.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.