Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please email your suggestions for Monday's Top 10 at 10 to bernard.hickey@interest.co.nz There are no concrete underpants at interest.co.nz  1. Poor dears - David Beckham and Brad Pitt are believed to be two of the stars caught out in the collapse of Dubai's Nahkeel, a major developer owned by the government. Beckham, Pitt and a whole bunch of soccer players bought properties in the now infamous Palm Jumeirah resort below, Hugh Tomlinson reports for TimesOnline from Dubai.

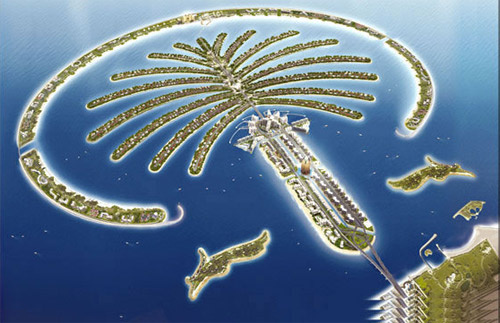

1. Poor dears - David Beckham and Brad Pitt are believed to be two of the stars caught out in the collapse of Dubai's Nahkeel, a major developer owned by the government. Beckham, Pitt and a whole bunch of soccer players bought properties in the now infamous Palm Jumeirah resort below, Hugh Tomlinson reports for TimesOnline from Dubai.

The concern is that Nakheel will be unable to continue developing the Palm and neighbouring projects, leaving Dubai and its coastal waters an ugly, unfinished construction site. When the 2,000 villas and townhouses on the Palm went on sale in 2002, they sold out in a month. Passing through en route to the World Cup in Japan and Korea were the England football team, and several players stopped off to sign up for £1 million properties on the artificial island, with Michael Owen, David James, Joe Cole, Andy Cole and Kieron Dyer, it was reported, joining Beckham on the beaches. Pitt and Angelina Jolie are also said to have bought homes. Joe Cole was one of the few who got out in time. The Chelsea player sold his villa for about $3.5 million (£2.1 million) last summer as Dubai's property bubble approached bursting point. The Dubai government has done its best to deny that a problem exists, claiming recently that the population would rise this year by 400,000, flying in the face of all independent assessments, which predict a sharp fall. The anecdotal stories of cars abandoned at Dubai International airport with credit cards in the glove box have become the stuff of legend, and not the image that the government has sought to project.

2. Turning back to sand - This piece from John Hopkins at TimesOnline goes behind the scenes at Dubai's World Golf Championship tournament on at the moment to find out what is happening in the bankrupt kingdom. It also details how golf was a driving force behind Dubai. The courses were all built on sand and fed by billions of litres of desalinated water. And debt.

A further example of not all being what it once seemed is that the Greg Norman-designed course on which the events will unfold over the next four days, while well conditioned, is little more than a resort course that was tweaked to make it more difficult after construction had begun, particularly the last four holes. Then again, the players are competing for $15 million, which is hardly chickenfeed. Yet the clubhouse is temporary, all the houses on the Jumeirah Golf Estates are empty and there is no mains electricity (it is provided by generators)

3. Peak of the boom - My daughter loves those Discovery channel programmes about engineering marvels and was particularly taken by one recently about the Burj Dubai, the world's tallest building currently being built in Dubai. Here is an excellent slideshow from The Telegraph with juicy pictures of a building far from finished, but due to open in January 2010.

4. A tad complicated - This makes Blue Chip look simple. At the heart of the Dubai debacle is this company called Nakheel, which is a tad complicated, as can be seen by this chart pointed out at FTAlphaville.  Questions are also being raised about the structure of the Islamic 'bond' known as a Sukuk underpinning Dubai generally and Nakheel in particular, the FT.com reports. The whole Islamic bond market is in danger.

Questions are also being raised about the structure of the Islamic 'bond' known as a Sukuk underpinning Dubai generally and Nakheel in particular, the FT.com reports. The whole Islamic bond market is in danger.

The Nakheel sukuk has been seen as an important indicator of how Dubai will manage the liabilities of its multifarious government-related entities, but a failure to repay the bond fully and on time could impact the global sukuk market, estimated at over $100bn. "There is a lot of shock and a little bit of anger," said Nish Popat at ING Investment Management in Dubai. "This is a major blow to the sukuk market. If it defaults, it would be the third one in the Gulf, and the largest Islamic bond default ever, and we're still waiting to see how sukuk-holders are treated in situations like this. There aren't any precedents."

And, of course, S&P and Moody's have bolted the door after Dubai's horse bolted by downgrading various securities connected to Dubai. And we trust these guys to give us warnings on our banks and finance companies? Remember Fitch's brilliant downgrade the day after Hanover defaulted? Meanwhile HSBC and Standard Chartered have some exposures to Dubai, Goldman Sachs points out. 5. Is Greece the next domino? - Many investors looking for the next trigger for a market collapse in Europe and more widely are watching Greece closely. It is inside the Euro but has a major budget problem that is causing all sorts of grief, Bloomberg reported.

EU finance ministers will reprimand Greece next week for failing to take "credible and sustainable" measures to reduce its budget deficit toward the EU limit of 3 percent of output, a draft document shows. Public finances deteriorated as many of the deficit-control measures adopted this year were never implemented. The government failed to control spending and was unable to make good on pledges to boost tax collection. "There is sovereign risk in Greece that is spilling over to corporate risk," said Francisco Salvador, co-strategist at Dexia Iberian equities in Madrid. "The public deficit and macro situation is worrying not only European authorities but investors too." National Bank of Greece SA, the country's biggest lender, fell 9.1 percent to 20 euros, the lowest since August. EFG Eurobank Ergasias SA, Greece's second biggest bank, dropped 7 percent to 8.30 euros, a four-month low.

6. He saw it coming - Ron Brierley has spoken to Denise McNabb at BusinessDay about GPG's apparent interest in buying Hanover Finance's loan book. He doesn't give too much away, but does have a few choice words for New Zealand's financial regulators.

In Sydney this week Sir Ron said he recalled seeing a television commercial for one finance company (Richard Long advertising Hanover) while visiting New Zealand a couple of years ago and thinking, "This isn't right". "I thought this company has got problems. The way they were advertising so strongly for funds suggested to me all was not well and sure enough, that eventually proved to be the case." Sir Ron said he believed there were still repercussions to come for New Zealand in terms of finance companies or semi-finance companies. Finance company collapses had been largely a New Zealand phenomenon. "There was no regulatory control so they ran amok, without the Securities Commission, without the boundaries," he said. But he did not think regulations had much to do with companies succeeding or failing. "What was thought to be good business has proved to be not so good business, notwithstanding so- called independent directors, and page after page of alleged corporate governance in the annual reports. It's ridiculous."

7. Gold bugs booted out - HSBC has had such a rush in demand by gold bugs to store gold in its vaults in New York it has asked them to leave to make room for more lucrative institutional investors, the Wall St Journal reports. HT Troy Barsten via email.

HSBC's decision has created a logistical nightmare for both the investors and the security teams in charge of relocating the gold, silver and platinum to new vaults across the country. Many of those vaults are also feeling pressure from the surge in demand for space from clients that have stocked up on metal. Investors have been loading up on gold this year amid worries about inflation and the stability of the U.S. dollar. As gold has continued to set new records, other investors have flooded in. Many of them are taking possession of the metal, rather than just trading financial contracts linked to it.

8. Negative equity - Almost one in 4 US homeowners homeowners with mortgages are now in negative equity, the Wall St Journal reports. HT Gertraud via email.  These so-called underwater mortgages pose a roadblock to a housing recovery because the properties are more likely to fall into bank foreclosure and get dumped into an already saturated market. Economists from J.P. Morgan Chase & Co. said Monday they didn't expect U.S. home prices to hit bottom until early 2011, citing the prospect of oversupply.

These so-called underwater mortgages pose a roadblock to a housing recovery because the properties are more likely to fall into bank foreclosure and get dumped into an already saturated market. Economists from J.P. Morgan Chase & Co. said Monday they didn't expect U.S. home prices to hit bottom until early 2011, citing the prospect of oversupply.

Home prices have fallen so far that 5.3 million U.S. households are tied to mortgages that are at least 20% higher than their home's value, the First American report said. More than 520,000 of these borrowers have received a notice of default, according to First American. Most U.S. homeowners still have some equity, and nearly 24 million owner-occupied homes don't have any mortgage, according to the Census Bureau. But negative equity "is an outstanding risk hanging over the mortgage market," said Mark Fleming, chief economist of First American Core Logic. "It lowers homeowners' mobility because they can't sell, even if they want to move to get a new job." Borrowers who owe more than 120% of their home's value, he said, were more likely to default. Just months after showing signs of leveling off, the housing market has thrown off conflicting signals in recent weeks. Jittery home builders and bad weather led to a 10.6% drop in new home starts in October, and applications for home-purchase mortgages have dropped sharply in recent weeks.

9. It was THAT close - Details are emerging now about how close the British banking system was to complete collapse in September and October last year. It turns out the Bank of England gave a secret 25.4 billion pound loan to HBOS and an even bigger one to Royal Bank of Scotland in those dark few days. Details of the loans emerged in Lloyds HBOS prospectus for its monster capital raising this week. Now there are are lot of Lloyds shareholders, who hated the HBOS deal from the start, saying they were misled. Fair enough. Here's the latest from TimesOnline.

The £25.4 billion extended to HBOS by the Bank of England has been widely perceived as evidence that the mortgage lender was far closer to collapse than was previously thought. Lawyers acting on behalf of Lloyds shareholders who want to sue the bank for buying HBOS said that the disclosure of the loan added significant weight to their case against executives. Jim Rai, a lawyer for Lloyds Action Now, a shareholder lobby group, said that it would strengthen claims being prepared against the banks' directors for failing to act in shareholders' interests when they recommended that the lender acquire the near-bust HBOS. Mr Rai said: "If a loan of this size was made, the bank's clearly in trouble, yet nothing was disclosed in the prospectus. They allowed shareholders to take the bait." Lord Myners, the City Minister, defended the Bank of England's decision to keep the loan quiet for a year. He said: "Parliament gave the Bank of England the right to operate covertly to support the banking system. We now know that the banking system was within a matter of hours of collapse. We are now seeing how true that was."

10. Totally irrelevant video - I know I can never really be famous because I will never be invited onto the Muppet show. But at least I can watch this. My favourites are always Animal and Beaker. Here they sing Bohemian Rhapsody because you can never make too much fun of this song.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.