By Roger J Kerr

Is the RBNZ about to make another monetary policy mistake, similar to their error in tightening policy to 8.25% in late 2007? Back in 2007 the bank economists and moneymarkets pressured and bullied the RBNZ into tightening, despite the economy faltering under the weight of an over-valued Kiwi dollar at 0.8000 against the USD at the time and inflation not coming from parts of the economy that are responsive to interest rate changes.

Within a few months after that booboo the economy was in recession, well before the global economic downturn. The same scenario is playing out in front of us again today. A pick-up in the housing market and retail spending over recent months has turned the former economic doomsayers (remember the bank economist forecasts of Armageddon for the economy at the start of 2009?) into re-born monetary hawks, as they call for the RBNZ to increase short-term rates sooner rather than later.

Alan Bollard and his economic gurus at the RBNZ should stand very firm on their current view for interest rates and the economy and not be cajoled by the market short-termists, who still have not worked out that our inflation in NZ does not come from increased consumer spending demand. Retail sales and business/consumer confidence have improved recently due to consumer goods going down in price i.e. more people can afford what they could not afford before. How is that inflationary? The RBNZ needs some sturdy steel in their combined backbones to resist the pressure from the moneymarkets (pricing a very steep interest rate yield curve) and economic forecaster's demanding interest rate increases in early 2010.

The RBNZ's job with inflation management is to look through the short-term economic vibrations and determine what pressures will be on prices in 12 to 18 months hence and thus the changes to interest rates required now to keep the annual CPI between 1% and 3%.

Whilst there is some improvement in economic conditions of late, the dramatic rise in the Kiwi dollar will reduce profits and incomes in 2010 in the all-important productive sector and pull forecast GDP growth for 2010 down. Inflation risks reduce in this environment.

The RBNZ needs to articulate this more realistic medium term outlook for the economy as the fundamental reason for not needing to increase interest rates until late next year.

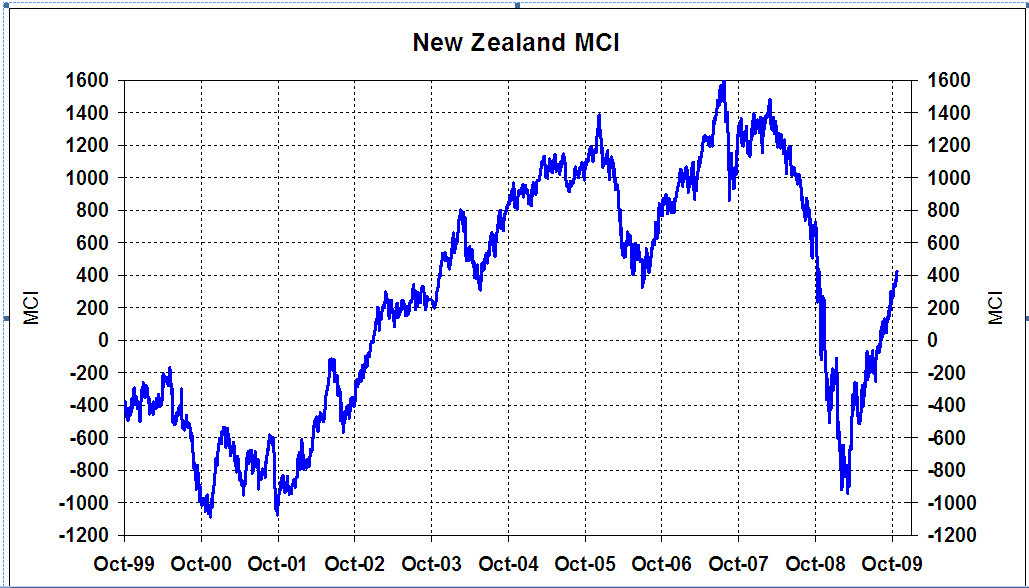

Monetary conditions, as measured by the combined currency and interest rate index (Monetary Conditions Index), have tightened considerably from -1000 in March (very loose) to +400 today (tighter than neutral). Where is the justification for the RBNZ to tighten further with interest rate increases over the next few months as many are now advocating? The high currency and slack capacity utilisation suggests the annual inflation rate will remain between 1.0% and 2.0% next year.

Mr Bollard should take a long, hard look at what the Canadians are doing with their monetary policy management right now. They are not raising their short-term interest rates as they see the damage their high currency value is having on their economy.

In his comments last week to the Parliamentary Finance and Expenditure Select Committee, Mr Bollard chose some rather poor and injudicious words to explain that the high currency would not prevent him form raising interest rates if that was needed in response to a stronger housing and retail environment. Strange words indeed when previously he was attempting to talk the NZ dollar down!

Hopefully the good Governor is choosing his words more carefully with this week's OCR review statement on Thursday. Another gaff like the one last week will have farmers waving pitchforks outside his office on The Terrace.

Another big worry for me is the RBNZ's continued fixation and pre-occupation with house prices as the source of inflation in the NZ economy. The RBNZ should be very careful about reading too much into the improvement in house prices over recent months. Under financial pressure from falling commission incomes, the real estate agent fraternity peppered the media with statistics of a shortage of supply of houses to sell. They needed to talk the market up to get buyers buying again.

My conclusion from anecdotally observing the growing numbers of pages of mortgagee sales in the Property Press publications is that the residential property market will struggle to make the house-price gains many are hoping for.

Unemployment is increasing, fixed rate mortgage rates are up and incomes are flat. Another boom in the housing market as a cause of inflation is not something the RBNZ should be concerning themselves with right now. Exporting companies losing money and laying-off workers should be more concerning for them.

The RBNZ can afford to leave interest rates lower for longer in 2010. The risks are low. If we get a major pull-back in the currency and stronger GDP growth, they can then lift the OCR more rapidly in late 2010 if they have to. The higher proportion of home mortgage borrowers now on floating rate and short-term fixed rate contracts means that any tightening of policy in late 2010 will be more effective in changing spending/price setting behaviour.

By Roger J Kerr

Is the RBNZ about to make another monetary policy mistake, similar to their error in tightening policy to 8.25% in late 2007? Back in 2007 the bank economists and moneymarkets pressured and bullied the RBNZ into tightening, despite the economy faltering under the weight of an over-valued Kiwi dollar at 0.8000 against the USD at the time and inflation not coming from parts of the economy that are responsive to interest rate changes.

Within a few months after that booboo the economy was in recession, well before the global economic downturn. The same scenario is playing out in front of us again today. A pick-up in the housing market and retail spending over recent months has turned the former economic doomsayers (remember the bank economist forecasts of Armageddon for the economy at the start of 2009?) into re-born monetary hawks, as they call for the RBNZ to increase short-term rates sooner rather than later.

Alan Bollard and his economic gurus at the RBNZ should stand very firm on their current view for interest rates and the economy and not be cajoled by the market short-termists, who still have not worked out that our inflation in NZ does not come from increased consumer spending demand. Retail sales and business/consumer confidence have improved recently due to consumer goods going down in price i.e. more people can afford what they could not afford before. How is that inflationary? The RBNZ needs some sturdy steel in their combined backbones to resist the pressure from the moneymarkets (pricing a very steep interest rate yield curve) and economic forecaster's demanding interest rate increases in early 2010.

The RBNZ's job with inflation management is to look through the short-term economic vibrations and determine what pressures will be on prices in 12 to 18 months hence and thus the changes to interest rates required now to keep the annual CPI between 1% and 3%.

Whilst there is some improvement in economic conditions of late, the dramatic rise in the Kiwi dollar will reduce profits and incomes in 2010 in the all-important productive sector and pull forecast GDP growth for 2010 down. Inflation risks reduce in this environment.

The RBNZ needs to articulate this more realistic medium term outlook for the economy as the fundamental reason for not needing to increase interest rates until late next year.

Monetary conditions, as measured by the combined currency and interest rate index (Monetary Conditions Index), have tightened considerably from -1000 in March (very loose) to +400 today (tighter than neutral). Where is the justification for the RBNZ to tighten further with interest rate increases over the next few months as many are now advocating? The high currency and slack capacity utilisation suggests the annual inflation rate will remain between 1.0% and 2.0% next year.

Mr Bollard should take a long, hard look at what the Canadians are doing with their monetary policy management right now. They are not raising their short-term interest rates as they see the damage their high currency value is having on their economy.

In his comments last week to the Parliamentary Finance and Expenditure Select Committee, Mr Bollard chose some rather poor and injudicious words to explain that the high currency would not prevent him form raising interest rates if that was needed in response to a stronger housing and retail environment. Strange words indeed when previously he was attempting to talk the NZ dollar down!

Hopefully the good Governor is choosing his words more carefully with this week's OCR review statement on Thursday. Another gaff like the one last week will have farmers waving pitchforks outside his office on The Terrace.

Another big worry for me is the RBNZ's continued fixation and pre-occupation with house prices as the source of inflation in the NZ economy. The RBNZ should be very careful about reading too much into the improvement in house prices over recent months. Under financial pressure from falling commission incomes, the real estate agent fraternity peppered the media with statistics of a shortage of supply of houses to sell. They needed to talk the market up to get buyers buying again.

My conclusion from anecdotally observing the growing numbers of pages of mortgagee sales in the Property Press publications is that the residential property market will struggle to make the house-price gains many are hoping for.

Unemployment is increasing, fixed rate mortgage rates are up and incomes are flat. Another boom in the housing market as a cause of inflation is not something the RBNZ should be concerning themselves with right now. Exporting companies losing money and laying-off workers should be more concerning for them.

The RBNZ can afford to leave interest rates lower for longer in 2010. The risks are low. If we get a major pull-back in the currency and stronger GDP growth, they can then lift the OCR more rapidly in late 2010 if they have to. The higher proportion of home mortgage borrowers now on floating rate and short-term fixed rate contracts means that any tightening of policy in late 2010 will be more effective in changing spending/price setting behaviour.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.