Here are my Top 10 links from around Internet at 10am. I welcome your additions and comments below or please send me your suggestions for tomorrow's Top 10 at 10 to bernard.hickey@interest.co.nz We take credit for everything at interest.co.nz  1. Impotent? - Reserve Bank Governor Alan Bollard signalled to Parliament's Finance and Expenditure select committee yesterday that there wasn't much he could do to influence the New Zealand dollar's inexorable rise in the short term, BusinessWire reported. Interestingly, Deputy Governor Grant Spencer was reported as saying the RBNZ didn't want to increase its exposure to the US dollar either, suggesting it's unlikely to sell Kiwi$ to buy US$ to push our exchange rate lower.

1. Impotent? - Reserve Bank Governor Alan Bollard signalled to Parliament's Finance and Expenditure select committee yesterday that there wasn't much he could do to influence the New Zealand dollar's inexorable rise in the short term, BusinessWire reported. Interestingly, Deputy Governor Grant Spencer was reported as saying the RBNZ didn't want to increase its exposure to the US dollar either, suggesting it's unlikely to sell Kiwi$ to buy US$ to push our exchange rate lower.

At Parliament's Finance and Expenditure Committee, the Reserve Bank Governor said any rate hike on his part probably wouldn't have much of an impact on the kiwi dollar, as the markets have already started pricing in rising interest rates. "We don't want to see the New Zealand dollar being put under unnecessary pressure again," Bollard said. "If and when we were to increase rates would you see that impact on New Zealand dollar? No, actually the markets already think quite a long way ahead of where we see monetary policy." He also warned that the bank couldn't intervene without taking longer view to the consequences of its actions. "You shouldn't be short-term overactivist and then regret it in the medium term," he said. At the same hearing, Deputy Governor Grant Spencer confirmed New Zealand's central bank was trying to move its assets away from the greenback as the world's reserve currency remained out of favour with investors. "We're trying to reduce our exposure to U.S. dollars as it heads south," Spencer said.

2. Finally - It seems the US government has worked out that the public are incandescent with rage over bankers jumping back on the bonus bandwagon so soon after the financial crisis' apparent end. The 'Pay Tsar' will order 7 bailed out banks to cut executive salaries about 50%, Bloomberg is reporting.

Cash salaries for the 25 highest-paid employees will be slashed 90 percent under Feinberg's plan, which will be announced this week, one of the people said today on condition of anonymity. Employees at the derivatives unit of American International Group Inc., blamed for insurer's near-collapse last year, can receive no more than $200,000 in total pay, one of the people said. Feinberg, 63, who was special master of the September 11th Victim Compensation Fund, was named to the Obama administration pay position in June. Executive compensation came under scrutiny after companies got billions of dollars in federal aid last year amid the worst financial crisis since the Great Depression. Public outrage flared in March after New York-based AIG paid $165 million in bonuses to employees of the derivatives unit. All perks such as limousine service and private aircraft valued at more than $25,000 must be approved by Feinberg, one of the people said.

3. Yes Sir! - This is a fascinating piece on NPR about Iran's Revolutionary Guards Corps (IRGC) and how it has quietly taken over the Iranian economy as a business. This would be one boss you wouldn't talk back to. However, it is a real challenge for any attempts to reform the economy and the democracy. For example, the IRGC now owns the mobile phone networks...no more Twitter protests... HT Troy Barsten via email

Last month, the IRGC took an $8 billion controlling interest in Iran's main telecommunications company. Given that there are an estimated 30 million cell phones in Iran, the investment is likely to prove lucrative. The acquisition also means the Revolutionary Guards will be better positioned to control Internet access and monitor private communications in Iran. Between its gradual displacement of the private business sector, its growing capability to monitor and control the opposition movement, and its potential control of black market and smuggling networks, the IRGC has come to be seen by reformers as a major obstacle to Iran's democratization. "Such an organization would not like to have a democratic state, especially if there is transparency and accountability," Nafisi says. "They like to have their shadow economy."

4. New hegemony - Irwin Stelzer at The Times speculates on how America could soon be in the position that Britain was soon after World War 2 when it had to beg the Americans for more money. Now the Americans will have to beg the Chinese. HT Troy via email.

Instead, they (the Chinese) see themselves in the position that America was in vis-Ã -vis Britain in 1946. America is deeply in debt and digging itself in deeper every day. China, America's principal creditor, is worried that Obama and his successors will attempt to pay back the more than $1 trillion they owe in wildly depreciated dollars. So it wants to see some plan coming out of the White House that will begin to reduce the deficit and, eventually, the national debt. No such plan exists. Obama, who styles himself a "transformational president", intends to keep the spending taps wide open. Unfortunately the old adage that if you owe your banker a huge sum you have him where you want him is not true "” not if the Chinese are your creditor. So it should be no surprise that Obama is the first president to refuse to receive the Dalai Lama, the Tibetan leader, despite the urgings of the celebrity luvvies who helped fund the president's election campaign. Or that America no longer presses the Chinese regime on human rights. All in an effort to keep the Chinese happy, and lending. Which brings us back to Keynes, Truman and the post-war world. Unless there is a big change in American economic policy, and soon, our version of the great British economist "” White House adviser Larry Summers, Treasury secretary Tim Geithner, or Federal Reserve Board chairman Ben Bernanke, or all three "” will head to Beijing to negotiate terms that will persuade the Chinese not to call in all their IOUs. The Chinese are likely to be less kind than we were and insist on terms that would sap our economic, and therefore military strength for years to come.

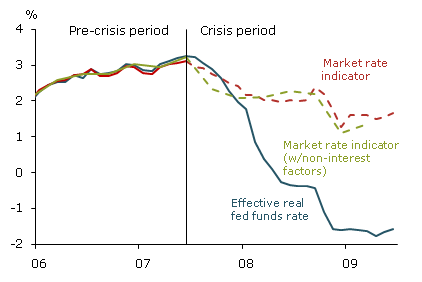

5. Print baby print - Paul Krugman at the New York Times believes America should keep its 'ZIRP' (Zero Interest Rate Policy) until the jobless rate is back under 7%. He also wants more money printing. Krugman points to an interesting study that says actual monetary conditions in America remain very tight. Remember, Krugman is closely read by the Team Obama. The problem for the rest of the world is that this cheap American money is being exported hand over fist. But we don't vote in America... HT Steven Jones via email.

Basically, this says that much of the Fed's loosening has been offset by troubles in the financial system, so that actual credit hasn't gotten much looser at all. And this in turn means that the zero-rate policy isn't nearly as expansionary as it might seem. That doesn't mean that the Fed funds rate has no effect; it means, rather, that you need a lower Fed funds rate to get any given effect. If credit-market troubles persist, this adds up to another reason to keep rates at zero for a long time "” possibly even after a Taylor rule suggests they should finaly start going up.

6. Vampire squid report - Felix Salmon from Reuters delves deeply into Andrew Ross Sorkin's now infamous book detailing who spoke to who about what and when during last year's crisis. Sorkin finds US Treasury Secretary Henry Paulson (and former Goldman Sachs CEO) was donkey deep inside Goldman's strategy while managing the collapse of a rival. The squid lives. Here's the comments from the book.

If all that weren't enough to deal with, [Lehman president Bart] McDade had just had a baffling conversation with [CEO Dick] Fuld, who informed him that Paulson had called him directly to suggest that the firm open up its books to Goldman Sachs. The way Fuld described it, Goldman was effectively advising Treasury. Paulson was also demanding a thorough review of Lehman's confidential numbers, courtesy of Goldman Sachs. McDade, though never much of a Goldman conspiracy theorist, found Fuld's report discomfiting, but moments later was on the phone with Harvey Schwartz, Goldman's head of capital markets. "I'm following up at Hank's request," he began. After another perplexing conversation, McDade walked down the hall and told Alex Kirk to immediately call Schwartz at Goldman, instructing him to set up a meeting and getting them to sign a confidentiality agreement. "This is coming directly from Paulson," he explained.

Oh dear. Salmon concludes:

In many ways, this is worse than Paulson's meeting with Goldman's board: in this case, Paulson is forcing Lehman to open its books fully to a direct competitor, for no obvious reason. And in this case it's not at all obvious that Paulson got a sign off from Treasury's general counsel before doing so. I suspect this is what happens when you do all your business by phone rather than by email: you're so comfortable with the fact that you're not leaving any kind of paper trail, it becomes much easier to cross the line and abuse your position as the most powerful Treasury secretary in living memory to the benefit of your former firm.

Cue public outrage in America...maybe. 7. Complacency abounds - Niall Ferguson makes the excellent point on Yahoo's TechTicker that America is being complacent about the Chinese always being there to buy its worthless bonds. The Chinese are rapidly diversifying their assets into hard commodities and developing their internal markets, Ferguson says. With no trade surplus the Chinese would stop buying. Anyone betting against a New Zealand dollar at US$1 by end of this decade? HT Greg Elliott via email.

"The idea they don't have anywhere else to go or would shoot themselves in the foot if there were a steep decline in the dollar or appreciation of their currency reassures many people in Washington "˜we can relax'," he says. "An appreciation of the renminbi may reduce value of their international reserves but increases the value of every other asset the Chinese own," most notably the commodity assets they have been buying all over the world. China's "current strategy is to diversify out of dollars and into commodities," Ferguson says. Furthermore, China's recent pact with Brazil to conduct trade in their local currencies is a "sign of the times." Perhaps most importantly, China's massive stimulus program is helping to generate internal consumption in the People's Republic, meaning local manufacturers are less dependent on exports. Because of the "rapid growth" of Chinese domestic consumption, Ferguson predicts China's international trade surplus could be gone by next year. "People in Washington rather assume because the U.S. consumer was so dominant there really isn't a substitute," Ferguson says. But China's trade surplus stood at $12.9 billion in September, down about 56% from a year earlier, according to MarketWatch.com.

8. Lost soul - Paul B Farrell at MarketWatch.com has written this magnum opus titled 'Death of Soul of Capitalism' which is getting plenty of attention. He details 20 reasons why America has lost its soul, starting with this... HT Sargon Elias via email.

1. Collapse is now inevitable Capitalism has been the engine driving America and the global economies for over two centuries. Faber predicts its collapse will trigger global "wars, massive government-debt defaults, and the impoverishment of large segments of Western society." Faber knows that capitalism is not working, capitalism has peaked, and the collapse of capitalism is "inevitable." When? He hesitates: "But what I don't know is whether this final collapse, which is inevitable, will occur tomorrow, or in five or 10 years, and whether it will occur with the Dow at 100,000 and gold at $50,000 per ounce or even confiscated, or with the Dow at 3,000 and gold at $1,000." But the end is inevitable, a historical imperative.

This could end up being viewed as the week when dollar weakness became too much for the rest of the world to bear, setting the scene for tense encounters at the upcoming meeting of finance ministers from the world's 20 largest economies. Brazil has now imposed a tax on some foreign-exchange inflows. The Bank of Canada has cranked up its negative tone on the strength of the Canadian dollar. And a whole slew of European officials have practically begged the U.S. to step in and boost the buck.

10. Sign 'o' the times - A 90 year old American man has been forced back to work after 25 years of retirement because he lost everything in the Bernie Madoff scandal, AP reports in this video. The former business owner now hands out flyers to customers entering a grocery store and earns US$10 an hour working 30 hours a week. How many other retired people are having to go back to work here in New Zealand after finance company collapses?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.