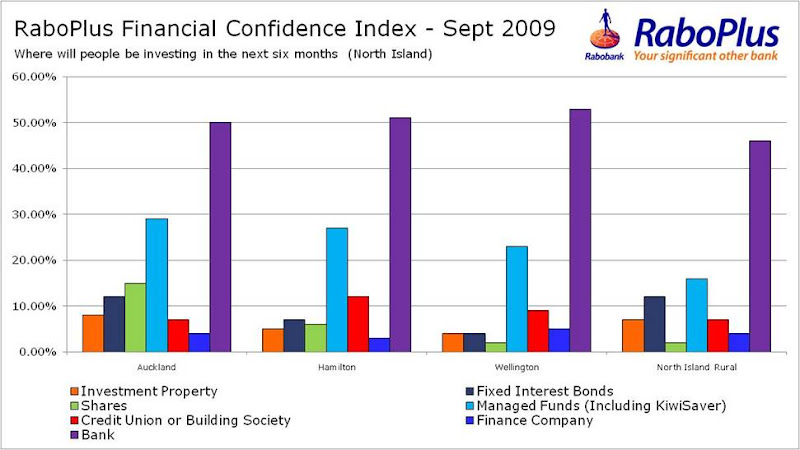

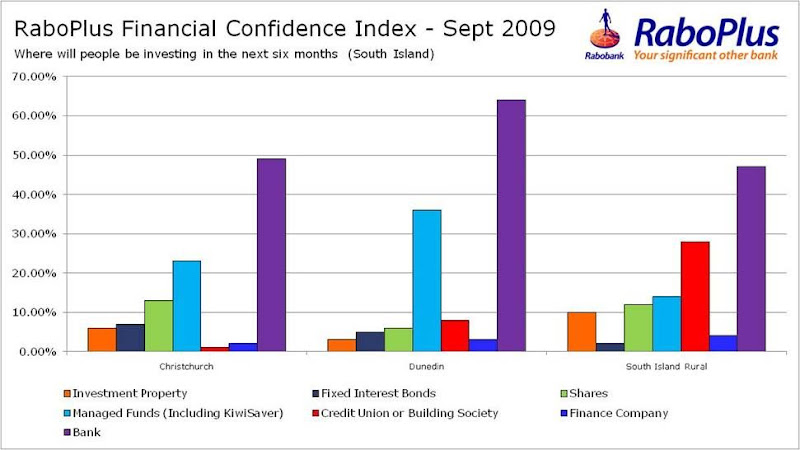

By Mike Heath In late September we launched the new RaboPlus Financial Confidence Index. The index is designed to primarily capture two things: · the level of confidence or trust Kiwi's have in the financial system, and in particular the various industry groups that fit under this classification (banks, finance companies, share brokers etc) · how people feel about their financial positions looking back to six months ago, and looking forward to six months in the future We will conduct this research every six months so we can track the changes and see if we can determine what is driving any changes in trust and confidence. You can have a look at the full results from my blog post of 22nd September, and the comments that Interest.co.nz also made. In this post I wanted to look at the regional differences in terms of what Kiwi's plan to invest in over the next six months, including investment properties and where there any significant differences. If you take a look at the chart below you'll see, by region, the percentage of people who definitely will or probably will invest in Investment property, Fixed Interest Bonds, Shares, Managed Funds (including KiwiSaver), Credit Union or Building Society, Finance Company or in a Bank. Given that Banks scored the highest (51%) across the whole country, there is no surprise to see them score consistently high in each region. However after that, things are not that consistent.

Here are a few of the key differences:

Here are a few of the key differences:

· Credit Unions or Building Societies are the second most popular option for the South Island Rural region (28%), yet the North Island rural region (7%) mirrors the results of the major cities. Are there more Credit Unions and Building Societies in the South Island? I would definitely expect them to have a lower profile, and therefore customer base, in the larger cities where the banks are dominant, but I'm not sure why they score so much lower in the rural North Island region. Hamilton is an exception (12%) "“ perhaps this reflects the dominance of the rural sector in their economy. · Aucklanders, when compared to Wellingtonians, appear to have a more balanced approach to their investment priorities. Proportionately they are planning to invest more right across the board, except for Finance Companies (Auckland 4% and Wellington 5%). · Perhaps the South Island property market has not suffered the same highs and lows as the likes of the larger cities because 1 in 10 rural South Islanders still see this as an attractive investment option. Interesting though to see that people in Dunedin don't feel the same with only 3% looking at investment properties in the next six months. · People from Dunedin, of which I must confess am one, are often characterised as astute and conservative investors. After banks, Managed Funds (including KiwiSaver) is by far their next preference (36%) and Finance Companies (3%) are their least favoured "“ perhaps the perceptions are true and that they have the balance right "¦ cash for the short term needs and managed funds for retirement? · And finally Wellingtonian's are not planning to invest in shares (2%) and in fact it's their 2nd from bottom preferred choice. Yet Managed Funds is their 2nd most preferred option (23%). Not sure what can be concluded from that.

What's your view on these regional differences? Note. Mike Heath is the General Manager of RaboPlus in New Zealand and commissioned the research into Financial Confidence, which has been widely welcomed by the Securities Commission, Commerce Commission and the Retirement Commission. RaboPlus sponsors the Ratesblog. More RaboPlus blog posts from Mike and Diana Clement can be found here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.