Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments in the comments below or please email me your suggestions for Friday's Top 10 at 10 to bernard.hickey@interest.co.nz Dilbert shows how the US government really works today.  1. A big crunchy, puffy meringue - Brian Fallow's Thursday column in the NZHerald is often an excellent read and this week's is no exception. He is rightly cautious about all the recovery talk and says the economy still has some major flaws. He says the optimism is based on a 'meringue' of an economy.

1. A big crunchy, puffy meringue - Brian Fallow's Thursday column in the NZHerald is often an excellent read and this week's is no exception. He is rightly cautious about all the recovery talk and says the economy still has some major flaws. He says the optimism is based on a 'meringue' of an economy.

The ratio of household debt to disposable income rose from 60 per cent in 1990 to 100 per cent in 2000 and over 160 per cent by its 2007 peak. It has only come back to 157 per cent. Even with interest rates around cyclical lows, debt servicing costs of 12.2 per cent are well above the average of 9.6 per cent since the early 1990s. This does not look like the platform for another sustained rise in house prices such as we saw between 2002 and 2007. ANZ National Bank economists in their quarterly forecasts released this week argue that what we experienced in those boom years was not normal and we are unlikely to return to that environment. "During that time credit growth ran at two to three times the rate of nominal GDP growth, house prices almost doubled in real terms and there was a general expectation that asset prices could continue to grow at double-digit rates. Cash flow fundamentals were supplanted by expectations of strong capital gains. The byproducts were nasty imbalances, including excessive leverage and risk-taking, a high current account deficit, significant affordability issues ... Policymakers would be irresponsible to let such behaviour and imbalances return." Quite. But are we seeing the beginnings of a return to the same behaviour, what you might call a recidivist recovery? In an ideal world we would now be in the throes of an export-led recovery, while households rebuilt their savings and reduced their debt. Instead the opposite is happening.

2. History always repeats - Bloomberg reports that JP Morgan is planning to offer interest-only mortgages to boost Barack Obama's housing recovery plan...No comment required. HT Troy Barsten via email titled "WTF!"

"We're working with our peers to develop a proposal to present," Douglas Potolsky, a senior vice president at JPMorgan's Chase home-loan unit, said yesterday at a Mortgage Bankers Association conference in San Diego.

Under the federal program, taxpayer subsidies to lenders, servicers and homeowners are used to encourage the reworking of borrowers' mortgages to cut their monthly payments to 31 percent of their incomes. Servicers are first directed to lower interest rates to as low 2 percent, then extend terms to as long as 40 years and then suspend payments on a portion of the debt until maturity.

The benefit of allowing interest-only periods as well would be "a significant pickup in terms of mods being done," because the current methods often fail to allow loans to pass required tests on whether modifications serve lenders better than foreclosures, said JPMorgan's Potolsky. The New York-based bank uses interest-only periods in many of the modifications it's doing outside of the U.S. program, he said.

3. Some good news - India seems to be one of the beneficiaries of the global trend of investors switching away from putting their money in the US dollar, the New York Times reports. There is some justice in the world. If any country needs foreign investment to lift the masses out of poverty then it is India. I'd much rather the money was going here than funding a profligate lifestyle for Americans looking to buy their 3rd SUV. HT Troy via email.

Six months ago, it looked as if India was in for a bumpy recession. Factories were laying off workers and construction sites were grinding to a halt as foreign investment slowed to a trickle. But in the last few months India has hit a gusher, as investors around the world have turned away from the dollar, the global refuge during the crisis, and rediscovered their optimism in the world economy and India's place in it. Nearly $7 billion more foreign direct investment flowed into India than left the country in the second quarter, from April through June, nearly twice as much as in the previous six months combined. Including cash invested in the stock and bond markets, India received about $15 billion in foreign investment, the most it has received in any quarter except the last three months of 2007, according to Macquarie Securities.

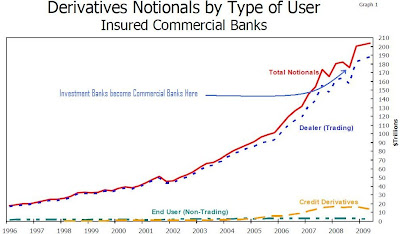

4. A very big number - There are estimates that the notional value of the world's derivatives market is now up to US$1.4 quadrillion (US$1,400 trillion) in this well-backgrounded piece in the EconomicEdge blogspot. US authorities put the number at over US$200 trillion. However, this piece says that adjusting for the investment banks now being commercial banks means that volumes of derivatives are actually falling fast. HT Gertraud via email

4. A very big number - There are estimates that the notional value of the world's derivatives market is now up to US$1.4 quadrillion (US$1,400 trillion) in this well-backgrounded piece in the EconomicEdge blogspot. US authorities put the number at over US$200 trillion. However, this piece says that adjusting for the investment banks now being commercial banks means that volumes of derivatives are actually falling fast. HT Gertraud via email

The clues are there, and they are telling me that net derivatives have peaked and are, in fact, falling backwards executing a classic parabolic collapse.

5. The real Dr Doom - Here's Marc Faber talking about the impending bankruptcy of America in a video on Bloomberg. 6. Version 2.0 - And here's Faber talking about how Gold (outside the US) is the best hedge. 7. Big tip - US investment banking culture remains on another deeply worrying planet. It turns out AIG is paying a kitchen worker in its Financial Products (the one that nearly destroyed the financial world) a retention bonus, FT.com reported.

AIG's "retention bonuses" went to hundreds of employees in the insurer's troubled financial products unit, including a kitchen assistant who received $7,700 in March, a US government report will reveal on Wednesday. News that support staff shared $168m-plus (£105m-plus) worth of retention awards could undermine AIG's insistence the bonuses were needed to persuade key employees to stay on and unwind the derivatives trades that almost brought down the insurer last year. The recipients included the kitchen assistant, who was handed a cash retention bonus of $7,700, and a "file administrator", who received $700, as well as more senior executives who were paid bonuses of up to $4m. AIG declined to comment but corporate governance experts said the decision to share the retention awards among so many employees contradicted their stated purpose. "It is odd for a kitchen assistant to receive a retention award," said Charles Elson, a corporate governance professor at the University of Delaware. "If everyone receives a retention bonus, it makes you wonder what the point of the programme is."

8. Too smart by half - Felix Salmon at Reuters talks about an interesting piece looking at how Wall St went off the rails when the really bright kids started working there.

Bankers have made money for centuries, by doing essentially what their fathers and grandfathers did before them. (They've lost money, too, but nearly always in the same way: by lending money to people who can't or won't pay it back.) Then Wall Street went go-go in the 1980s, and lots of smart, hungry, and highly self-regarding MBA types started flooding into big investment banks. When they started making money, they credited themselves, and their own intelligence. Which led to an obvious conclusion: if you did something even cleverer, you'd make more money still. Which, like most things in finance, is a strategy which works until it doesn't.

9. Relative wages and education - James Kwak at Baseline Scenario also looks at this phenomenon of bright Wall St bankers and includes this chart below . The basic problem is that the CEOs are dumber than their bright quants who made all the mess. I'd love to see the line for Wall St profits/losses superimposed on this. I agree with Kwak's view that the market for CEOs is deeply flawed.

"When the smart guys started this business of securitizing things that didn't even exist in the first place, who was running the firms they worked for? Our guys! The lower third of the class! Guys who didn't have the foggiest notion of what a credit default swap was." Technology firms also face a similar problem. In technology, as in most businesses, the way to make it to the top is through sales, so you end up with a situation where the CEO is a sales guy who has no understanding of technology and, for example, thinks that you can cut the development time of a project in half by adding twice as many people. I have seen this have catastrophic results. Even when you don't have the generational issue that Trillin talks about, the problem is that the sociology of corporations leads to a certain kind of CEO, and as corporations become increasingly dependent on complex technology or complex business processes (for example, the kind of data-driven marketing that consumer packaged companies do), you end up with CEOs who don't understand the key aspects of the companies they are managing. And the underlying problem is that, for all the blather that CEOs and boards spit out about succession planning and the importance of people, the fact remains that the market for CEOs is deeply flawed, as shown for example by Rakesh Khurana.

10. Nothing to do with finance - This is all about hot pies. Our police force is a fountain of useful knowledge. "Always blow on the pie. Safer communities together". A bonafide instant Kiwi classic. ( TV Production house Screentime in their ultimate (non) wisdom have taken this video off YouTube. A complete #fail in the age of promoting your work on the internet. Just ludicrous. An Old Media cockup) (Update) They've put it back up after the embarrassing reaction online. Good on them).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.