Top 10 at 10: PGC buyers reluctant; OECD deflation; English's bond sales trip; US cow glut; Dilbert

2nd Oct 09, 10:49am

by

Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments in the comments below or please send me suggestions for Monday's Top 10 at 10 to bernard.hickey@interest.co.nz We do not have an HR director at interest.co.nz...or gas leaks.

1. Interesting - Adam Bennett at NZHerald has a useful piece in his Stock Takes column about what some fund managers are saying about the Pyne Gould Corp rights issue to raise more than NZ$237 million. He talks curiously about some 'interesting' names in Australia who may buy in.

1. Interesting - Adam Bennett at NZHerald has a useful piece in his Stock Takes column about what some fund managers are saying about the Pyne Gould Corp rights issue to raise more than NZ$237 million. He talks curiously about some 'interesting' names in Australia who may buy in.

The capital raising represents a chance to buy into the company but will the instos take the opportunity? We hear at least one is, but Stock Takes spoke to a source at another who, having been briefed by the company, wouldn't. "I didn't understand the structure and they didn't provide suitable answers to our questions we raised regarding appropriate returns and I don't like the messy structure of it, to be honest." He also said he was mindful of the company's "linkage to the past" - namely Marac's impaired property loans. The fact that PGC and First NZ have managed to secure sub-underwriters for the $237 million rights issue indicates there are more than just one or two big investors prepared to back the company. Word is that apart from Kerr himself, the list of sub-underwriters includes some "interesting" Australian names.2. Ta very much - Chris Gardiner from the Waikato Times reports that Tatua Co-Operative will pay its 100 farmers NZ$5.38/kg this season, which is above Fonterra's NZ$5.20/kg.

Tatua chief executive Paul McGilvary said he suspected the Tatua payout was New Zealand's highest, although Westland Milk Products was still to announce its final payout.3. Deflation - This OECD report out overnight shows that prices fell 0.3% across the OECD in the year to August, which was slightly less than the 0.6% in the year to July. Debt deflation spiral anyone? 4. Decade of stocks pain - MarketWatch has an excellent summary of how fixed interest investments have outperformed stocks in the last decade in the United States at least, even after a strong couple of quarters. I'm sure it would be the same for New Zealand, apart for those poor souls who lost money in finance companies. HT Andrew Patterson via email.

"We think the equities market in particular is overvalued and well ahead of itself," said Bill Webb, deputy chief investment officer at Gluskin SheffWebb in Toronto. The stock market has gone a long way without a correction. The S&P 500 would need to advance 159% in the final three months of the year "to beat your brother-in-law who put the money in a 10-year Treasury." "On Jan. 1, 2000, the 10-year bond yield was at 6.66%. Today it's at less than half of that, at 3.19%. And what has the equity market done for you? Fixed-income would be preferable," said Webb.5. 'Giz some money' - Actually quite a lot. Bill English has announced he's flying out to Hong Kong and London on Sunday to talk about our economy and keep international investors sweet ahead of the massive New Zealand government bond issues coming up over the next decade.

"It's important that we are talking directly to these groups in the world's financial capitals, with the Government needing to borrow about $40 billion over the next four years," Mr English says. "As I did during my visit to Japan and the United States last month, I'll be reminding investors that New Zealand's economic fundamentals are sound and that we are well positioned to come out of the recession ahead of many other countries," Mr English says.6. Really? - Morgan Stanley boss John Mack has called for a single global banking regulator, Bloomberg reports. He is worried about the push for regulatory reform dribbling away. This is rich coming from one of the investment banks that was forced to convert to a bank to survive and now lives off a government guarantee. HT Ross Palmer via email.

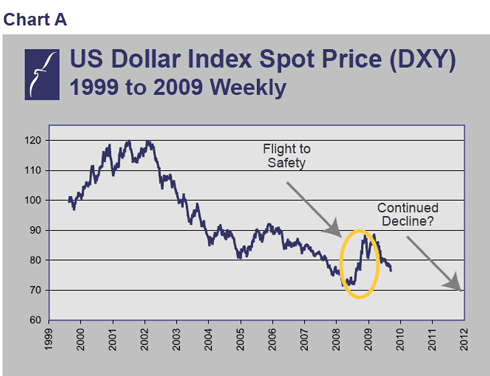

"A better system would be one uber-regulator," Mack said in an interview in New York for Bloomberg Television's "Conversations with Judy Woodruff," parts of which will air today. "We do need an overall systemic-risk management that everyone buys into. It's not a U.S. systemic boundary -- it's a global systemic risk manager." A global regulator would ensure that U.S. banks aren't subject to tighter regulations than the rest of the world, Mack said. A push for regulation during the financial crisis has weakened as the administration of President Barack Obama pursues other tasks, he said. Morgan Stanley and Goldman Sachs Group Inc. converted to bank holding companies one week after Lehman Brothers Holdings Inc., Merrill Lynch & Co. and American International Group Inc. collapsed or were rescued in September of last year. Less than a month later, Morgan Stanley took $10 billion from the U.S. government as part of the Troubled Asset Relief Program. It has since paid back the government. "I think the crisis is over," Mack said in yesterday's interview. "What I worry about is that we lose momentum with some of the regulatory changes that we need to go through."7. US dollar weakness - The fundamental driver for a weak US dollar is the amount of debt stored up and being issued by the US government and the amount of money being printed to fund it. Eric Sprott from Sprott Asset Management points this out in a very usesful newsletter. HT Ron Trounson via email.

According to the US Department of the Treasury, the current outstanding debt as of August 31, 2009 is US$11.8 trillion. To this we must add the unfunded promises that the US Government has made to its citizens. While there are no bonds, bills or notes issued to support these promises, they represent real commitments that will require US dollars to honour them in the future. The National Center for Policy Analysis (NCPA) estimates that the unfunded portion of the US Social Security program totaled $17.5 trillion as of June 2009. The NCPA also estimates that the aggregate unfunded promises for Medicare total a whopping $89.3 trillion.8. Inland Empire crumbles - This is a fascinatingly detailed blog post by Chris Rodriguez at RetailChatr Commercial Real Estate blog about how big the commercial real estate disaster is in the United States. He does an analysis of what what one fast food shopping centre in the Inland Empire in California is actually worth given the housing distress in the surrounding area. Here's the mashed up map below showing which houses are in foreclosure or effectively owned by the bank already and what that means for commercial property in the area. It's geek heaven for commercial property investors, particularly those of a bargain hunting persuasion. I drove through the Inland Empire over New Year during my RV trip across America. It is a vast suburban mess of empty new housing developments, strip malls and warehouses between Los Angeles and Las Vegas. It boomed during 2004 to 2007 as it became the warehousing hub for much of the imported consumer goods coming from China that was unloaded at Los Angeles' ports. It is one of the most depressing places I have ever driven through. Soulless, vast, commercialism at its worst. The rotten heart of America. HT Troy Barsten for this excellent piece.

The sale of this property in its current condition and anywhere near the asking price is a lawsuit waiting to happen. Clearly, there are still some owners out there that have not come to accept the current state of the market. The bid/ask gap remains wide and transaction volume will not return until it narrows. Most of the give will come from the ask side of the equation.

9. US cow glut - It turns out dairy farming isn't making any money for the Americans either, the New York Times reports. It points out the development of a new breeding technology that allows male sperm to be sorted out before impregnation, which in theory makes it easier and cheaper to expand cow herds.

9. US cow glut - It turns out dairy farming isn't making any money for the Americans either, the New York Times reports. It points out the development of a new breeding technology that allows male sperm to be sorted out before impregnation, which in theory makes it easier and cheaper to expand cow herds.

That's a supply shock right there. HT Andrew Wilson via email.

That's a supply shock right there. HT Andrew Wilson via email.

The dairy industry is in crisis, with prices so low that farmers are selling their milk below production cost. The industry is struggling to cut output. And yet the wave of excess cows is about to start dumping milk into a market that does not need it. "It's real simple," said Tony De Groot, an early adopter of the new breeding technology, who milks 4,200 cows on a farm here in the heart of this state's struggling dairy region. "We've just got too many cattle on hand and too many heifers on hand, and the supply just keeps on coming and coming." Desperate to drive up prices by stemming the gusher of unwanted milk, a dairy industry group, the National Milk Producers Federation, has been paying farmers to send herds to slaughter. Since January the program has culled about 230,000 cows nationwide. But the sorting technique, known as sexed semen, is expected to put 63,000 extra heifers into milk production this year, compared with the number that would be available if only conventional semen had been used, researchers estimate. That number will jump to 161,000 next year, and farmers fear it could double again in 2011. While that is a fraction of the 9.2 million milk cows nationwide, the extra cows this year and next could roughly equal those removed from production by the industry's culling program.10. Maybe not so strong yen - Ambrose Evans Pritchard at The Telegraph reports that the depth of the Japanese recession and deflation is so bad that the new government has already had to abandon its policy of allowing the Yen to appreciate to break its dependence of exports. This will make it difficult for the NZ dollar to depreciate against Yen. It's all part of the story of many developed but recessed countries (US, Japan, UK, Eurozone) engaging in competitive money printing and devaluations, which is done at the expense of those countries (like New Zealand) who don't print and end up importing the printed money, inflating their property markets and killing their export markets. HT Andrew Wilson via email.

Core inflation fell a record 2.4pc in September, a steeper drop than at any time during the country's Lost Decade. A surging yen is twisting the knife further. The currency has risen 22pc against the euro, 27pc against the dollar, and 43pc against sterling since mid-2007. Hirohisa Fujii, finance minister, ditched his non-intervention policy yesterday, saying Tokyo would "take necessary steps" to prevent disorderly currency moves. Yen strength is asphyxiating Japanese exporters and feeding a self-reinforcing spiral of lower prices and wages. This 1930s process increases the real burden of debts. Corporate debt alone is 180pc of GDP. Junko Nishioka from RBS said a yen near ¥90 to dollar has broken through the "break-even rate" for manufacturers such as Toyota, Honda, and Sony. "Exporters face the possibility of exchange losses," he said.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.