* China's external surplus is set to shrink sharply this year, and only rise somewhat in 2010. * Medium term growth prospects are less favorable than recent experience, but rebalancing could buoy sustained growth. * Serious asset price bubbles are unlikely to be imminent. However, risks of misallocation of credit and bad loans are real and it pays to be proactive. * China's exposure to asset price risks differs from that of most other countries. * The authorities have taken several steps recently in an effort to mitigate these risks. * Eventually, general monetary tightening will be required to dampen these risks.

3. Gold bugs look here - Asiablues has a nice analysis of the outlook for gold at Zerohedge, including a prediction that gold could hit US$2,300/oz and a look at Nouriel Roubini's claim that gold is overvalued in a world of deflation. HT Troy Barsten via email

The fast ascent to new record highs this year has some of gold proponents worried it might be getting ahead of itself. But on an inflation-adjusted basis, the prices of almost all commodities have reached their 1980's level, except for gold and sliver. On that note, gold would have to double to $2,291.55 to reach its 1980`s high, which its supporters believe means gold could go much higher. In addition, many U.S. creditors have fundamentally lost confidence in the US dollar and are incrementally diversifying into hard assets and non-dollar currencies. There are indications that China, for example, could be shifting to a partial gold standard through reserve accumulation. The Reserve Bank of India (RBI) yesterday said it had bought $6.7 billion worth of gold from the International Monetary Fund (IMF). The purchase RBI made is nearly half the 403.3 tonnes gold that the IMF decided to sell in September to raise resources for lending to low-income countries. Most speculate that China would be the buyer for the remainder of the gold for sale by the IMF. The deal represented one-eighth of the IMF's total gold stock. This is the first time since 2000 that the IMF has sold gold to a central bank. India's affirmation of current gold prices is a big sign that the nation sees the recent surge in gold isn't likely to abate any time soon. It also signals that the fall in the US dollar seems to be pushing central banks to strengthen their portfolio with gold. The purchase will lift the share of gold in India's 285.5-billion foreign exchange reserves from near 4% to about 6%, which is much less than most of the developed world and four times China's. This lower gold to reserve ratio also suggests the China and India could continue to be the buyer in the gold market.

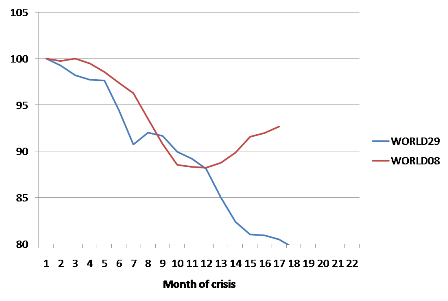

4. Useful chart - Paul Krugman points out a useful chart on global industrial production that he suggests shows the worst is over. We'll see. HT Steven via email.

Basically, we started out with a year that matched the Great Depression, but have since pulled back a bit from the edge of the abyss.

5. Inevitable bust - Felix Salmon at Reuters follows up on Nouriel Roubini's epic 'Mother of All Carry Trades' post with a few interesting comments.

Nouriel isn't saying when the current bubble is going to burst "” and if history is any guide, it's probably going to be a long time before the inevitable happens. Of course, the longer that a bubble continues to inflate, the more painful the subsequent bust. In that sense, every move upwards in US stocks or gold or the Aussie dollar or junk-bond indices is another step in exactly the wrong direction: it's a step towards yet another massive crash. And it's all being turbo-charged by Fed policy. If there's a painless way out of this situation, I can't see it.

6. Fitch cuts Ireland - Fitch, which is currently evaluating New Zealand's AA+ rating for a possible downgrade, has just downgraded Ireland by 2 notches to AA-, Reuters reported. Finance Minister Brian Lenihan put a positive spin on it.

"While this is a somewhat disappointing development it is worth noting that Fitch has given us a stable outlook," Lenihan said. Lenihan once again warned that Ireland's budget deficit could grow to as much as 15 percent of GDP next year without 4 billion euros ($6 billion) in savings that he said were backed by international organisations. "It is extraordinary that the European Commission, the OECD, the IMF all have said there is a clear way out for Ireland and that is that to resolve our banking crisis, address our public finances and restore our competitiveness," Lenihan told a news conference.

7. The next Iceland? - Ed Harrison at Naked Capitalism has a nice summary of what the Irish downgrade means and whether Ireland's bad bank (NAMA) will be enough, or whether full nationalisation is required.

The FT's Stacy-Marie Ishmael has a piece out doubting the maths used in NAMA, which bolsters the OECD view that the bad bank may not be enough.

So you have a trifecta of bad news coming out of Ireland: a two-notch downgrade by a major ratings agency, a warning from the EU that the economy will be weak for sometime to come and that deficits targets will not be met, and another warning from the OECD that the banking situation in Ireland is still very grave.

Quite frankly, it is not looking good for an Irish recovery at this time without the help of the IMF. This all brings me back to my question one year ago: Is Ireland the next Iceland? They will be if the EU, IMF and Irish government do not take today's bad news seriously and take drastic action to bolster the Irish banks, economy, and government finances.

Who said the financial crisis was over? It is not.

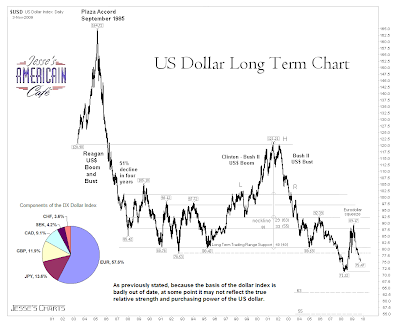

8. Long term decline - This chart below from Jesse's Cafe Americain is instructive on the long term decline of the US dollar. Click the chart for a bigger version. Jesse doesn't pull any punches.

The reasons for this decline are obvious, but so many miss this that we have to wonder what people are thinking. Despite the credit writedowns and even a potential unwinding of the dollar carry trade which we think is a bit overblown, as the demand for dollars in bank lending is slack, most analysts are missing the bigger picture of a huge overhang of eurodollars that are becoming increasingly less useful to foreign holders, especially if the power of the petrodollar declines. There is a potential double bottom to be made at 71, with a possible target in the higher 80's based on the charts. The fundamental scenario we would see is a significant equity market dislocation and/or an exogenous geopolitical event that caused another artificial short term demand for dollars and the T bills. Currency dollars are, after all, sovereign debt of zero duration and in any panic there is a rush to the short end of the curve, to the point of accepting some negative rates of return for the safety of capital. But after that event, the decline of the dollar will gain again in momentum lower unless there is a profound systemic reform and restructuring of the federal budget deficits. Even clever frauds can work only so many times, and there is nothing particularly clever or sophisticated about Wall Street's latest antics, excepting of course their size and their audacity which the average mind cannot well grasp.

9. The big US mess - Mish at GlobalEconomicAnalysis picks up on rumblings in local America, including a city in Alabama going bankrupt, a strike in Philadelphia, public sector pay cuts in Ohio and a declaration that Houston is bankrupt. This is largely about pension liabilities. America is a time bomb.

Expect to see many plans blow up betting the bottom is in or chasing risk because they need 8%. We are in a major pension crisis and this one is not going to blow over. Meanwhile the unions in Philadelphia are on a wildcat strike asking for more. The mayor needs to show them the door. Unless he does, I can predict the future. The future is Prichard. It's already too late for Houston and Detroit. It's probably too late for Baltimore as well. Please see Time for Baltimore to "Pull a Vallejo" and Declare Bankruptcy for details. Look for more city bankruptcies over wage and pension benefits. They are without a doubt coming.

10. Monkey and Goat on a rope - For absolutely no valid reason I am including this video for your entertainment. The best bit is just after 3minutes. I love how the goat is still chewing its cud while balancing on the vase on the rope while the monkey stands on its horns. Brilliant Russian commentary. Even better than Keith Quinn. HT Rolfe Winkler at Reuters.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.