Here are my Top 10 links from around the Internet at 10am. I am in Wellington today and will be live blogging the PM's speech on tax reform from after 2pm. I welcome your additions and comments below or please send suggestions for Wednesday's Top 10 at 10 to bernard.hickey@interest.co.nz  1. What happens when the printing stops? - The US Council on Foreign Relations has charted how the major buyer of US Treasuries in the last year was the US Federal Reserve, Jesse's Cafe Americain points out. Interest rates will rise when the Fed stops buying. This will raise interest rates globally. Do home buyers and businesses in New Zealand realise this or are they hoping the Fed will just keep printing ad infinitum?

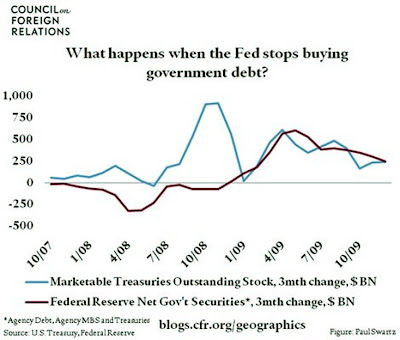

1. What happens when the printing stops? - The US Council on Foreign Relations has charted how the major buyer of US Treasuries in the last year was the US Federal Reserve, Jesse's Cafe Americain points out. Interest rates will rise when the Fed stops buying. This will raise interest rates globally. Do home buyers and businesses in New Zealand realise this or are they hoping the Fed will just keep printing ad infinitum?

The Federal Reserve plans to stop buying securities issued by government housing loan agencies Fannie Mae and Freddie Mac by the end of the first quarter. This is not only likely to push up mortgage rates; Treasury rates should rise as well. Throughout 2009, the private sector sold a portion of their agency holdings to the Fed and used those funds to buy Treasurys. Once the Fed's agency purchases stop, this private sector portfolio shift will end, removing a major source of demand in the Treasury market. As the chart shows, since the start of 2009 the Fed has bought or financed the entire increase in Treasury issuance. As Fed purchases slow and Treasury issuance continues at a high level, interest rates will have to move up to attract new buyers."

2. Geithner pour la guillotine? - There is increasing talk around Washington that Treasury Secretary Timothy Geithner is about to be discarded by Barack Obama as the smell worsens around the New York Fed's coverup of the defacto bailout of Goldman Sachs via a 100% payout of derivatives contracts with AIG. Here's Ellen Brown at Huffington Post. HT Iain Parker via email. Simon Johnson has also cited talk that Obama will dump Geithner, suggesting Fed rebel Tom Hoenig might be a good replacement.

3. Chart of the day - The European Union is collectively the second largest buyer of New Zealand's exports after Australia. This chart courtesy of ZeroHedge shows money supply contracting in the Euro zone (excluding Britain). The picture in Britain is just as ugly. This will not help any global recovery. I don't think most New Zealanders realise how dire the situation in Europe really is. Or in America for that matter. The only growth engine left is China, which is lucky for Australia and us. Until it stops too. HT Gertraud via email.

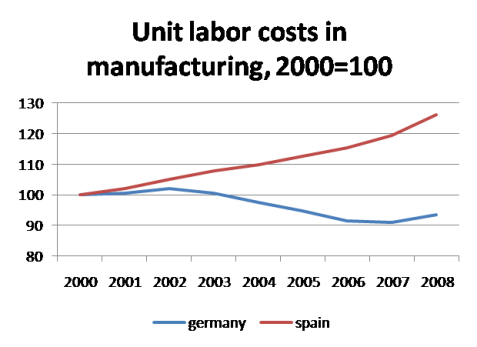

Another chart of the day - Paul Krugman from the NYTimes points out Spain's problem was a wage inflation spike that made it much less competitive than the likes of Germany, which went on a productivity spree over the last 5 years or so. The Spanish must be desperate for their own floating exchange rate right about now.

4. 'Lehman type risk' - Simon Johnson at Baseline Scenario points out there is a risk of a Lehman-style contagion brewing in the ugly European situation, partly because the problems with Credit Default Swaps that caused havoc through Lehman-AIG-Bear Stearns have not gone away. Swap spreads on Spanish and Portugese government debt hit record highs overnight, MarketWatch reported.

As this pressure mounts, we'll see cracks appear also in the private sector. Significant banks and large hedge funds have been selling insurance against default by European sovereigns. As countries lose creditworthiness "“ and, under sufficient pressure, very few government credit ratings will hold up "“ these financial institutions will need to come up with cash to post increasing amounts of collateral against their derivative obligations (yes, the same credit default swaps that triggered the collapse last time). Remember that none of the opaqueness of the credit default swap market has been addressed since the crisis of September 2008. And generalized counter-party risk "“ the fear that your insurer will fail and this will bring down all connected banks "“ raises its ugly head again. In such a situation, investors scramble for the safest assets available "“ "cash", which actually (and ironically, given our budget woes) means short-term US government securities. It's not that the US is in good shape or even has anything approaching a credible medium-term fiscal framework, it's just that everyone else is in much worse shape. Another Lehman/AIG-type situation lurks somewhere on the European continent, and again our purported G7 (or even G20) leaders are slow to see the risk. And this time, given that they already used almost all their fiscal bullets, it will be considerably more difficult for governments to respond effectively when they do wake up.

5. Just like 1992 - Wolfgang Munchau from FT.com compares the worries about the PIIGS' (Portugal, Ireland, Italy, Greece and Spain) sovereign debt with the mood in markets before Britain was forced out of the European Exchange Rate Mechanism by ruthless financial markets (remember George Soros). HT Gertraud via email.

The last few days have reminded me of the speculative attacks on sterling and the Italian lira in September 1992. Europe's finance ministers and central bankers at the time reacted with anger and incomprehension. Sterling's central parity in the exchange rate mechanism was as unsustainable then as Greek public finances or Spanish wages are today. Today's financial markets correctly perceive the eurozone as not addressing the imbalances. They are confused by shifting signals from Germany and France about a bail-out. Investors have concluded that the probability of a contagious default is rising. They are right. What has not changed since the 1992 crisis is that European policymakers and their economic advisers still lack a basic understanding of how financial markets react to policies or, in this case, to a lack of policies. At the moment, it is totally unclear what would happen should one eurozone country become unable to refinance its debt. I suspect there will be a bail-out, but I am no longer as certain as I once was.

6. 'It will never happen' - US Treasury Secretary Tim Geithner says America will never see its AAA credit rating downgraded, Bloomberg reports. He's that confident. Or deluded. Or just plain arrogant. I suppose that's what you can say when you have nuclear powered aircraft carriers, Steve Jobs, Larry Page and Sergey Brin.

"Absolutely not," Geithner said, when asked in an ABC News interview broadcast today whether a downgrade is a concern. "That will never happen to this country." Geithner said investors around the world turn to U.S. Treasury securities and dollar-denominated assets whenever they are worried about global stability. That reflects "basic confidence" in the U.S. and its ability to bounce back from the global recession, he said. Moody's Investors Service Inc. last week said the U.S. government's bond rating will come under pressure in the future unless additional measures are taken to reduce budget deficits projected for the next decade.

7. Chinese default - This Bloomberg story on loansdefaulting in China is interesting for those who believe China has the magic formula and will sail on serenely through the crisis, pumping out growth and exports and sucking in commodities from Australia.

"We work really closely with SASAC, the state-owned enterprise regulator in China, and there are literally trillions and trillions of renminbi of, frankly, defaulting loans already in China that no one is doing anything about," Neil McDonald, a Hong Kong-based business restructuring and insolvency partner with Lovells LLP, said at an Asia-Pacific Loan Market Association conference yesterday. "At some point there's going to be a reckoning for that." China's government is tightening controls, including banks' reserve ratios, to prevent record lending from fueling inflation. The Shanghai office of the China Banking Regulatory Commission warned yesterday that a 10 percent fall in property values would treble the number of delinquent loans in the city. Liu Mingkang, chairman of the CBRC, said Jan. 4 that loans were channeled into stock and property speculation last year, which China has been taking measures to stop. "At some point in China, maybe it will be two, three or five years, but at some point there will be in the property markets and in the markets generally, there will be rationalization of very poor lending practices," McDonald said during the panel discussion on restructuring and refinancing at the Global Loan Market Summit in Hong Kong.

8. 'The biggest bubble of all' - William Pesek at Bloomberg points outthat the biggest bubble of all is the huge stockpiling of reserves by Asian governments and China's US$2.4 trillion in particular.

China's huge arsenal of reserves is increasing its global influence. The trouble is, China is trapped in an arrangement of its own making. As China and other Asian nations buy more and more U.S. Treasuries, it becomes harder to unload them without causing huge capital losses. And so they keep adding to them. "This is a titanically large foreign-exchange trade," says David Simmonds, London-based analyst at Royal Bank of Scotland Group Plc. "It's the biggest one history has ever seen and there's nowhere for these reserves to go." China aims to diversify out of U.S. Treasuries into other assets and commodities. The question that governments are grappling with is which markets are deep enough to absorb China's riches? Gold? Oil? Euro-area debt? The Madoff family's next Ponzi scheme? The challenge for China alone is like trying to park an Airbus A-380 super-jumbo in a Volkswagen. Like all pyramid schemes, there's no easy end in sight and things could end badly. If the dollar collapses, panicked selling by central banks looking to limit losses would shake global markets more than the U.S. credit crisis has.

9. Hey everyone. We're insolvent - Sydney-sider John Hempton writes provocatively in his BronteCapital blog about the fiscal crisis confronting the developed world (and China too) as the babyboomers retire. He writes in depth about Australia's solution, which is immigration. He notes in passing that New Zealand is insolvent with a few choice insights... His whole post is well worth a read. His comments on the long term impact of China's one child policy is alarming. It means interest rates will rise in the long term because China will eventually have to sell all its US Treasuries to pay for its elderly. HT Stephen Taylor via email.

New Zealand "“ a country where I used to be a senior Treasury official "“ is alas long run insolvent by any count. Its population doesn't grow much even with immigration "“ and net migration has resulted in sharp negative productivity per head of population as skilled workers tend to move (to Australia) and unskilled workers are imported. The tax and welfare system also does not add up. [New Zealanders are paranoid about Australia as the response to this joke showed. However in truth New Zealand will one day beg to be the seventh Australian state and we will refuse. Also the Treaty of Waitangi is deeply inconsistent with the Australian sensibilities and (I think) law"“ but that is the subject of another post...]

10. Totally irrelevant video - Stephen Colbert talks here about unemployment and Toyota.

| The Colbert Report | Mon - Thurs 11:30pm / 10:30c | |||

| Job Man Caravan | ||||

|

||||

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.