Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please send suggestions for Tuesday's Top 10 at 10 to bernard.hickey@interest.co.nz We are a multiple monkey operation here at interest.co.nz.

1. When bright people make bad decisions - This piece from Michael J. Mauboussin, the Chief Investment Strategist at Legg Mason Capital Management, is well worth a read. He has written a book called 'Think Twice; The Power of Intuition' that has a bunch of examples of dumb stuff done by bright people.

They include the story of a guy who wrote a book about gullible people who then lost 30% of his savings in Bernie Madoff's ponzi scheme; how Dow's CEO overpaid horribly for Rohm and Haas; why surgeons opt for expensive surgery unless it is for their wives; how Best Buy's staff are much better at forecasting sales than its economists; why people buy more French wine when French music is playing, and how Boeing's push to outsource design for the new 787 Dreamliner was a disaster.

2. Markets opening up - ANZ is reported to be readying an issue of Samurai bonds to raise A$1.33 billion as the markets for such Uridashi/Kangaroo/Eurobonds start opening up again. It seems the Australian banks have a lot of money to raise, Reuters reported.

1. When bright people make bad decisions - This piece from Michael J. Mauboussin, the Chief Investment Strategist at Legg Mason Capital Management, is well worth a read. He has written a book called 'Think Twice; The Power of Intuition' that has a bunch of examples of dumb stuff done by bright people.

They include the story of a guy who wrote a book about gullible people who then lost 30% of his savings in Bernie Madoff's ponzi scheme; how Dow's CEO overpaid horribly for Rohm and Haas; why surgeons opt for expensive surgery unless it is for their wives; how Best Buy's staff are much better at forecasting sales than its economists; why people buy more French wine when French music is playing, and how Boeing's push to outsource design for the new 787 Dreamliner was a disaster.

2. Markets opening up - ANZ is reported to be readying an issue of Samurai bonds to raise A$1.33 billion as the markets for such Uridashi/Kangaroo/Eurobonds start opening up again. It seems the Australian banks have a lot of money to raise, Reuters reported.

Australian banks raised a meagre 394.3 billion yen last year, well below what was sold in 2008, mostly because of a spike in the cost of swapping yen for dollars, a major deterrent for foreign borrowers.

Australia's top four banks are expected to tap every bond market available this year to fill huge funding requirements, estimated at around $120 billion between them.

3. Too big to be taxed? - Karen Maley at businessspectator.com.au asks if the Australian government should be imposing a similar 'Obama Tax' on the big four banks, which of course are also our big four banks.

There's no doubt that the massive profits the big banks currently enjoy are the direct result of government actions during the financial crisis. And even though Commonwealth Bank's Ralph Norris, Westpac's Gail Kelly, ANZ Bank's Mike Smith and National Australia Bank's Cameron Clyne all like to claim personal credit for the resilience of their banks, the real hero was Kevin Rudd.

In the first place, his government allowed the big banks to get rid of a lot of pesky competition. As the financial crisis roiled global markets, Rudd's government cast aside competition concerns for the sake of stability.

Westpac was allowed to seize St George, and the Commonwealth Bank was allowed to snap up BankWest.

The big four banks now boast unprecedented dominance of the home loan market, writing more than 90 per cent of new home loans. And they haven't been slow to use their market power to boost their margins.

But this wasn't the only help the banks received. The Rudd government also guaranteed bank deposits and borrowings. And it kindly charged the big banks less to access its guarantee than its foreign counterparts.

4. Looming battle - The Obama Tax on big US investment banks to raise US$120 billion looks like it will face heated opposition from lobbyists. They are already getting ready for a constitutional challenge,

the New York Times is reporting. Cue public outrage. This could get ugly.

In an e-mail message sent last week to the heads of Wall Street legal departments, executives of the lobbying group, the Securities Industry and Financial Markets Association, wrote that a bank tax might be unconstitutional because it would unfairly single out and penalize big banks, said these officials, who did not want to be identified to preserve relationships with the group's members.

The message said the association had hired Carter G. Phillips of Sidley Austin, who has argued dozens of cases before the Supreme Court, to study whether a tax on one industry could be considered arbitrary and punitive, providing the basis for a constitutional challenge, they said.

5. Bonus diversion - 'Deadhead' at ZeroHedge points out the debate over bankers' bonuses is a diversion from the desperate need for US banks to use increased profits to bolster their capital reserves. He/she makes some good points, including that the banking system can't afford to be stripped of US$120 billion in taxes. This is because various accounting rule fiddles mean many banks are hiding the true value of their toxic mortgage bonds. This will eventually have to be accounted for properly at some stage when the cash flow doesn't come, creating an almighty

'Minsky Moment'

With bank profits quite handsome for Q4, and capital accounts woefully inadequate, it would be prudent to allocate this profit to capital accounts to reserve for losses on this incoming pile of fecal matter, but, no, let's just kick the can down the road further. The FDIC has decided to give a pass to the banks for one and one half years to begin the process of allocating capital in regards these assets. Read it yourself.

The bankers should have taken every nickel of profit and allocated it to capital accounts to provision for loan losses: past, present, and future. The regulators should force every nickel on to the balance sheet irrespective of the menagerie of FASB FAS 157. The government should not be taking this needed capital from the banking system. If we follow this path for a few years, maybe we'll have a chance to avoid a complete zombification of our banking system.

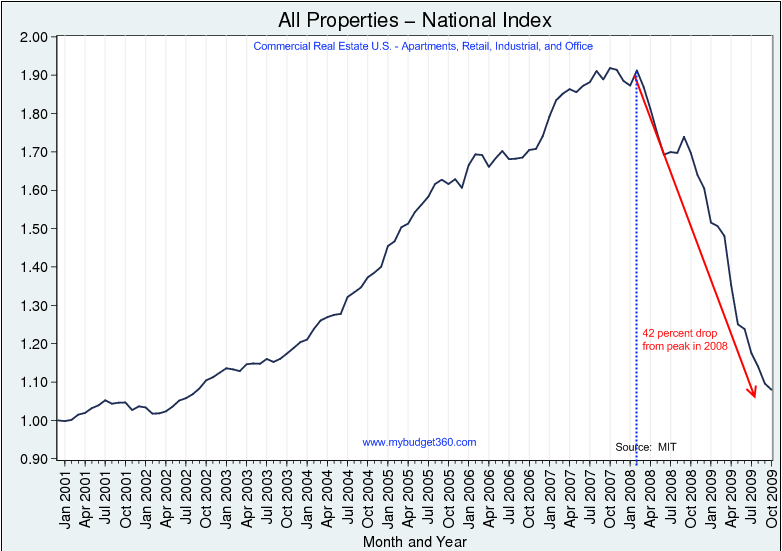

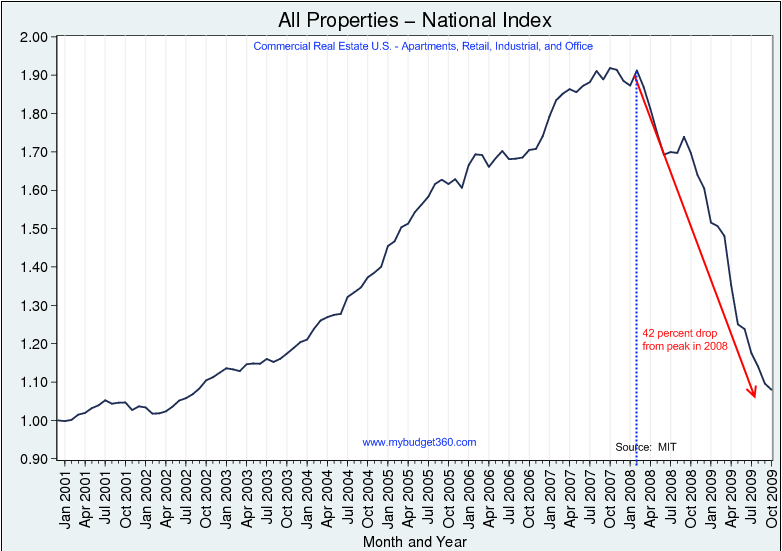

6. US Commercial Real Estate - The crash in US commercial real estate has received much less attention than the fall in the residential sector, but it is real. This piece from MyBudget360 details the 42% fall in commercial real estate values in the United States and questions whether this will derail any apparent recovery in the US economy. Most of these loans are held by regional banks, which are not too big to fail.

It is safe to say that commercial real estate is now in a negative equity position. The U.S. Treasury has discussed plans on bailing out this industry but not much has been done on this front since all the bailout funds have been concentrated on residential real estate and protecting the too big to fail banks. Many CRE loans are held in the smaller regional banks that are actually small enough to fail. The FDIC will be busy in 2010 given the above data.

7. March of the PIIGs - Arch Eurosceptic Ambrose Evans Pritchard at The Telegraph writes evocatively about the problems facing Greece and those in Northern Europe (German/France/The Netherlands) hoping to keep the Eurozone together. Evans Pritchard argues that without an ability to devalue Greece faces wage deflation and massive unemployment. The politics are ugly. The headline is for all those Nine Inch Nails fans out there...

Last week's €1.6bn (£1.4bn) auction of Greek debt did not go well. The interest rate on six-month notes rose to 1.38pc, compared to 0.59pc a month ago. The yield on 10-year bonds has touched 6pc, the spreads ballooning to 270 basis points above German Bunds. Greece cannot afford such a premium for long. The country must raise €54bn this year "“ front-loaded in the first half. Unless the spreads fall sharply, the deficit cannot be cut from 12.7pc of GDP to 3pc of GDP within three years. As Moody's put it, Greece (and Portugal) faces the risk of "slow death" from rising interest costs.

Stephen Jen from BlueGold Capital said the design flaws of monetary union are becoming clearer. "I don't believe Euroland will break up: too much political capital has been spent in the past half century for Euroland to allow an outright breakage. However, severe 'stress-fractures' are quite likely in the years ahead."

As Portugal, Italy, Ireland, Greece, and Spain (PIIGS) slide into deflation, their "real" interest rates will rise even higher. "It is tantamount to hiking rates in the already weak PIIGS," he said. This is the crux. ECB policy will become "pro-cyclical", too tight for the South, too loose for the North.

It comes down to a bet that Berlin will do for Club Med what it did for East Germany: subsidise forever. It is a judgement on whether EMU is the binding coin of sacred solidarity, or just a fixed exchange rate system like others before it.

8. Historic snapshot -

This is a document from Deloitte and Touche in 2001 explaining how new regulations then from US authorities, including the Fed, reduced the amount of capital needed to back securitised mortgage lending from 8% to as low as 1.6% (leverage of 63 times). Guess what happened next.

HT to Seeking Alpha's Alan Schram for this one.

This new 60-1 leverage (they thought AA and AAA rated MBS are safe), together with the corrupt ratings agencies, led to the explosion of that market, and the rest is history.

You still have to wonder why banks, allowed to put up only $1.60 for every $100 of AAA MBS, would be so reckless as to actually do it, and even more interesting, who would be so dumb to lend them the $98.4

9. Healthcare woes - This is a spectacular graphic from National Geographic.com showing how much Americans spend on healthcare per person per year (US$7,290) and how low its life expectancy is at birth (just over 78). New Zealand does ok with spending of US$2,510 and life expectancy of 79. The thickness of the lines represent the numbers of doctors visits per person.

10. Totally relevant video - Stephen Colbert picks apart the various testimonies of bankers to Congress.

1. When bright people make bad decisions - This piece from Michael J. Mauboussin, the Chief Investment Strategist at Legg Mason Capital Management, is well worth a read. He has written a book called 'Think Twice; The Power of Intuition' that has a bunch of examples of dumb stuff done by bright people.

They include the story of a guy who wrote a book about gullible people who then lost 30% of his savings in Bernie Madoff's ponzi scheme; how Dow's CEO overpaid horribly for Rohm and Haas; why surgeons opt for expensive surgery unless it is for their wives; how Best Buy's staff are much better at forecasting sales than its economists; why people buy more French wine when French music is playing, and how Boeing's push to outsource design for the new 787 Dreamliner was a disaster.

2. Markets opening up - ANZ is reported to be readying an issue of Samurai bonds to raise A$1.33 billion as the markets for such Uridashi/Kangaroo/Eurobonds start opening up again. It seems the Australian banks have a lot of money to raise, Reuters reported.

1. When bright people make bad decisions - This piece from Michael J. Mauboussin, the Chief Investment Strategist at Legg Mason Capital Management, is well worth a read. He has written a book called 'Think Twice; The Power of Intuition' that has a bunch of examples of dumb stuff done by bright people.

They include the story of a guy who wrote a book about gullible people who then lost 30% of his savings in Bernie Madoff's ponzi scheme; how Dow's CEO overpaid horribly for Rohm and Haas; why surgeons opt for expensive surgery unless it is for their wives; how Best Buy's staff are much better at forecasting sales than its economists; why people buy more French wine when French music is playing, and how Boeing's push to outsource design for the new 787 Dreamliner was a disaster.

2. Markets opening up - ANZ is reported to be readying an issue of Samurai bonds to raise A$1.33 billion as the markets for such Uridashi/Kangaroo/Eurobonds start opening up again. It seems the Australian banks have a lot of money to raise, Reuters reported.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.