Here are my Top 10 links from around the Internet at 10 am. I welcome your additions and comments in the comments below or please send your suggestions for Wednesday's Top 10 at 10 to bernard.hickey@interest.co.nz  1. South Island finance legend Allan Hubbard, 80, is talking up the prospect of a float that may include some of his other assets separate from South Canterbury Finance. Alan Wood from The Press (Stuff) has a rare interview with Hubbard, who seems a bit shaken by the losses taken by South Canterbury and the need for it to find a new cornerstone shareholder.

1. South Island finance legend Allan Hubbard, 80, is talking up the prospect of a float that may include some of his other assets separate from South Canterbury Finance. Alan Wood from The Press (Stuff) has a rare interview with Hubbard, who seems a bit shaken by the losses taken by South Canterbury and the need for it to find a new cornerstone shareholder.

"That's right, we're forging ahead, we're recovering and we're going to do a float, we'll give you the details of that later." South Canterbury Finance previously planned a $200 million-plus stock exchange float in 2005, but it later pulled out when Hubbard got cold feet. The company now has assets of about $2.31 billion but has seen some negative news in recent months, and Hubbard, who is aged in his 80s, acknowledged there was also the possibility of a new investor coming in to reduce his influence in the company of which he remains chairman. "Well, that is a possibility, we are talking to a couple of people. I've [also] got a lot of other interests that are going to go into it. You'll find out in due course, it's not finalised so we can't announce it." SCF chief executive Lachie McLeod last week said succession options included a new New Zealand-focused shareholder.

2. This high court ruling reported by the NBR's Chris Hutching appears to have ominous implications for the Retail Deposit Guarantee scheme. It seems to say interest payments should be made to debenture holders beyond the March 2 date of its receivership. 3. Chinese state-owned enterprises may default on commodity purchase contracts, Caijing.com reported, helping spark a heavy sell off on Chinese and other markets. If true, this would be bad news for Australia and, by extension, us.

China's state-owned enterprises may unilaterally terminate commodities contracts as they try to cut massive losses from financial derivatives, an industry source told Caijing on August 28. According to the source, China's State-owned Assets Supervision and Administration Commission (SASAC) has sent notice to six foreign financial institutions informing them that several state-owned enterprise will reserve the right to default on commodities contracts signed with those institutions. Chinese SOEs have suffered massive losses from hedging contracts since the onset of the global financial crisis.

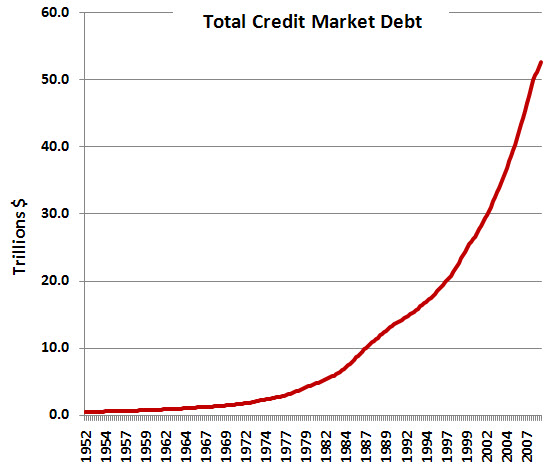

That's one way to deal with market movements you don't like: just default. 4. I watch a cantankerous US banking analyst called Chris Martenson closely. He dives deep into the detail of America's banks and always sheds light. In this post on Seeking Alpha titled the ' The Five Economic Horsemen' he paints a compelling picture of what might happen next.

I believe that a diminished standard of living is in the future for each of the major economies across the world especially those where the inhabitants have been living beyond their means. Another belief I hold is that any period of living beyond one's means must certainly be followed by an equivalent trough of living below one's means. For example, if you produce 100 but consume 110, then at some point you will need to produce 100 but only consume 90. I urge you to begin keeping a close eye on these five horsemen:The current presence of three, or possibly four, of these signs has me thinking very carefully about my assets, my family's needs, and how we will manage the changes ahead. When the fifth horseman arrives, it will bring a new reality for all of us, and I intend to be as ready as possible.

- New credit growth falls below interest payments

- The Fed monetizes debt

- Government deficit spending exceeds 10% of GDP

- The dollar goes down while interest rates go up

- US debt becomes denominated in foreign currencies

5. Vanity Fair has an excellent, if long, piece on former Treasury Secretary Henry Paulson and the dramas he went through last year. It includes interviews throughout the crisis. Here's a taste. HT Felix Salmon.

5. Vanity Fair has an excellent, if long, piece on former Treasury Secretary Henry Paulson and the dramas he went through last year. It includes interviews throughout the crisis. Here's a taste. HT Felix Salmon.

By this point in the crisis, Paulson was deeply fatigued"”"It wasn't the hours in bed. It was the hours I spent sleeping in bed!" he told me at one point when I asked him how much rest he was getting. He felt, he said, resorting again to a stock image from his repertoire, as if he'd been boiling in oil for a year. He was also increasingly frustrated. "As I look back"”and I'm a great second-guesser"”I would not second-guess any of these, because we did everything we've been able to do. But none of them have been sufficient."¦ We've been late on everything, because it just is the kind of thing"”it's just impossible to get ahead of with the authorities we have in particular. And I think I've been pretty consistent since I've been down here to say now we have a broken regulatory system, but we don't have the authorities and powers we need."

6. The 'too big to fail' banks in the US are getting even bigger, David Cho from the Washington Post points out. It's appalling, but before we throw too many stones from here in New Zealand, it's worth remembering that ANZ National has a balance sheet that's worth more than half of NZ GDP on its own. The other three, ASB, BNZ and Westpac, are each bigger in proportion to our economy than any of the US banks are to the US economy.

The crisis may be turning out very well for many of the behemoths that dominate U.S. finance. A series of federally arranged mergers safely landed troubled banks on the decks of more stable firms. And it allowed the survivors to emerge from the turmoil with strengthened market positions, giving them even greater control over consumer lending and more potential to profit. J.P. Morgan Chase, an amalgam of some of Wall Street's most storied institutions, now holds more than $1 of every $10 on deposit in this country. So does Bank of America, scarred by its acquisition ofMerrill Lynch and partly government-owned as a result of the crisis, as does Wells Fargo, the biggest West Coast bank. Those three banks, plus government-rescued and -owned Citigroup, now issue one of every two mortgages and about two of every three credit cards, federal data show. A year after the near-collapse of the financial system last September, the federal response has redefined how Americans get mortgages, student loans and other kinds of credit and has made a national spectacle of executive pay. But no consequence of the crisis alarms top regulators more than having banks that were already too big to fail grow even larger and more interconnected. "It is at the top of the list of things that need to be fixed," said Sheila C. Bair, chairman of the Federal Deposit Insurance Corp. "It fed the crisis, and it has gotten worse because of the crisis."

7. In the wake of UBS' humiliation at the hands of the IRS, Bruce Krasting has uncovered this gem from an obscure Swiss magazine showing the Swiss government and banking industry appears to know that over a third of banks assets in Switzerland are 'black money' that have never been subject to tax. And to think there are some who would like to see New Zealand become the Switzerland of the South Pacific. Hopefully not former investment banker John Key....

The August edition of Swiss Review provides some insight. WhileSwiss Review is not the end all source of information on this topic their writing is not independent of the Swiss Government who provides a portion of the operating budget. With that in mind I was shocked to find the following in the August edition of SR: "Switzerland has become a paradise for foreign capital on which tax is not paid. The uproar from foreign governments is understandable." These are not the words of a critic of the banks, but of private banker Konrad Hummler. He says that around 30%, or CHF 1,000 billion (US$1 trillion) , of the CHF 2,800 billion or so of foreign assets in Swiss banks is untaxed "black money". Mr. Hummler probably knows as much about the topic of black accounts in Switzerland as anyone.

8. Satjayit Das, a favourite of this site, has posted again over at Wilmott on the issue of executive compensation. I agree with him and don't have a lot of sympathy for those who say CEOs deserve very, very large pay packets no matter what. Often they don't.

Concern about excessive pay also focuses on "˜allocation'; "˜who' gets "˜what'. Mark Twain once admitted: "I am opposed to millionaires, but it would be dangerous to offer me the position." For others, the issue is "˜proportionality'; a chief executive's reward is disproportionate to his or her contribution. Tight, in-bred circles of directors and consultants determine senior executive salaries. "˜Benchmarking' exercises merely reinforce the "˜norm' with packages being justified as "˜needing to buy the best talent' or "˜meeting the demands of a competitive market'. Results are also easily manipulated to meet specified performance hurdles for bonuses. Recent severance payments highlight that failure is better rewarded than success.

9. Jon Stewart made me laugh this morning. Nine of every 10 dollar bills has traces of cocaine. That's the only good news in America these days.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Good News/Bad News - America's Recession | ||||

|

||||

10. We need some humour. The Onion reports that US unemployment projections improved drastically overnight after the fifth beer.

According to analysts, both long- and short-term forecasts showed signs of recovery between the third and fourth beer, but the fifth alcoholic beverage was the point at which the employment rate began to close in on 100 percent. Even in Michigan, home to the nation's highest unemployment numbers, fairly buzzed sources described a bright future for thousands of laid-off automotive workers and their families.

This video is a bit old, but still worth a chuckle. It butchers an already overused Elton John song. Not too much harm done then... HT Alex

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.