The Government will extend the Retail Deposit Guarantee Scheme and change some of its terms and conditions, Finance Minister Bill English said. The government's wholesale funding guarantee is not affected by this decision. (Update 5 includes video of Bill English talking about the extension in Parliament's question time on Tuesday afternoon and answering questions from Jim Anderton and David Cunliffe.) The current scheme ends on October 12, 2010. The new scheme will start on October 13, 2010 and end on December 31, 2011. "The Retail Deposit Guarantee Scheme was introduced as a direct response to international financial market turbulence. Immediate concerns about the stability of the financial system are now abating," English said. Key changes include: - the reduction of the value of deposits covered, from $1 million down to $500,000 in banks, and $250,000 in non-bank institutions, - only institutions with a credit rating of BB or better can be covered after October 2010, - new costs are being imposed, and they are a lot steeper for finance companies than other institution types. "Crown retail guarantees have helped maintain confidence in New Zealand's financial institutions. However, they also distort the market and impose costs," English said. "The planned extension will help maintain confidence in New Zealand's financial institutions while achieving an orderly exit from the scheme. It will allow both depositors and institutions to adjust back to a more normal business environment." "Today's announcement provides certainty for investors and financial institutions. It also strikes the right balance for taxpayers." "Depositors and institutions have more than a year of advance notice before the scheme changes and then a further 14 months under the extended scheme until the Crown guarantee ends on December 31, 2011." Here is a link to Treasury's Q&A page for the new scheme. Equitable Group CEO Peter Thomas told interest.co.nz that while they were all still digesting the facts, the biggest change he could see was the "demarcation line" drawn by the government between those who would be eligible for the new scheme and those who will not. "Thankfully we're north of that line," Thomas said. Equitable currently has a BB rating. Thomas said that while the current scheme was quite broad ranging in which institutions could be accepted, the extension at the moment would see significantly less than that. "(Government) are saying 'you need a BB rating', those who aren't eligible will have to accellerate their ratings program with their agency. It's going to be an interesting 12 months," he said.

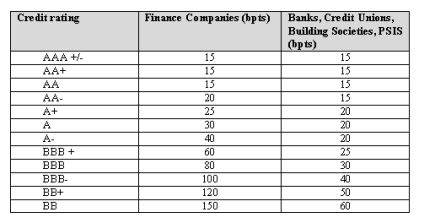

The changes that will take effect after October 12, 2010 are:All depositors currently benefiting from a Crown guarantee will have their deposits covered until October 12, 2010. Whether or not they are covered beyond that date will depend upon whether their institution joins the new scheme. Participation in the new scheme will be voluntary. "Some institutions may choose not to apply for the extended scheme and some won't meet the application criteria. As credit conditions improve some institutions may decide participating is not worthwhile and elect to stay out of the scheme. In these cases depositors will not be covered after October 12, 2010," Mr English says. When the Government introduces legislation to enact the changes, it will be passed through all stages. A list of institutions covered by the scheme beyond October 12, 2010, will be available on the Treasury website once applications have been processed. This will be regularly updated. The level of fees will vary by both credit rating and type or organisation, and is set out in the table below.

- Fees paid by participating institutions will be changed to reflect their risk profile. These fees have been set by the Minister of Finance. They are intended to approximately match longer term normal market pricing. Thresholds in the current scheme will be discontinued and the fees will apply to all funds in the new scheme.

- Eligible bank deposits will be covered up to a maximum $500,000 per depositor per institution and eligible non-bank deposits to a maximum $250,000 per depositor per institution. The maximum in the current scheme is $1 million per depositor per institution.

- Deposit-taking institutions with a credit rating of BB or higher can apply to participate in the extended scheme. Institutions with a lower credit rating or no rating won't be eligible despite being included in the current scheme.

- Collective Investment Schemes won't be eligible for the new scheme.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.