Top 10 at 10: Deflationists vs Inflationists; Ban financial advisor commissions; Dilbert

20th Aug 09, 11:15am

by

Here are my Top 10 links from around the Internet at 10am. I welcome your additions in the comments below or please send suggestions for Friday's Top 10 at 10 via email to bernard.hickey@interest.co.nz We don't play bingo at interest.co.nz.

1. The contest between the deflationists and inflationists goes on. The short view at FT.com describes the clash nicely and comes down on the side of the deflationists for now.

1. The contest between the deflationists and inflationists goes on. The short view at FT.com describes the clash nicely and comes down on the side of the deflationists for now.

With US retail sales and consumer confidence numbers also weaker than had been hoped, the deflationists' nightmare scenario is in better shape than the pick-up in many broader indicators of growth might suggest. Their fear is that the consumer sector, faced with unemployment and needing to pay down debt, may refuse to start buying. For the markets, the worst of the deflation scare is over. During the worst of last year's panic, inflation-protected security prices at one point signalled slight deflation over the next 10 years - worse than Japan suffered in the 1990s. They then bounced up to signal inflation of 2 per cent, and are now at about 1.7 per cent. The risks of a long-term return to severe inflation are obvious. But they are yet to make themselves felt.2. Australia's Securities and Investment Commission has recommended that financial advisers be blocked from taking commissions and must charge hourly fees, Alan Kohler at BusinessSpectator points out with glee. I agree. Our own Securities Commission have been weak and slow all through the rolling disaster that has been finance companies, First Step, ING DIF and RIF funds, and all those capital guaranteed funds.

In its submission to the Parliamentary inquiry into financial services released yesterday, ASIC has recommended a ban on financial planning commissions and the introduction of a legislative fiduciary duty on planners. It has even come out against remuneration that is a percentage of funds under advice, rather than an hourly rate, saying that it "also encourages sales and borrowing". "Disclosure appears to be an ineffective tool to overcome conflicts of interest." This is such a fantastic development, and such a dramatic shift in the debate around financial advice, that I won't even mention how long it has taken ASIC to see the light.3. This is a shocking chart highlighted by Tyler Durden at Zero Hedge. It simply shows the scale of the US government spending jump, the revenue slump and the resulting budget deficit blowout. The blowout word doesn't do it justice. Check it out and wonder why the Chinese haven't pulled the plug yet. They should.

We dare anyone to go to the bank and try getting a new credit card (with a limit anywhere between $50 and $5 trillion) by presenting this personal budget.

4. This is an interesting piece of research on the generational attitudes to saving and finances in Australia at least. Anneli Knight at The Age talks to Social researcher Mark McCrindle from McCrindle Research and finds that Generation Y (born 1980-1994) have blown their money on 'experiences' such as holidays and bungy jumping rather than hard assets (property) or softer assets such as shares.

4. This is an interesting piece of research on the generational attitudes to saving and finances in Australia at least. Anneli Knight at The Age talks to Social researcher Mark McCrindle from McCrindle Research and finds that Generation Y (born 1980-1994) have blown their money on 'experiences' such as holidays and bungy jumping rather than hard assets (property) or softer assets such as shares.

It is the Generation Ys (born 1980 to 1994) that have a bit of a problem with their finances. A report released by the National Centre for Social and Economic Modelling earlier this year found that in 2008 Generation Ys in Australia spent $48 billion on intangible assets - that is, assets with no easily measureable dollar value. "The Gen Ys we have found a surprising degree of financialilliteracy. They've been shaped in this era of the diminishment of the expert - they're not likely to get financial advice. It's a DIY world; everything is do-it-yourself. The problem with that is some of the sources of the advice they find online in dubious. There is a financial naivety with Generation Y. You've got the worst of both world - they're optimistic, they have more opportunities to invest but less professional advice and less of the financial conservatism of their parents. For many of them they are an accident waiting to happen." Rather than investing in appreciating asset classes, such as property and shares, Generation Y is into experience. "They've invested in their life experience. They focus more on the financial journey rather than the destination in life - it is about the consumption and the experiences rather than the outcome or what you have to show for it. But as far as hard assets go, they're further behind than any generation have been at any age. They haven't invested in much."5. China's stocks have fallen 20% in the last two weeks after its banks clamped down on lending in July, Bloomberg reports. Chinese bank lending fell 77% in the month after the government decided all the extra liquidity being pumped into the economy as part of the stimulus was dangerous. Ya don't think... This raises the question. What happens to the rest of the world's financial markets when central banks and governments decide to end their stimulus plans? Something to do with hot air and bubbles I suspect...

The gauge has slumped 19.8 percent since Aug. 4, after more than doubling from November, as China rolled out a 4 trillion yuan ($585 billion) stimulus package. A plunge in new bank loans in July, disappointing earnings and concern the government will seek to damp property speculation has sapped confidence, driving losses close to the 20 percent threshold for a bear market.6. Bloomberg's Matthew Lynn wonders what all the fuss is about deflation. A little bit of deflation, which is what we have at the moment, is not the end of the world, he says. He makes a strong case, arguing deflation is bad for bankers and CEOs, but not necessarily for the economy. People on stable salaries and who don't have debt love deflation. Sounds like a baby boomer talking.

In reality, anyone with a sense of economic history would have been aware that the whole deflation story was oversold. In the U.K., the House of Commons Library publishes data on prices going back to 1750. From 1814 to 1914, prices rose a bit in some years, and dropped a bit in others, so there was no real change in the price level over the century. In other words, there were plenty of deflationary years. Yet over that period, the U.K. became the greatest economic power in the world: Its relative decline only started once inflation took hold. Deflation didn't stop the Industrial Revolution, one of the most sustained times of economic creativity ever seen. Likewise, a 2004 study by the Federal Reserve Bank of Minneapolis looked at the data on deflation across 17 countries over 100 years. It found that although the Great Depression of the 1930s was linked with falling prices, that wasn't true of any other historical period. There was, it said, "virtually no evidence" that deflation caused a depression. Why should it? We are constantly told that deflation is bad because it makes consumers hold off from buying things, thinking they will be cheaper tomorrow. But that is just silly.7. Former IMF economist and current Harvard economics professor Kenneth Rogoff writes in the FT.com that governments have fixed nothing by bailing out banks. The banks must give up their guarantees and borrow for longer terms, he says. Governments should regulate much harder I agree. He hints at another crisis to come if this doesn't happen.

The fact is that banks, especially large systemically important ones, are currently able to obtain cash at a near zero interest rate and engage in risky arbitrage activities, knowing that the invisible wallet of the taxpayer stands behind them. In essence, while authorities are saying that they intend to raise capital requirements on banks later, in the short run they are looking the other way while banks gamble under the umbrella of taxpayer guarantees. If the optimists are wrong, does this mean that the pre-Lehman financial system was one big Sodom and Gomorrah, inevitably condemned to doom? We will never know. Theory and history both tell us that any economy that is excessively leveraged with short-term borrowing "“ be it government, banking, corporate or consumer "“ is highly vulnerable to crises of confidence. Accidents that are waiting to happen usually do, but when? Neither statistical analysis of history, nor economic theory offer tight limits on the timing of collapses, even to within a year or two.8. Here's an interesting name for a new hedge fund run by a former Lehman Bros trader: Ground Zero Strategic Commodities. Apparently the guy behind it, Edward Filippi, has already raised US$35 million despite not having a portfolio manager or operations manager. Here's the full story in the NYTimes' dealbook. Read it and weep. 9. Here is some good news on the relationship between China and Australia. China has promised to buy A$50 billion worth of natural gas from the Gorgon project on the North West Shelf, The Australian reported. This is good news for us, given Australia is our largest trading partner.

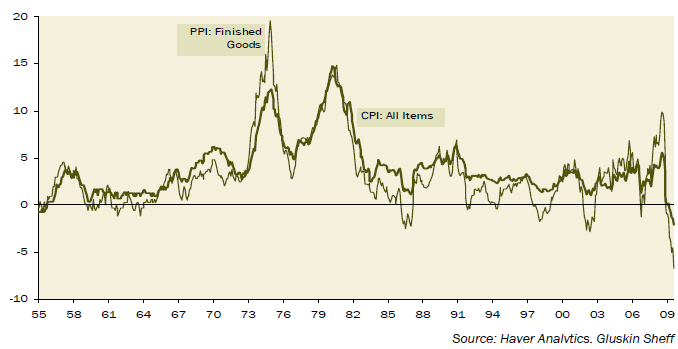

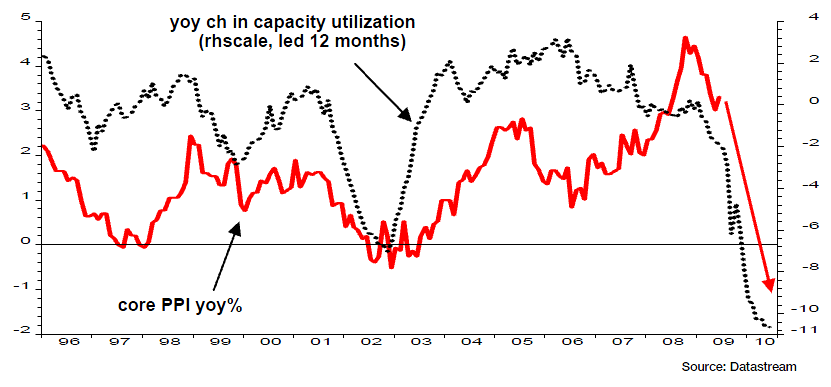

The deal is the latest sign that while diplomatic relations between Australia and China have ebbed to a decade low, Beijing's appetite for Australia's resources remains undiminished, coming only a day after Fortescue Metals Group said China's state-owned banks would back its rapid expansion with $US6bn ($7.3bn) in loans. This is the latest and biggest deal in the unprecedented escalation of gas projects which take in the $50bn Gorgon project and several deep-sea gas field developments by Australia's Woodside Petroleum, as well as surging interest in coal-seam gas deposits, mainly in Queensland.10. Barry Ritholz at The Big Picture is sure deflation has set in in in the United States and has the charts to prove it. A sobering view for those who fear deflation and a slap in the face for those who fear inflation. I'm tending towards Barry's view at the moment. It makes sense with the Japanese lost decades thesis. Is the global economy ready for a couple of lost decades?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.