Top 10 at 10: ANZ's Bonus bonds attacked; Houses 'selling like hot cakes'; Weldon 'overpaid'; Dilbert

17th Aug 09, 10:13am

by

Here are my Top 10 links from around the Internet at 10am. I welcome any additions in the comments below or please send suggestions for Tuesday's Top 10 at 10 to bernard.hickey@interest.co.nz No one called Ted works for interest.co.nz...

1. Rebecca Milne at the Herald on Sunday reports that at least two investors who lost money in finance company collapses have taken their own lives. One 68 year old man fell into depression after losing money in Blue Chip.

1. Rebecca Milne at the Herald on Sunday reports that at least two investors who lost money in finance company collapses have taken their own lives. One 68 year old man fell into depression after losing money in Blue Chip.

"I was quite suicidal, I was so low," he said. "Another letter would arrive from a lawyer and we just got the shakes. I would walk around in a daze. It's a disaster. God only knows when it will finish." The couple were financially comfortable when they bought two apartments from Blue Chip in 2006. They agreed to buy three more from the plans, thinking the rental income would be a nest egg for retirement. But the company collapsed last year, leaving thousands of investors some $80m out of pocket. The couple have a combined pension of $400 and can't repay even the interest on their liability bill of between $2.5m and $2.7m. They resorted to living in the workshop and renting their house to their daughter and son-in-law.2. Andrea Milner has two interesting reports in the Herald on Sunday with two sides of the same coin. The first one is titled 'Houses going like Hot cakes'.

The auction of a renovated bungalow at 23 Brookfield Ave in Onehunga attracted around 80 people on Wednesday evening, with attendees spilling out and blocking the pavement. Listing agent Dianne Nicholls said it was the type of property that appealed to young professional couples. "They're just going like hotcakes." John Wills, sales head for Custom Residential, said one Grey Lynn "do-up" attracted five unconditional offers after the first weekend of open homes and sold for $640,000 - around $50,000 above the vendor's expectations. "That's right in the sweet spot for that type of entry level. It was going to auction, but it didn't last past the first week." He said the "acute" listings shortage has reached "crisis" levels from the buyers' points of view. "These buyers are tired, they're frustrated and they're over it - they just want a house and to get back to a normal life."3. And the second story is all about a couple in Cambridge who are being forced out of their house because of a mortgagee sale by Westpac. The couple were on what appears to be regular incomes with one being a type of IT contractor. Somehow, Westpac decided to lend them NZ$390,000 and they couldn't make the payments. So they borrowed more to make the payments... I wonder how many of the people buying the 'hotcakes' above are being lent more than they can afford and are assuming interest rates stay at 6% forever. FYI the average 2 year fixed mortgage rate for the last 8 years (we only have data going back that far) was 7.743%. Reserve Bank figures show the average floating mortgage rate was 8.45%. Can anyone borrowing now to buy hotcakes afford a 10% mortgage rate, because that is what an 8% average rate implies. 4 Emma Page at the Sunday Star Times writes about how banks are easing up their conditions for home lending. This is a slow motion car crash all over again.

BANKS are relaxing their lending conditions as house prices stabilise, making it easier for would-be homeowners to get into the property market. Mortgage brokers around the country say banks are now willing to consider loan applications that just a few months ago would have been flatly declined. The changes, which include lending up to 90%, comes after a time when a minimum 20% deposit was the norm and banks were taking a more conservative approach to approving home loans.5. Brian Gaynor writes in his Saturday column for the NZHerald that bonus bonds are a nifty deal for ANZ. The scheme pays an extraordinarily high 1.48% management fee for a fund that invests in government bonds and quite a few ANZ securities. Anywhere else they would be considered related party loans...

The essential issue regarding the Bonus Bonds scheme is that it is not a lottery; it is an investment product that requires a prospectus under the Securities Act 1978 but is exempt from having an investment statement. Its transparency and disclosure is poor as the prospectus contains no detailed balance sheet information and one has to troll through the Companies Office website, which is not an easy task for uninformed investors, to get this information. Bonus Bonds demonstrate once again that the Securities Commission should be insisting on far better prospectus disclosure. It should also establish an easy to use website with the details of all costs, particularly for those funds that don't include all costs in the management fee. This website would clearly identify that the cost structure for Bonus Bonds is too high and a total cost structure of less than 1.00 per cent, instead of 1.48 per cent, would be more appropriate.

6. First Step investors are angry, Tim Hunter at the Sunday Star Times reports. My blood would be boiling too if the same thing happened to me. Doug Somers-Edgar is the man behind all this and the Money Managers empire...

6. First Step investors are angry, Tim Hunter at the Sunday Star Times reports. My blood would be boiling too if the same thing happened to me. Doug Somers-Edgar is the man behind all this and the Money Managers empire...

"You know, this has made us angry and we're a little poorer and somewhat wiser, but it's not going to break us. But this couple that [contacted us], all the money they had was diverted into Orange Finance and various other things when it came out of First Step, and they're likely to suffer about an 85% loss. It's just awful. And I bet there's a lot of people out there in much the same sort of situation, and they're sitting there in quiet desperation not knowing quite where to go." The Fletchers, now retired, may have avoided financial ruin, but feel they were misled by their Money Managers adviser. "We didn't realise they were really only marketing their in-house products," he said. "We went there asking initially that we could get into government bonds and local authority bonds, something pretty safe, and they talked us out of that pretty much." Fletcher said they were told there were particular tax advantages in First Step's structure as Australian unit trusts they were able to receive income tax-free through bonus issues of units. "They didn't say anything about the fact that the tax efficiency was about to be wiped out in the next budget it had been flagged a couple of years before but we didn't cotton on to that."

7. Pyne Gould Corp, which owns Marac Finance, wants to raise NZ$160 million in fresh capital from shareholders, according to an unnamed finance industry source in this Marta Steeman piece in The Press. And what happens if PGC shareholders won't swallow that much. It seems George Kerr will buy some of the leftovers. This begs the question: Is George Kerr moving to take partial control of PGC and Marac?

7. Pyne Gould Corp, which owns Marac Finance, wants to raise NZ$160 million in fresh capital from shareholders, according to an unnamed finance industry source in this Marta Steeman piece in The Press. And what happens if PGC shareholders won't swallow that much. It seems George Kerr will buy some of the leftovers. This begs the question: Is George Kerr moving to take partial control of PGC and Marac?

The finance industry source said PGC may look at issuing up to 200 million shares to raise about $160m to add to the 98.6 million existing shares and end up with about 300 million shares on issue. Entrepreneur George Kerr, the great-great grandson of one of the founders, has indicated a willingness to part-underwrite the share issue and might end up with nearly 20 per cent of the company, depending on how willing existing shareholders are to buy the new shares. PGC said three weeks ago the capital was needed to bolster the funds of Marac and to help bankroll an expanded funds management business, Perpetual Asset Management, which Kerr will chair. PGC's purchase of Kerr's fund management company EPAM (Equity Partners Asset Management) for $18m has already raised questions about sales to related parties. It is one of several funds Kerr wants to set up in the larger fund management operation to be developed over the next few years.8. Cactus Kate has teed off again on Mark Weldon. She creates a Weldon Index that shows, she says, how overpaid he is.

So how out of whack is Weldon's pay? I have created an index of random types and sizes of companies listed on the exchange where CEO's and officers can insert their market capitalisation and pop out what they should be paid based on the new CEO currency, The Weldon. For example, take Paul Reynolds, CEO of Telecom who can't regulate his own business. I bet now more than ever he wishes he could. Reynolds is paid around $4.8 million a year to run a company with a market capitalisation of $5.1 billion. That is, he is paid just 2.25 "Weldon's" to run a company worth 21 times that of NZX. Based The Weldon Index, Reynolds should be paid $46 million. The "Naked CEO" Rob Fyfe is paid 1.06 Weldon's but Air NZ is 5.5 larger than NZX by market cap. Fyfe should be paid $11.7 million by The Weldon Index.The Weldon Index

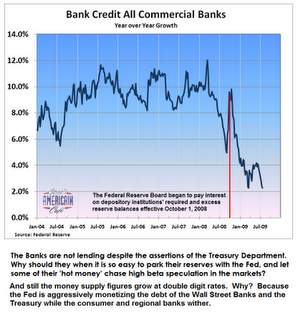

9. This piece from John Lounsbury at Seeking Alpha lays out why he thinks the United States is on the verge of another banking crisis. He says banks aren't lending enough, many are already failing, defaults will increase for three more quarters, the FDIC is in trouble and bank credit is contracting.

9. This piece from John Lounsbury at Seeking Alpha lays out why he thinks the United States is on the verge of another banking crisis. He says banks aren't lending enough, many are already failing, defaults will increase for three more quarters, the FDIC is in trouble and bank credit is contracting.

We have a confluence of five factors that have the potential to create damage to banking not seen in 80 years, and that includes the Great Depression. Without a strong recovery, there is little hope of a good outcome for the non-oligarchy banks. With a return to recession, in 2010 (and possibly 2011 and 2012) there could be carnage in regional and local banks not seen since the early 1900s, and maybe even worse than what occurred then. I hope we don't have to compare what happens in 2010 to 1873. The banking crisis of 1873 started what has been called "The Long Depression". This consisted of a period of rolling recessions that continued for almost 40 years and included additional banking crises in 1893 and 1907. This long period of economic and financial turmoil was a major motivator in the formation of the Federal Reserve Bank.Egads. 10. Bloomberg has a nice little story and a fantastic chart warning of changes to 'mark to market' accounting rules by the Financial Accounting Standards Board (FASB) that could king-hit the market again. HT Alex. Just click on the chart tab to see it.

"Like a horror flick monster that just won't stay dead, FASB's accountants are proposing to expand the application of mark-to-market accounting rules across the board to include all financial assets, including regular loans," Wesbury said. The CHART OF THE DAY, fashioned from one Wesbury is presenting to investors, tracks the performance of the Standard & Poor's 500 Index since the Securities and Exchange Commission and FASB clarified the meaning of the rules in September 2008. "Twice the market was teased with a sense of potential changes for mark-to-market accounting. Twice those hopes were dashed and twice the market fell to new lows," Wesbury said.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.