Here's my Top 10 links from around the Internet at 10am. I welcome your additions in the comments below or please send any contributions for tomorrow's Top 10 at 10 to bernard.hickey@interest.co.nz Interest.co.nz is idiot proof...

1. It pays to keep an eye on Latvia because it could be the flashpoint that destabilises the European banking system. If Latvia is forced to devalue, other Baltics may be forced to do the same, which could trigger banking and monetary chaos across Eastern Europe. That would force many of the Scandinavian banks and some of the Western European banks to book big, big losses. It would all kick off from there.

FTAlphaville has done a fine job here picking apart the latest results of Parex Banka in Latvia and how both its capital and its customer deposits have slumped. It seems this is all part of a standoff between the IMF and Latvia on a bailout necessary to protect the Lat from a slump versus the Euro. One to watch.

2. Here's something from French economics and markets website called GlobalEurope Anticipation Bulletin which predicts another September/October meltdown this year. Crikey. HT Rob via email.

1. It pays to keep an eye on Latvia because it could be the flashpoint that destabilises the European banking system. If Latvia is forced to devalue, other Baltics may be forced to do the same, which could trigger banking and monetary chaos across Eastern Europe. That would force many of the Scandinavian banks and some of the Western European banks to book big, big losses. It would all kick off from there.

FTAlphaville has done a fine job here picking apart the latest results of Parex Banka in Latvia and how both its capital and its customer deposits have slumped. It seems this is all part of a standoff between the IMF and Latvia on a bailout necessary to protect the Lat from a slump versus the Euro. One to watch.

2. Here's something from French economics and markets website called GlobalEurope Anticipation Bulletin which predicts another September/October meltdown this year. Crikey. HT Rob via email.

Contrary to the dominant political and media stance today, the LEAP/E2020 team does not foresee any economic upsurge after summer 2009 (nor in the following 12 months) (1). On the contrary, because the origins of the crisis remain unaddressed, we estimate that the summer 2009 will be marked by the converging of three very destructive « rogue waves » (2), illustrating the aggravation of the crisis and entailing major upheaval by September/October 2009. As always since this crisis started, each region of the world will be affected neither at the same moment, nor in the same way (3). However, according to our researchers, all of them will be concerned by a significant deterioration in their situation by the end of summer 2009. LEAP/E2020 believes that, instead of « green shoots » (those which international media, experts and the politicians who listen to them (5) kept perceiving in every statistical chart (6) in the past two months), what will appear on the horizon is a group of three destructive waves of the social and economic fabric expected to converge in the course of summer 2009, illustrating the aggravation of the crisis and entailing major changes by the end of summer 2009"¦ more specifically, debt default events in the US and UK, both countries at the centre of the global system in crisis. These waves appear as follows: 1. Wave of massive unemployment: Three different dates of impact according to the countries in America, Europe, Asia, the Middle East and Africa 2. Wave of serial corporate bankruptcies: companies, banks, housing, states, counties, towns 3. Wave of terminal crisis for the US Dollar, US T-Bond and GBP, and the return of inflation3. Richard Berstein, a former chief investment strategist at Merrill Lynch, says in this opinion piece in the FT that America is forever blowing bubbles and is set for a Japanese-style lost decade.

Japan's post-bubble strategy during the 1990s supported excess capacity and stymied the post-bubble consolidation forces. Companies were deemed "too big to fail", and excess capacity (particularly in the financial sector) was kept alive. Basic economics states that significant overcapacity leads to lower product prices, and Japan's policies accordingly resulted in an extended period of deflation. Japan did have some inflation during its "lost decade", courtesy of China's boom, which soaked up Japan's excesses. However, deflation returned to Japan and overcapacity grew once the Chinese economy cooled. US policymakers made a clear choice to follow a Japanese-like route when they declared that a select group of financial institutions were too big to fail, and devised the troubled asset relief programme (Tarp), term asset-backed securities loan facility, and public-private investment programme. The bankruptcies of General Motors and Chrysler may seem to run counter to this contention, because the government took swift action to reduce unnecessary productive capacity, but it will be interesting to see how the government deals with the resulting consolidation within the industries that supply carmakers.4. George Magnus, a senior economic adviser at UBS, points out in this FT comment piece that the problem of an ageing population retiring too soon is one faced by most developed nations. New Zealand is no exception and it can only be a matter of time before the retirement age is extended, regardless of John Key's ludicrous promise to resign if he extends it.

Commonplace angst about the surge in public borrowing caused by the recession and the costs of fixing the banking system is a foretaste. In the US and the UK, the banking crisis could end up costing between 15 and 25 per cent of gross domestic product. However, age-related spending ( pensions, healthcare, disability benefits and residential care) already consumes a similar amount of GDP in the eurozone and Japan every year, and about 12-13 per cent of GDP in the UK and the US. This proportion is expected to increase in the next decades by about 7 per cent of GDP on average, a little less in the UK, and possibly as much as 10 per cent of GDP in the US, depending on the details of healthcare reform. We cannot afford simply to hope that a solution will turn up. We should not believe for a moment that financial engineering, or adjustments to pensions, savings and benefit systems will provide an easy fix. The challenge is to think holistically about how we can raise the participation rate and productivity of people at work in general, and of women and persons aged over 55 in particular.5. Here's a fun video showing what US$1 trillion actually means. Very clever viral marketing video too by US budgeting website mint.com. 6. Here's an extraordinary investigation by the Florida Herald Tribune into mortgage fraud in Florida during the housing boom and the practice of 'flipping'. This is where a house is bought and sold quickly among friends and associates to raise values and skim cash off ever rising mortgages. HT Mish. Does anyone know if this happened in New Zealand? Here's more details in this piece

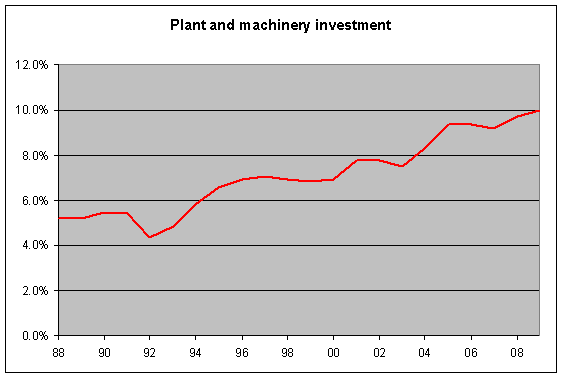

More than 100 properties from Palmetto to North Port doubled in price in a single day during the recent real estate boom. Proposed condos -- no more than ideas on paper -- flipped two or three times before anyone moved in. Some investors bought up dozens of houses within a few blocks. Within weeks or months, they flipped them at a profit. A yearlong Herald-Tribune investigation has found that many of these sales cannot be explained by shrewd deal-making or as an innocent consequence of the real estate boom. Instead, they were manufactured by property flippers who found ways to drive up housing prices so they could make money at the community's expense.7. The Bridgecorp pain goes on. Gareth Vaughan at Stuff (BusinessDay) reports that the Momi resort auction yesterday was postponed for a month "to allow potential bidders more time to do due diligence." 8. Matt Nolan at TVHE has an excellent post on the productivity debate, hitting back those, incuding Idiot/Savant, who say National wants to cut wages and big business doesn't invest enough in plant and machinery. This chart says it all. Business does invest in gear, yet we still have a big problem.

9. The New Yorker gets creative here with a mock memo from Goldman 'Vampire Squid' Sachs CEO Lloyd Blankfein to his staff after its recent motherlode profit.

9. The New Yorker gets creative here with a mock memo from Goldman 'Vampire Squid' Sachs CEO Lloyd Blankfein to his staff after its recent motherlode profit.

Wanting to celebrate our renewed success is natural, but it's important that we don't go crazy here. Remember, ten per cent of the non-bank country is unemployed, and even those who are working have "real" jobs, where payment is proportional to the creation of a "product" or a "service." Those poor bastards. So I ask that, in celebrating our raping of the stock market, we show restraint in the following ways:10. China has announced it plans to 'mobilise' its massive foreign reserves by buying real assets globally, the FT.com reported. Here we go.Furthermore, to avoid drawing criticism from the press, this year the bonuses, expected to be comically large, will be distributed in blood diamonds, which can be easily concealed in a briefcase so it looks like we're working. I'd like to thank everyone who made this possible"”for a second time. Respect to President Obama for keeping us in the green. Thanks to the big guy upstairs (me). And let's not forget all the ordinary Americans, who, for some unfathomable reason, have refused to put us behind bars. We are literally taking money out of their wallets. Seriously, with these returns we are making Madoff look like a little kid with his hand caught in the cookie jar. Amateur!

- Please limit high-fives and chest bumps to a dozen a day.

- Don't wear your crowns, except around the office.

- Stop paying for things in Monopoly money"”I understand it is the same as real money to us, but there have been some complaints.

- For now, let's take down the giant scoreboard that reads "Main Street: zero. Wall Street: a billion gazillion bajillion."

Beijing will use its foreign exchange reserves, the largest in the world, to support and accelerate overseas expansion and acquisitions by Chinese companies, Wen Jiabao, the country's premier, said in comments published on Tuesday. "We should hasten the implementation of our "˜going out' strategy and combine the utilisation of foreign exchange reserves with the "˜going out' of our enterprises," he told Chinese diplomats late on Monday. Mr Wen said Beijing also wanted Chinese companies to increase its share of global exports. The "going out" strategy is a slogan for encouraging investment and acquisitions abroad, particularly by big state-owned industrial groups such as PetroChina, Chinalco, China Telecom and Bank of China.

1 Comments

It is the need to consider and refine good ideas to change the way of life and thinking of every human being. A country develops when people change the way they see things. As an individual, I still have to read books on politics, business and life daily to change myself.

I very much agree with your sharing

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.