Top 10 at 10: Jacks Point prices halved; Kiwi's exposed to cocaine-fuelled New York 'Boiler Room'; Dilbert

9th Jul 09, 11:44am

by

Here's my top 10 links from around the Internet at 10am. I welcome your additions in the comments below or please send any links for tomorrow's Top 10 at 10 to bernard.hickey@interest.co.nz My soul is not going anywhere.

1. Nick Smith at The Independent has the inside story on why Treasury withdrew its government guarantee from Viaduct Capital, citing a Treasury memo. In particular, the memo highlights the shadowy role in the background of Hunter Capital's Paul Bublitz.

1. Nick Smith at The Independent has the inside story on why Treasury withdrew its government guarantee from Viaduct Capital, citing a Treasury memo. In particular, the memo highlights the shadowy role in the background of Hunter Capital's Paul Bublitz.

The Treasury memo alleges Viaduct breached rules regarding related party lending and general business conduct. It (Viaduct) initially launched its prospectus on March 3 seeking $50 million, but on April 20 Treasury withdrew its guarantee, citing the likelihood of the guarantee extending the benefit to people "who are not intended to receive that benefit''. One such person, according to the Treasury memo, is Paul Bublitz, managing director of Hunter Capital Group, which provided Wevers with the funding to buy Viaduct. Bublitz told The Independent in April that his sole involvement was providing funding for purchase. But Treasury sees it differently. "We consider that it is reasonable to take the view that the transactions surrounding the purchase of Viaduct appear to have been designed primarily to advance the interests of Mr Bublitz.'' Viaduct contends it did conduct proper due diligence on loans involving Phoenix Finance (Wever's holding company), Hunter Capital Property Trust and Hunter Capital Group.2. Nick Chris Hutching at NBR has an interesting piece on how the Dunedin City Council-owned electricity contractor Delta has bought 100 sections at Jack's Point that were earmarked for Hanover Finance, which has been unable to settle. One interesting byproduct of the story is that section prices at Jack's Point have been halved, but that somehow residential property investment is still better than other investment choices, according to the developer John Darby. Also, Delta appears to have bought a half share in the Luggate development from Jim Boult. What on earth is a council owned contractor doing buying undeveloped blocks from property developers?

Hanover had recently re-launched the Highland sections at prices between $280,000 to $325,000 for 1000sq m compared with $550,000 to $650,000 two years ago. Mr Darby said Hanover was probably "a little ambitious" in its original pricing. He said the re-pricing of real estate at Jacks Point made for attractive buying. The word he was hearing from local realtors was that inquiry levels were building but actual sales were still slow. He noted that residential property as an asset class continues to outperform other investment classes. Commentators often failed to appreciate that different sectors of the property market were performing better than other sectors and averages and medians tended to over generalise what was occurring.3. The FBI has arrested 6 brokers and the CEO of Sky Capital Holdings in New York and charged them with fraud. It seems they operated a 'Boiler Room' type operation that marketed to investors in Britain and New Zealand. Here is the link to the full Securities and Exchange Commission complaint. It seems the CEO Ross Mandell was a 'colourful racing identity' involved with cocaine and alcohol, FTAlphaville points out. Here's more from an FT article on Mandell's past.

In an interview with the New York Sun in 2005, Mr Mandell said he had been an alcoholic and addicted to cocaine. "I lived hard and played hard," he told the Sun. "I treated my friends, business associates and clients quite badly." He blamed his erratic behaviour in the preceding decades on his drug and alcohol abuse but insisted he was clean and sober. That same year, he told Forbes that his record since his sobriety "[compared] favourably with the most reputable brokers and bankers on Wall Street".4. More green shoots? The IMF has upgraded its forecast for economic growth in 2010 to 2.5% from 1.9%, the WSJ.com reported. Here's the full IMF World Economic Outlook Update document.

The global economy is beginning to pull out of a recession unprecedented in the post"“World War II era, but stabilization is uneven and the recovery is expected to be sluggish. Economic growth during 2009"“10 is now projected to be about ½ percentage points higher than projected in the April 2009 World Economic Outlook (WEO), reaching 2.5 percent in 2010. Financial conditions have improved more than expected, owing mainly to public intervention, and recent data suggest that the rate of decline in economic activity is moderating, although to varying degrees among regions. Despite these positive signs, the global recession is not over, and the recovery is still expected to be slow, as financial systems remain impaired, support from public policies will gradually diminish, and households in countries that suffered asset price busts will rebuild savings.5. The government is picking up on idea re-floated at the jobs summit. Bill English said in a release yesterday the government was considering a local body 'bond bank'. Local government New Zealand reckons the 'bond bank' could cut borrowing costs by 10 basis points.

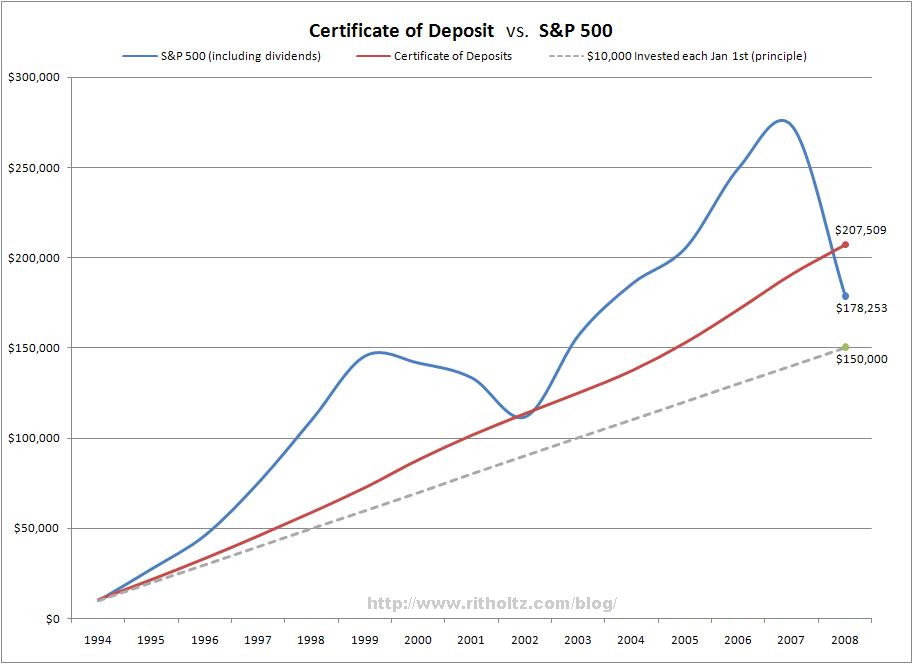

A study will look at whether combining councils' borrowing needs would result in lower interest rates and transaction costs. This arrangement is common overseas. The study will also investigate options for how such an organisation could be run.6. Barry Ritholz at the Big Picture points out that investors would have been better off putting their money in the bank since 1994 than putting their money into the S&P 500.

7. Bloomberg is reporting that Morgan Stanley is planning to repackage a downgraded Collateralized Debt Obligation (toxic debt) into new securities with AAA ratings. OMG. ROFLOL. Yikes. Read this and weep, and then rant, and then kick the cat, and then slump back in your chair. HT Kevin.

7. Bloomberg is reporting that Morgan Stanley is planning to repackage a downgraded Collateralized Debt Obligation (toxic debt) into new securities with AAA ratings. OMG. ROFLOL. Yikes. Read this and weep, and then rant, and then kick the cat, and then slump back in your chair. HT Kevin.

Morgan Stanley is selling $87.1 million of securities that it expects to receive top AAA ratings and $42.9 million of notes graded Baa2, the second-lowest investment grade by Moody's Investors Service, according to marketing documents obtained by Bloomberg News. The bonds were created from Greywolf CLO I Ltd., a CDO arranged in January 2007 by Goldman Sachs Group Inc. and managed by Greywolf Capital Management LP, an investment firm based in Purchase, New York. Two years after the credit markets began to seize up, costing the world's biggest financial institutions $1.47 trillion in writedowns and losses, banks are again taking so- called structured finance securities and turning them into new debt investments with top credit ratings. While the Morgan Stanley deal is the first to involve CDOs of loans, banks have been doing the same with commercial mortgage-backed securities in recent weeks.8. Here's a great new phrase from Paul Collier at The Guardian's Comment is free: 'Bankslaughter'. HT Felix Salmon

The key problem with using the law against bankers has been the difficulty of getting a conviction: surely, the managers of Northern Rockdid not intend to profit at our expense. We do not need to set the burden of proof that high. Intention misses the point. Faced with a corpse and a killer, police do not need to prove ill intent: manslaughter sets the hurdle lower than murder. It is enough to show the killer was irresponsible. That is the standard we need; we need a crime of managing a bank irresponsibly: in other words, bankslaughter.And he points out that restricting bonuses is no solution to the problem of containing irresponsible bankers.

The inherent problem facing shareholders is that incentive payments cannot go negative. However much damage a manager inflicts, wiping out both shareholders and depositors, the consequences cannot be remotely commensurate. As a result, even bonuses with a three-year lag bias the system towards risk-taking. If you thought big bonuses were history you have missed BAB, the new banking mnemonic: yes, Bonuses Are Back.9. Here's what the end of the US dollar hegemony could look like. Chinese exporters, often state owned, will simply stop accepting US dollars for exports. Slow but effective. Here's a Bloomberg story looking at one example.

Sales using the greenback at Guangxi Jinbei Group, where Huang is vice president, dropped to 30 percent of contracts in 2008 from 87 percent in 2007. The yuan, which has gained 21 percent since it was allowed to strengthen against the dollar starting in 2005, offers greater stability, he said. "In recent years, the dollar has gone in only one direction and that is down," said Huang, 45, in his second- floor office in Pingxiang, a town set amongst karst limestone hills and sugar-cane fields in China's southwest Guangxi Zhuang Autonomous Region, three kilometers (1.9 miles) from Vietnam. "Settling our orders in yuan removes a major risk." China expanded yuan settlement agreements last week from border zones to its largest financial centers, including Shanghai, Guangzhou and Hong Kong. The program is being rolled out across Malaysia, Indonesia, Brazil and Russia, all nations seeking to reduce the dollar's role as the linchpin of world finance and trade.10. Rolfe Winkler at Reuters points out that John Meriwether of Long Term Capital Management fame (remember that debacle?) is closing his fund after losing 44%.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.