Top 10 at 10: Bernanke's bluff?; Roubini's weeds; Jet repo-man; Daily Show on Starbucks; Dilbert

10th Jun 09, 7:41am

by

Here's my Top 10 links from around the Internet at 10 am. I welcome your additions in the comments below. I'm so glad I don't have to sit around in circles with managers anymore. Also, please shoot me if I ever accept a sponsorship deal with Starbucks.

1. Rolfe Winkler at OptionARMageddon makes some interesting points about the recent rise in US Treasury yields and US mortgage bond rates. He says it looks like US Federal Reserve Chairman Ben Bernanke has been bluffing with promises of bond buying and now the bond vigilantes have called his bluff. Bernanke's only hope now is to convince Obama to reduce the size of the deficit to cut long term rates, he says.

1. Rolfe Winkler at OptionARMageddon makes some interesting points about the recent rise in US Treasury yields and US mortgage bond rates. He says it looks like US Federal Reserve Chairman Ben Bernanke has been bluffing with promises of bond buying and now the bond vigilantes have called his bluff. Bernanke's only hope now is to convince Obama to reduce the size of the deficit to cut long term rates, he says.

Surely (the Fed) knows that rising mortgage rates are the neutron bomb that will obliterate their monetary-induced "recovery." If the "brighter" economic outlook to which he's referring brings with it median-reverting mortgage rates it will lead to a renewed deflationary spiral. And yet, even as Treasury yields and mortgage rates climbed last week, the Fed didn't step up asset purchases. The Fed still has hundreds of billions left to spend under their previously announced $1.75 billion asset purchase plan. Why are they waiting? Perhaps it's because they know that nothing, not even the printing press, is strong enough to fight off bond vigilantes who see $3.25 trillion of Treasury's set to be dropped on the marker. Remember when Hank Paulson spoke of the Federal Government "bazooka" that was going to protect Fan and Fred? With explicit government backing, he argued, there wouldn't be a run on Fannie and Freddie debt. The Chinese weren't impressed, sold their F/F debt, forcing Paulson to take the two into conservatorship. What's the moral of the story? As big a balance sheet as he has, Uncle Sam doesn't have the resources to corner the bond market. As powerful a tool as the printing press is, the Fed doesn't have enough electronic ink to corner the bond market either. Not when Congress needs to borrow trillions to meet its fiscal commitments.2. Nouriel Roubini freshens up his line that the green shoots are yellow and weedy in this piece republished in Project Syndicate.

Recent data on employment, retail sales, industrial production, and housing in the United States remain very weak; Europe's first quarter GDP growth data is dismal; Japan's economy is still comatose; and even China "“ which is recovering "“ has very weak exports. Thus, the consensus view that the global economy will soon bottom out has proven "“ once again "“ to be overly optimistic. So, green shoots of stabilization may be replaced by yellow weeds of stagnation if several medium-term factors constrain the global economy's ability to return to sustained growth. Unless these structural weaknesses are resolved, the global economy may grow in 2010-2011, but at an anemic rate.3. This is a great sign of the times story from Salon about a repo-man for corporate jets. Needless to say, Nick Popovich, is a busy man these days, although it looks like he's busy in regular times taking planes off armed drug dealers. He'll have to be more careful with all the investment bankers and CEOs who are being forced to give up their planes.

Nick Popovich is a repo man, but not the kind that spirits away Hyundais from suburban driveways. Popovich is a super repo man, one of a handful of specialists who get the call when a bank wants back its Gulfstream II jet from, say, a small army of neo-Nazi freaks. For the past three decades, Popovich has been one of a secret tribe of big game hunters who specialize in stealing jets from the jungle hideouts of corrupt landowners in Colombia, Mexico and Brazil and swiping go-fast boats from Wall Street titans in Miami and East Hampton. Super repos have been known to hire swat teams, hijack supertankers and fly off with eastern bloc military helicopters. For a cut of the overall value, they'll repossess anything. But Popovich is the most renowned of them all -- the Ernest Hemingway of super repo men. "Nick is the best of the best," says Doug Lipke, head of the bankruptcy group for the law firm Vedder Price, who has called Popovich on numerous occasions to retrieve jumbo jets from fat cats with thinning balance sheets. One time, Lipke needed a plane repo-ed from Michigan and flown to Chicago. "All the electrical went out on the plane and Nick was flying at night," he says. "He flew that plane back with zero electricity -- no lights, nothing. There aren't many guys that would be able to do that."4. Here's a useful story from TheDeal.com for those following private equity deals and deal makers. Lots of detail including this little gem to make a few people quake in their shiny shoes:

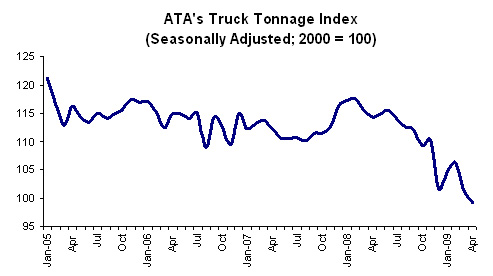

From 2012 to 2014, about US$430 billion of senior debt tied to that deal spree is set to come due. And unless the leveraged loan market roars back to life by then to accommodate a mass of refinancings -- something experts consider doubtful -- an avalanche of defaults could wipe out much of the equity the buyout industry wagered on scores of deals.5. Here's another one of these sobering little statistics that cast doubt on the green shoots theory. Barry Ritholz at The Big Picture points out that tonnages transported on US road and rail are still falling, albeit at a slightly slower rate. These figures should show the first green shoots.

6. This is Op-Ed in the New York Times should be required reading for Barack Obama. In a calm and detailed fashion, this piece from William D. Cohan (House of Cards) and Sandy Lewis points out that Obama has changed little and the same flaws on Wall St need fixing. They also call for proper inquiries into what went wrong and proper transparency into what The US Federal Reserve and Treasury have actually done with all thise trillions of dollars of taxpayer money.

6. This is Op-Ed in the New York Times should be required reading for Barack Obama. In a calm and detailed fashion, this piece from William D. Cohan (House of Cards) and Sandy Lewis points out that Obama has changed little and the same flaws on Wall St need fixing. They also call for proper inquiries into what went wrong and proper transparency into what The US Federal Reserve and Treasury have actually done with all thise trillions of dollars of taxpayer money.

Six months ago, nobody believed that our banking system was well designed, functioning smoothly or properly regulated "” so why then are we so desperately anxious to restore that model as the status quo? Nearly every new program emanating these days from the Treasury Department "” the Term Asset-Backed Securities Loan Facility, the Public Private Investment Program, the "stress tests" of major banks "” appears to have been designed to either paper over or to prop up a system that has clearly failed. Instead of hauling out the new drywall to cover up the existing studs, let's seriously consider ripping down the entire structure, dynamiting the foundation and building a new system that rewards taking prudent risks, allocates capital where it is needed, allows all investors to get accurate and timely financial information and increases value to shareholders and creditors.7. Beijing-based economist Michael Pettis worries here in this blog that China's banks and local governments are lending so freely they may bankrupt themselves in years to come. He also points out early in his blog that many Chinese graduates are struggling to find jobs and the number of new Chinese university students is falling this year for the first time. 8. Wolfgang Munchau at FT.com has a strong view that the export model relied on by China, Japan and Germany is about to have a cardiac arrest caused by appreciating exchange rates.

If my predictions prove correct, Germany will be down and out for a long time with a huge and still unresolved banking crisis, an overshooting exchange rate and lower net exports, presided over by politicians who panic about domestic inflation. This will not end well.9. Bill Gross, the manager of the world's biggest bond fund (Pimco), points out rightly that an irresistible force of greater government bond issuance is about to hit the immovable object of not enough money in the world. HT Ian Mathias at The Daily Reckoning.

"It is obvious," writes Bill Gross, "that the Chinese and other surplus nations cannot fund the deficit even if they were fully on board "“ which they are not. Someone else has got to write checks for up to $1.5 trillion additional Treasury notes and bonds"¦ "The concern is that this can be accomplished in only two ways "“ both of which have serious consequences for U.S. and global financial markets. The first and most recent development is the steepening of the U.S. Treasury yield curve and the rise of intermediate and long-term bond yields. While the Treasury can easily afford the higher interest expense in the short term, the pressure it puts on mortgage and corporate rates represents a serious threat to the fragile "˜green shoots' recovery now under way. "Secondly, the buyer of last resort in recent months has become the Federal Reserve, with its publicly announced and near-daily purchases of Treasuries and agencies at a $400 billion annual rate. That in combination with a buy ticket for over $1 trillion of agency mortgages has been the primary reason why capital markets "“ both corporate bonds and stocks "“ are behaving so well. But the Fed must tread carefully here. These purchases result in an expansion of the Fed's balance sheet, which ultimately could have inflationary implications. In turn, nervous holders of dollar obligations are beginning to look for diversification in other currencies, selling Treasury bonds in the process."10. And finally, here's Jon Stewart laying into Starbucks' lame product placement on a US news show. Starbucks is a perfect demonstration of the worst of America. It's coffee is bad and fake, it's sold in wasteful buckets and Starbucks just doesn't mesh with New Zealand's cafe culture. Restaurant Brands should shut down its Starbucks stores here.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Morning Joe's Sarcastic Starbucks Sponsorship | ||||

|

||||

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.