Here are my Top 10 links from around the Internet at 10 to 2pm.. I welcome your additions and comments below or please send suggestions for Monday’s Top 10 at 10 to bernard.hickey@interest.co.nz

1. China's trade deficit? - China posted a US$7.2 billion trade deficit in March, it's first monthly trade deficit since April 2004. On the face of it this is very significant. The major structural imbalance in global trade and capital systems is the huge trade surplus China has with the rest of the developed world (except Germany).

So if China has a deficit does this mean the problem has gone away? Does it need to appreciate its currency still? Have China's consumers started spending as the rest of the world needs? It seems this is temporary and the problems remain, says Patrick Chovanec, a professor at Tsinghua University's School of Economics and Management in Beijing.

1. China's trade deficit? - China posted a US$7.2 billion trade deficit in March, it's first monthly trade deficit since April 2004. On the face of it this is very significant. The major structural imbalance in global trade and capital systems is the huge trade surplus China has with the rest of the developed world (except Germany).

So if China has a deficit does this mean the problem has gone away? Does it need to appreciate its currency still? Have China's consumers started spending as the rest of the world needs? It seems this is temporary and the problems remain, says Patrick Chovanec, a professor at Tsinghua University's School of Economics and Management in Beijing.

China’s exports every year are highly seasonal — they peak in the fall, when Christmas orders are being shipped, and drop in the spring. So China’s trade surplus usually declines in the spring, and it’s not unprecedented for it to run a one-month deficit even in a year when it ends up running a sizeable trade surplus. The last deficit took place in April 2004, a year in which China went on to rack up a then-record $32 billion surplus. What tipped this month’s figure from a marginal surplus to a deficit was a surge in imports, up 66% from last year. But it going to be important to drill down and take a closer look at exactly what’s making up those imports. If they are finished consumer goods, then it could be a sign of rising consumption in China and a shift towards more balanced trade. But if they consist mainly of raw materials, as many economists suspect, it could indicate that Chinese manufacturers are gearing up for a surge in exports later this year (a phenomenon compounded by rising commodity prices for inputs like iron ore and crude oil, in part due to rising Chinese demand). The key question is, is this a trend or a cycle? Is it a trend towards higher domestic consumption and more balanced trade, or part of a production cycle that leads right back to where we started? I’m not convinced yet this is a trend.2. The next European debt bomb - Michael Hudson, a US academic, has written a piece in the Financial Times saying that there are other debt bombs set to go off in Europe. Solving the Greek problem may not be the end of the matter.

Some 87 per cent of Latvia's debts are in euros or other foreign currencies, and are owed mainly to Swedish banks, while Hungary and Romania owe euro-debts mainly to Austrian banks. These governments have been borrowing not to finance a budget deficit, as in Greece, but to support their exchange rates and thereby prevent a private-sector default to foreign banks. All these debts are unpayably high because most of these countries are running deepening trade deficits and are sinking into depression. Now that property prices are plunging, trade deficits are no longer financed by an inflow of foreign-currency mortgage lending. For the past year, these countries have supported their exchange rates by borrowing from the European Union and the International Monetary Fund. The terms of this borrowing are politically unsustainable: sharp public sector budget cuts, higher tax rates on already over-taxed labour, and austerity plans that shrink economies and drive more workers to emigrate.3. The Magnetar Trade - Jesse Eisinger at Jake Berstein have done an indepth piece at ProPublica, a philanthropic investigative journalism operation, about an unknown (until now) hedge fund called Magnetar. They report it helped create the toxic debt mountain that triggered the global financial crisis and then ruthlessly shorted the whole lot to make a killing. Lovely. There's even a song about them lower down.

In late 2005, the booming U.S. housing market seemed to be slowing. The Federal Reserve had begun raising interest rates. Subprime mortgage company shares were falling. Investors began to balk at buying complex mortgage securities. The housing bubble, which had propelled a historic growth in home prices, seemed poised to deflate. And if it had, the great financial crisis of 2008, which produced the Great Recession of 2008-09, might have come sooner and been less severe. At just that moment, a few savvy financial engineers at a suburban Chicago hedge fund helped revive the Wall Street money machine, spawning billions of dollars of securities ultimately backed by home mortgages. When the crash came, nearly all of these securities became worthless, a loss of an estimated $40 billion paid by investors, the investment banks who helped bring them into the world, and, eventually, American taxpayers. Yet the hedge fund, named Magnetar for the super-magnetic field created by the last moments of a dying star, earned outsized returns in the year the financial crisis began.

4. Talking his book? - George Soros, the fund manager who made a killing when he drove the pound out of the European Exchange Rate Mechanism in 1992, says Britain should look at a devaluation of the pound after the May 6 election, Bloomberg reported. Britain faces a rocky couple of months ahead.

The New Zealand dollar is already up near record highs vs the pound. Hard to see it weakening much in the next couple of months with all this turmoil around.

4. Talking his book? - George Soros, the fund manager who made a killing when he drove the pound out of the European Exchange Rate Mechanism in 1992, says Britain should look at a devaluation of the pound after the May 6 election, Bloomberg reported. Britain faces a rocky couple of months ahead.

The New Zealand dollar is already up near record highs vs the pound. Hard to see it weakening much in the next couple of months with all this turmoil around.

Britain “has more room to use exchange rate adjustments as a way of adjusting the economy” than do nations that use the euro, he said in an interview yesterday in Cambridge, England. “It’s a question for the next government to decide. It has a number of options, of which a currency depreciation is one.”5. Housing bubble march - Australian economist Steve Keen is set to walk up Mt Kosciuszko as part of his losing bet with Macquarie bank economist Rory Robertson on house prices. (Keen bet they would fall) It looks like becoming a media circus. Excellent. What was supposed to be a humiliation is now turning into a demonstration against overvalued house prices.

There are a large number of people coming on The Walk now, with about 30 likely to be there for the first day (12pm this Thursday April 15 at Federation Mall in front of Parliament House, for a 1pm start). We will have a troupe of stilt walkers taking part as well, who will hand out helium-filled balloons–rather apt for a protest against a government-sponsored housing bubble! With the stilt walkers, the balloons, the T-shirts (which look fabulous), and about 30 people walking, it should be a very colourful start to the event. We’ll finish roughly 25km later on the Monaro Highway, where there will be a catered dinner roadside (including wine and beer).

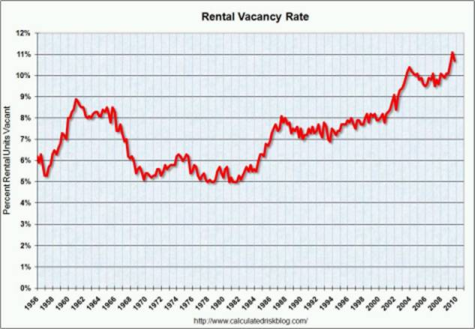

6. Less owning AND less renting - These two charts courtesy of Naked Capitalism show what is happening in the United States where people are selling or being booted out of their homes, but don't appear to be renting. The missing link is that either they are becoming homeless or are moving in with friends or family. Sound familiar?

6. Less owning AND less renting - These two charts courtesy of Naked Capitalism show what is happening in the United States where people are selling or being booted out of their homes, but don't appear to be renting. The missing link is that either they are becoming homeless or are moving in with friends or family. Sound familiar?

In other words, the correlation between falling home prices and rising defaults, on the one hand, with increasing rental demand and higher rental prices, on the other hand, doesn’t hold in a really tough economy.7. 'It won't work' - Ambrose Evans Pritchard writes at The Telegraph that the rescue package agreed over the weekend to bail out Greece won't work. HT Andrew via email.

This achieves nothing. Such wishful thinking has plagued the Greek/EMU crisis from the start. Simon Johnson, the IMF's former chief economist, said Greece needs €110bn to have any hope of pulling itself out of a tail-spin, given that the twin cures of default and devaluation are blocked. Even that may not work. Greece must squeeze a further 13pc of GDP from the budget to stabilise debt costs by 2012, and do so during a slump when every euro of tightening leads to €1.5 to €2 in lost demand The cleanest option for Greece is an Argentine default with a 65pc haircut for creditors, and exit from the euro. Argentina recovered fast after liberation. Greece could expect "decent growth" by mid 2011. True, but Greece is just "the tip of the iceberg", in the words of China's central bank. The design faults of EMU have left all Club Med trapped in debt deflation or perma-slump. Europe's banks are in turn stuck with fatal exposure. You cannot safely uncork Greece without risking a chain reaction. This has echoes of Credit Anstalt, the Austrian bank that collapsed in June 1931, exposing the underlying rot of Europe's banks. It set off an earthquake across Germany and Central Europe. Contagion spread back into the Anglosphere, snuffing out the recovery of early 1931.8. Totally irrelevant picture - It's the splinters I'd worry about. 9. Chinese connection - It seems the riots and revolution in Kyrgyzstan may have a Chinese connection. Many Chinese-owned buildings were pillaged, China.org reported. HT Troy via email. 10. Totally relevant video - How to bet against the American dream. Hedge funds go to broadway. HT Rob Mackintosh via email. Bet Against the American Dream from Alexander Hotz on Vimeo.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.