Here are my Top 10 links from around the Internet at 10. I welcome your additions and comments below or please send suggestions for Wednesday’s Top 10 at 10 to bernard.hickey@interest.co.nz

1. Nuclear hiccup - Former Israeli Defence Minister Ephraim Sneh has floated the idea in a Haaretz editorial that Israel would use its own nuclear weapons to stop Iran from building a bomb and that an Israeli pre-emptive strike would have to happen around November this year... Reading the detail, Sneh actually suggests Israel stop building new settlements so that the US can impose decent sanctions to avoid such a first strike, but it's not pleasant when someone so senior suggests such a thing so openly... And this guy is from the left it seems. Oil over US$100/barrel by Christmas anyone? HT Troy for this one.

1. Nuclear hiccup - Former Israeli Defence Minister Ephraim Sneh has floated the idea in a Haaretz editorial that Israel would use its own nuclear weapons to stop Iran from building a bomb and that an Israeli pre-emptive strike would have to happen around November this year... Reading the detail, Sneh actually suggests Israel stop building new settlements so that the US can impose decent sanctions to avoid such a first strike, but it's not pleasant when someone so senior suggests such a thing so openly... And this guy is from the left it seems. Oil over US$100/barrel by Christmas anyone? HT Troy for this one.

For practical reasons, in the absence of genuine sanctions, Israel will not be able to wait until the end of next winter, which means it would have to act around the congressional elections in November, thereby sealing Obama's fate as president.

2. It's all on - Gordon Brown has called a general election for May 6. The markets will now be focused on who might win and whether Britain can survive without IMF intervention. The state sector unions are already threatening strikes if whoever wins tries to cut government spending,

TimesOnline is reporting.

The National Union of Teachers voted to combine forces with the biggest civil service union to hold simultaneous strike ballots if pay is frozen or pensions and working conditions are cut. Such walkouts could extend from schools and benefit centres to hospitals, town halls, universities and other public services. Both unions urged the TUC yesterday to mobilise workers.

Delegates at the NUT conference chanted “the workers, united, will never be defeated”, fists raised, during a standing ovation for the call by Mark Serwotka, the left-wing general secretary of the Public and Commercial Services Union, for co-ordinated action across the public sector.

“Our message to the politicians should be simple,” Mr Serwotka told the NUT. “If you’re coming for our jobs, our pensions, our services and our education, we are going to stand together and we are going to defend them. And we are going to take united industrial action as a last resort, if we have to, because we know it’s the best way of defending ourselves.”

Here's a gratuitous but interesting

chart that fits nicely with the story below.

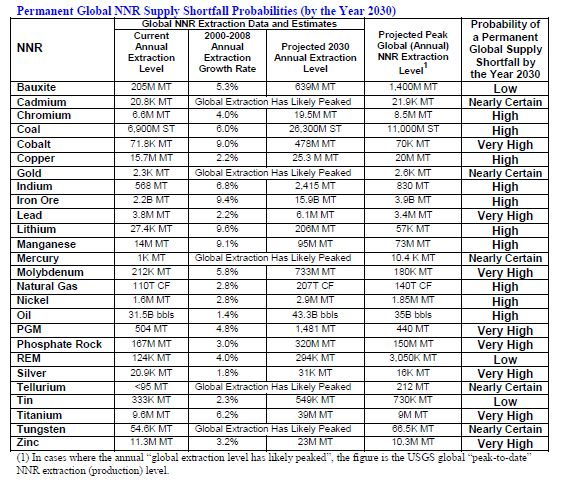

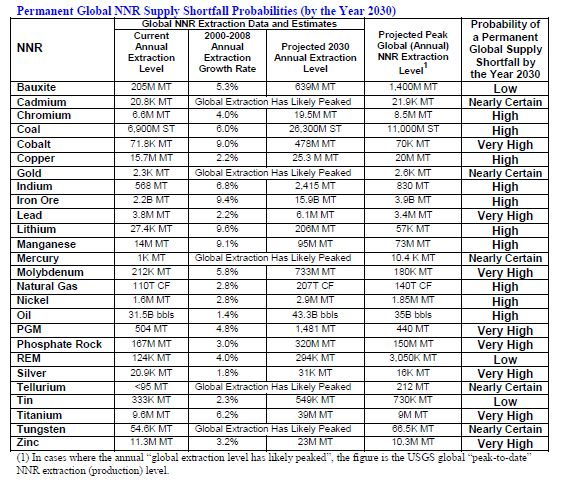

3. Seriously short - Chris Clugston posts a detailed analysis over at The Oil Drum about the increasing scarcity of non-renewable natural resources (NNRs) such as coal, iron ore and copper. Click on the

chart for a bigger more legible version. HT MG via email.

Increasingly, global NNR supplies are transitioning from “continuously more and more” to “continuously less and less”, as they peak and go into terminal decline. As a result, NNRs are becoming increasingly scarce—ever-tightening global NNR supplies are struggling to keep pace with ever-increasing global demand.

Fifty (50) of the 57 analyzed NNRs (88%) experienced some level of global scarcity during the period of global economic growth (2000-2008) that preceded the Great Recession. Twenty three (23) of the 26 analyzed NNRs (88%) will likely experience a permanent global NNR supply shortfall by the year 2030.

So long as 1.2 billion people seek to perpetuate their industrialized lifestyles and billions more actively aspire to an industrialized way of life, global NNR requirements and demand levels will increase unabated—while ever-tightening NNR supplies will continue to approach and reach their global peak levels.

The result of this demand/supply imbalance is a fundamental shift in the relationship among global NNR demand levels, supply levels, and utilization levels.

4. Greeks flee - Greek savers are pulling their money out of local banks to put it in foreign banks,

Harry Wilson at the Telegraph reports. This sounds like the beginning of an endgame in Greece.

Wealthy Greeks and companies have been clamouring to move their cash deposits to banks such as HSBC or France's Société Générale, which operate large branches in the country. They are among those to have received several billion euros of new money in recent weeks.

John Raymond, a banks analyst at CreditSights, said that on a visit to Athens last week capital flight was the number one issue worrying most Greek bankers. "The banks themselves are concerned by it because they can't get funding elsewhere at the moment," he said.

"Greek banks won't be able to increase lending volumes if deposits don't increase, and a continued deterioration in their deposit base will lead them to cut back lending even more, stifling real economic growth."

Recent bond issues by the Greek government have struggled to find much demand and fears are growing that the country could become the first Western nation to default on its debt, stoking fears among Greeks over the stability of not just the country's banks but the entire economy.

"Most bankers say they are worried about the stability of Greece and Greek banks. This combined with the tax issue is making many people nervous about keeping their money in domestic banks or within the country," said Mr Raymond.

5. Wobbly IMF-Eurozone plan - Now the Greek government is quietly saying it doesn't want IMF involvement in the rescue plan because the terms insisted on by the IMF will be too tough,

sources have told Market News.

Several Greek officials have already voiced their concern that the agreement reached by Eurozone leaders requires a lot of time to be put into effect and that the procedure is bureaucratic. The sources said the Greek government will be seeking a clearer European mechanism, without the participation of the IMF, which will be speedier and will respond immediately to a country's official request for financial support.

"What the government wants is to improve the deal and iron out the details that have not been decided yet," the senior official said. "There is a strong chance that Greece might be forced to ask for financial support after all, despite official statements to the contrary, and it is essential that the terms and conditions be clear."

6. Basle III - Felix Salmon at Reuters does a nice job of summarising some of the back-room moves to build the next set of global bank regulations, a process now known as Basle III. He says these moves to reduce bank leverage may take a long time as banks and their individual country regulators appear to be fighting the change.

Meanwhile, the various banks and regulators are all fighting in Basel for their own pet causes. The British regulators want tight controls on liquidity to stop it fleeing a national jurisdiction, as it did not only in the case of Lehman Brothers but also in the case of Bear Stearns; the Japanese banks want to continue to be able to count the value of their internal software towards their levels of capital. (Seriously.) Treasury, as we’ve seen, is worried about US banks ending up at a “competitive disadvantage” to their European competitors.

The banks in general seem to have done a pretty good job of persuading their regulators that there need to be lots and lots of impact studies trying to anticipate what might happen to the global financial system if certain rules were enforced. These studies have a useful delaying effect, of course, and also help to marshall arguments against any big changes. On the other hand, the regulators do seem to have learned one big lesson from Lehman, which is that they have to be able to independently confirm what the banks are saying to them. If a bank says X, the regulatory response these days is “show me”, rather than simply taking the assertion at face value.

The one thing that seems certain is that the negotiations are going to drag on well past the Basel Committee’s self-imposed deadline of end-2012 for implementing the new rules. And it’s also pretty clear that Basel III is the world’s best hope for fundamentally reforming the amount of systemic risk that can be buried inside the global financial system. But whether it’s ever going to get implemented by regulators around the world in anything like its present form is very far from clear.

7. Leaky report on leaky homes - Paul Walker at Anti-Dismal has highlighted a major backdown by Covec, the research company that suggested the central government should stump up more because it would make a lot of money in GST receipts on repair work on leaky homes. Treasury blew that one out of the water pretty quick and now Covec has admitted as much. North Shore Mayor Andrew Williams is a danger to himself and others....

Here's what Covec said:

Tax receipts from leaky building repairs should not be considered additional ‘windfall’ revenue. In the absence of spending on leaky buildings, the Govt would have collected revenue from other spending.

* The fact that the Govt obtains 25% tax revenue from spending on leaky building repairs does not provide an economic justification for the Govt to fund repairs to the tune of 25%, or any other amount.

8. Chinese whispers - Anne Davies at The Age has an investigation of this talk about Chinese buyers pushing up house prices in Australia. HT Rob via email. There's plenty of anecdotes.

DAVID MORELL, a buyer's agent in Melbourne, is sure that money from China was responsible for his client being outbid for a house in Camberwell in Melbourne's east two weekends ago.

''She was about 19 years old, she had no English and she didn't really know how to bid - she just kept her hand up. She was buying on a student visa,'' he says of the young woman who pipped him with a bid of $1.82 million for the three-bedroom house that, in his words, had been given the ''Feng Shui tickle''.

Chinese investors now prominent at auctions in Melbourne's eastern suburb have ''single-handedly fuelled Melbourne's growth'', she says.

''Asia is looking at Australia as the new Switzerland.''

9. Beejaysus part deux - This is a cracking yarn from the IrishTimes.com about one enthusiastic risk manager in Ireland who reported a catastrophic fall in liquidity at his bank below the required 90% threshold to the regulator and nothing was done. HT Brendan via email.

After weeks of pressure, James eventually insisted that the chief executive inform the Regulator of the breaches. In late July 2007, James personally delivered a letter from his company to the Regulator, stating that its liquidity ratio stood at just 70 per cent, but promising to fix the problem immediately.

James expected that in response the Regulator would move in to his office and demand to see all of its books. What happened instead was precisely nothing. The Regulator took no action, and James’s daily reports continued to show the company falling far below its liquidity requirements.

In a final effort, James brought in an independent risk management agency from London to look at his company’s books. Within a matter of days, they were able to inform him that he was wrong. The true liquidity ratio was not 70 per cent. It was 50 per cent. In September 2007, James wrote to his chief executive to tender his resignation.

10. Totally irrelevant video - Jon Stewart riffs on Harmid Karzai's threat to join the Taliban...he actually did.

1. Nuclear hiccup - Former Israeli Defence Minister Ephraim Sneh has floated the idea in a Haaretz editorial that Israel would use its own nuclear weapons to stop Iran from building a bomb and that an Israeli pre-emptive strike would have to happen around November this year... Reading the detail, Sneh actually suggests Israel stop building new settlements so that the US can impose decent sanctions to avoid such a first strike, but it's not pleasant when someone so senior suggests such a thing so openly... And this guy is from the left it seems. Oil over US$100/barrel by Christmas anyone? HT Troy for this one.

1. Nuclear hiccup - Former Israeli Defence Minister Ephraim Sneh has floated the idea in a Haaretz editorial that Israel would use its own nuclear weapons to stop Iran from building a bomb and that an Israeli pre-emptive strike would have to happen around November this year... Reading the detail, Sneh actually suggests Israel stop building new settlements so that the US can impose decent sanctions to avoid such a first strike, but it's not pleasant when someone so senior suggests such a thing so openly... And this guy is from the left it seems. Oil over US$100/barrel by Christmas anyone? HT Troy for this one.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.