Top 10 at 10: Real estate agents should use google; China's ghost city; Japan's debt mountain; Dilbert

9th Mar 10, 9:59am

by

Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please send suggestions for Wednesday's Top 10 at 10 to bernard.hickey@interest.co.nz We never have to pretend to be inspired at Interest.co.nz

1. Due Diligence - The fallout is now raining down in Southland over the collapse of a whiffy deal involving a Maori hapu backed by Dubai money to buy 28 Southland farms. The Otago Daily Times reports Federated Farmers as criticising the real estate agents involved for not doing much due diligence on the buyers. Google is a wonderful tool...

1. Due Diligence - The fallout is now raining down in Southland over the collapse of a whiffy deal involving a Maori hapu backed by Dubai money to buy 28 Southland farms. The Otago Daily Times reports Federated Farmers as criticising the real estate agents involved for not doing much due diligence on the buyers. Google is a wonderful tool...

Federated Farmers rural security spokesman and Southland farmer David Rose said a cursory check would have found the involvement in the hapu buying the land of convicted fraudster Shane Wenzel and the failure to complete the $150 million deal showed the need for higher professional standards in the real estate sector. "When a simple Google search revealed a convicted Australian criminal was associated with the people fronting this deal, you can see why Federated Farmers was more than sceptical," he said. But the agent trying to close the deal, John Wright of LJ Hooker, in Invercargill, disagreed, saying the proposal was not conventional and required different thinking. "It saddens me that Federated Farmers continue to grandstand on the Arab-hapu project, using old conventional thinking around something that is far from conventional." An Auckland hapu with financing from Dubai proposed to buy 28 farms in Southland and enter into a 99-year food supply contract with the Dubai interests. The deal fell over last week due to the hapu failing to meet deadlines and a breakdown in communication.2. China's ghost city - Regular readers might recall my links earlier this year to an Al Jazeera story about the empty city of Ordos in China where the government had spent money in a 'bridges to nowhere' style to artificially boost the economy. There was some controversy about the story and some people inside China (possibly connected to the government) said Ordos was plenty full.

Now we have Geoff Dyer from the Financial Times reporting on the new city of Chenggong in the southwest of China, which he says is almost completely empty. The picture (left) is better than a thousand words.

Now we have Geoff Dyer from the Financial Times reporting on the new city of Chenggong in the southwest of China, which he says is almost completely empty. The picture (left) is better than a thousand words.

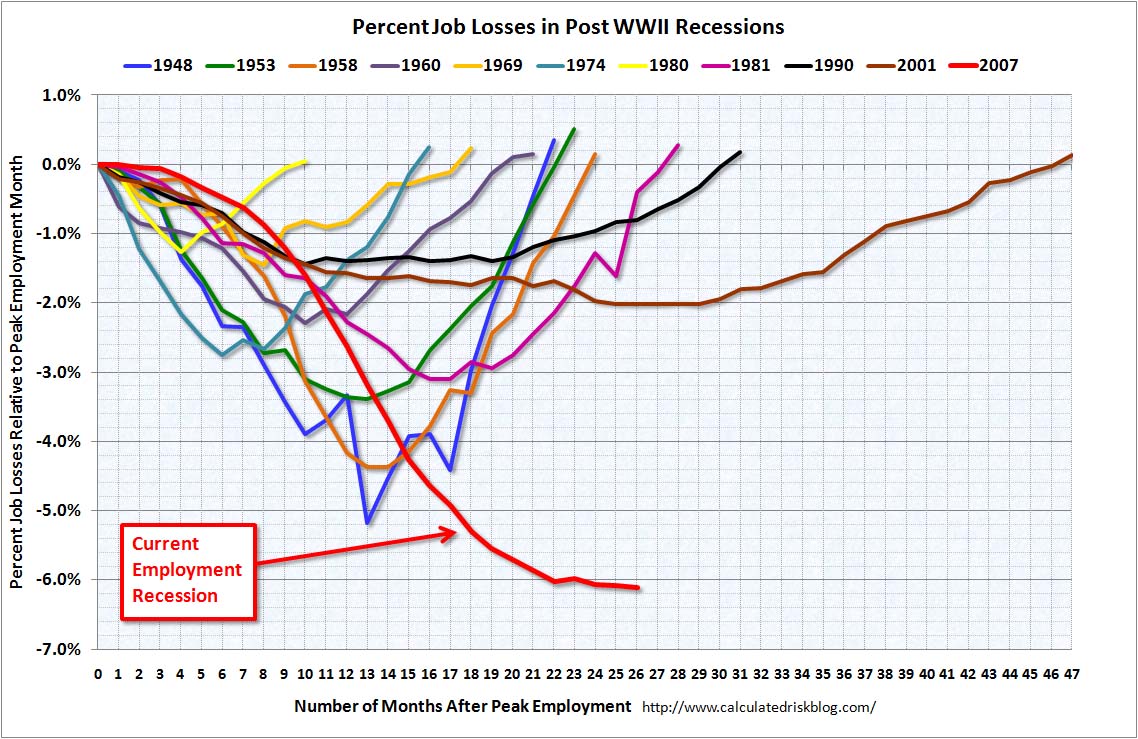

Construction started in 2003 and the results are now apparent in 13 immaculate local government buildings, each clad in marble tiles. A high school boasts an impressive indoor swimming pool and several of the region’s main universities have built large campuses. Pristine high-rise apartment blocks stand in rows, their new windows glinting in the subtropical sun. The one drawback: at the moment, Chenggong is almost completely empty. Its wide streets are all but bereft of traffic, a bank branch has no customers and leaves collect in the foyers of the municipal offices. It is places such as Chenggong that are starting to divide opinion about what is really happening in the Chinese economy. China was the big winner from the global crisis, with its economy expanding by 8.7 per cent last year amid recession elsewhere. But as the country returns from its lunar New Year holiday, divisions are emerging over the long-term impact of the stimulus package implemented by Beijing to carry it through the international downturn. While some regard China as having made forward-looking investments in infrastructure and urban planning that will lay the foundations for a new burst of growth, others fear last year’s recovery is really a mirage based on an investment bubble. It is also a crucial question for the fragile global economy. If China’s rebound were to fizzle, it could easily drag the rest of the world into a double-dip recession.3. Chart of the day - The dark red line is America's current jobs recession, which is way worse than anything seen since at least World War II. 4. Bond vigilantes - Paul Krugman at the New York Times looks at why some countries get pinged by the bond vigilantes when their net debt is over 100% of GDP and why others don't. It's all about confidence in politicians. New Zealand's net debt is set to rise well over 100%, but we're ok it seems because foreign investors believe our politicians and we're underwritten by Australia.

So what’s the problem? Confidence. If bond investors start to lose confidence in a country’s eventual willingness to run even the small primary surpluses needed to service a large debt, they’ll demand higher rates, which requires much larger primary surpluses, and you can go into a death spiral. So what determines confidence? The actual level of debt has some influence — but it’s not as if there’s a red line, where you cross 90 or 100 percent of GDP and kablooie; see the chart above. Instead, it has a lot to do with the perceived responsibility of the political elite. What this means is that if you’re worried about the US fiscal position, you should not be focused on this year’s deficit, let alone the 0.07% of GDP in unemployment benefits Bunning tried to stop. You should, instead, worry about when investors will lose confidence in a country where one party insists both that raising taxes is anathema and that trying to rein in Medicare spending means creating death panels.5. Changing our ways - James Kwak from Baseline Scenario has a review of Yves Smith's new book ECONned and likes the basic idea that America's lust for cheap debt and consumption needs to be turned around.

There’s another point that Smith makes that I found particularly memorable. She tells the fictional story of XCrop, a new, bioengineered food that is nutritionally complete and cheap to produce — a solution to malnutrition and obesity all in one. But twenty years after becoming popular, and after having become the mainstay of the food system (replacing today’s current staples), XCrop is found to have serious harmful effects on human health. Shifting back to today’s foods would be healthier, but it would be difficult and expensive. Recent financial technology, Smith says, is like XCrop. The point she is making is that our policy objective should not be to get us back to the good old days of cheap mortgages and widespread securitization as quickly as possible so we can return to the outsized consumption of the past decade. We need to have a healthier financial system, and to get there we have to give up the wonder food that turned out to be so harmful to the economy. Instead, however, Smith argues that much of the government has been captured by the financial services industry — the inventors and manufacturers of XCrop. And so, at the end of the day, and despite the central role that free market economic orthodoxy played in producing the crisis, the problem we face is ultimately one of politics.6. Japanese debt - There have been so many warnings about Japan's debt situation getting out of control that eventually one of them will come true. Here's the latest from The Telegraph's Edmund Conway in Japan. He makes the point that Japan's domestic savings rate is dropping as the population ages and soon local savers won't be able to buy all those Japanese government bonds.

People have been predicting an apocalypse for the Japanese budget for at least a decade, and year by year, the country has defied such warnings. The government has been able to sustain a textbook unsustainable level of debt because the debtholders have been willing to lend it money at interest rates of between 1pc and 2pc, compared with rates of over 4pc throughout much of Europe, and more than 6pc in Greece. And the reason those creditors have done so? Because 95pc of them are Japanese. This peculiarity of Japanese government debt – that it is vastly owned by Japanese citizens – has protected it from the discipline that would be imposed by international investors. However, a growing number of experts think this buffer will soon come to an end. The savings rate in Japan, which stood at around 14pc in the early 1990s, is now below 4pc – one of the lowest in the OECD. According to Naoyuki Yoshino, professor at Keio University, the country may have only four years until the stock of savings is overtaken by the supply of debt, meaning it will suddenly have to start selling a larger chunk of its debt to outside investors, potentially triggering a sharp increase in interest rates. “When those rates start to rise, then we would have to slash government spending,” he says.7. Canary in the mine - Japan's debt crisis may not be that far away, according to Societe Generale's Dylan Grice in a research note pointed to by FTAlphaville. The biggest buyer of Japanese bonds (JGBs) is now having to borrow money itself. And Japan's bond mountain has an awfully short average maturity of just six years compared to Britain's 14 years.

The biggest JGB holder on the planet – the Government Pension Investment Fund (GPIF) – which has already admitted it’s no longer able to roll maturing bonds, has announced that it will open credit lines so it doesn’t have to sell them to fund its obligations… To spell that out: we are going into a year in which the government has ¥213 trillion (US$2.3 trln) of bonds to roll over… and the biggest holder of JGBs is openly admitting he has no new inflows of money.8. Totally irrelevant picture - There's an elephant in the room. I welcome your thoughts on which is the biggest Elephant in New Zealand's room.

9. Somewhat irrelevant video - Dave Carroll is the country singer who did the now-famous United Breaks Guitars video on Youtube. It has become a seminal moment in customers exercising their power via social media (8.05 mln views and 13.1 mln links on Google). The trouble for United is that this is not going away. Carroll has done a fresh one. He's still mad. And so are lots of other people. Not a bad little ditty. Just a corporate PR nightmare. Good.

10. Totally relevant video - Who would have thunk it. China's house prices are now unaffordable. Looks like a bubble to me. HT Hugh via email. This video is from Al Jazeera

9. Somewhat irrelevant video - Dave Carroll is the country singer who did the now-famous United Breaks Guitars video on Youtube. It has become a seminal moment in customers exercising their power via social media (8.05 mln views and 13.1 mln links on Google). The trouble for United is that this is not going away. Carroll has done a fresh one. He's still mad. And so are lots of other people. Not a bad little ditty. Just a corporate PR nightmare. Good.

10. Totally relevant video - Who would have thunk it. China's house prices are now unaffordable. Looks like a bubble to me. HT Hugh via email. This video is from Al Jazeera

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.