Here are my Top 10 links from around the Internet at 10 am. What a night. I welcome your additions and comments below or please send suggestion for Monday’s Top 10 at 10 to bernard.hickey@interest.co.nz  1. Fat fingers or bad code? - The Dow's 'freakout' last night may have been caused by an errant algorithm or a trader accidentally typing 'b' for billion instead of 'm' for

1. Fat fingers or bad code? - The Dow's 'freakout' last night may have been caused by an errant algorithm or a trader accidentally typing 'b' for billion instead of 'm' for bmillion when selling some S&P 500 futures, the WSJ reports. Proctor and Gamble shares (a Dow component) fell US$20 in seconds. Stock in Accenture (chart below) fell to 1 cent from US$40 and then rebounded. CNBC also reports on the madness.

Shares of Procter & Gamble plunged to $39.37 from around $60. The New York Stock Exchange said each stock has its own circuit breaker level. When these stocks fall below their levels, then they can be traded on any other exchange or platform at any price. When P&G fell below its circuit breaker, a bid came in for the stock at $39.37 from the Nasdaq, the NYSE said. "You don't see a blue-chip stock like this go down 20 points with no news, said Frank Ingarra, co-portfolio manager at Hennessy Funds, a quantitative firm that deals with program traders. "All of the algorithms kicked in from this errant thing." Several market watchers said they heard a major firm may have accidentally released an errant program, where a trader accidentaly placed an order to sell $16 billion, instead of $16 million, worth of e-minis, the futures contracts tied to equity indexes.

2. To keep you in the mood, here's Le Chic with 'Freak out' below.

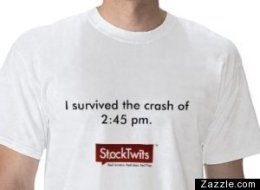

3. Eye for a very quick buck - You have to admire the American spirit of entrepreneurship and their eye for the quick buck. Someone at Zazzle.com has already produced a T-shirt commemorating the Dow's 998 point plunge that lasted a few minutes. 4. Bitten on the bum' - The court case over Bridgecorp's 2006 prospectus is digging up some interesting details around how the Ministry of Economic Development's Companies Office handled the prospectus. The NZHerald's Kelly Gregor reports on what happened inside the MED when they got the prospectus and then approved it. It doesn't look very attractive.

3. Eye for a very quick buck - You have to admire the American spirit of entrepreneurship and their eye for the quick buck. Someone at Zazzle.com has already produced a T-shirt commemorating the Dow's 998 point plunge that lasted a few minutes. 4. Bitten on the bum' - The court case over Bridgecorp's 2006 prospectus is digging up some interesting details around how the Ministry of Economic Development's Companies Office handled the prospectus. The NZHerald's Kelly Gregor reports on what happened inside the MED when they got the prospectus and then approved it. It doesn't look very attractive.

MED manager of securities and corporate compliance John McPherson said he had "flicked" through Bridgecorp's end-of-year prospectus of 2006 but did not sit down in detail to examine its content or whether the document complied with the disclosure requirements of the Securities Act. Instead, that job was passed down to a less senior member of staff. He said the MED's solicitor Ian Ramsay raised "residual suspicions" about whether Barcroft - a company Bridgecorp loaned money to - should be disclosed as a related party in the company's prospectus. In an email to McPherson he referred to the relationship between the two entities as "it seems all very Enronish" in reference to the collapse of the US electricity giant Enron and the cover-up of debts in its financial statements. Ramsay also wrote to McPherson saying the registration of the prospectus "will come back to bite us in the bum". Petricevic's lawyer Paul Davison, QC, questioned why, if such suspicion had been raised, the prospectus was registered. Davison said under the Securities Act a prospectus must not be registered if it contains false or misleading information. McPherson said apart from those residual suspicions there was not enough evidence not to register the prospectus, and documents that have been reviewed by major firms received less attention than documents from "Tauranga and Nelson".

5. 'Just give up' - Nobel prize winner Joseph Stiglitz, who we have interviewed, writes at The Guardian about the Euro zone's enormous problems, which are as much political as economic. It's a cold-eyed and clear look with a startling conclusion from someone so senior and sober. He concludes that Europe may be better off giving up on the 'Le grand projet' and just dump the euro.

One proposed solution is for these countries to engineer the equivalent of a devaluation – a uniform decrease in wages. This, I believe, is unachievable, and its distributive consequences are unacceptable. The social tensions would be enormous. It is a fantasy. There is a second solution: the exit of Germany from the eurozone or the division of the eurozone into two sub-regions. The euro was an interesting experiment, but, like the almost forgotten exchange rate mechanism that preceded it and fell apart when speculators attacked sterling in 1992, it lacks the institutional support required to make it work. There is a third solution, which Europe may come to realise is the most promising for all: implement the institutional reforms, including the necessary fiscal framework, that should have been made when the euro was launched. It is not too late for Europe to implement these reforms and thus live up to the ideals, based on solidarity, that underlay the euro's creation. But if Europe cannot do so, then perhaps it is better to admit failure and move on than to extract a high price in unemployment and human suffering in the name of a flawed economic model.

6. Swiss To Big To Fail - Switzerland is a lot like Iceland, Bloomberg points out. It is dwarfed by its banks, UBS and Credit Suisse. The Swiss and global authorities are hunting for solutions that may include forced breakups. The article also has an interesting discussion around Basle III and the coming demand for banks to hold more capital and leverage less. Again, this is all about de-leveraging and a scarcity of cheap loans globally for a couple of deceades. The 'what it means' for New Zealand is that these global banking monoliths will find it much harder to lend to other banks in our part of the world, turning off the tap of 'hot' cheap money that fueled our property bubble. Those wondering why the big banks here aren't lending much shouldn't be surprised. The easy, hot, cheap money has either gone or gotten much more expensive.

“Switzerland has the most severe too-big-to-fail problem after Iceland,” said Urs Birchler, a professor at the Swiss Banking Institute at Zurich University and a former central bank adviser on financial stability. “It has the potential to derail Switzerland as an economy and as a democracy.” UBS and Credit Suisse each have assets of more than 1 trillion Swiss francs ($900 billion), twice the size of the Swiss economy. The rules on capital and liquid assets that financial watchdogs have imposed on the two companies include proposals under debate by the Basel Committee on Banking Supervision, the standard-setter for lenders in 27 countries and territories. A panel appointed by the Swiss government is considering ways to carve up the Zurich-based banks should they threaten a repeat of Iceland’s collapse. UBS and Credit Suisse will have to draw up plans to separate units that are important for the country from businesses that would be allowed to fail in a crisis.

7. Growing revolt - PIMCO, the world's largest bond fund, has launched a scathing attack on the ratings agencies as the European sovereign debt crisis dissolves into a complete mess, The Telegraph reports. I wonder why, again, the Reserve Bank of New Zealand has given the ratings agency a semi-official role in providing ratings for the non-bank deposit taking sector. HT Andrew Wilson via email.

Bill Gross, managing director of the world's largest bond house, said Moody's, Standard & Poor's and Fitch lacked common sense and had foisted AAA ratings and the idea that countries do not go bust on "unsuspecting" investors. "Their warnings were more than tardy when it came to the Enrons and the Worldcoms of 10 years past, and most recently their blind faith in sovereign solvency has led to egregious excess in Greece and their southern neighbours," he said. "The result has been the foisting of AAA ratings on an unsuspecting (and ignorant) investment public who bought the rating service Kool-Aid that housing prices could never really go down or that countries don't go bankrupt." Mr Gross appeared to ridicule the decision by S&P to downgrade Spain one notch to AA from AA+, and to caution the country that it could face another downgrade. "Oooh – so tough!," he said. He also criticised Moody's and Fitch for maintaining Spain's AAA rating, despite a 20pc unemployment rate, a recent current account deficit of 10pc, a record of defaulting 13 times in the past two centuries, and despite its bonds already trading at Baa levels. "Their quantitative models appeared to have a Mensa-like IQ of at least 160, but their common sense rating was closer to 60, resembling an idiot savant with a full command of the mathematics, but no idea of how to apply them," he said of the ratings agencies.

8. Really? - Bill Clinton has blamed the current crisis on America leaving the gold standard, the Economic Policy Journal points out. HT Michael O'Kane via email from NZMint. Gold jumped overnight. Faith in fiat currencies has been shaken again.

During an interview conducted at the Peterson Institute by Bob Schaeffer, Clinton sounded like a hardcore gold bug as he said that the problems in the economy started when the U.S. went off the gold standard. He then hedged a bit and justified the U.S. leaving the gold standard for "economic management" reasons. Those economic management reasons were, of course, that the U.S. had printed so many dollars at the then price of gold ($35 per ounce) that the U.S. did not have enough gold to back up all the money it printed. But Clinton's statement clearly implies that he understands that gold is a check on out of control government printing of money.

9. Who's next - The Collapseatarians at LEAP2020.eu wonder who is next in the rolling Sovereign Debt Crisis racing around the world. They reckon Britain and the US are the next cabs off the rank. They see a sovereign debt crisis and pound collapse in the UK after the hung parliament result in the election overnight and then a crisis after US elections in November. Lovely.

The Greek finger doesn’t cite the Eurozone as much as the explosive dangers of the exponential financing needs of the United Kingdom and the United States British real estate is trapped in a depression which will prevent prices reaching their 2007 levels for many generations (in other words, never) according to Lombard Street Research. The three parties are preparing to face up to a catastrophic post-electoral situation . According to LEAP/E2020 the United Kingdom could well suffer Greek event with British leaders announcing that the country’s situation is substantially worse than that disclosed before the election. Who will be able/want to back the United States once the British fuse has started burning, causing panic in the sovereign debt market in which the United States is, by far, the largest issuer? Especially since the size of sovereign debt needed corresponds with the start of the expiry, beginning this year, of a mountain of US private debt (commercial real estate and LBO due for refinancing, amounting to 4.2 trillion USD of private debt expiring in the United States between now and 2014 (averaging one trillion USD a year ). Purely by chance, it is the same amount as new global sovereign debt issuance for 2010 alone, of which almost half is by the US Federal Government. Adding to that the financing needs of the other economic players (households, businesses, local authorities), the United States must find nearly 5 trillion USD in 2010 to avoid running dry. Winter 2010 will, equally, be the stage for another destabilised event in the United States: the first major elections since the beginning of the crisis when millions of Americans will probably express their feelings that they have had a belly-full of a continuing crisis, which doesn’t affect Washington and Wall Street, and which creates US public debt which is now counter-productive.

10. Totally irrelevant video - Chrome is faster than a speeding potato. And lightning. And the speed of sound. I am a Chrome user so I found this strangely satisfying and a tad amusing.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.