Here are my Top 10 links from around the Internet at 10 to 5 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Thursday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream

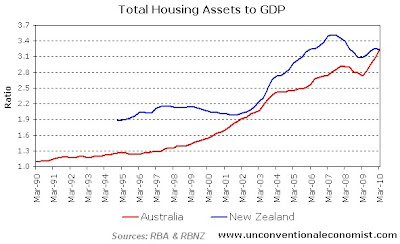

1. We're better than the Australians at something - Our housing bubble is bigger than the Australian housing bubble in many ways, according to Australian investment banker and blogger Leith van Onselen at the Unconventional Economist. HT Stephen. A must read I reckon.

He points out that New Zealand's housing assets to GDP ratio is over 3, which is almost as bad as the Japanese housing bubble before it popped in the late 1980s.

Prices there have halved over the last 20 years.

This is another cracking housing bubble post of his from August.

Here's Leith's argument.

Another way to measure the growth in housing values is to plot the total value of the residential housing stock against a country's GDP. As discussed in my previous post, Battle of the Bubbles, a country's housing market is clearly in bubble territory (severely over-valued) when its housing stock is valued at more than three times GDP.

Despite as significant reduction of mortgage interest rates over the past 20 years, the ratio of average interest payments (comprising mortgages plus other consumer debt) to average HDI has increased from around 8% in 1991 to 11 per cent currently (after peaking at around 15% in 2008).

The situation is similar in Australia, albeit less extreme. Whilst this ratio may look benign on the surface, only 35% of households in both New Zealand and Australia have a mortgage. So the actual repayment burden on indebted households is much larger than implied by the average.

He summarises thus:

The end result is that we are now left with Trans-Tasman banking systems where both nation's banks continue to borrow heavily offshore to inflate their housing markets under the cover of an implied government (taxpayer) guarantee that would become explicit should global credit markets again freeze. Leaving aside the broader competition effects of the guarantees, how are our situations all that different from how Fannie Mae and Freddie Mac operated in the United States prior to the GFC, with an implied guarantee from the United States Government?

Both Fannie/Freddie and the Trans-Tasman banks were privately owned enterprises that were 'too-big-to-fail' that engaged in risky finance under the premise of taxpayer support.As it turns out, New Zealand's taxation treatment of property is truly world-beating. First, New Zealand provides essentially the same negative gearing concessions as Australia, so property investors are permitted to write-off property losses against other forms of income (e.g. wages and salaries).

Second, New Zealand is the only jurisdiction in the OECD that does not have capital gains tax, so once an investment property is sold, the money remains with the investor. Third, the New Zealand Government does not levy stamp duties on property transfers and loans.

Finally, New Zealand’s 4% deprecation on buildings is higher than Australia’s 2.5%.

There's a half-off sale in the world's tallest building. Even with an address at the iconic Burj Khalifa, rents for residences in the tower are not immune from Dubai's real estate crash.

Indeed, nearly a year after it was inaugurated with a massive water-and-fireworks display, about 825 of the tower's 900 ultra-luxury apartments remain unoccupied, according to Better Homes, a real estate brokerage in Dubai.

The cost of renting a studio with floor-to-ceiling windows, marble fixtures and wooden floors has dropped to $1,815 a month from $3,025, while a one-bedroom apartment is available for $2,722 (it used to be $4,536), the brokerage says.

3, The problem with America - American hedge fundie Paul Tudor Jones puts his finger on the problem in America's relationship with China. America capitulated without a fight to get some cheap trinkets. Now's it's trying to fight back and we're all suffering. Worth a read. Jones is an interesting character.

That so many Americans continue to accept this suppression of a variety of exchange rates against the dollar is probably a function of the fact that for so long this suppression provided benefits such as cheap goods and cheap credit. In addition, for a while, manufacturing jobs seemed to be replaced by jobs in the service economy and construction industry without any economic disruption or any rise in the unemployment rate. However, the bursting of the credit bubble exposed the true structural decay that had occurred in the US economy.

But, like zombies, many Americans still cling to the naive belief that we can return to the good times of the 90s and the earlier part of this decade, unable or unwilling to recognize that those high times were a debt-driven anomaly. This delusion is fueled by a myriad of financial pundits who warn about the dangers of disrupting free trade. They are quick to point out that the Ryan Bill is contrary to rules of the World Trade Organization.

Incredibly, in the WTO’s rules of governance, there is not one reference in any of its documents to the underlying bilateral exchange rate between two countries when trying to reconcile trade differences. It is like trying to referee a World Cup match with a soccer ball that only the players can see. In the case of a controlled or manipulated exchange rate, it is patently unfair if the currency of one partner is grossly misaligned, as the RMB/USD rate is.

4. Greece to default within 3 years - Bloomberg reports that PIMCO, the world's biggest bond fund, is saying it expects Greece to default within 3 years.

“I have never seen 11 per cent of GDP being delivered” under the current program assumptions, Mr El Erian said. The debt burden at the end of the process is likely to be higher than it was at the beginning, he said. “The most likely outcome is at some point when the rest of system will be reinforced, they will have to address the debt overhang and its competitive position,” he said.

Credit-default swaps protecting Greek government bonds for a year cost 568 basis points, 66 basis points less than 10-year protection, according to CMA in London. Before the nation was rescued with the 110 billion euro international loan package in May, investors concerned Greece would renege on its debt commitments were willing to pay 665 basis points more for one-year swaps than for 10-year insurance.

Something's amiss. Without a bubble, Wall Street is a lackluster industry. Profitable?

Yes. But its ability to turn in the kind of performance it regularly turned out in the 2000s, without hollow capital being created out of dead-on-arrival Internet start-ups or straight-to-default mortgages is questionable at best.

6. Is it fair for anyone to be paid A$16 million in one year's work? - The Age reports Ralph Norris and the board of Commonwealth Bank of Australia seem to think so.

THE prospect of an investor revolt over chief executive Ralph Norris's $16 million reward package fizzled out after 90 per cent of shareholders backed his bonus deal at Commonwealth Bank's annual meeting yesterday.

7. The drugs don't work - Ian Fletcher gives 6 reasons why America should abandon the Free Trade Myth. HT John via email.

The price of living in the fantasy world of free-trade economics continues to rise for America. Failure to recognize the pitfalls will probably mean a continuing struggle to emerge from recession, as much U.S. domestic demand leaks abroad due to the trade deficit, rather than being recycled at home. And America will continue to lose key industries: not just the primitive ones a developed nation should shed, but the high-tech jobs of the future.

Any serious discussion of free trade must confront David Ricardo’s celebrated 1817 theory of comparative advantage, whose tale of English cloth and Portuguese wine is familiar to generations of economics students. According to a myth accepted by both laypeople and far too many professional economists, this theory proves that free trade is best, always and everywhere, regardless of whether a nation’s trading partners reciprocate.

Unfortunately for free traders, it is riddled with holes, some of which even Ricardo acknowledged. If they held true, the hypothesis would hold water. But because they often don’t, it is largely inapplicable in the real world.

8. The middle income trap - Alan Wheatley (who I used to play squash against when I worked with him at Reuters in Singapore) has written an excellent piece on the challenges China faces in kicking on from the 'middle income' area that seems to be a type of wall that many economies can't break through. HT Stephen via email.

Wheatley makes the point that South Korea seemed to avoid the trap.

“Many countries make it from low income to middle income, but very few actually make that second leap to high-income,” said Ardo Hansson, a World Bank economist in Beijing. “They seem to get stuck in a trap where your costs are escalating and you lose competitiveness.”

According to data compiled by Angus Maddison, an economic historian, and cited by Morgan Stanley, about 40 economies have attained a per capita gross domestic product level of $7,000 over the past century or so. Remarkably, the average economic growth rate of 31 of those 40 economies was 2.8 percentage points less in the decade after the $7,000 inflection point was reached than in the preceding decade. Japan and South Korea reached the $7,000 mark around 1969 and 1988, respectively, whereupon their annual average economic growth rates decelerated in the following decade by 4.1 and 2.4 percentage points, respectively, Morgan Stanley calculates.

China’s per capita gross domestic product is less than $4,000 at market exchange rates, but Morgan Stanley said China had reached Mr. Maddison’s magic number, which is based on purchasing power, in 2008. “If history is a guide and the law of gravity applies to China, China’s economic growth is set to slow,” Morgan Stanley said in a report.

9. David Llewellyn Smith at Houses and Holes points out what all this might mean for Australia. Remembering, of course, that Australia is a province of China and New Zealand is a suburb of Australia.

There is a double blow here for Australia. Not only is it a slower China, but its growth mix is less favourable to the key commodities of iron ore and metallurgic coal as it moves away from fixed investment and towards consumption. This blogger agrees this is a likely outcome for three reasons.

First, China is experiencing a shift to higher labour costs. Second, external pressures arising from the trade imbalance with the US give it no choice but to rebalance internally. And third, this blogger sees no evidence that China will be able to make the political shift to greater freedoms needed if it is to further liberalise its economy and escape the trap like Korea has been able to.

10. Totally irrelevant video - Jon Stewart on the NPR staffing mess. It's funny. Believe me.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| NPR Staffing Decision 2010 | ||||

|

||||

28 Comments

Real world inflation in America is surging. HT Gertraud.

On average, our basic food costs have increased by an incredible 48% over the last year (measured by wheat, corn, oats, and canola prices). From the price at the pump to heating your stove, energy costs are up 23% on average (heating oil, gasoline, natural gas). A little protein at dinner is now 39% higher (beef and pork), and your morning cup of coffee with a little sugar has risen by 36% since last October.

http://www.zerohedge.com/article/quick-glance-real-world-inflation

cheers

Bernard

This is what happens when you practice QE (money printing). First the sugar hit, then the currency devalues and all the exporters cheer, until the inflation strikes. Then they are less competitive than before as wages, materials and interest rise. So the Govt goes for price controls and everything turns to shit. NZ tried this in the 70's and early 80's and its taken 20 years to untangle the imbalances.

Ian Fletcher is an idiot.

All that turning that domestic US demand "inward" would accomplish is a shift of resources from productive enterprises to less productive ones. The US will end up spending more to get less. Genius.

So Bernard, should we be increasing the OCR to depress inflation? Is this what you inflationists are wanting. I suspect this is more to do with the US $ dropping in value. While the cost of living increases then we have less left to pay the bills, like the mortgage and rates.The inflation that matters is wage inflation and there is not much of that, unless you are Ralph Norris getting 16 mil. This is a classic response from the market as we enter deeper into a depression, due to all the money being created in the States, its not sustainable beware the end ,its going to be ugly. This bubble has to bust, its taking a long time but its still gotta burst.

The very latest:

KEY sells out! Warner Bros now add the NZ government and TAXPAYER to their list of lackies!

What do you reckon are the chances of getting full details of the measurable benefits to New Zealand from the 'strategic partnership' the Government has entered into with Warner Bros? Or will the press conference just held be the last we ever hear of it?

What do you reckon are the chances of getting full details of the measurable benefits to New Zealand from the 'strategic partnership' the Government has entered into with Warner Bros? Or will the press conference just held be the last we ever hear of it?

I'm guessing the benefits will be greater than the deal that Actors Equity were going for.

House prices in western economies are set by the banks. As long as they can obtain cheap credit they can keep the game going. I wonder if I could get a mortgage in US $.

Hey Bernard ... A good news story. New Zealand was found by Transparency International to be the most honest ( Least corrput ) nation IN THE WORLD , along with Denmark and City- State Singapore.

Our Public Sector is the world leader integrity .

John Key should be congratualing public sector employees

It is a good reason to be proud.

All we now need to do is get our business leaders to show the same integrity

Boatman

TI publishes a load of rubbish.

As there is not an 'independent' Commission against corruption in NZ, the corruption that is taking place does not get investigated and therefore is not reported to TI

I beg to differ . I grew up in Zimbabwe , a country in which corruption is rampant and which probably came about 75th in the same report by TI .

Corruption is a bit like the poor , wherever you go the poor will be there . But its all relative

Let me tell you it is an absolute pleasure to be stopped in NZ by a policeman who is not armed with a 9mm pistol or an AK47 and who is not drunk or stoned and does not invent an offence on the spot , and demand one of your posessions in your car, anything from asking you how much cash you have on you , to asking for cigarettes , your cellphone , a pen or an item of food or clothing that catches his eye .

Its great living in a place where the local authority actually collects your rubbish , where the street lights work , the roads are maintained . You can use libraries where the books have not all been stolen , go to a hospital ( that has water and electricity... forget medicine) and receive competent attention.

In NZ , your kids go to government run schools which have electricity , running water, the building still has a roof , windows and doors and even teachers, who actually come to work .

It beats living In a country where journalists are arrested and beaten , where Bernard Hickey would be jailed for printing his opinions simply because he expresses his views or challenges the staus quo .

If you live in a country where you can buy your drivers licence without passing a test , the road death toll is horrifc .

Need to get into Uni ? Its okay you can buy your ZCE school leavers certificate .Hell you might even get into Medical School. New Zealand wont recognise the medical degree unless you slip through the net like a Nigerian

Trying to get through Customs at the border? Remember to slip some US$ Notes into your passport and look away when he opens it on the photo page where he will see a loose picture of George Washington with a green background . This is necessary to speed up the process , and prevent 'delays'.

New Zealanders may complain a lot , but do not begin to understand what corruption is all about or what damage it does to a country , its reputation or its prospects .

But good on you for getting it right !!

It really is something to be proud of a nation

Total housing "assets".

Now that's the thing. How was this calculated. If it's the sum of the $ value of the labour and materials and land improvements that went into building the asset base then I would believe it.

If it's the average "price of a house sold" applied to both the existing stock and the new houses sold times the total number of houses then that's part of the bubble mentality that both central banks have presided over. If the mandarins in the central bank had been smarter than the people buying the houses they would have said woa, hold up, that's inflation right there. Sorry mister banker, the most you can lend on that is the original cost of building plus receipts for improvements, otherwise it's inflation in the real sense of the word.

Inflation that they are supposed to stop happening but bake into the system with a mandated, monoply imposed, cost of money, the OCR.

Surely of there are mamy persons trying to buy numbers of rental property it must at some point create a dearth of houses for the population at large.

WikiLeaks’ release of nearly 400,000 US military documents from operations in Iraq brings to light new evidence that private security contractors killed civilians with impunity.

The armed contractors,, now number 40,000 in Afghanistan and Iraq. These numbers are set to increase substantially;, as it reduces the number of soldiers under US uniform in the Obama administration’s “draw-down.”

The mercenaries, are accountable to no one. Soon after the US invasion of Iraq, Paul Bremer issued “Order No. 17,” giving security firm employees total immunity from Iraqi laws. Nor has any US court punished the contractors, even for known instances of murder. They are also not under the jurisdiction of the US military, freeing them from the court martial and even the often-flouted rules of engagement laid out in the US Army Field Manual.

re 8 & 9

Somewhere I recently read that the large and small Aussie iron ore producers plan to spend $10's of billion doubling production. Who will buy double the production and how the hell will price stay up?

Here's what Rio Tinto is planning and BHP and the others like Fortescue are also planning expansions in production.

http://www.upi.com/Science_News/Resource-Wars/2010/10/21/Australia-mini…

"Rio Tinto chief executive for iron ore and Australia, said the company's plan is to boost capacity by more than 50 percent to 333 million tons a year, with the potential to grow further."

So the cost/benefit of the hobbit - 65 Million USD was the starting position for the 15%, 7.5miliion USD x2 rebate per movies, pay $10 million USD of market cost for strategic partnership plus commercial sensative concessions unable to disclose...thats at least $100 million NZD for starters....interesting.

Benefits slightly harder to quantify....

I just hate the way a deficit running Government can simply announce further deficit spending without any thought for curbing some other expenditure to compensate.

Instead we get told about "enormous benefits" on the revenue side - in this case tourism revenue.

Yeah right... by the time these movies are released - can you imagine the cost of an airfare to little 'ol down-under?

Hope the agreement is in USD. If it is, it might not cost NZ much at all!

Forgot this was sent to me earlier today...

In reality, the cost of The Hobbit production will be broken down between (a) pre-production (b) a location shoot, divided between exteriors and interiors and (c) post production. (New Zealand stands at risk of losing (b) the location shoot segment, just as we ‘lost’ part of the location shoot for The Lovely Bones to Pennsylvania)

The higher subsidies elsewhere are relevant only with respect to the location shoot. I have no idea of the actual breakdown of these three primary elements. Let’s suppose though, there’s something like a 20% pre production, 40% location shoot and a 40% post production split, which sounds reasonable. The difference between what New Zealand can currently offer and what the Irish could offer is still “up to” $US26 million.

$25 million announced tonight is very close the above figure!!

I reckon that Warners may be smiling all the way home.

ps above post should have been 65 million USD...

Perhaps The Middle class shoulded be renamed The Muddled Class?

They are going out of existance and they don't know it. Their natural instinct seems to be to support corporations and the people that actually are rich. They still believe the 'talking heads' wearing suits, especially economists. They watch the news.

Meanwhile they wait, wait for parents to die so they can cash in on the property. Wait for the children to leave home and then leave the country. Wait to get rich again.

Re The Hobbit. I wonder how many other countries Warners will do a deal with saying that they are making the picture in that country and claiming tax and other benifits. Probably at least one more I would think. Although US* movie companies are not known for being wallflowers when it comes to getting what they want.

Re Ralph. The 16 million is brilliant. Well done. To think that he could sit there and take the money after being bailed out by the Governments of New Zealand and Australia is just brilliant.

If you don't believe or understand how he was bailed out, see The Muddled Class above for clarification.

* OK so they are not really US companies at all probably Cayman Islands but you get the idea.

Hugh P - if I hadn't hithertofore come to the conclusion that you were somewhat cranially-constrained, I'd have gotten there reading that statement.

We have a Parliamentary report on Peak Oil now. Key has it. You can read it. It is admittedly optimistic, in that it uses the IEA 'data' as it's basis, and it fails to factor in the demands of exponential growth, but we have it.

In light of the time-frame indicated, in light of the infrastructure readjustments needed, and in light of our unpreparedness (largely thanks to folk like Key and yourself - deniers of the limits to growth) there is no time to lose.

Stuffing around with opportunistically screwing a few workers, saving a few UB numbers, and throwing taxpayer money at a conscienceless multinational, are absolutely irrelevant.

Total waste of time and resources.

In a word: Stupid.

Iain,

in terms of number of words in your sentences, less can be more.

That first paragraph of yours has One Hundred And Eleven words.

Very few people can be bothered reading sentences that long.

If you are determined to communicate better then please google

+"sentence length" +understanding

for some links and guidelines on sentence length

The second to last sentence has 77 words , give or take ! I have told Iain many times , to use a simpler wording structure , to get his message across . But to no avail .

Here's the rub , if you can't get the message across in an easy to follow manner , why should anyone bother to read it .

I do not trust anything that is wrapped up in a cloak of verbage , or complexity . And that is an easy way to spot shysters , such as finance companies , and internet scammers .

Gibber, I think Iain’s comments/ explanations are very valuable. I don’t care about long sentences as long as they are full of good, informative reading -should we not concentrate more on that ?

It is more a matter of people reading more profoundly or skim through the articles. I cannot understand why he’s constantly the target of some bloggers.

Kunst,

First of all I get a lot out of Iain's comments.

When he writes in "Stream of consciousness" style I get much less.

The question I have for you is how many other readers here do you think take the time to fully parse Iain's longer sentences?

Does that hurt or hinder Iain's cause?

For me, once its hitting the 100+ word mark I'm thinking that if Iain cannot take the time to edit his sentences, why should I take the time to struggle through a 100+ word sentence and try to understand what he is saying? How much time would it have taken Iain to rework that sentence into 2 or 3 intelligible sentences? How much time did I have to spend to try to work out what Iain was trying to communicate?

There is possibly an unconscious perception amongst many of the readers of an unacceptable transfer of effort. That is, if Iain cannot be bothered editing his sentences into understandable chunks, then I cannot be bothered to try to parse and understand those sentences.

I want Iain to better communicate his message.

Writing in 100+ sentences means I believe he is reaching very few of the readers. Very counter productive.

Have you Googled on

+"sentence length" +understanding

And read a few of the articles?

I want Iain to better communicate his message.

Fair enough Gibber !

He is one of the best contributors of sharp, controversial, but competent articles, but always targeted by some cheap responses. So, I wouldn’t be surprised him one day having enough and leaving the blog.

Re #1

Yet another regurgitation of the same old graphs and charts - proving nothing at all.

This statement is a cracker though: a country's housing market is clearly in bubble territory (severely over-valued) when its housing stock is valued at more than three times GDP.

Typical of the doomsday mantra. Why is three times GDP "clearly" bubble territory? No explanation, just suppostion. Of course clearly "clearly" is sufficient explanation!

The graph starts at 1.9 and ends at just over 3 for NZ while Australia's ratio almost triples.

The graph showing rents is "clearly" also dubious with a drop of about 10% after the chart start then a slow increase to just 20% above 2000 levels. Bernard's data alone shows median rents were up 15% in the past 4 years (house prices only rose 10% in the same time by the way).

Then there's the chart showing interest payments as a proportion of income - of course this starts in 1991, once interest rates had dropped and before prices adjusted. Start this chart in 1981 and it'll look a very different story.

All in all a weak and uninformed viewpoint from Bernard's Australian friend.

What the doomsdayers don't understand is that the market will (and to some extent has) adjusted in real terms - this does not mean nominal losses are on the horizon. Some properties will of course suffer significant nominal losses, however overall property will continue to perform very well for its owners.

I like to give the example of a small central dunedin property which sold in 1882 at a jaw-dropping land value of 14,000pounds (in nominal terms $86 per sq metre). This had to be one of the most expensive properties ever sold in NZ at that time (located opposite the Stock Exchange). By the 1980s the location was considered poorly and undesirable and the land value in the area was only around the same as it was 100 years earlier in nominal terms! That is despite real prices rising more than 10 fold during that time.

So despite the property's real value dropping 90% (mainly due to the original price being paid before the 1890s banking collapses and the end of the gold rush and then subsequently local and national businesses abandoning the location and to some extent the city), however despite all of this it still maintained it's nominal value and since the early 1980s has actually increased in value in real terms so that it's value is only now about 70% below the 1882 price in real terms! Which is about a 12 fold increase in nominal terms.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.