Here's my Top 10 links from around the Internet at 10 to 2 pm in association with NZ Mint.

Plenty of videos and cartoons today.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz .

1. Extraordinary story - This story overnight about SEC charges of insider trading against Rajat Gupta are amazing.

He was on the board of Goldman Sachs and is alleged to have leaked details from board meetings to hedge fundie Raj Rajaratnam minutes after such board meetings.

He is a very heavy hitter and this will reverberate around the biggest board rooms in the world.

If proved, it shows the rot reached to the very highest levels.

Gupta was on the board of Goldman and Proctor and Gamble. He was also the head of McKinsey from 1994 to 2000.

Stunning and a real blow for him at the very least.

It seems for example he leaked the news about Warren Buffett buying into Goldman Sachs so Rajaratnam could get in first, Bloomberg reported.

Simply breathtaking.

Gupta's lawyers says the allegations are baseless.

Here's the WSJ with the story.

Mr. Gupta, a friend and business associate of Mr. Rajaratnam, allegedly spoke with Mr. Rajaratnam by phone after a special telephone conference call by Goldman's board and tipped him to the Berkshire investment and Goldman's upcoming public-equity offering before it was announced in September 2008, according to the SEC.

The Berkshire investment came at the height of the financial crisis, within days of Lehman Brothers Holdings Inc. seeking bankruptcy protection. Within a minute after the call, Mr. Rajaratnam allegedly arranged for Galleon funds to purchase more than 175,000 Goldman shares, the SEC said.

Mr. Rajaratnam had begun purchasing shares earlier in the day, following another call with Mr. Gupta, the SEC said. Mr. Rajaratnam caused the Galleon funds to liquidate their Goldman holdings the day after the information became public, making $900,000 in illicit profits, the SEC said.

2. Is it the same here? - The Guardian's Richard Woolf puts all the stats together on the transfer of wealth to the richest in America.

How different is it here now our top tax rate has been cut too.

It's not sustainable.

Maybe that's why the gift duty is being removed in New Zealand.

It allows the rich to move assets to family trusts tax-free before the shutters come down and the new higher taxes come back.

I hear accountants and tax lawyers are gearing up for major gifting action once the law change kicks in from October.

It seems an excellent way to pay dividends tax free...

Over the last half century, the richest Americans have shifted the burden of the federal individual income tax off themselves and onto everybody else.

The first graph compares the official tax rates paid by the top and bottom income earners. Note especially that from the end of the second world war into the early 1960s, the highest income earners paid a tax rate over 90% for many years.

Today, the top earners pay a rate of only 35%. Note also how the gap between the rates paid by the richest and the poorest has narrowed. If we take into account the many loopholes the rich can and do use far more than the poor, the gap narrows even more.

One conclusion is clear and obvious: the richest Americans have dramatically lowered their income tax burden since 1945, both absolutely and relative to the tax burdens of the middle income groups and the poor.

Consider two further points based on this graph: first, if the highest income earners today were required to pay the same rate that they paid for many years after 1945, the federal government would need far lower deficits to support the private economy through its current crisis; and second, those tax-the-rich years after 1945 experienced far lower unemployment and far faster economic growth than we have had for years.

The lower taxes the rich got for themselves are one reason why they have become so much richer over the last half century. Just as their tax rates started to come down from their 1960s heights, so their shares of the total national income began their rise. As the two other Wikipedia graphs below show, we have now returned to the extreme inequality of income that characterised the US a century ago.

3. Shoe-Throwers index - The Economist has come up with a 'Shoe-throwers' index which tries to compile various bits of data on population ages, censorship, corruption and age of government to predict which will be the next domino to fall.

Interestingly, Iran doesn't even appear on this.

4. Index of potential unrest - Meanwhile Richard Florida over at The Atlantic has come up with his own index of potential unrest that looks at various data on GDP per capita, life satisfaction and labour market conditions.

It finds Russia, Mongolia and India are vulnerable.

Strangely, New Zealand is seen as vulnerable to potential unrest as America and more likely to see unrest than Australia and Canada.

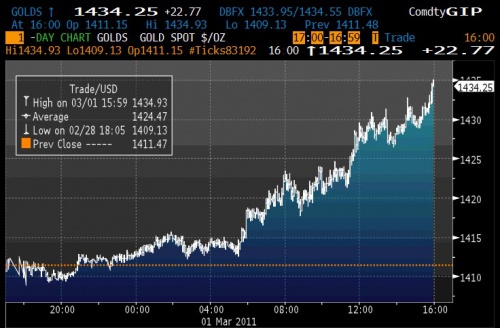

5. 'Bernanke's pedal to the metal' - Peter Schiff comments in this video below on Ben Bernanke's determination to blow up the world with printed money.

The metal being gold of course. Funny how it hit a record high after Bernanke's comments about continued money printing overnight.

Schiff talks a lot of sense. HT Justice.

6. Amazing life insurers - This Bloomberg article on how a US life insurer insisted a man killed himself in a car accident is startling. Insurers are not always the friendliest bunch. Does this happen in New Zealand? Or are we different.

As of 2009, the latest year for which figures are available, insurers in the U.S. were disputing an accumulated total of $1.3 billion in claims, the ACLI reports. Included in that amount was $396 million in death benefits turned down in 2009.

In the same year, insurers paid out $59 billion, the ACLI reports. What those numbers don’t measure is the trauma survivors like Jane Pierce face when wrongfully denied, says Aaron Doyle, a professor of sociology and criminology at Carleton University in Ottawa.

Most survivors don’t have the stamina and knowledge to file a lawsuit, says Doyle, who has spent a decade interviewing life insurance customers, employees and regulators in the U.S. and Canada. Often, survivors are dissuaded by their insurers from taking their grievances to state regulators or to court, Doyle says.

8. A double edged sword - Jeff Rubin at Financial Sense talks in depth about the problem for the Middle East of rising oil prices -- higher food prices. One for Powerdownkiwi.

The problem facing Arab countries today is higher oil prices feed directly into higher food prices. While oil may be massively subsidized in the Middle East, it’s not in major grain exporting countries such as Canada, Russia and Australia that Arab nations increasingly count on for their food supply. From the diesel fuel that runs tractors and combines to the power needed to pump water through irrigation systems, modern agriculture is one of the most energy intensive industries.

And the Middle East is the largest food importing region of the world. As the price of oil goes up, so does the price of food imports. Egypt’s problems feeding runaway population growth is not unique to the region... They are in evidence throughout the Middle East given the masses now out in the streets in Libya, Algeria, Yemen, Jordan and Bahrain demanding regime change.

Could Saudi Arabia be next? Population growth in the Middle East is rapidly outstripping the carrying capacity of the land. Democratic reform may be what is on the protestors’ lips but demographic reform is at the heart of the region’s problems.

9. Chimerican murder-suicide - This has a nice ring to it. A Zambian economist and former Goldman Sachs analyst, Dambisa Moyo, has written a book called "How the West was lost" where she argues that one option is for America to default, which would take China and the 'Chimerica' complex down with it...

Financially MAD (Mutually Assured Destruction).

The U.S. could, she says, opt for “nuclear options,” protectionist measures including a debt default. “Default sounds like a cataclysmic option” yet shouldn’t be casually dismissed, she says. “The attraction would be for America to wipe its slate clean and for the government to reset its financial statement.” A U.S. default would amount to a “murder-suicide in Chimerica,” a lethal blow to Sino-American co-dependency that would damage Chinese interests.

China not only counts on Yankees to buy its goods; it also has up to 82 percent of its foreign reserves in dollars according to calculations by Standard Chartered Plc. If the Chinese have tilted the playing field, the argument goes, why shouldn’t the U.S. resort to brinkmanship? Economics is, as Moyo says, a form of warfare, “one country seeking dominance over another.”

And here's a video where she explains the option of America moving to protect and default.

Pleasant to watch too.

10. Totally interesting video of how liquefaction works - A Cantabrian uses a great technique to explain this phenomenon.

11. Totally irrelevant video - What the Shuttle launch looks like from an airplane.

46 Comments

@item 6

The insurance industry has been gaming the system so long now that the entire industry is broken. There is an entire Sub industry within the insurance industry staffed with independent “contractors” that work from home and that do nothing but pour over every facet of someone’s life to find any detail that will allow an insurer to legally deny a claim. This is really at the heart of the health care crisis in the US. There is no health care crisis in the US since there is plenty of quality health care. The issue is that there is an Insurance crisis. The health insurance industry has been so successful at denying claims for profit that it has crept into every facet of every type of insurance. One tactic often deployed is to deny a claim at least 7 times prior to approving it. You would be surprised how well this works. Why pay a claim if you can get you customers to do it for you by being obtrusive and obstructive.

Indeed, I saw a comment that the argument really about "healthcare for all" is that it supports the insurance indusrty which is was going to flounder by making paying in compulsory. Otherwise Americans in good health actually could save the premiums and pay as needed and be no worse off...

Certainly the US insurance industry is a nightmare...just hope it doesnt get like that here...

regards

What I found ironic is that the Republican’s did a very good job convincing Americans that Obama was going to implement “death panels”. I keep telling people that “Death Panels” already exist and its some guy named “Joe” sitting comfortably in is apartment making $80/hr acting as an independent contractor for your healthcare provider pouring though you entire healthcare history denying your claim for chemotherapy because you have a “pre-existing” condition or because you lied about that time you smoked a cigarette.

#9 "Pleasant to watch too." hmmm, yes much like Amanda is ;-)

Erwin Stealtzer sure tries his best to down play the reality for the US doesn't he. I'm surprised he didn't cover his ears and go "nah nah nah" everytime she mentioned China

"Federal Reserve Chairman Ben Bernanke said the surge in oil and other commodity prices probably won't cause a permanent increase in broader inflation and repeated that borrowing costs are likely to stay low.".......liar

re 3 not very interesting that Iran doesn't even appear because it is not an Arab League country, not being Arab

Bernard

Re. # 2, I am a bit confused on where you stand on income taxes. I remember you used to argue that was unsustainable to impose high marginal income taxes on our ever diminishing population of skilled young PAYE earners who work hard, to fund an ever increasing number of beneficiaries.

Now you seem to be arguing that the tax cuts for these skilled people is wrong and these skilled people are bludgers.

The reduction in the top tax rate for income earned was a good thing and in fact it should be lower to reward and attract those young people with the necessary skills for the future. A much better way to tax the wealthy is to introduce a land tax. Increasing PAYE will only drive more skilled people offshore, taking their entire tax base and future skills with them.

Land is not mobile and hence you will not lose the tax base. It is also progressive in that the wealthly tend to own more land, such as batches or rental properties. It addresses the inequality between baby boomers and younger generations as the BB's own more land and have benefited the most from increases in property prices. Finally it captures foriegn land owners and the Maori Authorities who own large tracks of land but pay very little taxes.

Equality is the key Bernard. Increasing taxes on the 12% of taxparers earning over $70k who already pay 49% of the tax revenue and consume very little of the public services is not equitable or sustainable.

Having said that, I do think that given the public misconception that skilled PAYE workers are bludgers, is strong and I do believe that tax rates on those over $70k in NZ will go up significantly over the NZ few years.

I think you have the wrong idea...

The transfer to the rich is not about taxing the "ever diminishing population of skilled young PAYE earners" but in fact that the transfer is to the super-rich, most of which I suspect are 40+....and not PAYE as such... AWAY from everyone else and that includes the "ever diminishing population of skilled young PAYE earners".

PAYE v Land tax.....I agree there needs to be a re-dress, however those same 40+s are the ones who are land/property rich and carry significant political clout and are the same generation as the Pollies...so its not likely. The top tax rate has dropped while a regressive tax like GST has gone up, probably hitting the "skilled young PAYE workers" the most, thanks National for that one......

Equality has a few different meanings to whom you ask...

"public misconception that skilled PAYE workers are bludgers" I think you are wrong on this....Ive never heard such a thing except from the really loony, loony left....

Tax will go up for the $70k+ because in effect they are sandwitched between Labour and its supporters and National's so are consider faor targets for both IMHO....What we will see is tax for $70k earners will go up, but once up to say $150k then it becomes worthwhile to dodge taxes via an accountant.....taxes for these will not really go up.....it will get deflected.

regards

Yes, I suspect the recent move to abolish gift duty has more to do with allowing unlimited transfer of land/property assets into trusts before the introduction of some form of capital tax (as opposed to income tax changes) assuming the National government gets a second term, that is.

I suspect, at the time of introduction of such a capital tax after the November 2011 election, they may exempt those assets already in trust as at October 2011 - and that the treatment of trusts established after 1 October 2011 could well be different (for tax purposes).

The problem with the insurance industry is that there is asymmetrical information. It is the old economic adage of the used car lemon problem. The used car salesman knows what’s wrong with the car but the customer doesn’t, so how do you level the playing field? The healthcare insurance industry knows everything about your healthcare history and they use that against you. So the only way to have proper healthcare insurance is to never use your healthcare insurance. There is the same problem with auto insurance…the whole industry is a mess and they need to level the playing filed. If you allow the insurance industry to pick and choose their customer base then you break the system. That is what is currently wrong with the US system it is a market for lemons.

Sigh...

John Key tells Bloomberg he expects the RBNZ to cut the OCR next week.

So much for an independent central bank that isn't pressured by the PM

“The market has priced in a cut from the Reserve Bank,” Key said in an interview today in Wellington. “That would probably be my expectation, that the Reserve Bank would cut.”

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=auYBlzniCLns

cheers

And the currency dropped more than half a cent on the news...

Ever since he became the PM, he has pre-empted moves by the RBNZ with announcements in the media .... it's the trader in him.... he can't help making these sorts of predictions (and then "finding he's right!).

Totally out-of-line but then did we (or anyone) ever really believe in (or for that matter have) an independent Reserve Bank?

And....".. media reported PM John Key ... could not rule out a recession." Really!

If Alan Bollard considered his position and that of the RBNZ to be "independent" then he would have handed in the keys of his car and resigned some time ago.

hell no!

With $15b having to be transfered in to NZD to cover the Chch insurance claims and a NZ running a trade surplus, if the RBNZ doesnt lower the OCR, the exchange rate will spike up. Where are all the posters who were moaning about the high NZ dollar a few weeks ago?

Neville: Have you realized how much you will have to pay for oil ? or for that matter any other imported good that NZ needs ?. The recovery task is oil intensive.

$15 bn is chump change compared to the turnover of the NZ$ in the FX markets. I would have thought that its efect will be negligible

This $15b is real money that needs to take delivery of NZDs. The turnover you are referring to is mainly positional trades that balances buyers and sellers.

Bernard: Thank's for the heads up. I am not surprised that Key made his trading move. It is disturbing to think of all those suffering and going through hell while others are only concerned on how to proffit from the disgrace. I am not implying that J Key traded his Bloomberg words....noooooooooooo.

BH where do you see rates by the end of the year?

Rates dropping will have some effect on affordability, when is your next affordability report?

28/29 year old

Hard to say where rates will be. RBNZ was forecasting a rise by the end of the year.

Then the earthquake hit. Markets now saying about 50 bps cut within next six months.

We'll get a lot more detail next Thursday when the RBNZ's MPS is released.

The next Roost Home Loan Affordability report will come out about week after the REINZ figures on house sales and prices. Probably around the third week of March.

If prices fall as well then affordability should improve.

Here's last month's version, showing improvement to February 2004 levels.

http://www.interest.co.nz/property/home-loan-affordability-january-best…

cheers

Bernard

How much will that Affordability Report mean? I'd guess houses are a lot more 'affordable' in Christchurch this month. But would you want to buy one? The same applies across the country, to a greater or lesser degree, as "The Christchurch Effect" will spread to all. It has to. We have billions less to spend on anything, houses included, than we did 6 months ago.

China is gettin very nervous about social unrest.

China has warned Hong Kong's media against reporting on pro-democracy movements on the mainland, saying they will deteriorate the relationship between Beijing and this special administrative region, a local broadcaster said Wednesday.

"Hong Kong media are free to cover the mainland as long as they are in compliance with the country's 'basic law,' but if their attitudes are inclined to overthrow the regime, no country will accept that," Hao Tiechuan, director general of publicity at the Liaison Office of the Chinese government in Hong Kong, said in an interview with Radio Television Hong Kong (RTHK).

http://english.yonhapnews.co.kr/news/2011/03/02/0200000000AEN20110302004600320.HTML

I have just finished a book on Mao Bernard. Bloody scary what he did to a nation, and to a large degree the governance systems he set up are still in place. It isn't communism at all but a dictatorship in disguise.

We are talking about a guy that starved or had murdered 70m people just so he could maintain power and dominate the world through building a huge military.

The people there have been oppressed for a long time and continue to be. History shows there is usually a backlash.

People think that that are going to overtake America but I can't see them holding out much longer without imploding.

Bought the book for $1at a local book sale where the local library had withdrawn it.Hmmm.

Jung Chang Jon Halliday 'Mao the unknown story' perchance?

Just happens to be alongside the computer....

Yep thats it, fascinating but terrifying.

Might take you longer than a day though:-P

Hard to say if he had a mental disorder or was just an evil bastard. His efforts at poetry would possibly indicate a sound mind.

Seems like lame reporters are not a new thing either.

I will attempt to follow up by finding some material about post Mao China. Might be hard to find later sources though as this book was only published in 2005. Stratfor.com published an article on China last year that indicated fragile governance. Apparently 8% growth is required just to pay all the bribes, if it falls below this there will be trouble. Their policy with the printing press might be a little more urgent than Americas.

And perhaps relevant is this link:)

This was just sent to me by a Christchurch colleague (taken from WINZ website):

Business Recovery Centre

A Business Recovery Centre has been established to provide support for businesses affected by the Canterbury Earthquake.

Due to the latest earthquake this service is temporarily closed.http://www.workandincome.govt.nz/business/a-z-services/business-recovery-centre.html

Keep smiling!

#9, Chimerica Murder-Suicide. Isn't that wot Bernancke and Obama are already doing? That is, printing $$$$$ until the presses smoke, which will stoke inflation, which will result in an effective default?

Everyone has been criticising QE2, but I have been wondering whether it isn't just a cunning riposte to what China is doing to the US. A signal that this may be the case is the grumbles from Chinese officials at the printing.

Cheers

Further to #8 - Mish Shedlock has someting important to say. It's not only peak oil that will be a problem, it's also peak population. http://globaleconomicanalysis.blogspot.com/2011/03/oil-prices-are-double-edged-sword-peak.html

Andy R - Mish is right - here's a wee Op/ed I did a couple of years back:

http://www.odt.co.nz/opinion/opinion/72347/biggest-crisis-facing-planet…

It must have stuck in the craw, but give them their due, they printed it!

Economic Optimism? Yes, I’ll Take That Bet

By JOHN TIERNEY

Five years ago, Matthew R. Simmons and I bet $5,000. It was a wager about the future of energy supplies — a Malthusian pessimist versus a Cornucopian optimist — and now the day of reckoning is nigh: Jan. 1, 2011.

The bet was occasioned by a cover article in August 2005 in The New York Times Magazine titled “The Breaking Point.” It featured predictions of soaring oil prices from Mr. Simmons, who was a member of the Council on Foreign Relations, the head of a Houston investment bank specializing in the energy industry, and the author of “Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy.”

I called Mr. Simmons to discuss a bet. To his credit — and unlike some other Malthusians — he was eager to back his predictions with cash. He expected the price of oil, then about $65 a barrel, to more than triple in the next five years, even after adjusting for inflation. He offered to bet $5,000 that the average price of oil over the course of 2010 would be at least $200 a barrel in 2005 dollars.

I took him up on it, not because I knew much about Saudi oil production or the other “peak oil” arguments that global production was headed downward. I was just following a rule learned from a mentor and a friend, the economist Julian L. Simon.

As the leader of the Cornucopians, the optimists who believed there would always be abundant supplies of energy and other resources, Julian figured that betting was the best way to make his argument. Optimism, he found, didn’t make for cover stories and front-page headlines.

No matter how many cheery long-term statistics he produced, he couldn’t get as much attention as the gloomy Malthusians like Paul Ehrlich, the best-selling ecologist. Their forecasts of energy crises and resource shortages seemed not only newsier but also more intuitively correct. In a finite world with a growing population, wasn’t it logical to expect resources to become scarcer and more expensive?

As an alternative to arguing, Julian offered to bet that the price of any natural resource chosen by a Malthusian wouldn’t rise in the future. Dr. Ehrlich accepted and formed a consortium with two colleagues at Berkeley, John P. Holdren and John Harte, who were supposed to be experts in natural resources. In 1980, they picked five metals and bet that the prices would rise during the next 10 years.

By 1990, the prices were lower, and the Malthusians paid up, although they didn’t seem to suffer any professional consequences. Dr. Ehrlich and Dr. Holdren both won MacArthur “genius awards” (Julian never did). Dr. Holdren went on to lead the American Association for the Advancement of Science, and today he serves as President Obama’s science adviser.

Julian, who died in 1998, never managed to persuade Dr. Ehrlich or Dr. Holdren or other prominent doomsayers to take his bets again.

When I found a new bettor in 2005, the first person I told was Julian’s widow, Rita Simon, a public affairs professor at American University. She was so happy to see Julian’s tradition continue that she wanted to share the bet with me, so we each ended up each putting $2,500 against Mr. Simmons’s $5,000.

Just as Mr. Simmons predicted, oil prices did soar well beyond $65. With the global economy booming in the summer of 2008, the price of a barrel of oil reached $145. American foreign-policy experts called for policies to secure access to this increasingly scarce resource; environmentalists advocated crash programs to reduce dependence on fossil fuels; companies producing power from wind and other alternative energies rushed to expand capacity.

When the global recession hit in the fall of 2008, the price plummeted below $50, but at the end of that year Mr. Simmons was quoted in The Baltimore Sun sounding confident. When Jay Hancock, a Sun financial columnist, asked if he was having any second thoughts about the wager, Mr. Simmons replied: “God, no. We bet on the average price in 2010. That’s an eternity from now.”

The past year the price has rebounded, but the average for 2010 has been just under $80, which is the equivalent of about $71 in 2005 dollars — a little higher than the $65 at the time of our bet, but far below the $200 threshold set by Mr. Simmons.

What lesson do we draw from this? I’d hoped to let Mr. Simmons give his view, but I’m very sorry to report that he died in August, at the age of 67. The colleagues handling his affairs reviewed the numbers last week and declared that Mr. Simmons’s $5,000 should be awarded to me and to Rita Simon on Jan. 1, but Mr. Simmons still had his defenders.

One of his friends and fellow peak-oil theorists, Steve Andrews, said that while Mr. Simmons had made “a bet too far,” he was still correct in foreseeing more expensive oil. “The era of cheap oil has ended,” Mr. Andrews said, and predicted problems ahead as production levels off.

It’s true that the real price of oil is slightly higher now than it was in 2005, and it’s always possible that oil prices will spike again in the future. But the overall energy situation today looks a lot like a Cornucopian feast, as my colleagues Matt Wald and Cliff Krauss have recently reported. Giant new oil fields have been discovered off the coasts of Africa and Brazil. The new oil sands projects in Canada now supply more oil to the United States than Saudi Arabia does. Oil production in the United States increased last year, and the Department of Energy projects further increases over the next two decades.

The really good news is the discovery of vast quantities of natural gas. It’s now selling for less than half of what it was five years ago. There’s so much available that the Energy Department is predicting low prices for gas and electricity for the next quarter-century. Lobbyists for wind farms, once again, have been telling Washington that the “sustainable energy” industry can’t sustain itself without further subsidies.

As gas replaces dirtier fossil fuels, the rise in greenhouse gas emissions will be tempered, according to the Department of Energy. It projects that no new coal power plants will be built, and that the level of carbon dioxide emissions in the United States will remain below the rate of 2005 for the next 15 years even if no new restrictions are imposed.

Maybe something unexpected will change these happy trends, but for now I’d say that Julian Simon’s advice remains as good as ever. You can always make news with doomsday predictions, but you can usually make money betting against them.

JB - bollocks, complete bollocks. Simon was a f...........wit of the first order.

I can predict that one day, you will be dead. I can predict it with 100% certainty.

If you want to take bets on it not happening on any particular day, fine. Doesn't mean it won't happen, though.

And anyone who looks to the past (I've been alive this past.......years) then predicts the future on that basis, will be wrong at some stage.

Same with the depletion of finite resources. Sorry, we've had that debate. The timng is irrelevant. The issue is inevitable.

Peak oil will solve peak population....

regards

sure, peak oil, peak pop....blah, blah ,blah...we peaked oil prod in '06? peak pop 2050? that gives us 40 yrs b4 malthus poops the party...smoke 'em if you got 'em...btw murray, pop trebled in 50yrs, not 300

as originally writ, it had population trebling in 300 years until my lifetime, doubling in my lifetime. It has'nt trebled in 50 years, essentially 3b 1960 to 6.7b when written.

But I suspect you aren't really into a serious conversation - your comments remind me of a paddling pool.

my comments can be flippant, apologies. 1950...2b, 2000...6b? approx

This is a very disappointing top 10 (with the exception of Peter Schiff).

Insider trading is one of those made-up "crimes" where there is no victim involved, similar to the supposed "crime" of buying and selling recreational drugs. Contrary to the nonsense people like Bernard Hickey spout, insider trading is actually beneficial to the average investor because it allows for more accurate price signals and less market manipulation. The actions of the men in the Goldman Sachs story are neither extraordinary nor amazing nor rotten. And they're certainly not criminal.

Bernard's constant bleating about the rich getting richer and the poor getting poorer is also tiresome and hugely misleading. As economist Steven Horwitz has explained, an American study that tracked individual poor families over time found that within ten years the vast majority of them had moved out of the bottom quintile and many had even made it into the top quintile for income. In fact, the study found that incomes increased by more for those in the bottom quintile at the start of the study than those in the top quintile. So the rich got richer but the poor got richer even faster!

The rubbish piece about American tax rates ignored the fact that when the top tax rate went to 90% the amount of tax collected as a percentage of GDP stayed about the same, similar to how when Labour cut the top rate from 66% to 33% they found they were still bringing in the same amount of money. In other words, when you try to sock it to the rich they use clever people to help them avoid having large amounts of their income stolen by envy-ridden socialists.

Ok ... let me explain how insider trading is a crime. Suppose you own some shares. You think they are fairly priced, maybe a little expensive, so you decide to sell them. I happen to know some material and non-public information that will greatly increase the value of those shares, so I buy them from you at a price that DOES NOT reflect that information because no one else knows about it!

The next the day the information becomes public and I am able to sell those shares at a huge profit. I just stole your money. It's no different than if I took it out of your wallet.

It's not victimless and it does not aid in price discovery. The price discovery only occurs when the information is made public.

So inside traders are thieves and so they are criminals.

Kleefer,

The discussions between Buffett and Goldman Sachs would have confirmed that the company was not heading for the knackers yard - as many feared. This was then reported to the market by the proper process allowing the share price to recover somewhat.

The victims of this crime were the people who sold their shares for much less than they were worth on the basis of incomplete info.

Kleefer

Tax rates send a message to society. They say "regardless of what actually happens, this is what is fair, and we stand by it". We have seen far too much untested debate about the efficacy of capital gains tax, for example, when efficacy is not the issue.

The unfortunate part about this whole debate is that Kiwis will tolerate grinding drudgery and despair, as long as it's not in their back yard. But show them horrific pictures of physical devastation in someone else's backyard, and they get it: this is not their fault. Suddenly ideology and contempt and smugness go out the back door and we stand by our humanity.

I'm one of those socialists you talk about. But I'm not envy-ridden: My personal circumstances are adequate. I want my personal wealth to grow in the context of NZ society where my neighbour believes I have worked hard and sacrificed for it, so that I don't need to gate myself into a compound in order to hold onto my just rewards.

Studies that track individuals over time have an inbuilt bias. Whole swathes of American society have become untrackable. They are the poor and the destitute who lack the good fortune of circumstance. Pointing to these studies as some sort of proof that their society hasn't become rotten to the core is like pointing to the happy and successful lives of a very few porn starlets and sending your daughter off to pursue this promising opportunity.

I can only assume that your accomodation and circumstances have divorced you from the growing anger felt by many, many kiwis and which Bernard is giving voice to. Lets hope your kids and grandkids are as adept at burying theor heads in the sand... or can access a good locksmith.

By the way...the men in the Goldman story aren't men. That's just the polite name we give them.

Of course insider trading is a crime....the seller(s) has been dis-advantaged....if they had had the same info they would not of sold.....if nothing else the insider had a moral responsibility to keep privaledged information on his company quiet....so there are two victims at least...

Weird....I can but assume from your post you are totally amoral......but then since you like Peter schiff and Steven Horwitz so much, your outlook is explained, Liberatians pretty much are...

"Steven Horwitz is an American economist of the Austrian School"and as per Liberatarian outlook the present economic mess want caused by too little regulation not being enforced, oh no.....and lots of poor ppl becasme rich? lol.....kook comes to mind.

"In other words, when you try to sock it to the rich they use clever people to help them" Personally I am of the opinion that such "clever ppl" should go down with the tax avoidance penalty of their customers....say a 10% fine of the actual bill the customer has to meet from the IRD, that includes jail time....

regards

Emotive rubbish. Information is always asymmetrical in trades, not to mention that values are subjective and the future is uncertain. How is it a crime to be better informed than someone else? What is "inside" information and what isn't? Is a shop floor worker an "insider"?

Calling me amoral is insulting. I don't support theft and violence by the state and that makes me amoral? By the way, those "kooky" Austrian economists were predicting the financial crisis while mainstream economists laughed at them.

Good one Kleefer. Why should the few keep supporting an attitude of I am entitled to it, it's my right to have. Ok it isnt easy to make a dollar, for the all the reasons raised, by Bernard but simply squeezing the few that have isnt the answer. Justt as borrowing more isnt the answer. Youre only going to destroy the few left with anything. Until the government or us create a new attitude, with a democracy, we are heading down. AS to the nonsense regarding gift duty , unfounded nonsense. What capital gains are there in NZ to tax?? IRD know that it will be a waste of time

Bernard - if you are going to bang the drum for income inequality (particularly in the US) then this article is for you:

http://motherjones.com/politics/2011/02/income-inequality-in-america-ch…

Income inequality has been arround since men walked on two feet. And it will stay because it is a part of human society. Now a totaly different thing is Insider trading, the later are parasites of modern society, they are harmfull in every way and should be prosecuted as criminals... Forex trading is a widespread activity with billions changing hands by the hour on a level field that tests your skils in every decision that you take. all traders sit before the same markers and and a level playing ground. Insider trading should be ranked as theft.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.