Bernard Hickey details the key news overnight in 90 seconds at 9 am in association with Bank of New Zealand, including news Don Ha Real Estate Ltd has been put into receivership by its bank.

The firm is owned by prominent property investor, real estate agent and seminar promoter Don Ha. He is a Vietnamese immigrant reputed to have been worth NZ$60 million before the property bubble burst in 2008.

Don Ha said in a statement on his website that management controls at Don Ha Real Estate were weak and his bank didn't understand his position.

"Without going into too many details it came to my attention recently that some of the management controls and reporting systems employed by Don Ha Real Estate Ltd weren't what they should have been," Ha said.

"I am confident that the bank which put me into receivership doesn't have a true understanding of my position. I wish they had communicated with me more before taking their action because this could have been avoided," he said, adding there was no reason for anyone connected to the busines to be worried and it was "business as usual". He did not name his bank.

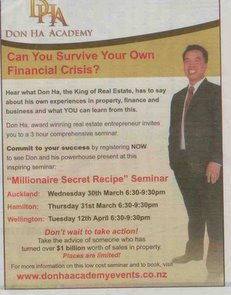

He showed this by advertising his latest seminar series titled "Can you survive your own financial crisis?' in the Sunday Star Times (see left). Details of the seminar series are here. They cost NZ$50 for two tickets and are due to be held in Auckland and Hamilton next week. Places are limited.

He showed this by advertising his latest seminar series titled "Can you survive your own financial crisis?' in the Sunday Star Times (see left). Details of the seminar series are here. They cost NZ$50 for two tickets and are due to be held in Auckland and Hamilton next week. Places are limited.

Meanwhile, a coalition of airforces from Britain, France and America launched airstrikes against Muammar Gadaffi's forces over the weekend, closing almost all of Libya's oil fields. See more here at Bloomberg.

Unrest in the Middle East and North Africa also spread to Syria, where protests against the ruling family grew.

In Japan, there are signs that the stricken nuclear reactors may be cooling and that the worst may be over, according to US observers. See more here at CNN and at Bloomberg.

Meanwhile, the G7 group of countries staged their first concerted currency market intervention late on Friday to drag the yen lower. The Yen had strengthened to as much as 76 yen to the US dollar on fears Japanese pension funds would repatriate funds to pay for earthquake damage. The intervention pushed it back down to 81 yen to the US dollar. See more here at Bloomberg.

Also in big breaking corporate news, AT&T has agreed to buy T-Mobile from Deutsche Telekom for US$39 billion in cash and shares. The deal combines the second and fourth biggest mobile networks in America and is an example of the sorts of deals being done now that are funded by cheap borrowing. See more at WSJ and here at Bloomberg.

Corporate America is also finding it easier to increase profit growth by either growing revenues in faster growing markets overseas or merging domestic operations to cut costs.

The New Zealand dollar was steady around 73 USc and 59 Japanese yen in early trade.

(Updated with video and Don Ha Seminar advertisment)

No chart with that title exists.

14 Comments

Another oil spill in the Gulf?

http://www.zerohedge.com/article/possible-new-oil-spill-100-10-miles-reported-gulf-mexico

Now don't go gettin upset people but I couldn't help but smile at this blog from ...zero hedge.. the blogger ...antidisastab..etc....the comment...

"Yes, well, the problem with being a doomster is that you actually have to hope for doom while pretending that you have everybody's best interests at heart."

eh ...uh....hey...now ya gotta say that has the smack of truth to it.

As a rule, if anyone says on their website/letters "Here's to your success", they don't really have your success in mind. This is how all of these property guys operate at the moment, including Olly. They figure, because everyone thinks they are very successful, why don't we show other people how to be successful and then charge for it. The fact is that they may have been successful but are now feeling the pain of the GFC, and now have to do seminars to generate cash. If they were truly successful, they wouldn't be showing other people how to do it, just a very select few.

Bernard : Which " property market bubble burst in 2008 " are you referring to ? .... Was Don Ha heavily invested in the US ...... 'cos there's been no property market " burst " here in NZ , nor over in Oz , not in 2008 ( no 30 % crash here , buddy ! ) , 2009 , 2010 , ...... 2011 ...... we're still waiting , oh great prognosticator ....

... meebee Ken Ring can help you locate that exact moment in space & time when the NZ property market will " burst " .

At precisely half past on the 12th GBH.............

The Society of Skeptics forgot to be skeptical of themselves, too.

Reminds one of the 'fire from heaven' sermon in Puckoon:

"I call on fire to come from heaven"

"I call on fire to come from heaven"

"I CALL ON FIRE TO COME FROM HEAVEN"

"Hang on Vicar" came a wail from the loft "The cat's pissed on the matches".

Spike would be proud of your timing.......made me laugh have not read it in many a year.....thanks PDK.

timing Christov?

It should have been written at '4.32 as the crow flies'

by rights.

GBH.....I guess it depends on a burst or a slow leak.....the bubble certianly isnt getting any bigger......

I really fail to understand why you cannot understand that there is a risk it may burst, but just how big or small or the timeframe that could unfold over is unkown....Japan has been deflating for years? decades? but the US clearly and pretty quickly burst.....

Some of the differences in the two situations might explain that big difference, for instance the US companies let lots of staff go in a short time frame making them unemployed so they defaulted pretty quickly...but limited knowledge on Japan suggest the Japanese companies stayed bloated....

NZ is similar to Japan I suppose, well not bloated but NZ companies dont seem to have shed staff, the result is a sort of stalemate.....stagnate...in property....so if you want to work on 5% CPI, houses are dropping in value or at least not gaining....so they are losing 5% or more per annum...

Im going to guess that as long as the OCR stays low and as long as NZ's credit rating doesnt drop much interest rates will stay low and the PIs and owners will be able to pay the mortgage....if however these change without more income we are going to see defaults and selloffs, then the drop starts and if it starts I think its going a long way.......right now its greed keeping it up....if/when that switches to fear........

regards

I'll bet Gummy is going to listen to Ha.......!

Ha ? ........................ Ha ha ha !

bugger fox

and again

Rob Fyfe (Rob Fyfe for PM I say!) on the media circus that has been the reporting of Fukushima. Really the media should be ashamed, including apparently credible outfits such as CNN and BBC:

"During the course of the week I have become increasingly disappointed with the media coverage here in New Zealand and amongst much of the world's English speaking media about the risk posed by the emergency occurring at the Fukushima Nuclear Power Stations - little of it is fact based, it is increasingly taking the form of a docu-drama with a mixture of fact, ill-informed non-expert opinion and a fair dose of fiction," he wrote in an update to staff.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.