Here's my Top 10 links from around the Internet at 3 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

Today there's another cycling video for those who loved yesterday's trick-fest in a junkyard.

1. Standard and Poor's exposed in Australian court case - As you can imagine, this is all very topical now in the wake of S&P's downgrade of New Zealand on Friday and its downgrade in August of America's credit rating.

An Australian court case bought by 12 Australian councils against ABN Amro and Standard and Poor's is now being heard in the Federal Court and the details emerging are sensationally bad for Standard and Poor's, Michael West reports from the Sydney Morning Herald.

The allegation is that S&P and ABN Amro misled the poor wee councils into buying toxic mortgage bonds in 2007 at the peak of the bubble.

It turns out Standard and Poor's poor wee analysts were forced/chose to swallow the rats served up by ABN Amro and gave the toxic junk AAA ratings without much of their own analysis.

It turns out S&P didn't do an independent report. There was a lot of copying and pasting from ABN Amro.

It looks real ugly for the ratings agency. It's always the emails that get them.

Here's a selection of the juiciest revelations courtesy of West:

“Smart” investment bankers had “sandbagged” Standard & Poor’s, “bulldozing” the world’s most venerable ratings agency into delivering its premiere “AAA” credit rating for a high-risk, and ultimately disastrous, financial product.

Just as remarkably, documents submitted to the court show these investment bankers were surprised to find that S&P didn’t even bother to do its own research for an “independent” report on the Rembrandt notes.

Rather, the ratings agency virtually cut and pasted a chunk of ABN Amro’s own analysis of the notes - even though this was the very bank seeking the credit rating and trying to sell the notes.

According to an email presented in opening submissions, one employee of S&P chided another, writing, “You are the wuss for bending over in front of bankers and taking it… You rate something AAA, when it is really A-?”

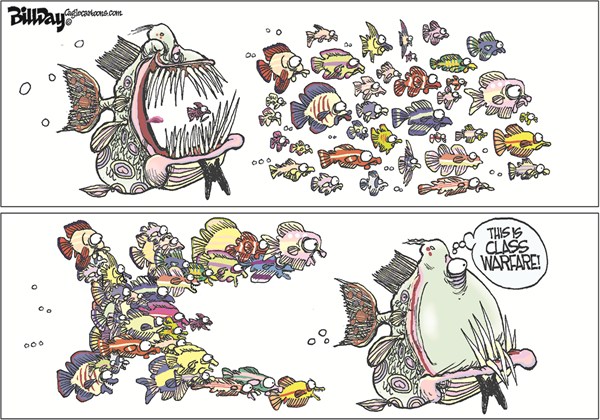

2. The reign of the 1 percenters - This long piece in Orion Magazine from Christoper Ketcham catches the mood of revolt that's brewing in New York over how less than 90,000 people in Manhattan (mostly bankers, traders and hedge fundies) have cornered America's wealth and income.

The tone of the piece is most interesting. It's almost febrile. You can see why the #OccupyWallStreet protests are taking off.

The anger is palpable now. It's taken a while, but it's coming now.

Good.

Here's a taste:

“Here,” I tell her, standing in the canyons of world finance, “is what New York is about. Sociopaths getting really rich while everyone else just sits on their asses and lets it happen.”

3. A New Zealand perspective - Here's an excellent musing by online entrepreneur-consultant guy Lance Wiggs about #OccupyWallStreet and the 1%.

Lance talks about how he brushed up against the 1% when he worked as a McKinseyite a few years ago and why he's glad he made it out.

He suggests a few ways that New Zealand can avoid becoming the divided place that America now is.

Here's a taste:

I was lucky (or unlucky) enough to temp for a few months in a bank that sold structured financial products in London, counting the amount of money that the bankers had made over and above the internally calculated value of those products. It was a calculation of a knowledge advantage, and the units were millions of dollar per day.

Those bankers or traders were seen as the elite within the bank people, but in reality they were arseholes, and like everyone else there, including me, they were dedicated to making money and to little else. I was lucky because I managed to get kicked out relatively quickly.

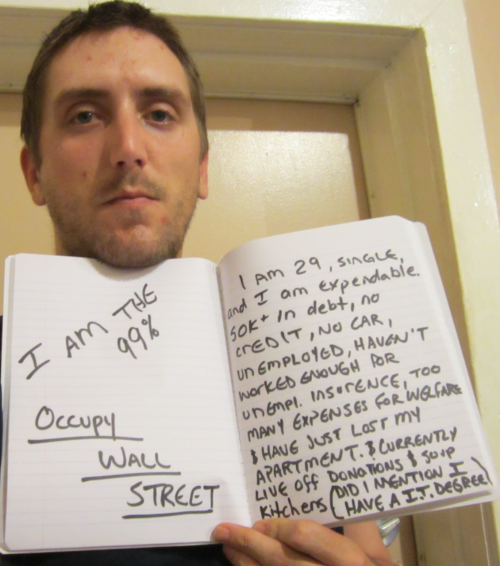

Lance, who's a good guy and former colleague of mine from my Fairfax days, links to this excellent site telling the story of the 99% who are struggling in America. Here's a sample of the picture below.

4. Chinese hard landing sign # 1 - Beijing based Tsinghua University Professor Patrick Chovanec writes an excellent piece detailing the signs of a hard landing in China.

He describes it as an "Economy on the edge of a nervous breakdown"

I hope John Key (HT The DimPost for the womens mag cover below) will read it.

In Shanghai, primary market property sales for Sept. 1-18 were down more than 50% year-on-year (contrasted with the all-time high inventories I mentioned earlier). In Beijing, nearly 5% of the city’s property agents have shut down in the past two months. The global price of copper, 40% of which is driven by Chinese demand, including wiring for all those new homes and office buildings, is down almost 25% since the beginning of August. But more dramatic, and worrisome, is what is happening in Wenzhou.

Wenzhou is a city on the southeast coast that is well-known as the center of free-wheeling entrepreneurship in China. Plenty of those entrepreneurs operate businesses and factories in Wenzhou itself, but others scatter themselves far and wide across China, forming networks of trade and commerce. With a reputation for getting by on their wits and the skin of their teeth, Wenzhou merchants have long relied on — and sponsored — informal methods of financing. So it’s no surprise that, as formal credit conditions tightened this year, they were front and center in providing alternatives. The fact that credit tightening has fallen disproportionately on China’s private sector presented them with both opportunity and risk.

For a while, I’m sure the opportunity was highly rewarding, with informal interest charges soaring to monthly rates of 4-10%. But eventually the risk caught up. Shanghai Daily reported on Sept. 23 that, in the previous ten days, at least seven local Wenzhou business owners had fled after defaulting on millions of yuan they had borrowed from banks and private creditors, which they in turn lent or invested in real estate and other speculative ventures.

5. Chinese hard landing sign #2 - Bloomberg reports BMW, Audi and Mercedes are cutting new car prices in China to make targets as demands slows.

In Beijing, BMW dealerships are giving markdowns of as much as 19 percent on a 3-series car, while some Mercedes dealers are selling the C-Class Elegance model at 20 percent less than the suggested retail price, according to cheshi.com, a pricing guide tracking more than 3,000 dealers in the country.

BMW, Daimler and Audi, the three largest luxury carmakers, face slowing sales growth and falling prices in China, the world’s largest automobile market, as some cities impose driving curbs and the central bank tightens lending.

“We’re in a cycle of dropping prices,” said Scott Laprise, a Beijing-based analyst at CLSA Asia Pacific Markets. “Dealers are worried about sales slowing and are cutting selectively in the luxury segment. They see where the overall market is going. They want to be preventive and keep their sales going.”

6. Chinese hard landing sign #3 - BusinessIsider reports from Deutsche Bank economist Jim Ma that he is now expecting a slump in Chinese growth to 7% and that the real estate market is worrying.

Here's the detail:

In recent weeks, the number of phone calls received by an author of this report from China-based property agents has increased several fold, indicating a significant rise in the urgency for developers to raise cash from selling properties. A property consultant told us that he recently received requests to help raise RMB10bn for cash-strapped small and medium-sized property developers – this amount is a huge multiple of what he is used to dealing with. In the offshore market, where many Chinese developers seek foreign currency funding due to lack of access to domestic funds (the domestic stock, bond and trust loan markets are closed to them due to policy tightening, and banks are also very stringent), their USD bond yields have surged to 20-25% in past weeks from around 10% before August. This means that even the offshore markets are now largely closed to Chinese developers.

All these suggest that many developers are now under greater pressure to sell their properties at a bigger discount in order to avoid a liquidity crisis. An emerging consensus from potential buyers and some developers is that a 10% drop in prices in the coming two quarters would be justified.

A further decline in physical property prices will likely reduce the incentive for developers to start new projects, and thus implying a deceleration in real estate fixed asset investment. Note that real estate FAI by developers account for about 16% of total FAI, and about 25% of the demand for steel, coking coal, and cement.

7. Chinese hard landing sign #4 - Steel prices in China are dropping fast, the Sydney Morning Herald's John Garnault reports.

This of course is a problem for Australia, which exports the raw materials for steel production in China.

Xu Xiangchun, at Mysteel in Shanghai, said market anxieties over the global economy had coincided with softening domestic demand including a pullback in railway construction due to a series of scandals in the Ministry of Railways.

Prices for ''rebar'' construction steel fell 2.6 per cent last week and they have dropped 8 per cent since mid-August, said Paul Bartholomew at Steel Business Briefing. Sliding prices are squeezing steel mill profit margins and putting pressure on resource suppliers to cut prices too.

Baosteel chairman Xu Lejiang said last week that steel was the least profitable sector in Chinese manufacturing, with margins less than 3 per cent.

''Steel mills are restructuring and it is possible that we'll see steel mill bankruptcies in the near future,'' said Ms Yin. ''Iron ore prices are likely to fall.''

8. Eurasian Union - BBC reports that Russia's soon to be former-new President Vlad 'the bad' Putin is proposing the creation of a 'Eurasian Union' of the former Soviet republics.

He says he's not interested in reforming the Soviet Union, but...

"There is no talk about rebuilding the USSR in one way or another," he said in an article in the daily newspaper Izvestia.

"It would be naive to try to restore or copy something that belongs to the past, but a close integration based on new values and economic and political foundation is a demand of the present time."

He said a "Eurasian Union" would "build on the experience of the European Union and other regional coalitions".

Mr Putin said the aim was to "create real conditions to change the geopolitical and geoeconomic configuration of the entire continent and have an undoubtedly positive global effect".

9. Greeks return to bartering - The New York Times has a detailed report on a plethora of often online bartering networks that have sprung up in Greece to replace the Euro.

Part alternative currency, part barter system, part open-air market, the Volos network has grown exponentially in the past year, from 50 to 400 members. It is one of several such groups cropping up around the country, as Greeks squeezed by large wage cuts, tax increases and growing fears about whether they will continue to use the euro have looked for creative ways to cope with a radically changing economic landscape.

“Ever since the crisis there’s been a boom in such networks all over Greece,” said George Stathakis, a professor of political economy and vice chancellor of the University of Crete. In spite of the large public sector in Greece, which employs one in five workers, the country’s social services often are not up to the task of helping people in need, he added. “There are so many huge gaps that have to be filled by new kinds of networks,” he said.

10. Another totally irrelevant cycling video - This one is from Danny MacAskill riding from Edinburgh to Skye.

34 Comments

Re #10, I can do everything that Danny guy can do up to 0.32, easy peasy.

We have a Kiwi Volos system too!

Re: #6 "he is now expecting a slump in Chinese growth to 7%" LOL! What a slump!

Mind you, a 2% drop in Chinese griowht is proably quite singifcinat given the size of their economy. However I suspect a "slump" in their growth would only really get ugly if it dropped to 5%

Are those braces on John Key's teeth? I guess it's never too late for him to make changes to all sorts of things....or maybe he just wants our next representative at the UN to have good teeth.....

Here's Morgan Stanley trying to dispel the rumours about its European exposures after a near 50% fall in it share price this year.

http://dealbook.nytimes.com/2011/10/04/morgan-tries-to-quell-rumors-about-its-holdings/

cheers

Bernard

Rob Alloway has paid 2 bucks for 335,000 Allied Farmers shares - https://www.nzx.com/companies/ALF/announcements/214687

No no. He has paid $2 for the shares are the warrents.

These warrents have value (depending if you think ALF is worth something - unlikely) but Alloway will resent to be the largest ALF shareholder thanks to the reset clause Hanover investors agreed to.

Journos have totally lost this. Cactus Kate has outlined it previously http://asianinvasion2006.blogspot.com/2011/05/run-away-alloway.html

Hanover investors and the people that recommended they accept the deal are morons.

The Hang Seng index seems to have totally blown a gasket - down another 3.4%, and I make that a loss of just under 19% IN UNDER A MONTH!!

Clearly traders are happy as larry that things in Hong Kong's hinterland are just booming, which just goes to show how well informed our glorious leader here in NZ is,

SWAT Teams in St. Louis Protecting Bank of America; Refusing Customer Withdrawals

http://www.youtube.com/watch?v=Db_P0wHsSz0

Hmmm. This is a worry.

And.. a Senator called for a run on Bank of America...

http://abcnews.go.com/blogs/politics/2011/10/durbin-to-bank-of-america-…

cheers

Bernard

Hmm rickrolled anyone

That protest and swat thing happened 2 months ago on the 12 August.

http://www.youtube.com//watch?v=2NY2tYpgoYA

Still either way - it's easy to see the fascism that exists in America now where Corporates can call upon SWAT Police teams to act as security.

Either way - certainly concerning.

@blairmrogers

They are refusing to take withdrawals from protester groups incase it starts a tidal wave I'd say after looking at this.

Here's a couple of links courtesy of Eric Crampton arguing against a Robin Hood tax.

Here's Tim Harford with an engaging Q&A style argument against it.

http://timharford.com/2011/10/a-%E2%80%98robin-hood%E2%80%99-tax-is-no-way-to-redistribute/

Here's Kenneth Rogoff

http://www.project-syndicate.org/commentary/rogoff85/English?wpisrc=nl_wonk

Such taxes surely reduce liquidity in financial markets. With fewer trades, the information content of prices is arguably reduced. But both theoretical and simulation results suggest no obvious decline in volatility. And, while raising so much revenue with so low a tax rate sounds grand, the declining volume of trades would shrink the tax base precipitously. As a result, the ultimate revenue gains are likely to prove disappointing, as Sweden discovered when it attempted to tax financial transactions two decades ago.

cheers

Bernard

"A man who tried to jump from Parliament's public gallery was aiming to land on top of Goofy"..... :-)

He probably got told "NZ is in for a soft landing" ;-) like we all did Wolly! Remember those words and who said em?

Hmmmmm....Matts cartoon has woken a grey cell...what price for a genuine placard used in the great depression and identified in a news photo of that era!....but which one to buy in this depression....keep it for 100 years and you could have a winner.

Now it seems the French have banned purchases of gold and other metals worth more than US$600, apparently to stop copper thefts...

http://www.prisonplanet.com/france-bans-cash-sales-of-gold-silver-over-…

Following the Austrian government’s announcement that it was restricting the sales of precious metals to $20,000 a time, an amount which would purchase just 11 ounces, the French authorities have followed suit with an equally draconian new measure to deter people from buying gold and silver.

A recently amended French law states (translation), “Any transaction on the retail purchase of ferrous and non ferrous (metals) is made by crossed check, bank or postal transfer or by credit card, not the total amount of the transaction may not exceed a ceiling set by decree. Failure to comply with this requirement is punishable by a ticket for the fifth class,” going on to confirm that any amount over €450 euros or $600 US dollars “must be paid by bank transfer”.

“If you want to understand why the Euro is in such trouble, take a look at the bank notes. The images on Euro notes are imaginary buildings. While national currencies typically feature real people and places –George Washington on the US dollar bill, the Bolshoi theatre on the Russian rouble – European identity is too fragile for that. Selecting a place or a hero associated with one country would have been too controversial. So the European authorities chose vague images that represented everywhere and nowhere” Hi Ho silver lining ?

Australia is having its own debate now about having an unsustainable tax base after 2050 because of pensions that can't be paid for

http://www.theage.com.au/business/summit-has-a-mountain-to-climb-201109…

Much of the pending explosion in spending is unstoppable. Prime Minister Gough Whitlam set the ball rolling on his election in 1972 when he promised to increase pensions to 25 per cent of average weekly male earnings. John Howard's treasurer, Peter Costello, set the trajectory in stone when he legislated in 1997 to guarantee the single pension rate would never fall below that benchmark, meaning in future it would rise by the escalator rather than the stairs.

As a result, pension payments are set to climb from 2.7 per cent of GDP to 3.9 per cent by mid-century. They are already the Commonwealth's second-largest cost after grants to the states. In today's dollars, the extra cost a year will exceed $46 billion.

No probs.

Get the Aussies to talk to John Key. He will magic away the burgeoning cost of pension schemes with a healthy growth projection that will *oh* just whisk that cost away!

Cheers

And now Bill Bryson is on the warpath to stop the development of green belt areas in Britain. Another boomer says don't develop houses near my house or do anything to undermine the value of my nest egg...

http://www.telegraph.co.uk/earth/hands-off-our-land/8801402/Hands-Off-O…

"One of this country's great, great unappreciated achievements is that through everything – industrial revolutions, millions of people living here – still, today, in 2011, you can go 15 minutes outside any British town or city and be in glorious landscape," he says.

"Britain still has the most reliably beautiful countryside of anywhere in the world. I would hate to be part of the generation that allowed that to be lost."

Here's Soros warning of Depression unless...

Policymakers have lost control of the economic crisis and financial markets are forcing the world into a depression, George Soros said on Friday, urging Europe to create a common Treasury, recapitalize its banks and protect vulnerable states.

http://www.reuters.com/article/2011/09/30/us-europe-soros-warning-idUSTRE78T28O20110930

The Elephant in the room being he didn't make mention of any hit to bond holders.

Of course he wants more power in even fewer hands, he is a globalist who does not care for sovereign states, the opposite in fact. The moneyed elite are always threatening to

implode systems if they are not given more money , bailouts and Power. Anyone else see a tend here in the narrative the filth like Soros pump out.

It's like the MSM getting Michael Moore to hijack the Wall St protests, the bloke is worth a couple of hundred million and is part of the establishment problem , it's all so transparent.

Here's Reuters on the need for massive Debt Relief

More than three years after the financial crisis struck, the economy remains stuck in a consumer debt trap. It's a situation that could take years to correct itself. That's why some economists are calling for a radical step: massive debt relief.

http://www.reuters.com/article/2011/10/03/us-haircut-idUSTRE79125J20111003

Bryson is one of the smarter people on the planet.

He knows the math.

He probably realises that it's odds-on they don't get to do the developing too - time's up, really.He'll also realise that our offspring can't afford it to happen. And - he'll know that 'afford' doesn't mean money.

Chances are we see implosion, followed by angst, followed by war.

Iain - did you ever read Insanity Fair? Douglas Reed, circa 1938. Warning of what he saw in Europe as a reporter (he was actually outside the Reichstag as it burnt). His despair at the non-comprende of his editors and the British pollies is palpable.

There were Wallys and Gonzos and GBH'S there too, screaming their lungs out, right arms up stiff..... It's an interesting parallel.

So Iain what do you think of the UKs solution

http://www.telegraph.co.uk/news/politics/conservative/8807498/Conservat…

Iain why do you say that if we had zero debt we would also have zero means of exchange in circulation? Are you treating fiat currency as debt and thereby excluding it? Or are you saying that we owe more than our money supply's nominal worth?

Just trying to join the dots in my head...

Money As Debt-Full Length Documentary

There was a good article in today's herald about how many restaurants are getting slammed by lack of business due to the rwc

Sell risk currencies (such as the kiwi$) say Morgan Stanley:

Hugh, the article states that asking prices (not selling prices) are at 58% OF peak, not 58% off peak. Also note that average asking prices are still at E194,000 (NZ$337K) which is not exactly cheap. Your theory that this was a "planning triggered bubble" would not be very widely accepted. That may have been a factor but I think most commentators would say it was a minor one. If anything planners should have prevented the industry from building so many unneeded houses. The number one reason for the Irish property bubble was low interest rates on mortgages:

1982 16.25%

1983 13.0%

1984 11.75%

1985 13%

1986 12.5%

1987 12.5%

1988 9.25%

1989 11.4%

1990 12.37%

1991 11.95%

1992 13.99%

1993 13.99%

1994 7.49%

1995 7.00%

1996 6.75%

1997 6.90%

1998 5.85%

1999 5.60%

2000 6.09%

2001 6.09%

2002 4.70%

2003 4.20%

2004 3.49%

2005 3.65%

2006 4.86%

2007 5.46%

This are the HIGHEST rates offered by building societies in each year. Some mortgages were going at <3% during the boom. Even now you can get 5 year fixed 92% LTV at 4.9%.

FYI here's a statement sent to me today from Standard and Poor's on the Australian court case.

"We conducted our own analysis in line with our ratings process and look forward to the Court hearing that evidence. The Councils are trying to deflect attention from the weaknesses in their case by pointing to out-of-context emails." "We believe the case brought by LGFS and others against McGraw-Hill UK lacks merit, and we are defending against it vigorously." cheers Bernard

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.