Here are my Top 10 links from around the Internet at 10am brought to you in association with New Zealand Mint for your bruncheon reading pleasure.

I'm in Wellington today for this conference on Retirement Policy and Intergenerational Equity. Will be reporting on it through the day.

I welcome your additions and comments below, or please send suggestions for Friday's Top 10 at 10 via email to bernard.hickey@interest.co.nz

1. Habitual investors? - The Hubbard Support Fund trust has now been set up and is now asking for funds, the Timaru Herald's Emma Bailey reports.

The trust was launched yesterday and Fairlie sheep farmer David Williams is a director. Mr Williams, who farms the shores of Lake Opuha, was also an indirect benefactor of Mr Hubbard, who financially backed the dam, enabling its completion.

"The trust is for [investors in the affected companies] who are financially struggling because their investment has been frozen and they have not been paid."

The trust will provide financial support for those affected by the Government's decision to put Allan and Jean Hubbard, their companies Aorangi Securities and Hubbard Managed Funds and seven charitable trusts into statutory management on June 20.

The newspaper then published this helpful paragraph.

To donate send a cheque to: Hubbard Support Fund Trustee, O'Connor Richmond, PO Box 172, Gore or at any Westpac branch to the account 030887 0473369 00

I have a couple of questions about this. Why are people who have not received interest cheques from Aorangi Securities so hard up that they need charity payments to help them buy food. Aren't they so-called habitual professional investors that didn't need the protection of a prospectus? And if this trust fund (and the newspaper) is soliciting funds to help make the interest payments on the frozen trusts, should it too be required to have a prospectus?

2. Surprising disclosure decision - CBS Canterbury have always been very open with us here at interest.co.nz and CEO Bryan Inch has been very helpful in agreeing to interviews. But the decision yesterday to ban the media from its annual meeting was a surprise. It was a public meeting after all and it wants to join up with Marac and Southern Cross to become a bank. That implies a willingness to be open and transparent. Surely a public meeting with shareholders is something that should be open to the media to be reported on?

CBS Canterbury chairman Gary Leech seems to think not. Here's the report from Marta Steeman at The Press, who I have worked with and have a lot of respect for.

CBS Canterbury typically does not allow reporters to report what is said at its annual meeting. Asked about excluding the media, chairman Gary Leech said yesterday: "At the start of the meeting I always have a preamble that basically says that nothing is to be reported from the meeting because it is a shareholder meeting. Last night's meeting was a particular one where we wanted a good free-flowing discussion with respect to a potential proposed merger.

"It was at a stage where we couldn't be definitive whether it was going to go ahead or not, and we wanted to give the freedom to our shareholders to ask whatever questions in a closed environment specific to them," Leech said. "I wanted to make sure that whatever did get reported was going to be what we also had lodged with the NZX," he said.

3. I wish we had a dictatorship too - Bloomberg reports China is going to trial a property tax to see if it can suck some air out of its property bubble. Maybe John Key needs to learn a few lessons from his new friends in Beijing.

China plans to start implementing a property tax in 2012 on a trial basis, the 163.com website run by Netease said in a report today, citing a finance ministry meeting in Beijing. The issue will be one of the ministry’s top tasks in 2012, the report said, without citing any official by name. Due to the difficulties of implementing such a levy nationwide, the tax may be rolled out first in a few cities, the report said without naming them.

Premier Wen Jiabao has restricted loans to real-estate developers and imposed higher interest rates and down payments for second mortgages to help cool surging property prices that rose by records in some cities in the second quarter. The State Council said in May it approved proposals from the nation’s top economic planning agency to gradually introduce a property tax.

4. Austerity's new friend - Now the IMF is saying Europe's governments need to be austere. Previously it said they needed to be careful before pulling back from the spending. Now it realises the bond vigilantes are in charge. Fair enough. Here's the New York Times' version.

The International Monetary Fund lent its support Wednesday to Europe’s budget deficit reduction efforts, pulling away from previous calls for stimulus even as it warned of a “moderate and uneven” recovery in the region. In response to increasing budget gaps in the region, “fiscal sustainability needs to be established, with ambitious medium- and long-term adjustment plans supplemented by short-term consolidation,” the fund said in an annual staff report on the euro economy.The comments solidified the fund’s U-turn in its guidance for euro-area policy makers. Late last year, Dominique Strauss-Kahn, managing director of the I.M.F., which is based in Washington, warned during a trip to Europe that “a premature exit” from economic stimulus was the “main danger” to the region. Since then, a number of euro-area countries have suffered as investors, alarmed by large deficits, dumped the bonds of many economies, pushing up interest rates.

5. More Chinese strikes - This is a theme to watch in coming years. Growing labour unrest in China and a push for higher wages is going nip away at China's competitive advantages and its political stability. Here's the Reuters report.

Workers at Japanese electronics maker Omron’s southern Chinafactory have gone on strike, the latest disruption in the manufacturing hub over demands for better wages and working conditions. The burst of disputes that started in May has since affected more than a dozen mostly foreign-owned factories, raising questions about the region’s future as a low-cost manufacturing base.

The Omron strikers, who walked off the job on Wednesday morning, are demanding a pay raise of at least 40 per cent from their current salary of 1,270 yuan, with some workers saying they want an increase of 500 yuan ($74) per month and another saying the demand is for 800 yuan more.

6. Ponzi scheming Chinese loan sharks - We're starting to see under the hood of China's property bubble now. Here's a blog from IsraeliFinancialExpert on how loan sharks have become a big part of the property bubble in China. If true, this suggests any bursting of the bubble could get politically as well as economically ugly. The blog cites numerous emails and youtube videos of protests. I'd take it with a few grains of salt, but something is up here. Any suggestions these loan sharking operations have made their way to New Zealand's Chinese communities? HT Aaron

China’s real estate market is a huge ponzi scheme supported by shark loans. Ordinary Chinese pledge their houses to get low interest loans from the banks, then lend to local shark loan companies at high interest rates to speculate in the real estate market. Actually, in the later part of 2008, when real estate prices dipped for while in China, many ponzi shark loan schemes blew up, in cities like Heilongjiang province , He gang, Hunan province, Ji shou, Zhejiang province , and Li shui.

In Il shui the whole city was rioting since many households couldn’t get the principal back after the local loan shark companies couldn’t pay interest anymore due to the real estate price slump.

Local governmental officials, that are demanded from the government to produce double digit GDP growth numbers give real estate developers permits to build housing projects in return for bribes. They also get bribes in return for allowing the shark loan companies to operate under their jurastiction. some of them are active partners in shark loan businesses. For example, a party secretary of legal affairs, that controls the public security bureau, which is a court and prosecutor division of government in Yongkang city, in Zhe jiang province, tried to run abroad using a passport in 2009 after he found out he couldn’t repay 60 million Yuan.

Every scheme has a ring leader who's job is to collect money from all the participants in the ponzi scheme.

When some of these ponzi schemes blow up, the party leaders always get bailed out first, and some even ask local business owners to lend them money, and then bail out their own personal fund. After that the ring leader turns himself in and gets protection from the local government.

7. 'Follow the debt to the corporates' - Floyd Norris at the New York Times reports on research from New York University professor Edward Altman that says observers are better looking for debt problems in corporates as an early indicator of debt stress than looking at sovereigns. HT Chris via email.

“Academics and market practitioners have not had an impressive record of predicting serious financial downturns or of providing adequate early warnings of impending sovereign economic and financial problems,” says Edward Altman, a professor at New York University who has long studied debt defaults by companies and governments.

Mr. Altman’s answer is fairly simple: “One can learn a great deal about sovereign risk by analyzing the health and aggregate default risk of a nation’s private corporate sector, a type of bottom-up analysis.”

After that analysis, using a system he developed with a company called Risk Metrics, Mr. Altman’s ranking of European governments now differs a little from conventional wisdom. He sees Britain and the Netherlands as the safest governments, ahead of Germany. Greece is at the bottom, of course, with Italy, Portugal and Spain looking better than it does, but not particularly good.

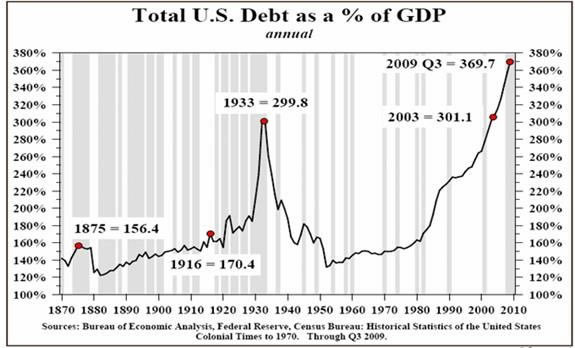

8. The Debt Supercycle - John Mauldin at Market Oracle has a bit of a ramble through the debt outlook and sees either restructuring or pseudo default through money printing and inflation. HT Michael via email. Worth reading for the charts alone, including this beauty below. Read it and weep. He essentially says everything looks fine for the debt sellers like the United States government...until it isn't.

There is a limit to how much debt you can pile on. But as the work of Reinhart and Rogoff points out (This Time Is Different), there is not a fixed limit or some certain percentage of GNP. Rather, the limit is all about confidence. Everything goes along well, and then "Boom!" it doesn't. That "Boom" has happened to Greece.

Without massive assistance, Greek debt would be unmarketable. Default would be inevitable. (I still think it is!) The limit is different for every nation. For Russia in the 1990s, it was a rather minor total debt-to-GDP ratio of around 12%. Japan will soon have a debt-to-GDP ratio of 230%! The difference? Local savers bought government debt in Japan and did not in Russia. The end of the Debt Supercycle does not have to mean calamity for each country, depending on how far down the road they are. Yes, if you are Greece your choices are between very, very bad and disastrous. Japan is a bug in search of a windshield. Each country has its own dynamics. Take the US. We are some ways off from the end. We have time to adjust. But let's be under no illusions, we cannot run deficits of 10% of GDP forever.

At some point the Fed will either have to monetize the debt or the bond market will simply demand an ever-higher interest rate. Why can't we go the way of Japan? Because we do not have the level of savings they have traditionally had. But their savings levels are rapidly declining, which says that if they want to continue their deficit spending at 10% of GDP, they will have to go into the foreign markets to borrow money at a much higher cost, or their central bank will have to print money. Neither choice is good.

9. Headless chooks - There is a certain hilarity to this story. In the wake of the just passed financial regulations in the United States, it seems Standard and Poor's and Moody's are telling their clients not to use their credit ratings because of a clause saying S&P and Moody's are legally liable for their ratings. Oh dear. Now bond buyers are actually having to do some research on the bonds themselves...

So tell me again why is the Reserve Bank of New Zealand relying on ratings from these agencies to help it regulate non bank deposit takers in New Zealand? And why is it also relying on trustees to these same non-banks to help regulate the sector?

Here's Temasek Hedge with the story, which is detailed in WSJ, which is paywalled... And here's Naked Capitalism with a great summary.

The nation’s three dominant credit-ratings providers have made an urgent new request of their clients: Please don’t use our credit ratings. The odd plea is emerging as the first consequence of the financial overhaul that is to be signed into law by President Obama on Wednesday.

And it already is creating havoc in the bond markets, parts of which are shutting down in response to the request. Standard & Poor’s, Moody’s Investors Service and Fitch Ratings are all refusing to allow their ratings to be used in documentation for new bond sales, each said in statements in recent days.

Each says it fears being exposed to new legal liability created by the landmark Dodd-Frank financial reform law. The new law will make ratings firms liable for the quality of their ratings decisions, effective immediately. The companies say that, until they get a better understanding of their legal exposure, they are refusing to let bond issuers use their ratings. That is important because some bonds, notably those that are made up of consumer loans, are required by law to include ratings in their official documentation. That means new bond sales in the $1.4 trillion market for mortgages, autos, student loans and credit cards could effectively shut down.

10. Totally irrelevant video - Jennifer Anniston has adopted a 33 year old Kenyan groundskeeper...

Jennifer Aniston Adopts 33-Year-Old Boyfriend From Africa

11. Bonus - Darth Vader's minions take the subway

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.