Here are my Top 10 links from around the Internet at 10 to 1 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Wednesday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream under the Top 10.

1. Did July volumes drop really fast? - Alistair Helm from unconditional asks the question begged by comments from QV in its survey on Monday about house sales volumes being down a third from a year ago.

What does QV know?

We'll find out for sure on Friday when the REINZ release their figures, but it doesn't look good for volumes.

Here's Alistair:

QV undertake their analysis of property prices based on Land Transfer documentation, this data clearly includes sales stats, however as the data set of these recorded sales is based on settlements rather than unconditional transaction records the data tends to cover an extended period which may span a couple of months given variable settlement terms.

To enable people to make informed decisions as to the state of the property market requires accurate information, if QV has a more accurate and up to date insight into the property market it would be great to see this information, especially if it does highlight sales down by 33%.

And here's what QV's Jonno Ingerson said back to me in an email. He later said he had assumed sales of about 4,200 in July, down from 4,575 in June and down 30% from 6,014 in July last year.

I estimated what I expect July sales volumes to be. I did this based on data we already have (which is more recent than he suggests), plus based on what the QV Valuers are hearing in the market from real estate agents, plus other evidence like Barfoot’s release for the Auckland market, plus the RBNZ home loan approvals series, all of which point to a further decline in sales volume for July.

That being the case then volumes for the three months to the end of July will be about one third down on last year and more like 40% down on the LTA (long term average).

2. 'Slightly more negative commentary' - Tony Alexander's monthly email survey of business confidence is always a good read, as much for the flavour in the anecdotal comments attached.

I always have a look at the real estate agent comments to cop a feel. They seem to comment a lot. Maybe they have a bit more time on their hands at the moment...

Here's how Tony Alexander summarises it:

Slightly more negative commentary than last month with buyers happy to sit on their hands, vendors refusing to budge on price to sell.

And here's a few of those comments. I've picked out the worst ones. There's plenty of good ones too for those requiring balance. One curious one about selling a house before the GST rise hits.

Why would that be?

Wellington: Market is flat, with Wellington City rents pegging back, owners squealing, no tenants around. Top end of the market remains calm, lower end of market is tough. Many vacant properties, more frequent rent arrears, more frequent visits to the Tribunal. Residential property management. Tradesmen are just surviving as fewer people are prepared to have maintenance done unless it is urgent. Few investors are buying property as their is no capital gain in sight. Only bargain priced properties are being sought.

It has been a very quiet 2 weeks in my office, no sales, which is the first time in 10 years that I can remember that happening. Residential Property Sales, Christchurch Real Estate - Eastern Beaches. There has been a marked difference during the last two weeks of the number of enquiries being received - whether internet, media or phone. They are half what they had been. Resulting in a much quieter market place and some very concerned vendors. There are vendors who would like to sell before the increase in GST but the buyers are not being reasonable in their offers and a stalemate situation develops.

3. China's big, big bubble - The Burning Platform points out some research with a few interesting charts on China's real estate bubble. I was surprised at the size relative to GDP.

I thought the real estate sector there was still relatively small. Maybe not... HT Gertraud via email.

The Chinese government has created the mother of all bubbles and when it pops, it will be felt around the world. The China miracle is not really a miracle. It is a debt financed bubble. Sound familiar? I picked out 4 charts from Bud’s article that paint the picture as clearly as possible. The chart below shows that compared to the real estate bubble in Japan during the late 1980s and the current bubble in China, the US housing bubble looks like a tiny speed bump. The US has 20% to 30% more downside to go.

For those looking for a housing recovery, I’d like to point out that Japan’s housing market has fallen for 20 years with no recovery. I wonder if the National Association of Realtors will be running an advertisement campaign in 2025 telling us it is the best time to buy. Take a gander at home prices in China. Since the 2008 financial crisis, the Chinese housing market has skyrocketed 60%. There are now 65 million vacant housing units. The question is no longer whether there is a Chinese housing bubble, but when will it pop.

4. Is the next bubble bonds? - Gloom about the US economic outlook is driving many investors into US Treasuries on expectations interest rates will stay lower for much longer.

But is the money piling into government debt driving prices up (yields down) to bubble-like prices? The jury is out. Here's the New York Times on the phenomenon, along with a handy chart.

Rates are unlikely to turn higher soon, economists say. In fact, they could fall even further. While the Fed cannot lower its official federal funds rate much more — that rate has been stuck at 0.25 percent all year — it can ease credit in other ways. On Wall Street, a consensus is forming that the Fed might take less conventional steps, like buying more Treasury securities, to push market rates lower still.

Lower and lower rates may eventually encourage corporations to invest the big stockpiles of cash in plants and equipment. That, in turn, could lead to new jobs. But if companies instead sit on their hands, waiting for sure signs of an economic revival, basement-level rates may not do much to spur the economy. The latter, Mr. Gross said, amounts to “waiting for an economic Godot.”

5. Some sad news - Matt Simmons, the oil industry analyst I've linked to a few times, died overnight, apparently of a heart attack. He had predicted peak oil and was a very harsh critic of BP in the Gulf of Mexico oil spill.

Consumerenergyreport has the report. HT Blair Rogers via twitter @BMR789

6. Now that's a government - China has ordered 2,087 steel mills, concrete works and other factories to close by September 30 to improve energy efficiency, the NYTimes reports. No RMA. No hearings. No consulting with staff. Just do it. HT @samfromwgtn via Twitter

Earlier this summer, Prime Minister Wen Jiabao of China promised to use an “iron hand” to improve his country’s energy efficiency, and a growing number of businesses are now discovering that it feels like a fist.

Over the years, provincial and municipal officials have sometimes tried to block Beijing’s attempts to close aging factories in their jurisdictions. These officials have particularly sought to protect older steel mills and other heavy industrial operations that frequently have thousands of employees and have sometimes provided workers with housing, athletic facilities and other benefits since the 1950s or 1960s.

To prevent such local obstruction this time, the ministry said in a statement on its Web site that the factories on its list would be barred from obtaining bank loans, export credits, business licenses and land. The ministry even warned that their electricity would be shut off, if necessary.

7. 21 days and counting - South Canterbury Finance's future will be decided within the next 21 days. It's clear from Marta Steeman's report in BusinessDay that August 31 is D-Day for SCF and, unfortunately, there isn't a nailed down deal yet for someone (anyone) to inject NZ$200 million or so of fresh cash equity.

The Trustee is champing at the bit and CEO Sandy Maier says he's hopeful. Hmmm. Read the quotes and feel the confidence...

Firstly the trustee Yogesh Mody of Trustee Executors:

"They have insufficient capital for the types of business they are operating in, so we are absolutely entitled to take enforcement action and we have chosen not to. We did that back in February fundamentally as a quid pro quo for receipt of the extra assets [Helicopters and Scales Corporation]."

The trustee and investors were now awaiting the recapitalisation plan. "It would be fair to say they [SCF] are well aware of the time frames, and they are working feverishly towards them."

And then Sandy Maier

"We still have a number of parties in negotiations. We haven't lost anybody. We are closing in on time and detail. We are still headed for an announcement on August 31," he said. The number of investors interested had increased, but he was unwilling to provide the number.

"It's getting to be a pretty solid list and hopefully one of them will come up with something that is doable."

8. Google knows everything - There's been some talk recently about what the US economy might look like without the US dollar if there was a catastrophic collapse of confidence in the world's reserve currency.

People have talked about gold and silver and Australian dollars and Canadian dollars. As ever, Google seems to be ahead of everyone. It has just bought a virtual currency company called Jambool, paidcontent.org reports.

Along with analytics and demand-side platforms, social payment startups are a current favorite among investors and companies like Google which are looking to keep acquiring.

Jambool’s ‘Social Gold’ platform lets developers create their own white-labeled virtual currency systems. It powers virtual payment systems within big name apps and online games, including Lil’ Green Patch and Mafia Wars.

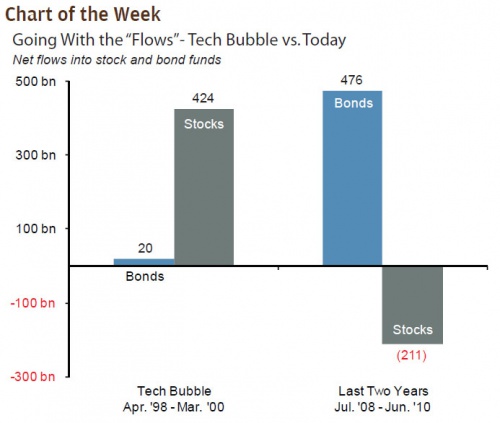

9. Bond bubble part II - This chart referred to by Zerohedge is an eyeopener on how much money has been pumped into US Treasuries compared to the tech bubble circa 2000.

JPMorgan has tallied the total flows into stocks in advance of the tech bubble (April 1998 through March 2000) and compared it to the period since the Lehman collapse (July 2008 through June 2010), the result is surprising: there has been over $50 billion more allocated to bonds in the past 2 year period ($476 billion), than to stocks in advance of the biggest market bubble pop before the housing/credit bubble popped in 2007/8.

Totally irrelevant video - Ricky Gervais is a doctor on Louis CK. It's a bit rude.... HT @DavidSlack via Twitter Click through as no embeds.

Another totally irrelevant video - For techies. A movie trailer about programmers who won't use .net. My favourite bit is the hot young lady on a Raleigh 20 who thinks java programmers are lovely. Ho ho ho. HT @rhyslewis via twitter.

9 Comments

FYI here's an interesting piece in The Australian about a housing supply shortage and why it's a problem.

It mentions user pays infrastructure as an issue. Interesting thought. HT Hugh P via email.

"Infrastructure taxes and charges on new residential activity are an inequitable method of funding residential infrastructure, which requires the final new home buyer to bear the cost of infrastructure that will benefit the entire community.

Is it fair that a small part of the community, the new house buyer, must in effect fund the infrastructure for the next five generations?"

http://www.theaustralian.com.au/business/time-to-fight-the-growing-hous…

cheers

Bernard

US student loans are now bigger than credit card debt

HT John Walley via email.

http://blogs.wsj.com/economics/2010/08/09/student-loan-debt-surpasses-c…

cheers

Bernard

New Zealand has around NZ$11 billion of student loan debt, which is more than twice the NZ$5.3 billion owing on credit cards.

cheers

Bernard

These charts showing how much the US economy needs to grow are a tad interesting. HT Gertraud

http://www.zerohedge.com/article/above-trend-gdp-growth-ever-sstf

cheers

Bernard

I own it to live in it. It's not an investment decision. It's a lifestyle decision.

The difference is with people who buy property as an investment.

cheers

Bernard

Brent Wheeler suggests here we shouldn't go overboard with any rewrite of our capital market rules.

http://brentwheeler.com/finance.php?itemid=841

cheers

Bernard

Mortgage fraud in the UK has soared to a 22 year high. Seen similar here? HT Fairfax O'Rourke

http://www.independent.co.uk/news/business/news/mortgage-fraud-cases-so…

As we approach the eve of QE II it's worth reading this piece from Todd Harrison at Minyanville. HT Michael

"As we navigate unchartered waters and sail through The Eye of the Financial Storm, an increasing number of people are weighing their options -- and some of the smarter folks I know are “going dark.”

What does that mean? They’re selling businesses, unwinding trading operations, or otherwise insulating themselves from the capital markets."

http://www.minyanville.com/businessmarkets/articles/todd-harrison-stock…

cheers

Bernard

FYI House prices down 73% in Stockton North California HT blair rogers @bmr789

http://www.latimes.com/business/la-fi-inland-20100809,0,7550167.story?track=rss

cheers

Bernard

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.