Here are my Top 10 links from around the Internet at 10 past 12 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Wednesday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream under the Top 10.

1. 'Not enough good debt' - Christopher Worthington from Gareth Morgan Investments writes in the NZHerald challenging those among us who have a religious fervour about debt deleveraging.

He says debt may not be the problem.

There just wasn't enough good debt, Worthington says.

Does anyone else think that would make a good Tui billboard?

He does make some interesting points about intergenerational wealth transfer which may be both profoundly depressing and true.

He says deleveraging may not happen because the babyboomers will not let it happen.

They will force the young to take on the debt to pay for the babyboomers retirement...

The deleveraging story may be completely back to front. The problem is not too much debt, but not enough of the good stuff.

The crisis and aftermath are both consistent with the notion that the demand for risk-free bonds is growing faster than supply. That growing demand was another potential cause of the credit crisis. It led to a large market for newly-created "safe" assets - the CDOs that were manufactured to turn sub-prime mortgages into (supposedly) AAA bonds.

So we come to the final piece of the puzzle: why is there so much demand for safe assets? The first reason is that developed economy assets are very attractive to developing countries like China with weaker social safety-nets, and oil-producing countries looking to sock away the windfalls from high oil prices.

The second reason, and perhaps the strongest argument against the idea of deleveraging, is the ageing of developed world populations. If the baby boomer generation is to maintain a high standard of living in retirement, despite a higher ratio of retirees to workers, then they must build a large claim over future workers' earnings.

In other words, they must keep lending to younger workers and allow them to build up their debt. A world where, instead, debt ratios fall for the next 20 years, is one where the baby boomers either work until they're carted away or eke out their retirement on arrowroot biscuits in Bluff.

2. Housing fading as a store of wealth - The New York Times reports that housing wealth in America may never recover to the levels it was at before the bubble burst.

Couldn't happen here could it? Or could it? HT Sargon via email

“There is no iron law that real estate must appreciate,” said Stan Humphries, chief economist for the real estate site Zillow. “All those theories advanced during the boom about why housing is special — that more people are choosing to spend more on housing, that more people are moving to the coasts, that we were running out of usable land — didn’t hold up.”

Instead, Mr. Humphries and other economists say, housing values will only keep up with inflation. A home will return the money an owner puts in each month, but will not multiply the investment.

Dean Baker, co-director of the Center for Economic and Policy Research, estimates that it will take 20 years to recoup the $6 trillion of housing wealth that has been lost since 2005. After adjusting for inflation, values will never catch up.

3. 'Like a mirror image' - Jeff Opdyke at the Wall St Journal has written here about the strong inverse correlation between gold and the US dollar.

Despite the apparent recent strength in the US dollar and 'safe haven' US Treasuries, I wonder about how much real confidence there is in the US dollar.

The chart is the thing. HT Nicola at NZMint.

So if inflation doesn't push and pull at gold prices, what might it be? If you believe correlation studies, the answer is the U.S. dollar. Going back to 1973—a period that defines the modern, non-gold-backed dollar—the greenback's movements closely track gold's direction.

The correlation between month-end gold prices and the Major Currencies Dollar Index, as reported by the Federal Reserve, is minus-0.45. That clearly is a stronger correlation than you find with inflation. But let's take this a bit further. Let's shorten the time frame to the period from gold's 1980 peak to today. The result: Over the past 30 years, the correlation between the dollar and gold is minus-0.65—a high negative correlation. It means the dollar and gold are effectively on opposite ends of a seesaw. When the dollar is in favor, gold retreats.

When it is under pressure, gold prices swell. Look at the nearby chart. It is like a photo of a mountain scene reflected in a tranquil lake. The rises and falls and horizontal meanderings of gold are nearly the negative of the dollar's. The implication is that gold isn't a commodity—at least not one that hews to the definition of something that people and industry consume. Instead, "gold is a currency" whose daily price is a gauge of the market's concern about the "potential diminishment" of the purchasing power of the dollar and other paper currencies, says Paul Brodsky, a principal at New York's QB Asset Management.

4. 'Brace yourself' - Now commercial property loans in America are coming under intense pressure, Mish points at at Global Economic Analysis. HT Hugh P via email.

Bernanke's stimulus efforts did next to nothing for residential housing, and absolutely nothing for commercial real estate. With a wave of maturities coming due, and with lease prices still dropping, pressures on commercial real estate are enormous. Moreover, it is crystal clear that the economy is headed back towards recession, assuming of course one believes the recession that started in 2007 ever ended.

I suggest the recession never ended in light of the fact that 3rd Quarter GDP was Likely Negative. How much patience lenders have in a weakening economic environment to restructure loans remains to be seen, but surely it isn't infinite.

Given that regional banks are in general the ones with the most commercial real estate exposure, it should not be too difficult to look one step ahead and see the effects of another economic downturn on mid-sized banks.

Brace yourself because the recovery of 2009 was nothing but a statistical mirage fueled by unsustainable government spending and bank bailouts. That mirage is rapidly fading off into the sunset.

5. 'Imagine being kicked or bitten by one' - Perhaps the future is camels. The European Union has granted the United Arab Emirates the first license to export camel milk products to Europe, the Chicago Tribune reports. The brand is Camelicious. I'm not kidding.

Maybe this is something New Zealand could do. I'd love to see Allan Crafar try to ride one.

"We know this isn't what you'd call a mainstream product in the West," said David Wernery, legal adviser for the Camelicious brand, whose parent company goes by the more staid name of Emirates Industry for Camel Milk & Products. "We're thinking about health food stores and alternative markets. It's probably going to be a niche thing at first."

It would be something of a coming-out party for the small but passionate community that describes camel milk in awed tones. It has at least three times more vitamin C than cow's milk and is considered an alternative for the lactose-intolerant. Researchers have studied possible roles for camel milk in fighting bacteria, tumors and diabetes, as well as traditional uses such as a treatment for liver disease across the range from central Asia to North Africa.

6. 'Enron Accounting' - Boston University Economics Professor Laurence Kotlikoff tells YahooFinance that the US debt is closer to US$202 trillion, not the US$13.3 trillion officially touted. HT Gertraud via email.

“Forget the official debt,” he tells Aaron. The “real” debt - including non-budgetary items like unfunded liabilities of Medicare, Medicaid, Social Security and the defense budget - is actually US$202 trillion, the professor and author calculates; or 15 times the “official" numbers. “Congress has engaged in Enron accounting,” says Kotlikoff

Yet, the debt market continues to have an insatiable appetite for U.S. Treasuries; heading into Monday's session, the yield on the 30-year Treasury bond (which moves in opposition to its price) was at its lowest level since April 2009.

Kotlikoff says that's because the market is focused on the "mole hill" of official debt. In time, the U.S. will have a major inflation problem to rival that of Germany's post World War I Weimar Republic, he predicts.

“We have to think about the fact that unless the government gets its fiscal act in order we’re going to have the government printing lots and lots money to pay these enormous bills that are coming due over time.”

Bacon prices are up US$1 or 33% a pound. HT Troy via email. Americans seem to be putting bacon into everything. Even bras. And mints.

"This is about as tight as we've ever seen it," Muelhaupt said. Once only a breakfast staple, bacon now is a round-the-clock food for all manners of dishes.

Rich Nelson, analyst for Allendale Inc. in Illinois, said demand is up because restaurants, seeking to regain business lost to the tight economy last year, have been adding more bacon to sandwiches and salads to spice flavors. "Pork bellies are always a premium cut," Nelson said.

"But this is unreal. A year ago, bellies were 18 percent above hog prices. Now the spread has widened."

8. ECB printing again - Europe still looks the mostly likely source of the next blowup in the Global Financial Crisis. The European Central Bank quietly started buying a lot more government bonds overnight, the WSJ reported.

In a sign of more trouble brewing in Europe, the European Central Bank is ratcheting up its emergency relief program for weak euro zone economies again. The ECB on Monday said it bought well over 300 million euros worth of euro zone government debt between August 12 and 14, according to Dow Jones Newswires.

That’s much higher than the 10 million euros worth it bought during the previous week. The ECB’s increased bond purchases reflect the tougher climate we’ve seen recently in the bond markets of countries like Ireland and Greece. For weeks, investors have speculated that the ECB has been buying Irish debt after renewed worries about its banks drove credit spreads wider.

While the ECB doesn’t say whose bonds it bought, the new figures provide fresh ammo for the “ECB needing to help Ireland” theory.

Greece’s cost of borrowing for 10 years hit 11% from 10.91% on Friday, while Ireland continues to pay an eye-watering premium over Germany’s borrowing rate to finance itself.

“There are no signs of a change in sentiment,” analysts at Barclays Capital wrote Monday. “During the past two weeks, if anything, the outlook has begun deteriorating once more.” In short, Europe’s debt crisis hasn’t gone away, it’s just gone into hibernation. Investors should keep their eyes peeled for more trouble.

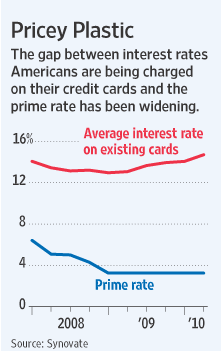

9. Expensive credit (cards) - This chart from Naked Capitalism tells the story of widening lending margins in America, particularly in credit cards, where typical rates are still well over 15% while the OCR there is 0.25%.

9. Expensive credit (cards) - This chart from Naked Capitalism tells the story of widening lending margins in America, particularly in credit cards, where typical rates are still well over 15% while the OCR there is 0.25%.

Here's Yves Smith's take on it.

She says these rising interest rates are compounding the deleveraging going on among consumers and small businesses.

Luckily in New Zealand, credit card borrowing (around NZ$5.5 billion) is much, much smaller than housing borrowing (NZ$190 billion) so is not such a factor, but...

Even though banks are getting all kinds of bennies from the Fed and regulators, such as a nice steep yield curve and lots of regulatory forbearance (econ-speak for extend and pretend), they are still out to extract a pound of flesh from the retail borrower. Since that has been a core element of their business model for the last decade, it is probably not so surprising that they are loath to give that practice up.

Now some will argue, correctly, that consumers need to delever. But guess what? They are paring debt levels, including credit cards. The number of open accounts has fallen by over 20% since the peak, as has the balance outstanding (over 6%). And not all of this has been voluntary. Banks have been shutting accounts and cutting credit lines. But (drumroll) increasing interest rates, particularly when the banks are getting very sizeable subsidies, means that more of the money consumers pay to credit card companies goes to interest, less to reducing principal (of course, the banks will maintain that they are merely recouping lost income from penalties, since new credit card rules have curbed abusive practices).

A more serious issue is that not all consumer debt is consumer debt. Credit cards have long been an important source of funding for small businesses. Generally speaking, banks will lend only to relatively large, established “small” businesses, or against assets.

For instance, Amar Bhide, in his landmark book on new venture, found that the biggest sources of funding for new enterprises were savings, friends and family, and credit cards. Small business owners often use credit cards to contend with temporary cash flow shortfalls or seasonal borrowing needs. And I’ve known some who have maxed out their credit cards to save their companies.

10. Totally irrelevant video - Here's Jon Stewart on the Mosque issue in New York. I've avoided this until now. Worth a watch.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Extremist Makeover - Team Mohammed vs. Team Jesus | ||||

|

||||

10 Comments

re #5 and the camels

bh:"I'd love to see Allan Crafar try to ride one."

yeah but it's getting him off it that's the tough part. da dum pshhhhh

The cat is finally out of the bag. Mind you his record in public communications doesn't bode well if he intends to use it inflation controlling tool. Much like having a toothless guard dog.

John Key interviewed on Bloomberg.

http://noir.bloomberg.com/avp/avp.htm?N=av&T=N.Z.'s%20Key%20Says%20Fina…

Ok now that was cute, lol.

So what is it, (hyper) inflation or deflation? http://www.zerohedge.com/article/guest-post-how-hyperinflation-will-hap…. 600 plus comments. Here's my pick. The price of oil increases, this gives the $US more time, next crisis US fed extends further currency swaps to all other central banks in the "club" all goes well till one breaks ranks either when the price of gold can no longer be suppressed (see FOFOA) or it becomes cheaper to buy oil with non USD.

A higher oil price makes it more expensive to buy oil for everyone except the US who effectively print the money necessary, so its a transfer of wealth to the US for as long as US$ are needed to buy oil and this is what props the US$. Agreed there is a point at which this trips out and it might be $147.

re number 7

those aren't pork bellies

Interesting article on the decine of the USA from the Guardian : http://www.guardian.co.uk/business/2010/aug/23/us-economy-unemployment-property-market

Hmm, this lack of transparency surrounding UK govt views on peak oil is a tad concerning. http://www.guardian.co.uk/business/2010/aug/22/peak-oil-department-energy-climate-change

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.