Here are my Top 10 links from around the Internet at 10 to 6 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Wednesday's Top 10 at 10 via email to bernard.hickey@interest.co.nz. I'll pop any surplus suggestions I get into the comment stream under the Top 10.

Zerohedge points out US spending and bond issuance is out of control and all it would take is a rise in long term bond yields to blow the US government out of the fiscal water.

When will the US bond bubble burst?

Or will it just float on forever in a massive act of blind faith in American democracy and military power?

Today, the US Treasury department disclosed that its August deficit was a slightly better than expected $90.5 billion, compared to $103.6 billion in the year prior. What received less fanfare was that the comparable increase in debt in the month of August 2010 was $212 billion, compared to $143.6 billion a year earlier. In other words, more than twice the the deficit had to be issued in the month of August.

Over the past 47 months, or almost 4 full fiscal years, the US has accumulated a $3.3 trillion deficit, while over the same period, total Federal debt increased by $4.9 trillion, from $8.6 trillion to $13.4 trillion. What many pundits have yet to realize is that on average the US issues exactly 50% more debt than it needs to merely fund its deficit: whether the difference goes to fund intertemporaral differences in short-term debt maturities is irrelevant: the point is that the $10 trillion in deficits over the next 10 years, will most surely result in at least $15 trillion of new debt.

We say at least, because if interest rates pick up, the US will have to issue more and more debt just to fund interest payments. Incidentally, this month 8% of all tax revenues went to fund interest expense: this is an increase from the roughly 5% spent on interest outlays in early 2010. Already the trend of interest funding is one of increase, and rates are still near record all-time lows. Just wait until the 10 Year is back at 5-6%.

2. Grain feeding a problem - One of New Zealand's good points is that our cows and sheep are not grain fed, thus avoiding the sort of venom directed by staunch vegans against wasteful factory farms that pump cattle full of water and land sucking grain.

Now poster boy vegan supporter George Monbiot at the Guardian has recanted on his staunch veganism. This opens up an interesting angle for our meat marketers in Britain. We should push the grass fed thing much, much harder.

If pigs are fed on residues and waste, and cattle on straw, stovers and grass from fallows and rangelands – food for which humans don't compete – meat becomes a very efficient means of food production. Even though it is tilted by the profligate use of grain in rich countries, the global average conversion ratio of useful plant food to useful meat is not the 5:1 or 10:1 cited by almost everyone, but less than 2:1.

If we stopped feeding edible grain to animals, we could still produce around half the current global meat supply with no loss to human nutrition: in fact it's a significant net gain. It's the second half – the stuffing of animals with grain to boost meat and milk consumption, mostly in the rich world – which reduces the total food supply. Cut this portion out and you would create an increase in available food which could support 1.3 billion people. Fairlie argues we could afford to use a small amount of grain for feeding livestock, allowing animals to mop up grain surpluses in good years and slaughtering them in lean ones.

This would allow us to consume a bit more than half the world's current volume of animal products, which means a good deal less than in the average western diet.

3. The problem with Basel III - The Australian banks (meaning ours) have brushed off suggestions tougher new Basel III capital rules will force them to raise fresh capital. That's true, but it doesn't disquise the need for European banks such as Deutsche, Credit Suisse and UBS to raise close to US$60 billion, Zerohedge points out.

All this will drain the well globally for capital in invest in banks in all parts of the world.

And our banks are still dependent on foreign funding.

4. China's water crisis - CNN reports China can't dam or divert water quickly enough to keep up with its thirsty population and industry.

In northern China this month, farm fields have developed cracks up to 10 meters (32.8 feet) deep. Farmers in Chifeng city have had to delay harvests to avoid injury, the state-run Xinhua news agency reported. According to the Chifeng's hydrological bureau, 62 percent of the city's 51 reservoirs have run dry, Xinhua said.

More than 250,000 people are short on drinking water. In southwest China's Guizhou province in August, a drought affected more than 600,000 people and nearly 250,000 heads of livestock, according to Xihua. Parched soil in rice fields was covered with cracks. Beijing's water shortage will soon reach 200 million to 300 million cubic meters, even as the city waits for a new diversion of water from southern China, according to state-run media.

At a conference co-hosted by the IMF and the International Labor Organization, visiting Spanish Prime Minister Jose Luis Rodriquez Zapatero said high unemployment may trigger a "crisis of confidence" in Europe.

The IMF said more and more workers worldwide were unable to find jobs for longer periods, weakening social cohesion and raising risks of unrest and even undermining democracy.

"The labor market is in dire straits," IMF Managing Director Dominique Strauss-Kahn told the one-day meeting, adding that the Great Recession had left a "wasteland of joblessness."

"We must acknowledge that the crisis will not be over until unemployment declines significantly," he said, calling growth and jobs the "most urgent problems."

6. The global landgrab backlash - Ambrose Evans Pritchard at the Telegraph picks up on the World Bank land grab report I mentioned a few days ago. He documents how Latin America is drawing up laws to stop foreigners buying land. But apparently not Uruguay... HT Darryl/Gertraud via email.

Hedge funds that struck rich 'shorting' US sub-prime have rotated into the next great play of our era: 'long’ soil. "Productive agricultural land with water on site, will be very valuable in the future. And I've put a good amount of money into that," said Michael Burry, star of 'The Big Short'.

Needless to say, this has set off a fierce backlash. Brazil has passed a decree limiting acreage held by foreign-owned companies, the latest evidence that our half-century era of globalisation may be drawing to a close. Authorities are probing whether firms are using local fronts to disguise investment in Mato Grosso and Amazonia.

"Brazilian land must stay in the hands of Brazilians," said the farm development minister, Guilherme Cassel. It is starting to feel like the early 1970s when the military regime more or less froze out foreign buyers.

7. More US house price falls - The WSJ points out US house prices are set to fall again as banks start foreclosing again after government measures to slow things down wear off.

"We see the perfect storm brewing with rising supply and falling demand," said Ivy Zelman, chief executive of research firm Zelman & Associates and one of the first to warn of trouble five years ago. She estimated that distressed sales could account for half of the market by year-end if traditional sales didn't rebound.

8. And even the banks see falls - William Alden at HuffPo points out Capital One CEO Richard Fairbank sees the potential for further falls in US house prices. He should know. His bank is sitting on a bunch of unsold inventory. HT John Walley.

Capital One CEO Richard Fairbank was pessimistic about the housing market and about consumer demand -- but optimistic about his bank's prospects. Fairbank, in remarks that were broadcast on the web, was asked by an audience member whether there will be a double-dip in the housing market. He chose his words carefully.

"I think we feel very cautious about the housing market," Fairbank said. "I think that even despite some of the recent months where home prices have gone up, I think it's a very plausible case for home prices to go back down again." His dim view of the U.S. housing market, he said, is based on the current "logjam" of defaulted mortgages and foreclosures being dealt with at Capital One, which added a retail banking arm to its lending and credit card businesses in 2005.

"Unsold inventory is really at just about an all-time high."

9. Basle's Maginot line - Joseph Cotterill at FTAlphaville has a useful roundup up of what the Basel III changes mean. He points out that Basel and the market has focused on capital strength when liquidity may be the real issue, particularly given the long lead in time to fix this. HT Kevin via IM

It’s not the capital, it’s the liquidity. It’s not the Maginot Line; it’s how many Panzers are pummelling through the Ardennes beside it. And thus it’s not Basel III; it’s what banks will do — and where they will find the liquidity and the counterparties to do so — to get around it.

Arguably, the liquidity standard that the Basle committee is proposing will be more relevant to heading off a re-run of 2007-09 than changes in the banks’ capital requirements.

After all, most banks remained solvent through the crisis without government help to shore up their capital. What led these banks to rein back their lending to the broader economy, with dramatic impact on general business activity, was the spreading illiquidity that caused money markets to seize up. If banks had held more liquid assets going into that time of stress, and had been less dependent on wholesale funding, they might not have felt so keenly a sense of urgency in cutting back loan exposures.

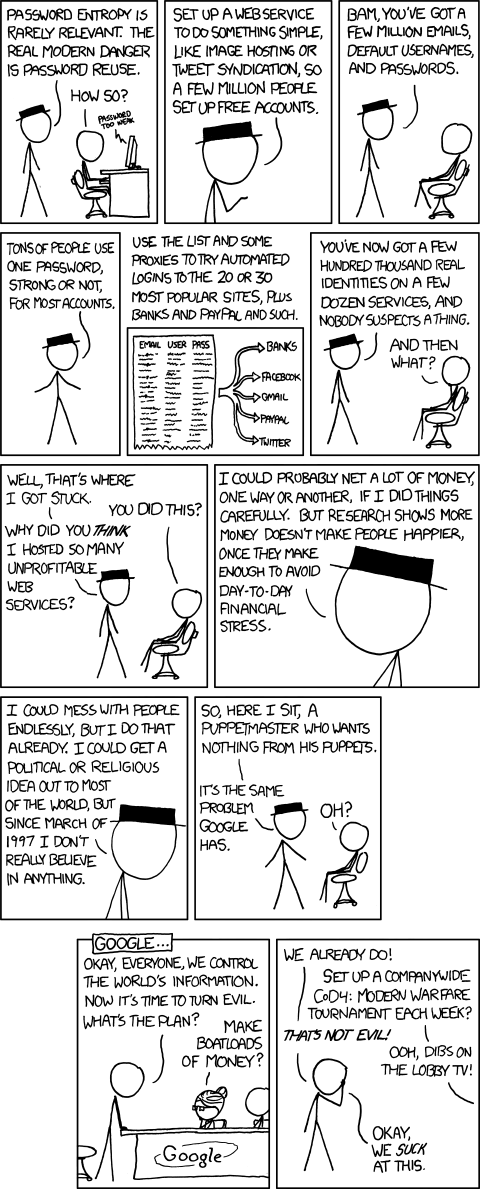

10. Totally irrelevant cartoon - For Geeks and Google lovers among us.

12 Comments

No 2, 4 and 6 are all related. In an over-populated, resource constrained and climate impacted world, the most valuable assets will be arable land, especially where water is readily available.

All good news for NZ and all good reasons why we should not be selling our greatest assets.

An excellent book to get an understanding of the challenges is "The Meaning of the 21st Century" by James Martin.

I am sure PowderdownKiwi has read this as he has been delivering the consistent, valuable message for a long time.

Nope, never heard of it - but I'll look it out!

These days, I tend to read the optomist/spin/hype types, kind of 'try and understand your enemy'.

Doesn't take long!

Oh and our farmers want to feed animals palm kernels and corn....and suck out even more water.....

All I can hope is somewhere around the world (and not us) there will be a major collapse of the aquifiers (gaza?) and the rest of us we wake up to our stupidity of over extracting.

Fat chance I know....what will happen is the NZ farmers etc will carry on over-extracting because everytime someone objects they will use legal avenues or political ones to get what they want...and then when the aquifier collapses they will use the same tactics to get compensation / govn bailouts because the govn/regional council 'allowed them to"

ppl must be simply stupid.

regards

Re #10

Now we now why Bernard wants commenters to register!

Re #1: "When will the US bond bubble burst? Or will it just float on forever in a massive act of blind faith in American democracy and military power?"

The bubble will not burst because as the sovereign issuer of US dollars, the US government will never default - unless is CHOOSES to.

It is never revenue constrained.

As long as the economy is not saturated, it can credit accounts of bond holders to pay interest indefinitely without risk of inflation.

The market understands this. This is why the yields are low: the risk is low.

The irony is that Interest payments on borrowed money is inflationary in of itself.

This is why the US government should not borrow to spend.

Its becoming increasingly obvious that NZs water/land resources are going to be an extremely valuable assets. I believe NZ agriculture/ horticulture/ aquaculture are on the verge of a sustained golden era. If managed correctly this is very positive news for NZ indeed.

Aquaculture is a maybe; as I've mentioned here before, nobody gets the fact that aquaculture is not a free lunch.

It is part of an energy back-line called the food-chain.

We all understand the need to return nutrient to paddocks, or they will end up dustbowls.

Nobody is even contemplating what is going to be displaced down-chain by aquaculture intruding. It has to impact directly on conventional fisheries - if I was a quota holder in the proposed areas, I'd be very uneasy indeed.

um...dont forget we over fish conventional fisheries....so that wont be an issue then...

;]

regards

We should push the grass fed thing much, much harder.

You're not wrong, Bernard. That's the competitive advantage. You won't find E Coli in grass fed beef. It's the grain fed cows that get that.

Free range beef is the equivalernt to free range eggs. If NZ was smart, we would be charging twice as much for our meat compared with the unhealthy, tastelss, greasy feedlot meat. That is if we still own the NZ farms and cattle? Oh, we just shovel the shit these days for the boss.

Many ppl dont care...they just want meat at the lowest price, or might pay a small premium if they were convinced it was quality...Grass fed is cheaper so even if we sell at the same price as corn fed its a bigger profit....

In terms of convincing ppl we have a premium product, personally I feel that the marketing has got so un-realistic that there is no way to honestly determine if there is the slightest bit of truth in anything said., so I work on buying the cheapest thing consistant with it looks OK....not very scientific I agree....but I cant see any other option....price is no indication of quality...

regards

Clearly Don Brash, there is significant flow on effects for agricultures income increasing. You only have to go to any Ag fieldays like Mystery creek or Lincoln to see how many companies and livelyhoods are feeding off the nipple.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.