Here are my Top 10 links from around the Internet at 10 to 7 pm, brought to you in association with New Zealand Mint for your reading pleasure. I welcome your additions and comments below, or please send suggestions for Thursday's Top 10 at 10 via email to bernard.hickey@interest.co.nz. I'll pop any surplus suggestions I get into the comment stream under the Top 10.

1. How much needs to be printed ?- Ambrose Evans Pritchard reports some people think the Federal Reserve needs to buy US$30 trillion of government bonds to have an impact. Yikes. What would that do to the New Zealand dollar vs the US dollar? The chart below gives an idea. It doesn't bear thinking about.

Here is a back-of-an-envelope guess by David Greenlaw at Morgan Stanley on what the Fed can expect from a second blitz of bond purchases, or `Shock & Awe’ as he calls it. If Ben Bernanke does a further $2 trillion (on top of the $1.7 trillion already in the bag) the yield on 10-year US Treasuries will drop 50 basis points to around 2.2pc.

GDP growth will be 0.3pc higher than otherwise in 2011 and 0.4pc higher in 2012. The unemployment rate will be 0.3pc lower in 2011 and 0.5pc lower in 2012 — (in other words drop from 9.6pc to 9.1pc, ceteris paribus).

That looks like trivial returns for a collosal adventure into the unknown, with risks of dollar flight and mounting Chinese suspicions that the US intends to default on its external debts by debasement.

I had dinner recently with a former Goldman Sachs hedge fund guru, and while I can’t remember the exact details through a fog of Mersault Premier Cru, I am pretty sure he said it would take $30 trillion to do the job – given the scale of wealth destruction from the US property crash and ferocity of debt deleveraging still to come.

2. Target the liquidators and receivers? - Australian authorities are wondering whether liquidators and receivers can be trusted and are even asking if the regulators are doing a good job of stopping white collar crime in the corporate clean up industry, BusinessDay reports.

There are real risks liquidators and receivers sell assets cheaply to their mates. I hope someone is keeping an eye on all the liquidators and receivers here, particularly given the taxpayer money at stake in South Canterbury, Mascot and Allied Nationwide.

A SENATE inquiry report will call for the corporate watchdog to lose it power over the insolvency industry because the Australian Securities and Investments Commission has responded too slowly to complaints raised by high-profile corporate collapses such as ABC Learning, Opes Prime and Storm Financial.

The report is expected to recommend a new regulator be set up to oversee personal bankruptcies and corporate insolvencies and call for a flying squad with powers to investigate complaints against liquidators. Senator John Williams, who initiated the inquiry, refused to comment on the report but called for a royal commission into white-collar crime in Australia.

"When I am told about wrongdoings by banks, liquidators, solicitors and auditors it makes me more convinced that we should have a royal commission into white collar crime in Australia," he said. "I have been told of many actions of wrongdoings. If white-collar crime is systemic in Australia then it should be brought to an immediate halt and a royal commission with wide-ranging terms of reference would be the best way to do this."

3. China hunts for Potash - Caixin reports China is keen to get its hands on Potash as it hunts the globe for stuff that makes and grows other stuff.

Access to affordably priced potash that China needs to fertilize farm crops could become more challenging if BHP buys the Canadian company. China fears a new resource struggle similar to the battle it's waged over iron ore dug from overseas mines – including some under BHP control – whose owners have become increasingly concentrated in recent years. So it yearns for ways to control prices and maintain supplies of Canadian potash.

The response so far has been to elevate previously little-known Zhongchuan International Mining Holding Ltd. to the status of industry star. The company drew fresh attention from government and industry following the BHP bid. And now, it's hoping to win government financing for a major project.

4. Watch out for a gnarly ride - The WSJ looks at economists' reaction to the Fed's statement about being ready to intervene again.

These comments represent the third step down the barrel of a potentially gnarly ride. After June’s comments about commodities deflation, August’s assessment of lower but stable inflation, and September’s inflation-too-low statement, there is strong evidence to suggest that, despite all public appearances, the FOMC is growing concerned about outright core deflation.

Bernanke’s wearing yum yum yellow against a backdrop of bond sharks, but before he jumps in, we’ll likely need to see outright evidence of declining price levels, something that could — emphasis on “could” — hit in early 2011 at the soonest.

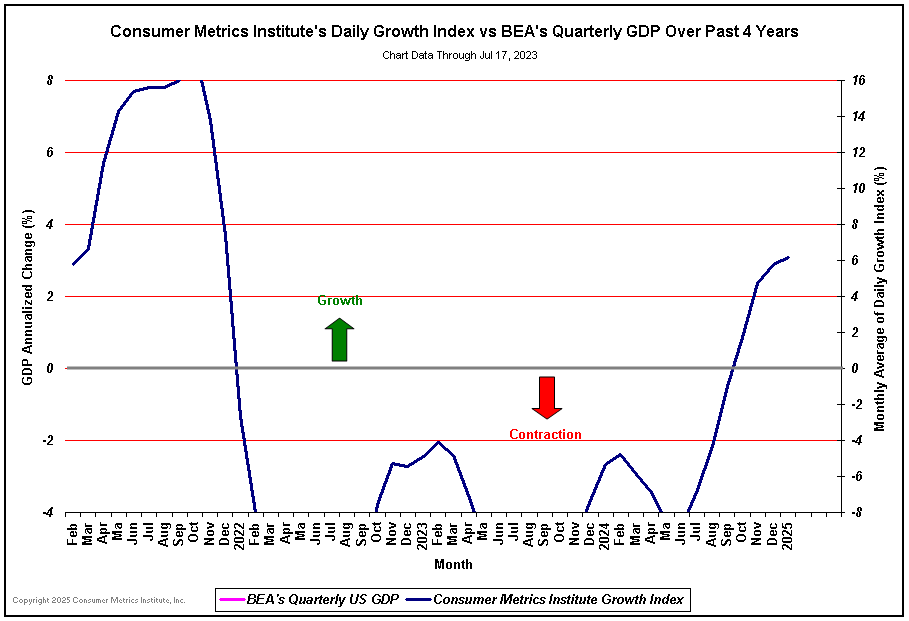

5. This chart shows real time statistics on sales online in America and how much of a leading indicator it is of GDP. It's not pretty.

7. 'Let's have a closer look' - Labour Finance spokesman David Cunliffe is calling for a closer look at the circumstances around the decision to put South Canterbury Finance into receivership.

He will need to tread carefully. There is an awful lot of heat and speculation around. He makes these points in his comments to the blog post on Red Alert.

Overall there are three high level hypotheses being debated:

– was the Govt prudent and successful in minimising the liability to taxpayers in its handling of SCF?

– were the actions of regulators and decision makers at all levels transparent, appropriate and prudent?

– who wins and loses from the result and is that result seen to be fair and appropriate?

8. Not if but how - Morgan Stanley details in this piece how governments will default rather than whether they will default.

9. The drums are beating - David Leonhardt has a nice piece in the New York Times talking about the problems between America and China and how a higher renminbi/yuan may not solve America's problems immediately.

Then, of course, there are those bills before Congress ominously threatening to put new tariffs on Chinese imports. The bills have definitely gotten China’s attention. If anything, they are a hotter topic in Beijing than in Washington, filling state-run newspapers and broadcasts. The tricky part now is using the credible threat of tariffs to force a faster rise in the renminbi — which is up only 1.6 percent since 2008, mostly in the last two weeks — without setting off a trade war that would cost jobs in both countries. With the benefit of hindsight, we can see the real lesson of that story about the yen is that success can take time.

The yen has continued to gain strength since the 1980s and, even after its fall in the last week, it is still more than twice as high versus the dollar as in 1985. Not coincidentally, the trade deficit with Japan, as a share of the economy, has shrunk 66 percent. This is the path that rising economic powers, from Germany to the United States to Japan, have taken before. They start as exporters and then build up a thriving domestic economy. (Japan, alas, hasn’t been so good at the second part.)

It’s the path China needs to take now, for the sake of its citizens and for the world. The currency move of the past couple of weeks is a good start — so long as it continues.

10. Totally irrelevant video - Even beer looks much better in slo-mo. Even Australian beer. HT Ken Freer via twitter

29 Comments

"........he said it would take $30 trillion to do the job – given the scale of wealth destruction from the US property crash and ferocity of debt deleveraging still to come....."

Trust these people, they know what they are doing. They were wrong about the property bubble in the first place, but we can rely on their $30 trillion of printed money to turn the US - and the world - economy round.

Old Chinese curse: "May you live in interesting times".

http://gerrycanavan.wordpress.com/2010/09/05/the-apocalypse-is-already-…

I liked this line from William Gibson

“The apocalypse is already here; it's just unevenly distributed.”

#7, they seem to be three very reasonable questions. Especially so when considering the disclosures we've had in Alan Bollard's recent book around the banking problems last year which leaves one to wonder if government are similarly unjustified in denying an inquiry here, as they did for the banking problems?

I'd rather not rely on the chance of someone coming out with inside information in a private book venture at a later date - conveniently after the next election say. The small cost of an inquiry could well be worth the benefit to support democracy and the integrity of our institutions - as it seems would have been the case with the requested banking inquiry where we now know, a little of, what really went on, thanks to Alan Bollard. Cheers, Les. www.mea.org.nz#1 Americans won't print $30 trillion. They are going to systematically devalue the dollar not shock and awe. Probably will run this printing game till everything is priced in SDRs.

Thanks Iain for another competent comment.

It's ostrich, not osterich, which is an eastern wealthy person, rather than an overgrown turkey

Anno, annas, annat,

annanus, annatus ?

takes me back.....

Well that's what happens when car salesmen become journalists..politicians...Mayors...and Foreign affairs advisors...it's all about the fluff Iain....... just like on the telly.......if you got to package and sell it to an idiot...it has to reflect that market.

What's your point, Iain?

He's a secret gold bug Muzza!

There's nothing in Evans-Pritchard's article that links the over-valuation graph to another $30T of QE. I think what he is suggesting is that is what the situation is right now.

The minute it becomes obvious the Fed is embarking on a QEII devaluation/default any institution that is holding US Treasuries will dump what they have. Long before Bernanke could purchase 30 Trillion, the bond vigilantes will put the knife in. Any American holding wealth will follow Jim Rogers to Hong Kong.

Obama's economic team is being disassembled just in time for mid-term elections that will almost certainly see a gridlocked Congress. In the end, printing 30 Trillion dollars in the world's reserve currency would be the financial equivalent of targeting every central bank in the world with an ICBM. The modern manufacturing infrastructure is still in Asia, debt will still have to be paid (whether in gold, SDR's, or commodities) and taxes will still be due.

It will be messy, but New Zealanders will be much better off than most others: We have plenty of water, favourable weather and decent food sources. And let's face it... the world's rich westerners will have to bunker down somewhere - why not here? Buy property.

Hi Iain, I agree with your comments and am watching with interest. Many of my farming friends are now facing the reality of some form of penury with the banks holding the strings

This guy is getting interesting

It has started.The world may not yet realise it, but Crash 2010 is underway. These things tend to start very quietly.

You are one of the very few people in the whole of this lovely planet that know this, so think carefully about how you use this information.

Some crazy movements in forex today. All indicative of massive confusion and stress at work.

Here is a guide to how far we might have to go.

TNX is the code for US treasuries' 10-year yield. When it is moving down, it signifies trouble ahead.

Lower rates tend to mean economic contraction & deflation.

You can see TNX is not far off it's lows of 2009, yet the SPX (S&P500) is way up still.

It is likely you will see S&P catch up, and soon, as the time lag is stretched so far already. TNX will keep on falling, so the S&P has to move fast to catch up. Give it a month or two, it'll be there.

Just watch the markets over the next week or two. Ignore mainstream media.

Just keep coming here!

Good luck.http://wealthadviseruk.blogspot.com/

"ignore mainstream media".

exellent advice. Been doing it for years.

Just listening the Business on Nat Radio - "an economist says" "an economist says" and "an economist says".

What, exactly, do the investigative reporters say?

You pay seed money, you apparently get parrots.

The quality of modern journalism is just shocking....even their english is poor and I consider myself at best semi-literate!

Then there is the content....if it isnt rugby or sport its laughable....

Hence why I do a quick flick past Stuff and wont buy a paper....its of no use.

regards

What I find amazing about the whole world financial situation is that governments and individuals alike have developed a mentality such that both look set to spend their last borrowed dollar on unnecessary 'stuff' which simply eats up valuable energy - take the Commonwealth Games for example.

Where NZ is concerned, I believe our government looks set to spend its last borrowed dollar on "saving" the South Island. I found it very interesting how it was reported that our local lending/insurance institutions would do okay given they were re-insured by offshore interests. Such a statement assumes those offshore institutions actually have the ability to pay. Only time will tell.

Chinaman getting too tubby....big worry for Beijing.....soldiers too fat for uniforms....how you change that!

It`s going to happen very soon. The great event which will end the horror. Which will end the sorrow. Next Tuesday, when the sun goes down, I will play the Moonlight Sonata backwards. This will reverse the effects of the world`s mad plunge into suffering, for the last 200 million years. What a lovely night that would be. What a sigh of relief, as the senile robins become bright red again, and the retired nightingales, pick up their dusty tails, and assert the majesty of creation!

I'd use Rachmaninov's Second.

Do it all by yourself though.

$13.476,661 trillion this is offical US total public debt as @ 22/09/10 how the hell is the Fed going to buy $30 trillion of treasury bonds or is Obama going to expand the Govt a tad more or perhaps the Fed is going to be buy the whole bond market worldwide.

Why should they ? That level of debt is manageable ......... Actually , on a per capita basis , it is similar to NZ's public debt level . ..........All the Fed want to do is to artifically stimulate a little inflation .

Good question Colin. I think this has been lost in translation somehow - Evans Pritchard does admit he was pretty pissed.

The $30T would have to include toxic mortgage debt, Commercial RE, Govt debt just about the lot. Total credit market debt in the US is about $52T

........ and as the books must balance , it follows that someone's debt is someone else's credit ............ which is probably manna for the oil rich states and some emerging market economies . America's folly in getting so deeply indebted is serving to enrich others around the globe ............ Cool !

Yeah, but the oil-rich states have a major problem. Internal poverty, lotsa sand, and an increasing demand for energy internally. When the flow stops, no finite amount of cash will keep any country going forever, and as energy dwindles, some of us think purchasability will too.

Yes and no Gummy Bear...you see if the someone with the debt goes up in smoke...then it don't matter what the promise to pay is written on.....the loot has gone pooof. Just what a whole heap of PIIGS bond holders are set to discover.

And that is why the Greek bond rate is so amazingly high , yet the Yankee one is ridiculously low . The market , through balancing fear and greed , arrives at acceptable levels . Beautiful when no idiot civil serpents or politicians poke their oar in . Capitalism can operate efficiency ............. when allowed to .

And that is why the Greek bond rate is so amazingly high , yet the Yankee one is ridiculously low . The market , through balancing fear and greed , arrives at acceptable levels . Beautiful when no idiot civil serpents or politicians poke their oar in . Capitalism can operate efficiency ............. when allowed to .

[ interesting , press the button once , and the comment appears twice ............. it must be humdingary good .............. that makes a change for me ............ way cool , man ]

Barry has a secret plan.....no he's not changing his name again...he plans on getting the morons in Congress to vote through a law that puts every Yank with tax code into a ballot and them what's lucky enuff to get their number pulled...they get invited to the White House...where they will be fleeced of a donation to save Aymereeka...about 10% of their estimated worth should do it...for that they get their picture taken with Barry and a wee flag to wave to the folks back home.

Well it's better than all the other plans...so don't knock it.

It's a good'un. With a couplea lookalikes and some mirrors, he should be able to up his productivity.

Always good.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.