Here are my Top 10 links from around the Internet at 10 to 7 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Monday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream.

1. The China worry - What might happen next year with China?

Could some sort of slowdown there affect demand for exports from New Zealand and Australia?

Could any Chinese slowdown burst the bubble in the Australian housing market?

The key will be when and how much interest rates are tightened there.

Bloomberg reports it might be quite some series of hikes.

One to watch.

China may raise interest rates up to six times by the end of next year as inflation becomes more entrenched in the economy, according to Mizuho Research Institute Ltd.

China’s central bank has relied on reserve-requirement ratios to help control liquidity, and with levels near 20 percent there’s little room for increases, said Takamoto Suzuki, a senior economist at the unit of Japan’s third-largest bank.

“A rate hike will be inevitable,” Tokyo-based Suzuki said. “It wouldn’t be surprising if the central bank lifts interest rates by about 1.5 percentage points by the end of next year.”

Let's face it. America is a corrupt plutocracy.

Mortgage firms are pressing the Federal Reserve to curb homeowners’ right to invalidate loans based on flawed documents -- a right consumer groups say is one of the few weapons borrowers have to battle unfair lending. Consumer groups and industry lawyers say a rule under consideration by the central bank would make it harder for borrowers to exercise their right of “rescission,” which forces a lender to relinquish a lien on a mortgaged property.

Lenders are pressing the Federal Reserve to act on the issue now because starting in July, rescission rules will come under the purview of the new Consumer Financial Protection Bureau, industry lawyers said.

“I cannot understand why the Fed is rushing through this voluntary gift to the banks unless the Fed is afraid that if it doesn’t curtail the rights of rescission now, it will never happen,” said Kathleen Engel, a professor at Suffolk University Law School in Boston.

The right of rescission was established by the 1968 Truth in Lending Act. Borrowers who can show a material misstatement in loan documents have three years to issue a rescission notice to the lender, who must revoke its lien on the property.

3. Coming down the line - Bloomberg reports that new international bank capital rules from the Basel committee would have forced banks to raise a further US$797 billion in capital if they had been in place from last year, rather than the 2019 that they are supposed to be phased in from.

All this money has to be raised at a time when governments and everyone else is raising or rolling over enormous amounts of debt.

There is just too much debt in the world.

The more I look at it, the more I wonder about the debt jubilee idea.

It seems the only way out of all this debt is restructuring or inflation. Neither of which are attractive.

Lenders would also have had a 2.89 trillion-euro shortfall in the funds needed to guard against a run on deposits had the planned Basel Committee on Banking Supervision’s rules been in place at the start of 2010, the panel said in a statement on its website today. The committee agreed in July to phase in the capital and liquidity rules by 2019 in a bid to mitigate their effect on banks emerging from the credit crisis.

The shortfall projected by the Basel committee is a “vivid demonstration of the sheer impact of the new liquidity standards,” said Etay Katz, regulatory partner at law firm Allen & Overy LLP in London.

“There is a considerable concern about finding an effective way of bridging such a shortfall -- bar drastic changes to business plans and business disposal programs which may be unfeasible or imprudent.” Lenders would have had a 2.89 trillion-euro liquidity shortfall against a net stable funding ratio at the end of 2009, the Basel committee said. That ratio, slated to be put in place in 2018, aims to limit the mismatch between the duration of loans and deposits to ensure banks don’t face funding shortages.

4. 'The quiet before the storm' - The Germans are still feuding with the rest of Europe about how to deal with the Sovereign Debt Crisis there. Here's Bloomberg's take on the crucial meetings happening this weekend.

European Union divisions widened over how to contain the debt contagion that threatens the euro, limiting a summit that began today to an agreement on a crisis- management mechanism that takes effect in 2013.

German Chancellor Angela Merkel balked at boosting or making more flexible use of the EU’s 750 billion-euro ($1 trillion) emergency fund, as leaders neared an accord on the tool to contain future debt shocks and the European Central Bank armed itself with more capital. Strife among Merkel, the ECB, Luxembourg Prime Minister Jean-Claude Juncker, and the German domestic opposition intensified on the eve of the Brussels summit, marring confidence in Europe’s handling of the fiscal woes that forced Greece and Ireland to fall back on financial handouts.

“There is a situation of European gridlock again with Germany blocking actions to make progress,” said Nick Kounis, chief euro-region economist at ABN Amro NV in Amsterdam and a former U.K. Treasury official. “There is a high risk of the crisis re-escalating and maybe now it’s the quiet before the storm in markets.”

5. A wicked rant - Joe Bageant rants here about why Americans are so dumb and why America is so ...er ... fornicated. HT Rob via email. A really good laugh with an uncomfortably truthy feel to it (in parts).

6. What the boomers will do to prices - We ain't seen nothing yet. Glen Asher writes that retiring baby boomers who try to sell their houses to scarce and poor young people will drive down prices further ahead of themselves. All around the developed and ageing world.

That includes us people.

Here's the thinking.

According to the study, sales of existing homes make up 85 percent of the homes sold today. Senior citizens are by and large the suppliers to the housing market as they downsize, move into senior's residences or pass away. Those over 65 years are proportionately more likely to own their own homes in comparison to younger adults so they are more likely to have houses to sell.

The first baby boomers are slated to reach their retirement years at the age of 65 in 2011 and the last will pass through the "gate" to seniorhood in 2029 so it seems likely that the effects of this demographic change on the real estate market will be seen sooner rather than later. As well, a decrease in the number of younger, first-time home buyers means that the housing market will feel additional stress from shrinking demand at the same time as it faces rapidly growing supply.

This does not bode well for prices since the supply of available housing will be increasing at the same time as the demand for that housing is decreasing.

7. Zerohedge speaks - 'Tyler Durden' of Zerohedge fame explains his philosophy in a discussion with Chris Martenson.

Two bears have a good old moan. Fun to read. HT Jeremy via email.

We fail to see how an unwind to a previous “restore point” to borrow a computer analogy, is possible at this very late stage in the global Ponzi scheme. We tend to simplify the world: When everything else is stripped, the only two things that matter are a) where is the money coming from? and b) where is it going? And never in the history of the world have so many assets created so little cash flow.

To a big extent, this is due to the fact that a bulk of asset purchases in the past three decades have been due not to asset turnover, but as a result of cheap credit resulting from an explosion of credit money through the quadrillion dollar derivative boom. As a result, most incremental dollars go not to organic business growth and economic output, but to satisfying what has become the biggest debt burden in the history of the world, whereby the labor and intellectual output of most goes to fund the living standards of a very few.

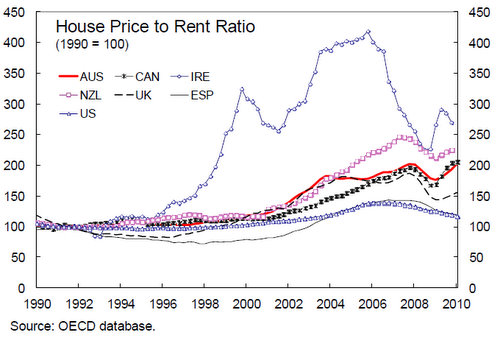

8. The IMF speaks - House prices in Australia and New Zealand might be over valued, it suggests in this 25 page paper. Fair enough. HT Rob.

Price-to-income ratios appear to be above 10-year averages at end-June 2010 by about 20 percent in Australia, 15 percent in Canada, and by 26 percent in New Zealand at end-March 2010. these ratios were good indicators of overvaluation in house prices in countries that subsequently experienced a correction.

In Ireland for example, at the peak of the housing boom in mid-2006, the house price-to-income ratio and house price-to-rent ratio were respectively about 40 percent and 30 percent above their 10-year average. Since then real prices in Ireland have declined by 35 percent in real terms, and ratios of house prices to rents and income have fallen from historically high levels.

9. Some serious rioting - Here's the video of the very ugly riots in Greece this week. Worth watching and listening to. This is ominious.

10. Totally Jon Stewart with Michael Steele as a Muppet.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| The Great Gaffesby | ||||

|

||||

64 Comments

#9 - haven't the greek police learnt anything? where were the water canons, rubber bullets & about 200 more riot police??

The water is frozen and ice canons don't work.....rubber bullets cost too much so the riot squad have trained to yell "pop" instead.....the 200 extra police were laid off and have joined the rioters. Meanwhile the pollies are drinking from the top shelf, eating Caviar and imported fruits while relaxing beside their heated internal pools and the stinking rich Greeks have flitted off to warmer places in the southern hem.

Damn Cost cutting

FYI this is sobering from David DeGraw at the Public Record. Incendiary. But real people are saying this stuff. HT Troy. Dark stuff indeed.

http://webcache.googleusercontent.com/search?q=cache:YgQwsVxBo78J:pubre…

America needs a revolution.

Sad, in the 21.th century there should be other means to end criminal activity.

Is this for real Bernard? I have heard the bailouts where kept secret, but to this extent? No wonder Wall Street made massive profits and bonuses last year! The extent of the 0% interest bailout is staggering, I can't help but think it can't be true, surely mankind isn't this stupid!

Again if it is true, then very disheartening, as they say, there is no such thing as a free lunch..... Unfortunately I don't think many will see it coming. Poor old 2011, doesn't bode all that well really does it.

tailslide....someone said......Two sure things in life.....The universe and Human stupidity......n not totally sure about the universe

Here's Terry McCrann at the Herald Sun stirring it up on global warming and China's demand for coal -- Australian coal. HT Paul

http://www.heraldsun.com.au/business/terry-mccranns-column/hsbc-researc…

The myth of a Chinese switch to so-called clean energy has become the last refuge of the global warming scoundrels, in their desperate attempts to prop up the climate change scam and the endless free lunch of handouts and gas-belching conferences.

Yes, China might be making a massive investment in alternative energy. But even so, by 2020 wind and solar will add to less than 10 per cent of its total generating capacity on official targets. On HSBC's higher estimates, they would still only add to 15 per cent. Crucially of course, these numbers are in relation to generation capacity. What power you actually get is a very different matter. When the wind don't blow and the sun don't shine ...

That means the actual percentage of power that China - going gang-busters to install so-called clean energy - will get from wind and solar in 2020 will be more like 3-5 per cent of its total electricity.

Almost all of much more than it generates today will be coming from coal. And then there's India on top, so to speak.

Are central banks running a fractional gold system? HT Gertraud

http://www.financeandeconomics.org/Articles%20archive/2010.12.16%20BIS…

cheers

Bernard

Dude where's my Mortgage. How a Corrupt Outfit Called MERS Is Destroying Our System of Property Rights

HT Anthony

http://exiledonline.com/dude-wheres-my-mortgage-how-an-obscure-outfit-c…

cheers

Bernard

Link not working?

Worked for me. Here it is again just in case.

http://exiledonline.com/dude-wheres-my-mortgage-how-an-obscure-outfit-c…

cheers

Bernard

Fantastic interactive chart from Washington Post showing who owes what to who in Europe. HT Reece via email.

http://www.washingtonpost.com/wp-srv/special/business/financial-crisis-…'

You can see that Irish banks are over extended in that they lent 121% of Irish GDP to the UK and 52% of Irish GDP to the States. However to bail out those banks Ireland has run up a deficit of 30% of GDP to prevent contagion. Yet if Ireland defaulted on 100% of the debt shown it would only = 8% of Portuguese GDP, 7% of UK GDP & 5% of German GDP (so a manageable hit for those countries). If Portugal, Spain & Greece all defaulted on Irish debt then the cost to Ireland would (only) be 23% of Irish GDP. Sure a lot of blood on the floor, but it seems Ireland would be better of letting it banks default and then be defaulted on. Also a short sharp shock would clean out the mess that seems destined to drag on and on.

More on China's empty cities. HT Mark

http://www.unconventionaleconomist.com/2010/12/chinas-empty-cities.html

http://www.businessinsider.com/pictures-chinese-ghost-cities-2010-12?slop=1#slideshow-start

cheers

Bernard

Woah coming thick and fast Bernard, I might have to save some for the morning.

Here is an interesting link. Some currency traders telling it like it is, guys who have their money where their mouth is.

Scarfie, It is good that you bring this up, these are the guys who actualy know how the mkts are shaping up. I think that the high yielders are in for a big tree shaking and many monkeys in the top branches of speculation will fall hard. Special care should be taken when going long the AUD... often happens that the best becomes the ugly, and I think that China's rising OCR will be Australia's undertaker.

So if Ireland should default and cause defaults Bernard, why shouldn't NZ do it?

What you're saying is "if your in the s**t" why not admit it, go bankrupt and re-build. Just like some of our recent high profile developer bankruptcys. Most of them will bounce back.

So picture the scenario that Ireland defaults and recovers eventually. While we in NZ carry on borrowing $250mln per week from whom and from where? Does anyone really understand where the weekly money JK borrows to pay for our motorway potholes to be filled comes from...like is it real money?? or is it all on paper leveraged up to the hilt...all smoke and mirrors BS. I contend that it is. Problem is it may all be smoke and mirrors but guess what? JK (read you and me) has to pay it back to those mysterious rich money generators.

How about we (NZ) default and live within our means? Wouldn't that be the smart thing to do? Beat the stampede to do what many other countries will surely do in the coming years? The downside (amongst scary others) is we'd have to navigate the motorway with all those potholes. But let's get real here - we can't actually afford to fix them!

Perhaps NZ citizens would then band together and use their nouse to work out how to earn the money to pay the people to fix the potholes. Then again perhaps they won't, because they don't have to, because we'll just continue to borrow $250mil per week to fix them.

Any wise guys here got any ideas on how we could stop borrowing this money from faceless rich enterprises and start living within our means? Is that not the right thing to do? Or are we all convinced that the only way to get rich is to use other people's money? It ain't working folks - NZ ain't gettin richer.

Correction FYI....English is now or soon to be borrowing $350oooooo a week....$50oooooo a day and he's using it to feed a benefit system designed by previous govts to keep govt snouts in the trough....do not expect this to change...expect to receive a steady stream of effluent on future surpluses and growth and other BS.

Our political system is a total failure if you expect a govt to be planning decades ahead and working to erradicate internal corruption and waste. If however you are happy with a 'handout for votes' culture of stupidity and rorting scammy behaviour dressed up as 'leadership' then this is as good as it gets.

Look after number one mate....do not rely on govt to be of any help at all. When English Key and Co are gone into history, the pile of debt effluent will remain along with the banks still farming the whole economy with the full support of govt and the RB.

Not gunna happen while JK calls them entitlements.

I'm thinking the only way to really kill the welfare state is for NZ Inc to go bankrupt.

Hit the reset please.

Would the escape tunnel have to be sealed first (AUS).

The Govn would empty everyone's bank accounts....

Welfare is not the issue/problem....economic misdirection and financial fraud is.....welfare may well be sacrificed....but it hasnt caused this.

regards

RE #9

This will come here and it will be just as ugly.

From someone who knows, out Police have been underpaid, under resourced and under trained for more than 20 years.

Because of low pay the acceptance level for Police recruits has become steadily lower since the 80's.

The Police got caught with their pants down during the springbocks tour, when running riots in Auckland petered out rather than being controlled.

There is no follow up driver training after Police College. Being required from time to time to carry firearms, they are required to have an live shoot every year. Well every three years would be about normal. Riot gear is likely only available for the current shift, that is 1 for every 5 front line staff, which is about a third of total staff. Perhaps 5-600 sets distributed over the whole country. Physical training was negotiated away for pay many years ago and it up to the motivation of individual officers. Training days are regularly consumed by administration work. This is just a taste of the inadequacy.

So you think we live in a safe country?

Well I wouldn't bet on it.

Sounds pretty realistic to me Iain. Would be interesting to see what would happen if NZ stopped borrowing. If NZ could.

Iain

Here is Michael Hudson on debt, I posted it earlier but thought you may have missed it.

It appears that the Banks have not paid much tax this year. But then why should they if they own Nz Inc?

Thanks Iain, I have your blog on my favourites now and will read plenty. I was blown away by your depth of research and knowledge presented there!

Loved this extract from the 1955 NZ Royal Commission you so aptly presented:

The Central Government also chooses to borrow, although it has power to finance all its requirements by taxation or by requiring the Reserve Bank to issue more money to it. Excessive use of the latter would result in disastrous inflation, and it is often more convenient and expedient for a Government to raise part of its requirements through a voluntary loan than to raise all by compulsory taxation.

"to tell you the truth I am at a stage when I nearly dont give a shit and sometimes think all the fools deserve everything they have coming." same here but the problem is we are all in the same test tube....

regards

Irelands got downgraded again

How's the Irish stock exchange looking these days? Must be a few bargains in the mix?!!

As bad as business life in Ireland currently is , their stock market's total capitalisation is around $US 37 billion ............ double that of ours , the NZX , at $US 19 billion . ....... Ouch !

Even little Luxembourg boasts a stock market with a combined capitalisation of $US 51 billion , nearly triple that of NZ's .

........ oh the shame , the shame of it all !

One worthy of a looksie is Dublin based United Drug . They last traded at 2.025 Euros , given them a market cap of 480 m. E . The dividend is 8 cents ( 4 % yield ) . Diluted EPS of 14.22 c , translates to a PE of 14 . Profit from operations ( cashflow ) is a healthy 27 c / share . Revenue to 31/12/09 was 1718 m. E , giving a PS ratio of 0.28 . Shareholders' Equity is 321 m E ( assets of 892 m E less liabilities of 571 m E. ) .

Given that their revenue base was 1333 m E in 2005 , this is a growing Irish company . They have 3800 employees across operations in Europe & the USA .

The answer seems to be yes , there are some bargains on the Irish stock exchange .

Oh wait you missed the USA....we are smaller than them as well!!!!!

Consider, their populations are? Their GDP?

NZ has a population of 1/2 one decent sized EU city and its spread out....across a land the size of the UK with 60million...

Most of our trading partners east of us are the pacific "developing" world...to the west the only trading partner of size....OZ...

Roll on the NZX merging with OZ....

regards

Iain's right you know Bernard. You do have an opportunity to speak it as it is but I too feel you're afraid of upsetting the applecart when I see you on telly, etc. You should get a weekly spot on some program and highlight the most telling stories you dig up here...your "must reads" weekly...educate the masses, maybe? Do you have the desire? Or are you scared you'd be shot down too often?

Bernard attitude unfortunately isn’t a reflection of the blog’s member opinions. Of some reasons like so many media he’s too soft dealing with politicians etc. and therefore doesn’t ask the right questions - far from even go into a debate.

There must be a way for the media to nail the politicians facing the public with hard questions and make them accountable.

Is it Bernhard's role to have an " attitude " , or just to present the facts and the theories that circulate the economic world .

If he ripped into his double-shot guests , a'la " Hard Talk " of BBC reknown , few would present themselves for future grillings . Blame the namby-pamby piss weak bunch of gut-less wonders we currently have as politicians , don't blame the Hickster .

The columns that BH writes in the NZ Herald do garner comment and an audience far wider than just us little group here at interest.co.nz .

It is discussed elsewhere...

http://www.cobdencentre.org/2010/12/positive-money-practical-reform/

and of course

http://www.talkcarswell.com/show.aspx?id=1672

maybe we just have to wait for someone else to suggest it...

p.s. again - the site is sponsored!!!

Nice piece on the history of debt and the historical precedents of debt amnesties:

http://canopycanopycanopy.com/10/to_have_is_to_owe

BH,

Read the Fed article - Jesus Christ and OMG - Some thought I was a little on the negative side - I say on the side of realism but this is almost beyond comprehension.

The issue is I guess - can this all happen without consequence.

I doubt it !

The Devil's Christmas letter. CHSmith.

As you know, this time of year usually finds me quite despondent, as the Prince of Peace's influence waxes most atrociously around his birthday. But this year I am in fine spirits, nay, let me even declare myself absolutely giddy, for the destruction of the United States of America draws ever nearer.

Though my minions have long sown festering seeds of hate and disharmony in that now-benighted land, only recently have my favored weapons of destruction--leverage, debt, half-truths and endless, preening justifications for greed, sloth, lust, pride, envy, anger and gluttony--have been unleashed to worm their way into the stricken heart of that Republic.

My most treasured hopes of destitution and conflict in the U.S.A. are nearing fruition.

http://www.oftwominds.com/blogdec10/Devils-Christmas-Letter12-10.html

Iain

You are right about the stock getting killed. I talked to friend who works at a SFF plant in Hawkes bay, they have been bringing ewes up from the south Island to kill and way south at that, they are not being processed but going out full carcass. Like the forestry industry processing is getting too expensive and shipped off shore. Its going to have an impact as we are so low in stock numbers, the last thing we need is the meat industry doing this in it quest for a 'quick buck'.

Who buys full carcass?

I cannot see how a 'developed country' (USA, UK etc) can do it cheaper.

The beast is on a hook, and a few more actions give you the 'cuts'.

Is the meat being 're-badged', or just chucked into a giant mincer?

Who is getting the 'valued added' component that we don't seem able to achieve?

I suspect its going to the middle east. Our fish caught here, processed in Asia, repackaged shipped back and no one even knows.

No 'grown in NZ' stamp?

I wondered whether there was a premium being paid for full carcass. I can see restaurants etc wanting to get their hands on the full beast ('cutting out the middleman' / showing skill as a cook). I can see large supermarket chains taking over the processing, but I stumble slightly at the idea that it all ends up in a giant 'shepherds pie' ready meal made in India for Tesco's.

(or Lamb Korma).

Factory chicken is a much cheaper meat surely.

These are older ewes will be going to a traditional market in the middle east. They will be cooked in the local styles slow and spicy I rather like it except the fatty shoulder. I suspect that the cutting and boning rooms in the meat industry are not the great profit enterprise they are made out to be but a great employer all the same. One day soon all the capital stock thats been killed in the last few years is going to show up in our exports, I dont know when, i thought this year but another drought has resulted in a reasonable kill again.

Phew, that sounds like a much better market, so at least the product is appreciated for what it is, to be used by people who cook, rather than just a 'dubious protein component' .

So the next question... does it command a premium because it's grown here? i.e. can you as a farmer feel proud of the product and its end use, or does the satisfaction stop (as so often suggested) at the farm gate.

This goes to Walter's ongoing quest.

An example of how some British sell it.

http://www.waitrose.com/food/foodissuesandpolicies/fairtradeforbritishf…

I wonder if smaller farming co-ops would serve better than the old models from pre ECC days. (though there must be some waiting for a return to these days!)

The 'good' stories seem to get hidden -

Marlborough real estate agent Scott Engstrom says "heaps" of vineyards are on the market but no-one is buying.

"At this point in time, if they are selling, they are being sold to overseas buyers," she says, noting that the New Zealand dollar has made even that difficult.

Not even the big vineyards are prepared to pick up their neighbours and prices are "way below GV".

http://www.stuff.co.nz/business/industries/4472069/Over-a-barrel

http://www.stuff.co.nz/national/4472229/Expensive-paperweight-fired-aft…

Cant find many on Trademe, but then again I was looking around central Otago

I have commented on here before about vineyards in Marlborough.

Unofficially there are around 200 for sale, but think about the consequences of listing all those at the same time. Agents know they are for sale but only list a few at a time for fear of spooking the market.

And banks won't open the books on their true mortgage debts for the same reason: they're aware of the likely consequences.

Drip feed...drip feed...drip feed..."sshh, nobody will notice"...

The European Central Bank (ECB) on Friday said it has arranged to borrow up to £10bn from the Bank of England in a temporary swap to ease liquidity at Irish banks.

http://www.telegraph.co.uk/finance/financetopics/financialcrisis/821052…

"A Supreme Court ruling has left New Zealand's 1.4 million ratepayers more exposed in the multibillion-dollar leaky-building fiasco.

The court has refused to allow the North Shore City Council's appeal that it was not liable to pay for the leaking building disasters at the 14-unit Byron Ave townhouses in Takapuna and the 21-unit Sunset Terraces in Mairangi Bay." harald

What does this do to the so called govt agreement with the banks and councils?

As if the banks would sign it....I wouldnt, the cock up was not the banks fault.....the risk is not the banks problem......the ppl who should be paying but are not are the professionals, the developers, engineers, architects, builders and suppliers....yet it looks like none of them are wearing much cost.....

regards

Wolly says - "What does this do to the so called govt agreement with the banks and councils?"

This is the reason why the banks have been stalling on this issue. It now seems that all the costs will have to be paid by the ratepayers.

..and what should be the long term consequence (learning process) out of this -

A comprehensive new approach - a NZtailor- made economy. Smaller nations have to think smaller, but with bigger ideas a ‘100%NZpure Economy” – making real/ honest money for the nation and the next generation.

http://www.rollingstone.com/politics/news/bernie-sanders-puts-barack-ob… I

thought about this when I watched Bernie go through his amazing one-man filibuster against the Obama tax cut deal last week. Week after week, month after month, we watch politicians who disappoint us, not just as leaders but as people, failing to achieve the basic life-competency standard we expect of most grown-ups, doing things we wouldn’t tolerate from 15-year-olds.

Whether it’s Mark Foley writing sexy letters to little boys, or Charlie Rangel or Duke Cunningham or Jerry Lewis doing the pay-for-play game, or even assholes like Orrin Hatch roaring with partisan excitement when the individual mandate – his own idea – was recently declared unconstitutional by a federal judge (who himself has financial stake in the health care business), these guys fail the common decency/honesty test with unnerving regularity.

It’s sad but true, but in 99.9% of all cases, you wouldn’t think of looking up to an elected official as a moral role model. Which is why Bernie Sanders is such a rarity, and people should appreciate what he’s doing not just for his home state of Vermont, but for the reputation of all politicians in general.

As part of the inflation/deflation debate I posted the Gonzalo Lira Hyper inflation theory a month or so ago. Here is Soneleigh's rebuttal.

Exert: "I do not see this as a transitory problem leading back to business as usual, and I mean NEVER returning to what we would now regard as business as usual, let alone doing so in only a couple of years.

Deflation and depression are mutually reinforcing. This is a persistent dynamic that should last at least as long as the last depression, and likely longer as every parameter is worse going into depression this time. We have more debt, far more structural dependencies (on cheap energy and cheap credit primarily), looming resource limitations, far higher expectations, a much larger population, a far smaller skill base etc.

I think we are looking at an economic catastrophe of unprecedented proportions, not a bump in the road that can be quickly consigned to history, if only we face our problems head on. In my view we are going to have to live through deflationary deleveraging, a long and grinding depression, and then quite possibly hyperinflation once the international debt financing model is broken, and with it the power of the bond market to constrain currency printing".

http://theautomaticearth.blogspot.com/2010/12/december-15-2010-debunking-gonzalo-lira.html

3.........A site i visited.......might have been the Global European Anticipation Bulletin......mentioned a figure of 12 trillion of debt worldwide to be rolled over starting early in the new year n a shortage of creditors.....are we going to see interest rates heading north to compete ????

Here it is ladies & gentlemen ... a little history (when you have a few hours spare).

The money masters:

http://video.google.com/videoplay?docid=-515319560256183936#

The neo-plutonic bourgeoisie have the system near complete control!

This system is more than 300 years old and growing.

Take the passport chips, bank account card chips and cell-phone chips, and put them into a convenient micro-chip and stick in your forehead and the oligarchy have us lock-stock & two-smoking barrels ...

I'm curious how you would see a debt jubilee working Bernard? It may be a truism but one man's debt is another man's asset so haircut one and you cut the other.

For one thing, in a fully fledged debt jubilee if it were to be implemented world wide (how realistic is that !!!) the baby boomer's would lose their retirement savings and we've seen repeatedly that the power of this cohort at the ballot box is too much for the politicians to resist.

It may have worked in biblical times with the only people taking the hit being the wealthier members of the tribe (who could afford it), but in an interconnected world I cannot see how this could be possible without destroying the financial system and the international trading system.

But I'm willing to be persuaded :-)

Parky where are you....Simon D thinks " one man's debt is another man's asset "...explain to him why this is incorrect.

If you're referring to the fact that money is "magic'ed" into existence by a bank to provide a loan/debt, then yes you've got a point. After all how can someone own something that was originally created out of thin air...eh! The only problem with this is that the entire financial system is based on this particular mass delusion. We might as well pack up our bags go home and learn to live hand to mouth before we kick over that particular turd.

So let's presuppose that we want to continue with the charade, issued debt goes onto the bank's books as an asset and can be then be flogged on to fund managers as mortgage bonds. Your average mum and pa, investing in his kiwi saver spends his money with a fund manager to buy these bonds by proxy to save for their retirement. Forgive the debt and you cancel the asset.

S

All great dreams SimonD but reality sees the banks in control of the markets and so the economy and govt policy and RB regs....the RB and govt are but the fiction that democracy exists.....the voting peasantry are brought up to believe and live the myth......

Go the greeks! yee haaa! destroy ALL what has become corrupt

Don't read this ..it's all about lying thieving criminal behaviour.....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.