Bernard Hickey details the fifth in this series of Top 10 charts for 2010 in association with Bank of New Zealand.

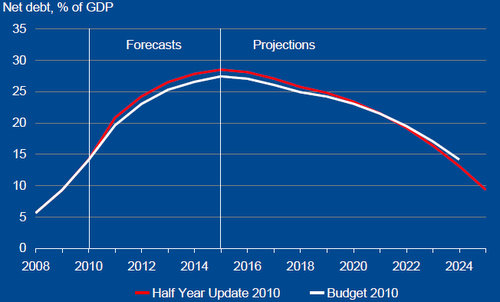

This chart from Finance Minister Bill English's presentation of the government's fiscal and economic update on December 14 shows how the government's debt is forecast to almost double from around 15% of GDP now to almost 30% by 2015/16.

But it is forecast to start falling back after 2015/16.

However, this assumes GDP growth over the next three to four years of around 3% per annum.

That looks a tad optimistic given the near double dip recession seen in the June and September quarters, although the boost from the Christchurch earthquake rebuild and the Rugby World Cup is yet to have an impact.

The government debt peak forecast in the December update (red line) is slightly higher than in the May 2010 budget forecast (white line) because of weaker GST and corporate tax revenues in the last year due to the slower than expected economic recovery.

This may be a factor Standard and Poor's takes into account as it assesses the outlook on New Zealand's AA+ sovereign credit rating.

It currently has the rating on review for a possible downgrade with typically a one third chance of a downgrade.

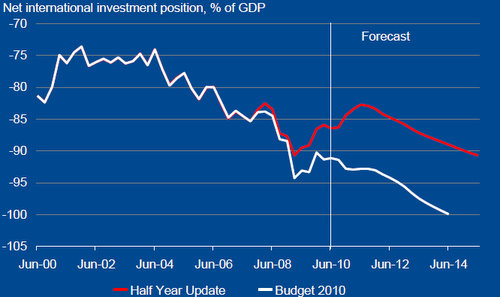

Meanwhile, total net foreign debt (chart below), which includes both private and government debt, was actually forecast by Treasury to have improved in the December update from the May update.

That's because the slower economic growth softened demand for imports and stronger commodity prices boosted export returns. Also, weaker profits from foreign owned companies reduced the outflow of dividends.

However, this improvement is seen as temporary before New Zealand's national savings problem eventually starts driving the debt up again as a percentage of GDP to over 90% again, putting New Zealand in the same vulnerable position as Greece, Ireland and Portugal. This is not as bad as forecast in May because of the factors mentioned above, the long term trend is disturbing for foreign investors.

New Zealand may not have the same government debt problem as these three PIGs countries do, although it's notable that neither did Ireland in 2008 before the Global Financial Crisis.

Ireland's mistake was to guarantee its banks, which then collapsed and forced the Irish government to take on much more debt because of it.

New Zealand also guaranteed its banks and finance companies. Luckily for the government, the banks have not collapsed, although the collapse of the guaranteed finance companies has already cost more than NZ$2 billion.

10 Comments

As long as government ministers Hide, Brownlee, Joyce underperforming and import most everything instead of allocating infrastructure orders to NZcompanies it doesn’t get better. Stimulating/ developing NZproduction in the "Light Industry" would not only reduce our account deficit, but also provide 10’000 more skilful jobs for our workforce, attract entrepreneurial and innovating young talents and reduce the brain power moving overseas.

Like in so many other countries a strong manufacturing culture needs to be developed in order to make real money.

A Happy New Year for everyone !!!

Sounds good in theory but just as we have got rid of our car assembly industry I don't think we want to make the likes of our own trains and carrages where the cost and delivery time is twice what the Chinese can do. Lets do what we do best. The USA is also in the same boat - they import more and more manufactured goods.

An offshoot of importing cheaper goods from overseas is that it keeps inflation down. If we made expensive goods here it adds to inflation. Even better on a rising dollar!

We imported cheaper finance for most of the 2000's and that sure as heck didn't keep inflation down.

The empirical evidence continues to stack up that dogmatic statements like "Lets do what we do best" lead to a hollowing out of the economy.

Continue to suckle at the teat of a discredited economic theory for all you are worth skeeter. You are not alone. English and Key look like they are elbowing others out so they can continue to suckle from the treasury teat of economic dogma that Cullen and Clark used to suckle from. At least Cullen ran a surplus which is more thay can be said for the National stewards of the economy....

skeeter - good you wrote that nonsense last year.

Are we looking at the correct risk variable when we use net international investment position as distinct from gross - a far larger figure ?

It's gross debt we have to refinance - not net.

Imagine a street where I - through my bank which has borrowed offshore, have a mortgage of $ 1 m.

My neighbor has $ 300,000 on deposit with the Commonwealth Bank in the lucky country. ( Better interest rates and an FX windfall )

Sure the street only has net foreign debt of $ 700,000 but it's a bit like saying the average Kiwi has one tit and one testicle.

I am of the view we should focus on gross debt as the risk variable that could sink us.

If I can't pay my mortgage - my neighbor is ambivalent to my predicament.

We'll never hear it mentioned from JK, BE or the RBNZ as it's too horrible to contemplate - currently > $ 250 B and rising. Problem solved !

What is the view of smarter and less confused minds on this issue ?

you guys are amazing...you don't miss a beat.....we could throw you any subject incl. a dissitation on the effects of interest rates on the price of cockles and you would be onto it like hungry dogs...rock on and happy new year..

Bill English is the resurrection of Robert David Muldoon. This will all end in tears as it did in 1984. John and Bill just reinforce why I do not vote for the Nats! They need to cut government expenditure and NOW. Drop every taxpayer funded advert that is on TVOne would be the most easy decision to make!

Never good reading or are we not ambitious enough?

US has stimulated via increasing the balance sheet by about an extra 2 trillion this past year which is approx. 15% of GDP while they have approx. 3% growth. A crazy expansion on the Fed Balance sheet.

Yeah looks like most of it went into equities market which made the 30% of people with equities feel a better better at Christmas time regardless of the snow and spend a bit more on presents.

While in NZ we loaned approx 8% GDP at (250 million per week and now rising) with growth not to be seen. What a joke.

If we had loaned more possibly we could have had some spend more on Christmas as well, oh la la la, what a worthwhile outcome!!!

If you were taking a punt which countries balance sheet is more likely to get away with it?

This should probably be described as mismanagement from the government.

How can they make projections that it will go down from 2016? by that time they will probably be wanting to bribe voters again and will cut taxes again, and keep the borrowing going.

It's no good expecting governments in the future to do the hard yards when you won't do them yourselves now, in the future they will be just as keen to stay in power, and run up debt as a consequence.

The projections in the first graph are a tiny portion of several 2 years olds crayon line drawings of an Elephant and was selected by a panel of experts at Treasury who took five hours to make their minds up at a cost of $25000.

In the second, the two year olds were asked to draw where two friendly Elephants walked before and after they started to argue about where to go for lunch.

Treasury expect to return to the same pre school for similar help during 2011.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.