Seeing as the MPs are back in Parliament (it was actually quite nice here while they were away), here's my first politico-economic blogroll for 2011. It's been a strong start to the year economics-news wise. Great to see most of the other media have forgotten about the economy while the Hone case rages.

From the right

1. Government isn't doing anything to control its debt. Everyone's favourite former Reserve Bank Governor, National Party leader and Kiwifruit orchadist Don Brash is at it again, telling an Auckland Rotary Club he's pretty bloody worried about the nation's debt levels. When he gave his last big speech in November, Brash said he was still a member of the National Party. It doesn't look like he'll start a new right-wing party, so when is he just going to throw his lot in with Act? HT David Farrar @ Kiwiblog

In fact, government spending as a share of GDP is now more than it was in any year of the last Labour Government, and the structural budget deficit is now bigger than it was under the Muldoon Government.

The Prime Minister has said this year’s Budget will aim to keep spending for new initiatives to some $800 million.

But of course this is on top of the increased spending built into the system for existing programmes – for education, health, New Zealand Super, KiwiSaver subsidies and so on – so this degree of restraint is trivial compared to the scale of the problem.

As a result, government debt is growing fast.

And the bad news is that if the government doesn’t show more restraint soon, that debt is going to get a lot worse.

Treasury predicts that on current policies the ratio of government debt to GDP will reach 220% by 2050.

How bad is that?

Here's a great map of Australia. HT Not PC. This is our biggest trading partner.

2. Serve the people, not the staff. Homepaddock blogs that the public service is too big, welcoming comments from the Prime Minister this week that government will look to downsize and amalgamate some departments. What would be the best amalgamations I wonder? A friend of mine suggested putting Treasury with Creative NZ. Imagine how cool the charts would be.

The public service grew too big under Labour. It’s a costly burden which is weighing down the private sector.

Back room functions are necessary to support front line staff and leave them free to do the work that matters most. But when the back room expands too much and uses scarce funds needed more for services and those who provide them it’s time for rebalancing.

The public service is supposed to serve the people who need its services not those who staff it.

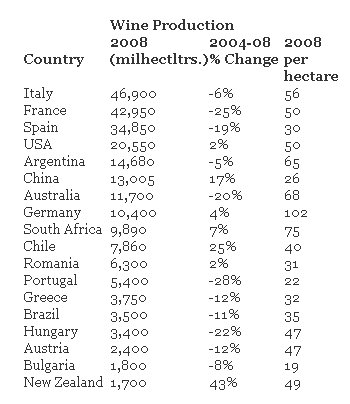

3. Why the wine industry’s fermenting: Anti-dismal has some figures showing NZ wine production increased 43% between 2004 and 2008.

Italy, France and Spain are the big boys on the block. The size of Chinese production surprised me but Morss points out its mainly for local consumption. The growth in New Zealand's production over the 2004-8 period is pretty amazing and may help explain the current wine glut.

4. Dumb, dumb, dumb. Not PC was not very happy the government raised the minimum wage

At a time when unemployment is going up and more and more would-be labourers are being left on the shelf, they’ve gone and raised the price of their labour. Or rather, they’ve had it raised for them.

Because try though they might, their government has once again made it illegal for them to agree to sell their labour at anything less than the govt’s own chosen rate—which minister Kate Wilkinson has just put up, being raised today by this National-led imbecile of a government to a minimum legal wage of $13/hour in the same week that figures were released showing unemployment continuing to rise.

Dumb, dumb, dumb.

It’s not like they raised it by mistake, either. They did this before, right at the very start of this Great Recession, right along with the abolition of Youth Rates—leading to the truly unsurprising result that unemployment among those looking for unskilled work or “starter jobs” has continued to rise, with more than one-in four youngsters aged 15-19 now unable to get started on the employment ladder; more than one-in-six Maori; and more than half of the single parents.

From the left

5. Where will the next million jobs come from? ChrisH at The Standard has unearthed (there's a pun here - read on) a 1953 article by John Cox that looked at the future of the New Zealand economy and what it should focus on producing as the world's population grows over the next 20-30 years. There are some well recognisable comments in the piece (written 60 years ago) about NZ's ability as a primary goods (mainly food) producer, amply placed to feed the rest of the world.

However the comments in the Cox article that struck me the most was his call for a "stock-taking" of the nation's "natural assets and limitations". Well, the current government carried this out, but a march of 40,000 people down Queen Street last year put some of these plans on the back-burner.

Cox argued NZ needed to diversity its export base because of the dangers faced by our food exporters from foreign competition.

Let's be honest, this (minerals) is the gap between New Zealand and Australia. The rest of the world will need food, and New Zealand is still well-placed to supply this. But the rest of the world is hungry for other primary resources NZ has to offer. This shouldn't be put to one side and worked on in the dark vaults of MED to be realeased quietly when the next Pansy Wong saga comes along.

Finance Minister Bill English said last week job growth needed to come from the tradable sector in order to dent unemployment figures. One way to get this happening is to start digging.

This from The Standard:

The tragedy of New Zealand’s economic history for the next sixty years is that this was not done. Instead, we got into real estate, into ‘wealth creation’ by borrowing money overseas and investing it, not in industry, but in real estate speculation, as an online New Zealand Herald graphic succinctly puts it.

More recently, Coriolis Research have argued that New Zealand could still climb the value chain in food processing, but that this would by now require “deep pockets … Massive capital investment … Willingness to accept losses for long periods”. See here and here. In practice this means a government that is prepared to back such investment and at the same time curbs the real estate market in order to channel capital into development, in the same way that successful European and East Asian economies have generally done.

If there is no political will to do that, then we seriously have to look at our population policy, because if we remain a raw commodity exporter, where will the jobs for the next million come from?

And here are a few comments from the 1953 article:

The inroads of margarine into our market in Great Britain should make us think. Wool, too, is always under threat from synthetic materials. It is only the war clouds of the past few years that brought down the golden rain on the backs of our woolly sheep. But take meat. So long as our most important market is Great Britain we are constantly in danger from the competition of other countries such as the Argentine who have the advantage of being closer.

...If the world doesn't want this food we can grow something else—or can we? Surely this is the question. What can we produce in New Zealand? Do we know? In a vague sort of way—yes! But there has never been a systematic study of resources. We need this urgently now—a sort of stock-taking. How otherwise can we have any clear idea as to what we can produce and where we can produce it?

6. The Join Australia Movement. Not too sure whether this belongs in the left or right section, but I got it from No Right Turn, so will put it in here. No Right Turn noticed one nomination for the Botany by-election was from the JoinAustraliaMovement Party - a new political party arguing for New Zealand to become a state of Australia, which is possible under the Aussie constitution. They're going to stand in this year's general election as well. Here's a YouTube video from them:

7. Minimum wage of NZ$17? Greens MP Keith Locke argues government should look at other ways of determining the minimum wage in this piece on Frogblog. He suggests fixing it at 66% of the average wage. That would be about NZ$17 an hour...

Why do we have such an arbitrary minimum wage fixing system? The government should look at how its own MPs’ salaries are determined. Every year the Remuneration Authority studies the salaries of private executives and increases MPs’ salaries accordingly.

Surely, ‘relativities’ should also determine the minimum wage. Wouldn’t it be good for the minimum wage to be always 66% of the average wage. $15 an hour, as asked for by the Greens, Labour and the Maori Party, would get us well on the way to this 66%. Currently the average wage is $25.83 an hour.

The business lobbyists tell John Key that any movement upwards in the minimum wage will cost jobs. Funny, they don’t seem to use that argument when determining their own salaries.

In fact, what is costing jobs at the moment is workers cutting back on spending due to low wages, which aren’t keeping up with inflation. And Australia seems to be doing ok with a minimum wage of $A15.

Economics blogs

In New Zealand at the moment there is definite scope for opening up SOE’s to private sector investment – that is where we are sitting now. However, even given this I cannot go as far as Roger Douglas and say that the price does not matter – in fact, price is THE issue that the government should use when deciding whether to sell assets.

Why do I say this? I have already said that I believe that, in the absence of external benefits, the private sector is more than likely to run the organisation more efficiently. However, just because the evidence says this happens on average, and just because I have a value judgment that individuals are more responsive to incentives than government, isn’t sufficient to justify policy when we have prices available!

Effectively, a private purchaser will be willing to pay up to their reservation price for an asset. This reservation price will be based on the dividend yield they expect to get from the asset, and the relevant opportunity cost of investment.

At the same time the government know that, if it keeps hold of the asset, it expects to make some dividend yield from said asset through time. As a result, the government can price the asset – they can say they would not accept a bid below the discounted expected return from holding the asset.

If the government sticks to its guns, and a private sector agent is willing to pay MORE than this then we know that – ex ante – the private agent will be able to run the business more efficiently/add more value. This implies that the government SHOULD NOT sell for less than their discounted expected return (note the should, so I’m being all prescriptive).

In essence, pricing the assets (including relevant external benefits) and then seeing what price people are willing to pay gives us information regarding what can be run more efficiently in house – and more efficiently in the private sector.

Looking backwards and saying “this business is paying dividends overseas, wahhh” or “this business ended up making more than what we sold it for, wahhh” is a rubbish argument against privatisation – but so is saying “the private sector is better, so give it the assets for free, wahh” is a poor way of justifying privatisation.

9. The war on tariffs. Economist Eric Crampton has this fantastic 'scoop' on NZ Glass Tarriffs after he and Roger Kerr did some research into why the price Epic Beer paid for its imported glass bottles suddenly jumped a whole lot. Turns out a New Zealand glass tariff was abated for three years for the benefit of the country's biggest glass manufacturer, which was upgrading its plant. This is when Epic began brewing and importing its cheap glass bottles. When the NZ manufacturer was back to full strength, the abatement was, well, abated - pushing up the price for Epic's imported glass.

And they say we're proponents of free trade...

A couple of months ago, Luke Nicholas, brewer of Epic's fine line of hoppy ales, dropped me a note asking what I knew about some new tariff on the glass bottles he was using. His imported bottles jumped in price substantially. So I checked into the working tariff document - nothing new there. I emailed a couple folks in Treasury, who checked with folks in Customs. Nope, nothing there. I was wondering whether Luke somehow got hit by the voluntary environmental glass levy that I'd heard something about. Luke thought it was some play intended to hit a distiller who'd secured a big lot of cheap imported bottles destined for the ready-to-drink market.

Roger Kerr finally figured it out for me after consulting with the Ministry of Economic Development. It turns out that the tariff had never changed but it had been temporarily abated. In 2007, New Zealand's sole manufacturer of glass containers had to do some furnace upgrades that weren't set to be completed until 2009. The company agreed to a temporary tariff concession for glass products of Tariff heading 70.10. The concession was extended until September 2010 when the bottling plant was back to full strength. With the domestic producer again up to full capacity, the tariff was put back in place.

Luke, who only started bottling a few years ago, didn't know he was operating under the temporary benevolence of MED. It's really his own fault for not reading the Gazette where such changes are duly notified. As far as the little guys are concerned, the regs might as well be posted in the basement of the local planning office in a locked filing cabinet in a disused lavatory behind a door saying "Beware of the tiger".

I suppose we should at least be thankful that there was tariff abatement during the interval in which the local manufacturer was unable to supply the market. The local manufacturer, as far as the small brewers of boutique beers are concerned, continues to be unable to supply the market unless you want large lots of the standard DB bottle. But hey, small and temporary mercies.

Glass tariffs in New Zealand protect one manufacturer at the expense of everybody in the country who uses glass. Perhaps every toast raised in the next year ought finish with a curse upon the glass tariff.

10. Totally relevant video (well, sort of). Here's Billy T James on how to find a job.

4 Comments

Hate to say it: It's another article referring to "population control" (read immigration) and it was an issue back in 1953, and its still an issue today

Item Number 5

If there is no political will to do that, then we seriously have to look at our population policy, because if we remain a raw commodity exporter, where will the jobs for the next million come from?

Item Number 10

Love his stuff. Did he ever do one on population control eg myxomatosis?, one-child-policies?etc

#3 is only relavant if you show the 'exported' litreage from each country as our industry is largely export driven!!!

"New Zealand could still climb the value chain in food processing" read pump more expensive fossil fuels into food.....a dead duck there.....

"where will the jobs for the next million come from?" ..........start worrying about this million [that have jobs]...........and yes kill off immigration.......

"they don’t seem to use that argument when determining their own salaries." good point....they are of course worth it.....yeah right.........

regards

Minerals -

When I was about 8, I used to save up and buy the Tintin books. In the meteorite one, Prof Phostle had predicted the time at which a planet-destroying meteorite would hit, and exclaimed "I will be famous".

An 8-year old could see through that.

Let's apply that to resources. Claims from Brownlee, Kokshoorn et al, that they are worth X billions.

If all wealth is on the back of physical resources, the last half of the dwindling pile of anything, is going to reduce the wealth available. At the last shovel/loader-full, it's worth nothing. (think it through - what is going to underwrite the 'money' paid for the shovel-full?)

Given the exponential nature of demand, those points are not very far away, much as it is hard to get ones head around the concept. The key one, of course, is energy (eg coal/lignite) without which none of the othere get dug, processed or transported.

Just as you gear up the infrastructure, she's all over. Better to set up a sustainable society - one capable of being continued indefinitely.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.