I'm back.

Here are my Top 10 links from around the Internet at 10 past 3 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Wednesday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream. My apologies for no Top 10 yesterday. Just got swamped.

1. The importance of Guanxi - Australian hedge fundie John Hempton has written a fascinating piece on the power of Guanxi (connections) in the Chinese private equity business.

He reckons nepotism is rife among the princelings (children of Communist Party officials) and that many of the best-connected private equity funds are making dumb decisions and being ripped off by the princelings.

He makes the point that the princelings in China seem less shamed about taking lots of money than the princelings in the west.

Hempton's larger point is that this is all just indicating a bubble in values in China.

It's something we should be very wary of when accepting investment from Chinese groups.

Hempton points to a particular scandal just uncovered around China Forestry, a Hong Kong listed firm backed by the (in)famous Carlyle Group (full of former Presidents and PMs) that is now suspended. See more here at Reuters.

Here's Hempton.

I have a friend with a fair career as an analyst in Asian private equity funds. He describes the central debate as being between the “Guanxi guy” and the “Analyst guy” (in his world they are mostly guys) and he says the “Guanxi guy” has won almost all of the battles.

“Guanxi” is one of those words proponents claim defies easy translation: something between connections and relationship. Wikipedia defines it as a personal relationship between people in which one is able to prevail on another to get things done. Whatever: Guanxi is often sold as the key to doing business in China.

At Private Equity (PE) firms the debate as to which deals to do and what price to pay has been between the Analyst guys and the Guanxi guys - and with the Guanxi guys winning almost every time. Analysts - when they have reservations about deals - are seldom heeded.

And here's the juicy detail on China Forestry.

China Forestry had a business model which consisted of fast-growth forestry to extract greenhouse gas credits - a business model that barely made sense to some analyst guys that looked at it. However it was a business model that made sense if the company had enough Guanxi - enough connections to extract a really bad (ie nonsensical) deal from the Chinese government.

And the holders of China Forestry to some degree believed just that. They believed in the Chinese Guanxi. And implicitly they believed the deals were being bought to them by the Guanxi of their staff. Now China Forestry remains suspended.

No reasonable questions are being answered - so I am going to reveal to you the Analyst gossip: the bulk of the forests do not exist. Sure they had some “front” - plantations they would take potential investors to. But the vast bulk of the business was a fiction and “accounting irregularities” is code for “fiction”.

2. Very tough and very expensive - Reuters reports the price of ferro-tungsten hit a record high this week as demand from Chinese steel makers grows and supply struggles to keep up.

This is another angle of the global commodity price inflation story. Anything hard that can't be devalued by more printing of money is being sought after.

Yet the US Federal Reserve is still determined to inflate its way to freedom...

3. The problems off balance sheet - Here's another example where deals done to park things -- often smelly things -- off balance sheet simply cost more in the end and don't really protect or benefit shareholders much. Philip Aldrick from The Telegraph has this fascinating story about Barclays parking US$12.3 billion of toxic debt off balance sheet in a vehicle called Protium.

It's now dawning on shareholders they are being done over by former Barclay managers who have jumped across into this new vehicle called Protium.

Anyone thinking that PPPs and other such off balance sheet vehicles are a good idea should read this.

Protium is effectively a Barclays subsidiary. It is funded by a 10-year, $12.6bn Barclays loan and its management company, C12, is staffed by 45 ex-Barclays bankers who quit solely to do the deal. At the time, with the financial crisis still rumbling in the background, it seemed like a smart move. Converting the toxic assets into a corporate loan de-risked the bank by changing the accounting treatment. Released from having to mark the assets to market, losses would be more manageable.

Something was not right, though. For a start, in September 2009, the structured credit market was recovering.

But what was really problematic was the structure of the arrangement. To comply with US accounting rules and ensure Protium qualified as off-balance sheet, Barclays brought in external shareholders. They invested $450m – 3.5pc of Protium’s total capital. Bizarrely, though, Barclays agreed to rank the investors higher in the creditor structure, which means the $12.6bn loan must be completely wiped out before the investors’ money is even at risk.

Despite the cast-iron protection, though, the investors were awarded far better terms than Barclays secured for itself. They will retain no risk after four years and take home $315m in interest over the 10-year term of the deal.

Further, should the assets appreciate in value, any “excess cash remaining in the fund” will go to the investors. Barclays’ generosity did not stop there. It agreed that Protium would pay C12 a management fee of $40m a year. After office costs, that would equate to at least $500,000 for each ex-Barclays banker. Over 10 years, the total cost would be $400m.

By contrast, Barclays’ net income over the life of the loan is set to be around $650m. In other words, Barclays will make less on its risk-bearing $12.6bn loan than the investors and managers for their virtually risk-free exposure.But that’s only the start. Sources have confirmed that the C12 staff are on a performance package on top of the base $40m management fee. One insider said the deal was little more than “a retention scheme for the staff”. The incentive scheme is believed to be a multiple of base salaries.

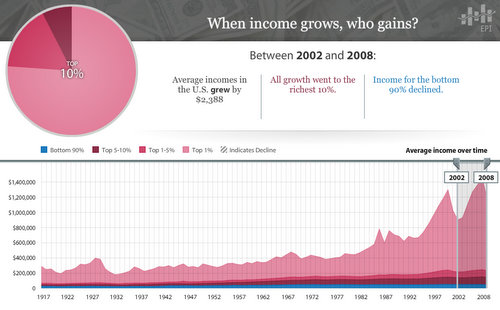

4. When income grows, who gains? - The interactive graphic below from the US Economic Policy Institute showing which parts of the income spectrum in the United States gained when incomes rose is just a cracking thing to play with. Click here to play or click the chart below.

For example, the graphic shows that all of the economic growth in America between 2002 and 2008 went to the richest 10% while income for the bottom 90% fell.

5. Don't take it from me - Take it from the Governor of the Bank of England Mervyn King. He talks in this Telegraph Video about how British workers have not seen any rise in real wages since 2005, which hasn't happened since the 1920s....

Here's a great chart....

6. Guanxi on a very fast rail - China's Minister of Railways has been dismissed and is "helping the authorities with their inquiries" about "severe disciplinary violations," the FT.com reported via Xinhua.

Perhaps China is building a few high speed railways to nowhere. It plans to spend a further US$106 billion this year on new rail developments. Even a thin slice of that is a lot of money to put somewhere else. This reminds us we should always ask how the Chinese money being invested in New Zealand by mysterious Chinese figures was actually 'earned'.

Although the Xinhua report provided no details about the reason for the probe, it is likely to raise questions about China’s massive investment into high-speed rail, which Mr Liu spearheaded.

This is not the first time that Mr Liu’s family has been involved in corruption probes. In 2006, his younger brother, Liu Zhixiang, who was then a senior railways official in the central Chinese city of Wuhan, received a suspended death sentence after being convicted of trying to hire an assassin to kill a man who had informed on him. He was also accused of embezzling $5m.

The Railway Ministry said last month that domestic rail investment for 2011 would top Rmb700bn ($106bn), roughly the same as last year, with around 70 new inter-city projects scheduled to break ground. However, critics have suggested that some of the lines will be uneconomical because the fares will be out of reach for many rail passengers.

7. Oh dear - 14% of American kids aged 4 or 5 can tie their shoes while 21% can play at least one smart phone app, WSJ.com reports.

In the same study, which polled 2,200 mothers in several developed countries, 22% of children that age knew at least one Web address, 34% could open a Web browser and 76% could play an online computer game.

By comparison, 31% knew to dial 9-1-1 in an emergency, 35% could get their own breakfast (which we assume doesn’t mean making eggs) and 53% knew their home address. (A full 67% could ride a bike, which makes your Digits blogger feel bad for not learning until she was well into elementary school.)

8. Cuts here, cuts there, cuts everywhere - Britain's version of the Teap Party, UKUncut, has made a real impact there protesting against companies such as Boots, Vodafone and Barclays their not paying their fair share of taxes. Here's a mashup-video by Diva Schematic for UKcut.org HT Billy Bragg via Twitter. Please excuse the rude word that crops up a few times...

9. 'Madoff style pyramid' - Philip Aldrick at The Telegraph points to research by the Centre for Policy Studies in Britain that worries that public sector pensions could thump the UK economy and create a society of haves and have nots split along public sector/private sector lines.

Same problem here?

Public-sector retirement promises have become a "Madoff-style pyramid, now collapsing under the weight of insufficient contributions, rising longevity and an ageing workforce", Michael Johnson said in his report for the Centre for Policy Studies, "Self-sufficiency is the key". Unless the problem is addressed, Britain faces a "societal division" caused by the gulf between private and public-sector pension provisions, and the "disproportionately high pensions paid to high earners" in the Civil Service.

Without reform, the divisions will be entrenched between the generations, he added, warning of "looming generational inequality [that] manifests itself as a rising tax burden on today's workers, who then save less for their own retirement". More than three-quarters of civil servants are in a final salary scheme, compared with less than a fifth of private-sector employees, with the taxpayer providing almost 80pc of all public-sector final salary contributions.

10. 'The Youtubes were funny' - Here's the response to the now famous 'Ben Bernank' video with the animated rabbits. It only has 24,349 views to over 4.2 million views.

This is my favourite line: 'The Glenn Beck and The Fox are literally f....ing ret....ed'. Although I don't want to impugn those with learning difficulties by association with Glenn Beck...HT Alex, who doesn't have learning difficulties

8 Comments

Excellent piece from Mish on the on-going US housing market collapse, with particular reference to how cities once thought immune are now falling prey:

http://globaleconomicanalysis.blogspot.com/2011/02/housing-crash-bites-…

Must read for those still naive enough to use the 'its different here' routine.

Great link Andyh. Funny how that 30% fall number keeps cropping up...

cheers

Bernard

And another one for you Mr B. When even the hyper bulls at CNBC sniff a rat (and a big one at that) in the US unemployment figures you know there is a problem:

http://www.cnbc.com/id/41583533

You have to ask yourself how (allegedly) US unemployment has fallen and yet the employment participation rate keeps hitting new lows.

So we have a US housing market that is literally leaking tens of billions of dollars of value a month and a vast pool of unemployed who no doubt are getting more and more into debt. Recovery? Maybe on Wall Street and maybe around the periphery but the Bernanke is going to have to print a gadzillion more to offset these massive drags on the 'recovery'.

You probably caught this PDK but Puvlava had a 30 min discussion with Chris on Feb 8th

http://www.financialsense.com/financial-sense-newshour

Required listening for anyone grappling with what their choices are in a peakoil/resource depleting world.

A good listen.........

regards

Generally in most industry's, training and/or business models, it is quite often based around themes and/or what they are doing in the USA which is used as the "good" example of how to do it better, not so long ago there was on offer a huge selection of courses/motivational seminars/guru's bought in from the states by NZ companies to "upskill" NZ salespeople on how to upsell/close the deal/7 steps to a sale or any other fancy ctach phrase they could come up with, where are they now?, easy to sell a seminar package when the market is on the up and the sales happen anyway, it show's this whole industry for the BS that it is and questions why anyone would want to look to the US as the model to follow, time for something new/different/interesting.

re #8 I knew a very wealthy british investment banker who registered and paid his company taxes in spain (which equated to bugga all) and was able to do this by living out of england for 5 months of the year, he was having a good laugh about about

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.