Here's my Top 10 links from around the Internet at 10 to 8pm in association with NZ Mint.

As I publish we're seeing reports of an 8.8 earthquake in Japan and a Tsunami.

It looks horrendous. All our thoughts go out to everyone in Japan. Here's the Reuters report.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

1. The fallout has only just begun - Seumas Milne at The Guardian hit a nerve this week when he wrote that politicians are clinging to a broken economic model and are failing to realise that the real fallout from the crash of 2008 has only just begun.

The comments by Mervyn King to The Telegraph last week are reverberating in Britain where the pain from budget cuts is now biting deep just as the Too Big To Fail bankers award each other a big new round of bonuses.

David Cameron is on an austerity drive.

He should be careful.

The public might actually revolt in Britain.

It has taken the Bank of England governor Mervyn King of all people to nail the endlessly repeated falsehood that the deficit is the result of Labour profligacy – rather than the breakdown of an unregulated and unreformed financial system enthusiastically endorsed by the entire political class.

King blamed the bankers for the cuts, and warned of the threat of further crises unless the financial behemoths were brought to book. And it was Richard Lambert, the outgoing head of the employers' CBI, who took the government to task for absurdly relying on the ruthlessness of its cuts to deliver growth.

Mervyn King expressed surprise last week that the "degree of public anger has not been greater than it has" over the costs of the system's failure. But as those costs are rammed home, both in Britain and across the world, it will become clearer that the fallout has only just begun.

2. Preparing for higher interest rates - This is extraordinary really. The world's biggest bond fund, PIMCO, has just sold out of all its US Treasuries, Bloomberg reported.

Yet still people buy US Treasuries.

Or at least the Fed does...and the Chinese...even though they don't trust the Americans any more.

Longer term interest rates, at the very least, are headed north.

Yet our central bank just cut its rates....

Some of the biggest private investors in the bond market, from fund managers to insurers and pensions, are preparing for an end to the three-decade Treasury rally, as interest rates near zero and unprecedented spending by the U.S. government and the central bank threaten to fuel inflation. Their strategies range from reducing the longest-dated holdings and shifting to higher-yielding corporate debt, to investing in stocks, commodities, non-U.S. bonds and even holding cash.

“U.S. government bonds are not a safe haven,” Jim Rogers, the global investor who predicted the 2007-2009 housing-market crash, said in a telephone interview from Singapore. “I cannot conceive of lending money to the U.S. government for 30 years.”

Pacific Investment Management Co. said yesterday that Gross, who runs the $237 billion Pimco Total Return Fund, eliminated government-related debt from his flagship fund last month as the U.S. projected record budget deficits. Gross, who has overseen the expansion of Pimco into a $1.2 trillion bond shop over four decades, predicted a year ago that “bonds have seen their best days.” Last month, he said Treasuries may have to be “exorcised” from model portfolios.

These comments from Chinese observers are most interesting.

“China has kept on lending money to the U.S. to keep its export machine going, and to prevent losses” on its existing holdings of Treasuries, said Yu Yongding, a former Chinese central bank adviser. “Perhaps it is too late to do anything about the existing stock without causing a serious political and financial backlash. But at least China should stop continuing building up its holdings.”

China’s currency’s de facto peg to the dollar limits its ability to diversify away from Treasuries even while its policy makers are “very, very bearish” on the dollar, said Andy Xie, formerly Morgan Stanley’s chief Asia economist in Hong Kong. China’s probably trying to diversify by increasing purchases of euro-denominated bonds and buying bonds with shorter maturities to minimize risk, Xie said.

“China’s faith in the Fed broke a few years ago,” said Xie, now an independent economist based in Shanghai. “China used to be enamored of people like Greenspan and Bob Rubin even though at that time the dollar was coming down. QE2 destroyed whatever faith was left.”

3. An Egyptian song for all - The CEO of PIMCO (that very same bond fund mentioned above) is Mohamed El Irian, the son of an Egyptian diplomat. Here in a blog at Reuters he picks out a popular Egyptian music video celebrating the revolution. It's well worth a watch on Youtube below if you want to understand what is going on in the Middle East.

For centuries, songs have provided populist narratives of historical movements. And, every once in a while, a song comes along that also succeeds in capturing forcefully the raw emotions of the moment. This is the case today with “Sout el Horeya,” or the “Voice of Freedom,” sung by Hany Adel and Amir Eid.

Coming out of Egypt, this song skillfully encapsulates the strong drivers behind the ongoing transformations impacting the Middle East and North Africa. It is a “must hear” for all those trying to understand previously-unthinkable developments in the region, including western governments whose sophisticated intelligence services have been caught flat-footed and are now playing rapid catch up.

4. Show me the hole in your Caja - Here's one of the reasons why there is so much nervousness around Spain's sovereign debt market at the moment. Moody's has cut its rating, but also a hole in the accounts of Spain's savings banks is about to be revealed, Bloomberg reports.

The numbers are mindboggling. 100 billion euros of loans are 'problematic' and only a third have been provided for.

The Bank of Spain will publish each lender’s capital shortfall and the overall amount, which the regulator has already estimated won’t exceed 20 billion euros ($28 billion), or 2 percent of Spanish gross domestic product. The government wants most of that to be raised privately even as central bank Governor Miguel Angel Fernandez Ordonez said Feb. 21 that some lenders will ask the state-rescue fund for help.

Spanish banks, mostly savings institutes called “cajas,” have recognized losses equivalent to 9 percent of GDP since 2008, the Bank of Spain said on Feb. 21. Cajas’ exposure to the real-estate and building industry amounts to 217 billion euros. About 100 billion euros of that is already classified as “potentially problematic,” of which 38 percent is covered with provisions, the regulator said.

5. Peak coffee - The New York Times reports on how global warming might be creating peak coffee. It seems to be boosting prices.

The shortage of high-end Arabica coffee beans is also being felt in New York supermarkets and Paris cafes, as customers blink at escalating prices. Purveyors fear that the Arabica coffee supply from Colombia may never rebound — that the world might, in effect, hit “peak coffee.”

In 2006, Colombia produced more than 12 million 132-pound bags of coffee, and set a goal of 17 million for 2014. Last year the yield was nine million bags.

Yet as stockpiles of some of the best coffee beans shrink, global demand is soaring as the rising middle classes of emerging economies like Brazil, India and China develop the coffee habit.

“Coffee production is under threat from global warming, and the outlook for Arabica in particular is not good,” said Peter Baker, a coffee specialist with CABI, a research group in Britain that focuses on agriculture and the environment, noting that climate changes, including heavy rains and droughts, have harmed crops across many parts of Central and South America.

6. Keep an eye on Europe - There are meetings this weekend and nearer the end of the month where the immovable object (German public opinion) meets the unstoppable force of out-of-control budget deficits in the rest of the euro zone. The New York Times reports that many are sceptical about the prospect of any agreement.

Essentially the Irish, the Portugese, the Spanish and ultimately the Italians want to keep running deficits and not have the Germans looking over their shoulder at every turn.

The Germans, meanwhile, hate the idea that the ECB is buying all this toxic European paper with their German money, devaluing it as it goes. That's why Axel Weber left the ECB in a huff. The euro is a couple of bad election results away from destruction.

Berlin sees a deal on the “pact for competitiveness” as a precondition for bolstering the €440 billion, or $608 billion, backstop fund for euro zone countries and making it permanent – and possibly more flexible – at another summit on March 24. However, after a rebellion by smaller countries, the initial French-German plan for the pact has been softened, leaving only one contentious issue: moves to bring Europe’s corporate tax systems closer together.

Without tough and binding commitments to tackle structural problems across the euro zone, the German government will find it more difficult to persuade its public that it is right to increase in the bailout fund or to allow it to be used more flexibly.

The latest version of the proposals states that countries should announce concrete commitments to improve several aspects of their own economic performance within the next 12 months. These targets should be announced on March 24 if possible or, for countries unable to do so, in June this year. But by giving countries the ability to choose the detail of their own measures, the latest draft of the pact has made it difficult to use the agreement as a vehicle to impose rigid, Germanic, fiscal discipline on the euro zone.

“It’s not worth the paper it’s written on,” said one E.U. official speaking on condition of anonymity in accordance with policy.

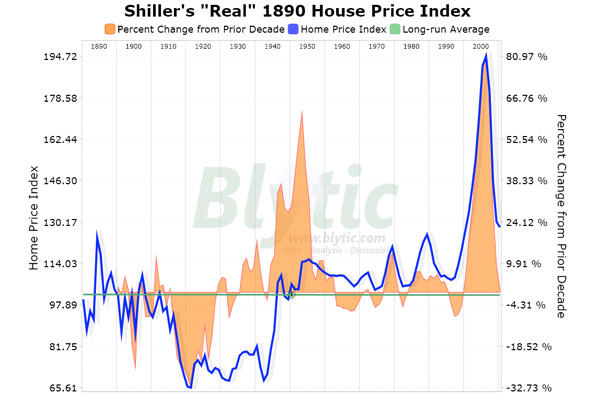

7. Really long term poor performer - Rotten Apple at MacroBlog in Australia picks out a long term chart of real house prices in America and finds it's not so good and on its way down from a big blowout.

8. 'My big fat Greek bond issue' - Greece is planning to sell 'diaspora' bonds to rich emigrants living in America, Canada and Australia to get itself out of its fiscal mess. I kid you not. Here's the WSJ with the story....

Mr. Arvanitis, who immigrated in 1974, said he would be willing to buy about $10,000 of the bonds, after getting his wife's approval. "I'm proud of Greece—we gave the world democracy and history and art, everything," he says.

"Greek people are smart people, but they don't know how to run a government."

Greece also has indicated it will reach out to expats in Australia and Canada, both also home to large Greek populations. The so-called diaspora bonds will be marketed to U.S. investors of Greek descent during the first half of 2011, a senior Greek finance-ministry official said Wednesday, after the financially strapped Mediterranean nation filed shelf-registration with U.S. regulators to proceed.

The Greek government official said the country is aiming to pay a yield of less than 5% on the debt, which would mature in between three and 10 years. That is far below what Greek bonds fetch on the open market. Two-year Greek debt has a yield of 15%. And many worry that those who lend money now may not get it all back.

9. 'Proud to be British' - Sir Fred 'The Shred' Goodwin, the guy behind the Royal Bank of Scotland debacle, has succeeded in taking out a 'super injunction' in a British court to stop newspapers there publishing details of an ... ahem... marital issue. It seems Fred was very, very busy during the Global Financial Crisis. Richard Smith has this very British tale at Naked Capitalism.

In what will be seen as another blow to free speech, judge Mr Justice Richard Henriques sided with the married banker. The banker, who is paid a substantial six figure sum, began the illicit affair before the credit crunch erupted and plunged the country into recession, The Sun reported.

One bank insider told the paper: ‘Given what was going on at the time they got together, I’m surprised either of them had the time or the energy.’

In the words of Prime Minister Winston Churchill, informed that an MP had been caught sodomizing a Guardsman under a tree, on the coldest night of the decade: "Makes you proud to be British."

This is what happens when a truck carrying printer ink crashes. Details here at Gawker.

10. Totally regular weekend video of Clarke and Dawe

11. Totally black and white movie with a song about Steve Jobs and the need for flash on the iPhone. There is swearing. It's a bit rude in a geeky sort of way.

98 Comments

Here's a few extras.

Vast reserves of coal in the far west of China mean it is set to become the "new Middle East", a leading figure in the global coal industry has claimed. Fred Palmer, the chairman of the London-based World Coal Association and a key executive at Peabody Energy, the world's largest privately owned coal company, also said that China is leading the US in efforts to develop technology to "clean" coal of its carbon emissions by burying them underground.

http://www.guardian.co.uk/environment/2011/mar/08/china-coal-new-middle-east?CMP=twt_gu

America's new boom industry. Cannabis.

Britain may break up its big banks

http://dealbook.nytimes.com/2011/03/10/a-death-warrant-for-british-banks/

More pain in Spain

Spain's banks have been told to find an extra €17bn (£14.5bn) to shore up their finances and prevent a collapse in confidence after ratings agency Moody's shocked the markets with a downgrade of the country's debt.

The Spanish units of Deutsche Bank and Barclays were among several banks to fail tests set by the Banco de España, Spain's central bank, with Barclays the worst hit by a demand to inject €552m to reach a core capital ratio of 8%.

http://www.guardian.co.uk/business/2011/mar/10/new-fears-for-spain-bank-stress-tests-debt-downgraded

Here's Ed Harrison at Credit Writedowns

- Captured by the Corporatist, the government attempts to revive the status quo ante via bailouts and stimulus instead of using stimulus as a way of cushioning the downturn and increasing employment as the economy re-balances which means inequity is apparent in much starker detail due to the gravity of the downturn.

- The populace becomes angry. Stimulus is no longer supported. Austerity rules. What if the banks had been bailed out under harsher terms or nationalized? How would that have affected the political debate today?

- Depression ensues as it did in 1937 in the U.S. and 1997 in Japan. Insiders are prosecuted for malfeasance. Incumbent government is overthrown.

http://www.creditwritedowns.com/2011/03/a-brief-note-on-corporatism.html

I could enjoy the last two coming to pass....may make the first bearable knowing the ppl responsible are in jail and being well roggered for their part in this.....

Wisconsin looks ugly....this is the first real flare up I think.....Americans may yet take back their Govn.

regards

terrible event in Japan

We should send help out to reciprocate how they helped us

houses smashed over like nothing - just shows how impermanent human marks on the landscape are, and how silly the price we pay for small vulnerable timber boxes

FYI a very French call for resistance against the "international dictatorship of the financial markets" from an old man in a pamphlet of all things.

FYI there is a Tsunami warning for NZ from civil defence

http://www.civildefence.govt.nz/memwebsite.nsf/0/B3881D742D017F9CCC2578500026E5A4?OpenDocument

I just got this email from a kiwi mate in Tokyo, who told me he, his wife and son are all okay. He was at work. "Our building shook like nothing you could imagine, I stayed inside, a lot of people left though. Everyone is shaken up though, fires breaking out around tokyo."

A few minutes ago Japan used a nuclear emergency. (Fire in a nuclear power station - NE -> Onagawa)

Japan struggling to 'cool down' nuclear plant, minister says

http://edition.cnn.com/2011/WORLD/asiapcf/03/11/japan.nuclear/

Take your time and watch this film. The moon.

Kunst - yes, that's the problem with the current crop of nuclear plants - no Yucca Mountain, no alternative, and they're all decades old.

I still remember, the 26 April 1986, at reactor number four at the Chernobyl plant during a test ruptured – the Swiss media advised to stay inside because of an easterly wind = 1’622km away.

An ex-pat business associate who was in Christchurch on 22 Feb. who is now back in his based in Tokyo said it was massive, starting to feel its his fault!!!

"starting to feel its his fault!!!"

pun intended or unintended???

Does it matter? Why are people so obsessed with the intention of puns? Not punny.

Re # 7 : For a bit of light reading , check Ken Fisher's " The Wall Street Waltz " , a visual perspective , with 90 or so charts and explanations ........ And we do love charts here at interest.co.nz ! ...

.... The charts for real estate and for gold will cause Big Daddy to wee-wee in his man-kini ........ Barely above CPI rates of return are shown over the very very long term .....

.... But of course , those charts relate to the nineteenth and the twentieth centuries ....... That sort of stuff couldn't happen now ... We're smarter than them ..... Got the internet ..... Ken Ring ...

.... Yup , this time is different !

Thanks Gummy

Here's a link to the book

cheers

Bernard

M6.2 earthquake has hit near Nagano, Japan,

The pre dawn earthquake was at a depth of 1km

#8

Greek 2 year bonds jumped to 17,1% !!!

http://www.bloomberg.com/news/2011-03-10/german-10-year-bonds-rally-aft…

http://gregpytel.blogspot.com/2011/03/you-cannot-regulate-risk-self.html

Thirdly, and above all, banks cannot be "too big to fail". For hundreds of years this was precisely the case. If banks are "too big to fail", then the free market is dead. Self regulation does not work. Instead it is a system akin to communist central planning that so spectacularly failed over two decades ago.

In a nutshell, in order to put the financial system back into shape governments must not regulate more but less as it is impossible to regulate dynamic financial risks. It is exactly the same problem as a challenge of centrally planned economies: predicting people's micro-behaviour. Governments must reintroduce free market into the financial industry. Banks must be small enough to fail. Banks must regulate themselves, apart from general law and basic, bottom line regulations (which should be a role of central banks and general justice system). And in case of a banks' failure all those carrying responsibility for managing such bank must be held personally responsible expecting very harsh penalties

local problem?local solution!we are heading back to real and viable communities.the chch quake will never pay for itself.the japanese may want some funds returned back home to help out their govt.you're doing a fanastic job bernard,thank you.

Ganesh Nana at BERL yesterday says the present economic model focusing on monetary policy doesn't work - the world has changed. And then - dang - the video cuts out!

http://tvnz.co.nz/business-news/amp-business-economist-attacks-ocr-redundant-3-49-video-4056938

So did anyone see it - does he get around to suggesting anything as a viable alternate?

Try You Tube Kate. I will have a look myself and if I find it I'll post it up

No nothing, cant find a thing even at BERL

I will ask Ganesh in for a Double Shot to get the full picture

cheers

Bernard

try this one--it ran to full time--- he did,t seem to have any options

Ta. Well at least he's got a sense of urgency and an idea same 'ol, same 'ol won't do.

:-)

Volcano Sakurajima errupts.

http://en.wikipedia.org/wiki/Sakurajima

Fukushima reactor pressure may have hit 2.1 times capacity -METI

http://www.reuters.com/article/2011/03/11/japan-quake-tepco-pressure-idUSLHE7EB00R20110311

Almost simultaneously with the strong shock that hit Japan and triggered a giant tsunami in the Pacific, the Russian Kamchatka volcanoes erupted too. Eruption was accompanied by earthquakes

-

(Reuters) - Tokyo Electric Power (9501.T) said it had lost its ability to control pressure in some of the reactors of a second nuclear power plant at its quake-hit Fukushima facility in northeastern Japan.

http://www.weatherwatch.co.nz/content/video-1996-quake-docu-warns-chch-could-be-hit-hard

Listening to that film document - it could become a long and rough road for home owners dealing with insurance companies/ council/ government.

....and another example, how greedy, irresponsible people in this case developers can destroy life’s of others.

Anybody think Nuclear power is a good solution for NZ now?

I think me old Buddy Mark Weldon has his work cut out for him now......

Why ? ..... Are they sending him into the core of that Japanese nuclear reactor ??? ..... Cool ... !

.

Listen to another “Prof. AIChE- Wallstreet liear”: Nuclear power plants are extremely safe.

People say: He's clever, smart makes lots of money = Salary I guess $US 220’000.p/a- plus

http://earthquakes.videohq.tv/2011/03/japan-neis-chief-nuclear-officer.html

A rotten system - full of irresponsible people - just to make greedy money.

Yes, great send them over ! Our PM has the same info’s we have – clever, smart. Salary ??????? p/a - lovely !

http://www.stuff.co.nz/world/asia/japan-earthquake/4761624/Japan-tsunami-NZ-to-send-rescue-help

I hadnt thought of that! Was more thinking that it will be hard to raise money overseas to pay for the Chch earthquake damage which is pretty minor in the face of the damage that Japan is facing - together with a nuclear crisis. That might be slightly more demanding of Marks 'US networks' than his pleads of poverty.

Re Andrew J on Free markets: From Wiki:

In the classical economics of such figures as Adam Smith and David Ricardo, "free markets" meant "free of unnecessary charges" and a "market free from monopoly power, business fraud, political insider dealing and special privileges for vested interests".[17] A "free market" particularly meant one free of foreign debt;[ as discussed in The Wealth of Nations.

It turns out that Milton Freedman 'co-opted' the term 'Free Markets' and made it mean something completely different, almost the exact opposite.

So I think Andrew J is on the money with his comments about banking.

M6.1 earthquake has hit TONGA

Comment form Telegraph on Japans reactors

PatLogan2

Today 01:26 AM

Recommended by

22 people

It's good to see the Telegraph maintaining the tradition of quality reporting that we expect from the British media on matters nuclear.

First, the headline. It's hardly surprising that Fukushima is "boiling". It's a Boiling Water Reactor. Boiling is the normal means of heat removal from the core. 30 seconds on google would have led your reporter to a source that told him or her that.

Second - the apparent overpressure. It'd actually make more sense if your reporter had said (or bothered to find out) if the 50% excess pressure is in the reactor pressure vessel - which would be a major event - or within the containment - which would be utterly normal within the operation of shutdown systems.

When a BWR is "scrammed" - or undergoes an emergency shutdown - decay heat from the fuel is removed by venting of overpressure from the main reactor circuit into a water pool in the containment, unsurprisingly called the suppression pool. This condenses the steam, but over time temperatures and pressure rise in the containment, and the system is designed to vent (via filters) to atmosphere. There are some short-lived activation products in the steam, but nothing hazardous to health. A 50% overpressure in the containment, btw, would be of the order of a few pounds per square inch. Not scary.

As to the power loss - these systems are usually supplied with mains power, or by back-up generators. It sounds as though neither is available, but all of these systems have a fall back, by which they are powered by steam generated by the decay heat itself. It sounds as though the plant is running on these.

Incidentally, I'm pleased to see the hysterical earlier story about the US Navy shipping in "coolant" seem to have died the death. Hardly surprising. The "coolant" for these systems is hardly exotic. It's water.

I'm a former nuclear engineer, having worked on the UK's AGR designs - admittedly dissimilar to BWRs like Fukushima, but designed around similar principles of "defence in depth".

So far, stripped of media hype, what I'm hearing is that the primary systems are out, but secondary and tertiary systems are running much as designed. It's not a circumstance that any engineer would like to be in, but neither is it a catastrophe.

Finally, one small point. When a reactor scrams, depending on the age of the fuel, it can be generating up to 10% of it's normal output in decay heat. That falls off exponentially, making the cooling problems much, much less problematic. Generally, a good rule of thumb is within 3 days, that initial 10% will fall well below 1%. If things are going to get bad, it'd normally be an issue in the first few hours, rather than later.

Awesome post Andrew. Copious kudos.

Andrew I have reasonable good technical information in German about the type of reactors. The probability of a core melting is even considered by Japanese atomic experts.

Obviously cooling cannot be maintained, because of missing equipment, which cannot be connected.

In which case the multiple backup systems should shut it down automatically.

regards

The system has shut down, but without continuously cooling the fuel rods a melt down is increasingly likely, leading to radiation of the environment, with severe consequences for Japan.

Next to Swissgerman my "first" language is German, the reason why in highly technical issues or when I need to informed myself accurately about other more complex issues I often do it German. In such cases English is too difficult for me.

What about you vic can you talk about nuclear power issues in German ?

http://www.spiegel.de/wissenschaft/technik/0,1518,750459,00.html -

I have chosen an article simple to understand not too technical.

What do you think ?

vic no, but I'm not stupid.

Kunst - he/she/it won't be an expert in anything either.

As you say, with intelligence, anyone can learn anything.

The inintelligent are reduced to making inane, short-word snide comments, ie not contributing to the debate. You can always identify them by that.

I've found that if you scratch the surface, those folk usually turn out to be either vulnerable in a real sense (leveraged -which is betting that the future will stay as today, is a common one) or in a psychological sense (the kind who aren't confident to face the world as they are, but need to identify themselves by their posessions).

I don't include either sort in my visiting rounds :)

pdk - good nickname !

As that nuclear accident demonstrate, how much people really understand/ care is reflected on their attention to certain issues – most time - not much.

The current event, but especially the nuclear accident could potentially ruin Japan.

2 weeks ago I wrote on a property issue: Many people willing to migrate to New Zealand is a strong possibility of different reasons - among nuclear accidents.

Now now boys. Civility is a virtue. You now need to buy each other a beer/coffee and have a smile about this little exchange.

cheers

Bernard

Bernard - whatever you write, I don’t accept comment from vic 12.3. 10:27pm (see email also) either you deleted it or I’m out. Your team always advocate for “a fair go” this comment just goes too far.

I do not understand that our PM is sending NZemergency personnel to Japan in the current situation, where the possibility is increasing of a nuclear catastrophe.

News : First explosion just happening !

Info's about the reactor

http://en.wikipedia.org/wiki/Boiling_water_reactor

It's only the urban search rescue crew and I doubt anyone would be put near that reactor Kunst. We surely owe the Japanese some help in return as good global citizens do we not? Their disaster is 1000 times worse quite literally

I’m 100% in favour of help of course, but how many of the nuclear power plants are at risk after the earthquake/ tsunami ? How big is the impact on life’s - unanswered questions !

As I wrote, it is about timing.

Life's one big unanswered question. There's always positives that can come from negative outcomes Kunst.

If they do have meltdown then MAYBE we can finally start building Thorium reactors as first intended.

Take a look, it was meant to be

http://www.guardian.co.uk/world/2011/mar/12/japan-nuclear-meltdown-fukushima-reactor

That is the "fairest" article I found on the net. It seems some experts comments on both sides are already politicking the accident lobbing - especially for the continuation of nuclear power use.

Government member Yukio Edano confirms the escape of radioactivity from power plant Fukushima 1.

Pretty good chance atleast one of those reactors is stuffed. Lessons are always learnt the hard way (for about 20-30 years and then they thuck it up again and all go "Ohhh,,,that's right, that radiation thingy sure is dangerous")

"Incidentally, I'm pleased to see the hysterical earlier story about the US Navy shipping in "coolant" seem to have died the death. Hardly surprising. The "coolant" for these systems is hardly exotic. It's water."

It's not the "exoticness" that's the issue - NZHerald:

"Robert Alvarez, senior scholar at the Institute for Policy Studies and former senior policy adviser to the US secretary of energy, said in a briefing for reporters that the seawater was a desperate measure.

"It's a Hail Mary pass," he said."

Are you going to accuse Alvarez of being hysterical?

AndrewJ

Was relieved to read this reasonable sounding explanation from a man, who supposedly knows about it. After a few seconds, my old doubt crept in. If this is as described, why on earth would the Japanese Government risk to call it a Nuclear Emergency and evacuate people instead of saying the secondary systems are working as designed?

Ive been reading the reports.....beyond the emergency I have to wonder why it has a licence to operate.......its beginning to look like a string of failures due to one event has shot its systems....that simply should not happen especially in a earthquake prone island.

regards

as usual so much ill informed comment from the media

Was watching CNN last week, the birds they had presenting were horribly hyping it, talking about a massive wave rushing across the Pacific, and impending doom for the Pacific Islands

there are more than a few confused soul,s out and about--this lot reckon,s the quake,s are the result of global warming

pwilkie - what does happen to a sphere when you heat it?

by .05 of of a degree ?--bugger all

if its somethign the size of a house, yes....0.05 Deg C when the mass is huge, a huge amount of energy is envloved....

For AGW though I find the link very difficult to justify....

regards

Have a closer look, especially 1:33 - 1:40:

What is it with you?

----------

----------

regards

No, we show the similar outlook/conclusions based on maths, engineering, science, risk assessment.....applying these disaplines to the issues of peak oil, peak food, peak everything and AGW, lead us to these conclusions

The ultimate one is basic maths you cannot have infinite [expotential] growth on a finite planet....start from that absolute truth....

We differ a bit on the solutions though.

and your thought process is based on what? confused? Im not surprised....its pretty obvious that you lack any of the above and/or you ware huge political or religious blinkers....so that leaves fear, and denial as your friends it seems....

By all means show some quality of argument.

regards

vic why don't you actually contribute to the debate instead of trying to smear other contributors?

Come on vic, make a contribution to the debate or go away.

7. I love/hate that chart.... Do the math.........so at 100%...............during the first great depression from the mean of 100% house prices dropped 32%.......

Today houses are close to 200% of what they should be worth...so 50% loss in value just to get back to the mean....then add in a 30% below that again....to get an idea of what the house will be worth if we see a great depression mk2.....and the odds are very good for it IMHO....

So today my house is probably going to drop by 60 to 70%.......I take a small loss....ppl who have bought in the last 5 years, well they are buggered....

regards

Cheer up Steven, it's never as bad as pessimists think, nor never as good as optimists think.

It won't be half of your feared 60-70% drop in value , you'll see.

Muzza,

I admit I dont know for certain what the drop will be, if any....however historically we can see from the first GD a drop of 70% looks possible.

To quote "its different this time" Indeed it is.....

We do have massive concentration of wealth in the hands of the few, thats similar.

We do have an institutional blindness to the impact of a GD,.....the ppl who lived through it are mostly dead or 75+....we have only known for 3 generations good times, you know house prices only go up, that chart clerly shows thats a falsehood.

We didnt have peak oil last time, and in fact the US was still discovering oil, production in the US was increasing and it was a net exporter, it had goods to sell.

We didnt have the BBs retiring.

We didnt have massive financial fraud on a breathtaking scale.

We didnt have massive debt.......

We didnt have huge over-population....I think in the 1920s we had 2billion? that was about right...

So the last 5 of the above are on top of the first two....which were enough......

regards

Count on being lied to steven...expect serious consequences from Bernanke's bullshit and Bollard's games...this economy was in the shite before sept last year...the quakes have only compounded the mess...stay away from debt and bonds, both of which promise to kill you.

The property collapse in NZ has yet to gather pace...that will happen post the election with the higher rates bashing into the indebted...expect the govt and the RBNZ to fiddle the money supply to protect the banks from the flood of blood.

Unemployment set to rise. The exodus to gather steam. Retail to be hit again. Fiscal hole to become a chasm. Commodities bubble to topple over. Chch rebuild to add to the inflation side of the stagflation trap in which the economy is caught.

Wolly I agree with your thoughts on Bernakie, but in some ways he's caught between a rock and a hard place. The rock is the federal govn and congress who dont care what nation(s) it shafts just as long as the good times (sic!) for the US continue....the hard place is the effect on other nations this policy entails ie overthrowing dictatorial Govns but then oil prices rocket....feeding back into crippling the US economy...

They are complaining of $3.50US petrol when we are paying $6.40US!!!!

Bollard I believe is doing his very best for NZ, all I can say is thank god Brash still isnt there....give him some slack, he isnt political aka Brash.

Debt, without doubt.....bonds may not be that bad, if you look over the long term and in fact during the GD they paid good interest and will NZ default? all I can say is once you leave deposits all bets are off IMHO......I think NZ bonds maybe the lesser of many bad bad evils....

Property a bad bad eveil, the biggest, a way bigger risk than bonds IMHO....its not just the probable fall but just how far....

Unemployment, yes past 10%, in 2011 or 2012 looks likely but once there what exactly would stop it continuing to get worse? Im stumped to find a reason......

Taxes have to go up and the only ones with any $ are those around and over 100k....we cant cut, once you step outside the core Govn costs it cant be cut and shoudlnt be, private provision is even more expensive in terms of its effect on GDP eg health, education.

Retail is dead IMHO....there is no way having so much churn called GDP will ever be so big again....find a % of retail that was in the say 1950s....20%? that will be it....not 60 or 70%...Toursism goes the same way, jet fuel will cost too much.

ChCh will never recover.....personally I think the trend of GDP will be down once oil supply starts to drop....ChCh may then be adandoned....

regards

Wolly - I agree with you all the way.

Wish you wouldn't be so optimistic, though, people won't take you seriously. :)

OK, have your way then, but to expect a $250,000 house, say in Matamata to drop in price by 70%, would mean it would decline to $75,000 which is ridiculous.

Muzza, look at that chart...in effect look what happened from 1929 in 5 years........there is a historic precitent, but we are way more bubble'd....

regards

have a gander at these high rise,s

http://www.youtube.com/watch?v=1JQBGOliAcQ&feature=player_embedded#at=23

TPP

Nice to see the US DMCA act is getting included in the TPP draft, well a more extreme version of it. What the hell is the govt thinking as it's negotiating this rubbish.

Yet another, we'll screw the [foreign] public over....clause, what really annoys me the most is its secret, we do not have the opportunity to comment as voters....that to me is un-democratic....

regards

roubini's outlook gets darker...lastest is 50% chance....its getting worse and worse....

http://www.guardian.co.uk/business/2011/mar/11/roubini-double-dip-reces…

After Christchurch another shock !

The world is currently facing one of the biggest tragedies. Japan will change for ever.

Where do people go ? How safe is the Pacific region ? Can New Zealand take 100’000 people ? What is their future socially, financially, economically ? How does this event influences the world markets/ economy ? How does this event influences the New Zealand economy and state of finances ?

....or do we just not have an answer ?

Difference between Chernobyl and Fukushima

please, click the links for more info’s.

…then just the news a few minutes ago the USA retrieving their vessels/ aircrafts from the coast near Fukushima, because of increasingly higher radioactivity.

The situation is highly critical (core melting) and winds are changing - people should leave Japan.

good grief, you lot are feeding off each others negativity, take you meds and get in and do something!!! At least some of us are.

Note to all

The economic ramifications of the Japan tragedy are yet to be explored.

Surely such a major event for the 2nd / 3rd biggest economy is really going to shake the world economy , which was already so fragile

You got that right!

Great to see somebody is awake. What manufacturing can occur with reduced power.

Let's not forget the tens of thousands in evacuation centres and god knows how many families mourning.........

The fallout from this will be immense....even without the nuclear consequenses

With Japan accounting for 20% of Australian exports, How does that bode for the AUD ?

http://theautomaticearth.blogspot.com/

Macquarie Bank said the tight coking-coal market may see pressure eased as a consequence of the earthquake while steel mills assessed damage, but that demand for thermal coal used in power plants could rise. The increased fuel costs and repair work from the 2007 earthquake were chiefly responsible for Tepco posting a 150 billion yen ($1.82 billion) loss for the year ended March 2008. Tepco's oil use jumped around 50% on year to 9.99 million kiloliters in 2007-08.

Japan has few energy alternatives, as it lacks indigenous energy reserves and must import 80% of its energy requirements. It was therefore prepared to make Faustian bargains despite what should have been obvious risks. The impact of the loss of so much capacity, much of it probably permanently, on available electric power following the accident is very likely to impede Japan's ability to recover from this disaster, potentially strengthening the parallels with America's Hurricane Katrina.

"New Zealanders, by large majorities, are not confident the Government has adequate plans to reduce unemployment, achieve economic growth, increase household incomes, and cut government and private debt, according to the Horizon Research study."

Gosh it's only taken 2 years and 3 months for the sheeple to wake up to reality!...hello debt are you staying long.

Only genuine saving over a long period and a change in attitudes will result in more real employment, economic growth, higher household incomes and reduced debt. Bollard's ocr game last week shows the RBNZ is not encouraging genuine saving and prefers to go with endless debt based splurging to fake the numbers.

That's true , Wolly , but what's the alternative ? ........ Goofy and Cunny really do believe that fairy story Cullen spun them , about pixies at the bottom of the garden with a Gestetner money-printing machine .

.......... Cunny reckons that the only problem with WFF is that it isn't generous and wide enough . They wanna give more , to more .

Unless Gareth Morgan and Bernard are willing to give it a go , the only " viable " other option at the next election will be Winsome Peters .......... oh lawdy lawdy lawdy ......... spare us that , again !

Gareth Morgan - last I heard - denies that there are limits to growth. He'd be of little use at this juncture, on that basis.

Yes at first sight the alternative is really goofy. The only way forward is to pressure the govt to remove Helen's red knickers and throw away the game of tweak and fiddle. The Chch event has given them the one chance they will ever get to bring about an abrupt end to the madness. They have to come out and make it public..scream the message from the copper roof of the bloody Beehive.".this country is bloody stuffed and the game is over...we are going to rock the bloody boat from here on in and if you don't like it..you can vote for the goofy idiots and revert to the idiocy of the past"

The chances of this happening are somewhat remote...look after number one Gummy!

Radiation fears trigger Tokyo exodus

http://www.ft.com/cms/s/0/a7e1716e-4d67-11e0-85e4-00144feab49a.html#axzz1GVY4mvpu

FYI I have banned Vic and The Duke for uncharitable comments that repeatedly broke this part of our rules listed at the bottom of each post.

"Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making these comments."

Regards

Bernard

FYI from a reader via email

I think we're right in then midst of it. In case you missed it, a MAJOR development has occurred in the financial world in the last 48 hours. As usual the mainstream financial media has completely missed it. That "development" is the Bond King, Bill Gross, the single largest bond fund manager in the world has dumped ALL of his US Treasury holdings. Think about that for a moment. The single largest bond investor on the planet has ZERO exposure to US Treasuries right now. He's cleaned out completely. The implications of this: Bill Gross, with the possible exception of Goldman Sachs, has the best access to the US Federal Reserve and US Treasury Department of any investor on the planet. During the 2008 Crisis it was rumored the Treasury had him on "speed dial." So for Gross to be dumping ALL of his US Treasury holdings means that the US debt implosion is about to hit the markets...

which means Treasuries collapsing, interest rates soaring...and inflation going into hyperdrive. http://www.pjtv.com/?cmd=mpg&mpid=113&load=5081

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.