Here's my Top 10 links from around the Internet at 10 past 6 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

Plenty of charts and a bonus video. Have a great weekend.

1. Capital controls work - Harvard economist Kenneth Rogoff and Peterson Institute economist Carmen Reinhart, who wrote the widely acclaimed study of deleveraging called 'This time it's different', have a written a piece at VoxEu in tandem with IMF economist Nicolas Magud in praise of capital controls. Yes really.

New Zealand has been a purist for a couple of decades on capital controls.

The assumption is we would get beaten up by the George Soros' of the world if we tried.

But is that really the case? Others such as Brazil, Turkey, Chile and Malaysia have used them successfully.

Many countries have used various means to slow down the hot money that can push up currencies and kill off exporters.

I hope our Reserve Bank is looking at such measures, including reserve requirements for banks accepting such hot money.

Our results are based on a meta-analysis of 37 empirical studies. The main findings can be summarised as follows.

Capital controls on inflows:

- Make monetary policy more independent,

- Alter the composition of capital flows, and

- Reduce real exchange rate pressures (although the evidence on the latter is more controversial).

- Do not reduce the volume of net flows (and hence the current-account balance).

2. 'It was low interest rates stupid' - Helen Mees aruges at VoxEu that the US Federal Reserve's low interest rates are to blame for the US property bubble. Fair enough.

This chart shows US equity extraction from home values.

At the Paris G20 meeting on 18 February 2011 , Federal Reserve Chairman Ben Bernanke squarely laid the blame for the financial crisis and ensuing economic crisis on global imbalances, or the so-called global saving glut (for a review of the arguments see Suominen 2010).

What the Chairman failed to mention is that the Fed’s easy monetary policy in the early 2000s played a crucial role in bringing about the global saving glut.

3. 'Still a safe haven' - Nouriel Roubini reckons the US dollar will remain a safe haven and reserve currency, if only because the alternatives are woeful.

"I'm not in the camp of those who think there's a chance of a long-term dollar collapse," the New York University economist said in a telephone interview with Dow Jones Newswires. "What are the alternatives?"

"A (US) debt default or credit event is unlikely," Professor Roubini said. "But a credit agency may still downgrade" if it felt spending and deficits weren't sustainable in the longer-term, he added.

Wall Street ratings agencies, Professor Roubini said, may actually fear the ramifications of a downgrade from US officials. "If an agency downgraded the US, I think they'd probably have to headquarter themselves somewhere else," he quipped. "Politically it would not be popular."

4. It just won't work - Former Bank of England policymaker and now Dartmouth Economics Professor David Blanchflower says on Bloomberg austerity is just not working for Europe.

5. Rachel Ray is a good cook. The sub editor for the front page of Tails is not a good editor.

6. The rich are secretly fearful - That they don't have enough money. Graeme Wood at The Atlantic reports on a survey of the Super Rich that found they're a grumpy lot.

The study is titled “The Joys and Dilemmas of Wealth,” but given that the joys tend to be self-evident, it focuses primarily on the dilemmas. The respondents turn out to be a generally dissatisfied lot, whose money has contributed to deep anxieties involving love, work, and family.

Indeed, they are frequently dissatisfied even with their sizable fortunes. Most of them still do not consider themselves financially secure; for that, they say, they would require on average one-quarter more wealth than they currently possess. (Remember: this is a population with assets in the tens of millions of dollars and above.)

One respondent, the heir to an enormous fortune, says that what matters most to him is his Christianity, and that his greatest aspiration is “to love the Lord, my family, and my friends.” He also reports that he wouldn’t feel financially secure until he had $1 billion in the bank.

A vast body of psychological evidence shows that the pleasures of consumption wear off through time and depend heavily on one’s frame of reference. Most of us, for instance, occasionally spoil ourselves with outbursts of deliberate and perhaps excessive consumption: a fancy spa treatment, dinner at an expensive restaurant, a shopping spree. In the case of the very wealthy, such forms of consumption can become so commonplace as to lose all psychological benefit: constant luxury is, in a sense, no luxury at all.

7. Here's hoping - Bloomberg reports the Basel Committee are looking at forcing the 'Too Big To Fail' banks to put aside an extra 3 percentage points in capital to stop them blowing up the world when they leverage their balance sheets to make big bonuses for executives.

The Swiss government has proposed raising the minimum common equity requirement for UBS and Credit Suisse to 10 percent from the 7 percent level set by the Basel committee.

The Group of 20 nations asked the Basel committee in November to draft the extra requirements for banks deemed too big to fail. The Basel group brings together regulators from 27 countries including Brazil, China, India, Germany the U.K. and the U.S.

“Several of my colleagues on the Basel committee have referred to the Swiss proposals as a source of inspiration,” Mark Branson, head of banking supervision at the Swiss Financial Market Supervisory Authority, told journalists on March 22.

Increasing the Basel requirement by 1 percentage point is “just not worth it,” he said. “Certainly what’s being talked about at the moment is more than that.”

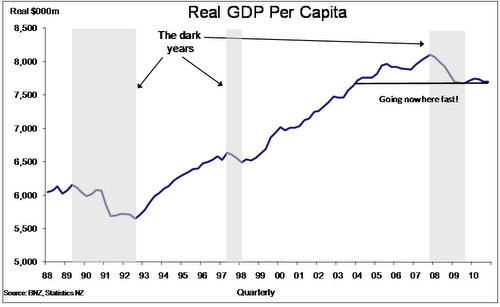

8. Here's a chart showing New Zealand's per capita GDP is no higher than it was in 2004. Thanks to BNZ for the chart. Do people understand what this means? Real wages should be lower. Instead they are higher because we borrowed the difference. Nuts.

And here's a chart showing what has happened to New Zealands productivity over the last decade or two. We haven't earned our way to greatness. We just borrowed our there...

9. Another great chart on what has happened to US house prices in real and nominal terms since 1900. Prices still have a way to fall.

10. Totally useful video from Jon Stewart explaining what's wrong with Barack Obama's reasoning for the Libyan no-fly zone.

11. Bonus video - Here's John Clarke and Brian Dawe do their thing on Australia's carbon price debate.

39 Comments

We think commodities and food is more expensive?

Interesting chart charting wheat etc over many decades.

http://peakoil.com/consumption/stuart-staniford-long-term-crop-prices/

Apart from that so interesting bits,

"With a couple of major excursions due to world events (price drops in the depression, and rises in the second world war and 1970s commodity price shocks)"

So will commodies drop? my thought is not this time long term....I think as in 2008 they will drop as we go into a depression, but they will come back as ppl will need to eat and less fertilizer and pesticides are used....hence less fodd per acre...it might just be a long play.....keep cash and buy in at some point.

regards

Good morning fellow peasants...here is the news:

It's from the http://www.telegraph.co.uk/finance/comment/jeremy-warner/8405399/Britains-200bn-time-bomb-of-debt-interest.html....but is an exact mirror of the govt and RBNZ policy platform of pork and BS....

"A little bit of inflation is a good thing, right? Well, that's one way of looking at it, and if you were being charitable, it might even provide a decent explanation of why the Bank of England (RBNZ)appears to have given up on the inflation target.

Three powerfully negative effects are identified by the OBR.( a job that should be done by treasury in NZ) As a result of higher than expected inflation, living standards will fall for longer than previously anticipated, public borrowing will end up higher, and real terms cuts in public spending will have to be deeper.

Using the OBR numbers, the Institute for Fiscal Studies calculates that in fact real spending on the National Health Service will fall by 0.9pc unless the Government tops it up from somewhere else. In the round, the public spending cuts will have to be £4bn deeper, while borrowing will end up £46bn higher. So much for inflating away the nation's debts.

The cause of this phenomenon is obvious when you think about it. Large elements of spending, including benefits and the costs of servicing index linked gilts, will continue to rise in line with inflation( that's the benefit hikes etc here in NZ), but because earnings are lagging prices, there will be a shortfall on the revenue side of the ledger, thereby increasing the amount the Government has to borrow.( Bill's bigger fiscal hole!)

Similarly, higher inflation – but no change to the cash size of departmental spending limits means that the real size of the cuts will be bigger.( Sir Humphrey will be pissed)

The miracle is that the bond markets remain as compliant as they are given this toxic mix of inflation and continued public indebtedness." .....Don't expect this to apply to us.....we have been warned....English and Key and Bollard have been WARNED

So the only question this weekend, apart from reactor 3, will English Key and Bollard ... do something beside talking about doing something!!!!!

Great link Wolly

cheers

Bernard

This comment from Warner resonated.

"The miracle is that the bond markets remain as compliant as they are given this toxic mix of inflation and continued public indebtedness. Moody's reaffirmed the UK's triple A rating on Thursday, but it warned inflation posed a significant risk. They can say that again. There must come a point when the gilts market turns. What higher interest rates would do to that £200bn debt servicing bill scarcely bears thinking about."

Another boot in the Beehive bum!

"In a very gloomy world, that is a not inconsiderable plus. It is to the Coalition’s credit(UK) that it has had the courage to shrink our grotesquely bloated state to save our economy. All the militant trade unionists joining this weekend’s anti-cuts march should remember that."

A grotesquely bloated state.....sound familiar Bill?

yada....yada..........so you even know what the NZ state spends its $ on? broken down as a % ? or even $?

So we have health and education two of the biggest......what do you suggest we do with those Wolly? Health takes about 8% of GDP.....go private? that would double to 18% of GDP (aka USA).....so we'd be paying 8%~10% tax to a private insurance company and not even know if we were covered....

Education, its costs about $6k per student/child or go private and again that cost doubles....$10k to $15k per annum is quite common....most ppl couldnt afford that....or of course you could take out bank loans for your kids education from 5 to 21....so pay 7%~20% interest on those sums to private "investors"

So we see the end result, the ordainary person/family locked into spiraling debt and controlled by it, that isnt a society...its slavery........get real....

The NZ state is bloated.....pollies for years have been cutting off the "fat" do you really seriously think there is any left?

When you take out the above and Justice, WINZ spending there isnt actually a lot left of Govn...

regards

Oh good one steven...because health education and welfare are massive splurges, we have to leave them alone....try seeing it from the perspective of a fiscal hole that brings a ratings downgrade...now on the cards...!

What will that do for your " ordainary person/family locked into spiraling debt"(sic)...does it not dawn on you that the cost of the debt will rise because the fiscal hole is deeper!!!!

Had the families(adults) not borrowed heaps to chase property in the socialist madness that clark and cullen sold as a period of better times...they would not have the debts round their necks would they...did that not dawn on you?

Wolly you only see one side of the coin it seems.....if the Govn does not provide these cost effective services via tax, then we, the taxed have to pay them directly from our pockets to private entities and that costs us and NZ more.....simple. So pay Govn tax or corporate tax....thats the choice.

ergo taxes have to increase.........but then logic isnt Pollies/voter forte....

Yes families and PIs have chased the property madness, though quite a few families like myself just wante dtheir own home....no it isnt just Labour....National are as bad if not worse... Labour didnt sell better times any more than National....we made the decision to borrow, we are responsible...any time the Govn though to or tried to do something voter "anger" made them stop....

Its not LAbour or left, example, USA what socialist/Labour was in charge there?, or maybe OZ?

"Dawn on me", are you some sort of idiot.....I havnt gone mad on property, I saw the stupidity and the impact of peak oil and Ive been paying down my debts as fast as I can for a decade+ I would say over the last 2 or 3 years in here Ive been saying the same thing....its silly...it will end in tears.

Dont blame Labour for doing little / nothing when thats exactly waht the voter wanted.......

regards

Your problem steven is you actually believe that pollies and bureaucrats are better at managing your life than you are....you are happy to hand over your earnings and let them decide on how it should be spent....or are you saying many Kiwi are incapable of managing their own lives unlike you and that they need to be guided through life by pollies and bureaucrats..I am not an advocate of zero state services but I do question the waste and why there were for 9 years of socialist madness with no effort made to cut down the waste....Clark even dished out two state jobs for the Labour party president...two bloody taxpayer funded jobs! Now we are stuck with a bloated state and with debts pushing the upper limits before a downgrade and there is no end in sight to this, regardless of what blather English comes up with.

Don't blame Labour you say...blame the voters....that's just drivel steven.

Pleased to see you recognised the stupidity of the splurging madness and oil deadline...how come you can't recognise the farce that is Labour.

What about all the middle class welfare that helped delude New Zealanders over the last 5 years that we were worth a pay rise?

Remember, GDP per capita is still below where it was in 2004.

First we deluded ourselves with private debt via the ATMs in our houses to subsidise our lifestyles.

Then we deluded ourselves by increasing public debt to subsidise our lifestyles via Working for Families, Interest Free Student Loans and 'free' early childhood education.

cheers

Bernard

There is actually a movement in the UK where ppl stage sitins of companies like Vodafone and Boots who, based on "quiet" changes to tax policy or existing tax poilcy wont pay any tax.....so what we see is PAYE / OAPs etc being taxed so corporate UK can pay none....

"Militant" no, just ppl getting p*ssed that the rich are making themselves richer and attempting to lock it in...

So ordainary ppl get intot he hands of "militants" maybe because they feel they have no other options...both major parties have deserted them.....same in the US, certianly thats how I feel here.......

regards

Rising Oil Prices Threaten Recovery

"THE Gillard government's chief promoter of the climate change debate has admitted even a global effort to cut carbon emissions would not lower temperatures for up to 1000 years."

Don't ya just love it.....!

Wolly (if you're still the same persona - the vernacular has morphed somewhat).

You claim to be an ex-teacher? I hope it wasn't maths, science or stats.

We don't need to 'lower the temperature', we need 'not to raise it'. Flannery 'admitted' that? That's reportorial bias.That's 'stated', not 'admitted', and it's not in question.

And yes, there always scientists on all sides of any field. It's to do with standard distribution graphs, which I learned about in Form 2-3. In this instance, the tail at the 'denier' end is 3%. Compare that to the 97% who are convinced, minus the expectable percentage of 'erring in the side of'.

But oh no, Those who don't want to be persomally disadvantaged NOW (read: selfish) leap on anything which supports their line of inaction.

Nuts.

Re majority this quote comes to mind: "People eat s**t, 10 billion flys can't be wrong". And I'm affraid, second grade is insufficient to analise warming statistics. Most people are navalgazing and have lost the big picture. As long as planetary and solar influences are not considered all arguments for action against climate change are futile. Presently any form of carbon trading/tax is just another tool of the global banking elite and their politician cronies and will have little or no effect on climate improvement.

Don't have to look too far to see waste in the tertiary sector, so there is a clear cut example.

Interesting those that are keen to back the status quo of Government spending generally never consider in the same breath how to pay for it. Be nice if more people placed their energies into how it will be paid or creating wealth for the country. It is always easier to increase income than cut expenditure, a lot more positive approach to.

Wealth is created by drawing down resources, if you will your savings account, sooner or later its empty....what we have been doing for the last decade is raiding our kids piggy bank...now thats empty as well...

regards

Well holistically yes however in current timeline you can sell an idea to one country which in return provides wealth to this country. Yes i do use energy to do this, like any living person on the planet and conceed a larger carbon footprint when travelling overseas for meetings...but where does you comment take us... no where. Just don't cut the Government services.

I would be interested to see how much others here bring into this country to be taxed or are you playing with the pie which exports of goods and services deliver.

Wolly

Not only your comments are patronising but also devoid of a broader perspective. You adress others as peasants and sheeplee and yet your views are limited to only housing and interest rate rhetorics . People like you moan about state expenditure on health and education without ever bothering to compare what the vidence is out there about the private healthcare and education costs and outcomes for majority of the poulation in such settings. Your coments are monotonous whinging.

Hey I don't mind being called a peasant...and yes private health care is expensive...never suggested it wasn't...what about private welfare...you left that out!....are we to believe we get better state sevices from spending more on health education and welfare...well are we?

How about some cost benefit work before the splurges begin....and if you want to keep the spending going at current rates, please tell us all where the funds will come from...just how much borrowing is deemed by you to be too much?

Steven makes some good points above. Credit where it's due.

There is no private welfare beyond job loss insurance which costs a fortune and only lasts some months. The ppl who probably would need it the most, couldnt afford the premium and probably would not be insurable...

Are we getting better deals on health? we have before us obvious answers at least in health, we have the US [style] system and the UK [style] system......

The US system costs the US, 18% of GDP and does not cover many americans throw in that the AMerican average life span is shorter than most other OECD countries and you have pretty damning statistics.

Then throw in that Microsoft etc are complaining about their health care costs and you get a pretty clear indication of the impact of double the cost of GDP....

Education is harder, I can only see the NZ and UK systems in a limited context, NZ systems cost about $6000 per child per year, Im not aware of any private school that can offer places at that price, in fact most are 2 to 2.5 times more....now yes they on a per child basis generally offer better outcomes but they are smaller scale and its not clear cut....for instance private religious schools eg cathoilc ones generally do worse than "normal" schools...

How is it paid for? thats sort of simple we have to make two choices, do we want a service? and how is it provisoned? if so.....

Govn debt, yes its not good, but what we should have been doing in the good days was building rainy day funds, apart from teh cullen fund we did not, we should have saved, we did not....if we had we would have been in a good position. The adian countries leart that one from their last crisis in 97.

So our choice is now borrow or increase taxes....neither are good....but we can blame ourselves for the fact taht those are the only choices we have left ourselves.

regards

take back the handout Smiley Wavey has given his rich mates would be a good start - that's multiple billions

cost effective and population coverage generally superior, kick the USs butt....quality... NZ is not that great.

Need private health insurance to get timely assistance with early stages of cancer treatment etc as an example of poor delivery here..

"our choice is now borrow or increase taxes...."......no it isn't.....you are capable of cutting back on your spending when you see your take home pay shrink.....why is this concept not possible for Bill English to grasp. The choice he has been forced to make by the IMF and the liar agencies, is to reduce the splurge, if a department of state contributes nothing or stuff all....close it down.

For two years plus we have seen Tweak and Fiddle wave and smile and say "NO"....because they thought the mighty Bernanke would magic the world back to the future and all the nasty debts would go away...utter total brainless garbage.

Even without the quake, the economy was dead in the water...thanks to the debt bloat. We still have the $300,ooo,ooo,ooo of private sector debt and English is rushing to pork the govt number above 30% where Key said it would be a problem.....

So English has to get off his butt and start cutting and post November the govt has to start flogging assets to get some cash to lower the debts.

Wolly,

Exactly what parts of govt expenditure would you cut.

Please a little more than your usual generalistions.

Policies / Departmentsetc please.

Wolly, as I said its if you decide you have to spend it.........

By all mean show us just where you can, not spend, Im sure BE is all ears on that.

Be can not spend on health, what happens then is we have to privately there is no saving its just spent at a different point.

regards

No, there is a third choice. Not 'theirs' of course but for that very reason one that would deliver. That choice would be to cut out all parasites of the system, i.e. the very people who drive it. Now, that would necessitate an educated population, one which is not selfabsorbed and appeased by 'bread and games' but one that can get rid of the enemies of sustainable society. Firstly it would need to address the most unsustainable and most detrimental influences: ridding all public office from bureaucrats siphoning off public funds for themselves and their cronies, including their masters at the beehive, killing (taxing) excessive and obscene remuneration of top-bress echelons in private and public enterprise, demanding a proper background of knowledge and education for politicians, curbing the excesses with which the judical system pilfers the population and reinging in the stupefication the MSM peddles. That education is prerequisite for any informed choice of a people brings us back to the importance thereof. I short: too many leeches, not enough producers.

Gareth Morgan et al have researched the health care system and conclude it is doing a remarkably good job considering budget limits. One of the big problems is an aging population with the ballooning costs of treatment for aging related conditions. Operations costing 10000s ( 100000s? ) with no gaurantee of success and maybe only a few years at most of limited benefit - better to focus on pallitive care to improve patients' quality of life and redirect resources to early childhood healthcare.

Several doctors I know have commented that the wards these days are more like geriatric rest homes....

There are also some cases in the UK? where the hospital management has been trying to get trespass notices served on OAPs who refuse to leave....sounds drastic but apparantly thats the case...otherwise OK OAPs locking out beds for the real needs....

I agree on the comment that there is a well known issue that most individuals get most healthcare spent on them in the last two years of their lives and its not usually terribly effective from a life quality point of view.....yet its spent....where it could be spent on 20 to 60 year olds with a decent life expectancy and future in front of them, and yes worse its going to get, especially as provate pensions and PI type "savings" get wiped.

regards

Rising Oil Prices Threaten Recovery

Past oil shocks have led to recessions...........

Oil back at $115.....nice..............not.........

http://professional.wsj.com/article/SB100014240527487045205045761627800…

"Most economists reckon that the price of oil would have to rise to at least $120 a barrel, and stay there, to threaten the recovery." uh huh.......$115 isnt that far off...some economists think $100.....

http://blogs.ft.com/gavyndavies/2011/02/24/how-big-is-the-2011-oil-pric…

"It is important, though, to remember that none of these effects would do much damage unless they were expected to last for quite a long time. Otherwise, consumers would just dip into their savings to finance what they expected to be temporary increases in energy expenses. Therefore the severity of any oil price shock should be judged not only by the size of the short term spike in oil prices, but also by its duration."

Um what consumers have savings? most seem to be running their CCs....

I find it strange that we see articles such as this that assume certain things/behavior but in other articles sometimes on the same paper layout what is happening in real life to destroy the falacy of the assumption(s) made....

No one it seems is or more likely wants to join the dots..........

I can but assume the smart ppl can join the dots and act accordingly while the others at best gamble...

As Pkrugman has said about the WSJ listening to them would have cost you money....ie losses....

regards........

D. Hughes gone - Ph Goff naked - please a new leader !

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10715018

Is everybody confident....can't think of a reason not to be...can you?

http://globaleconomicanalysis.blogspot.com/2011/03/us-consumer-confidence-lowest-since-nov.html

Wolly, has Bill english contacted you yet, as he needs to confer with you as one who has all the answers for NZ and the whole world

Some of Wollies ideas have merit...although sometimes the delivery could do with a little more finesse.......

Wolly had an idea? I missed it amongst the whinning!!!

where?

regards

democracy at work----nsw voter,s dusted off their baseball bat,s and annihilated the labour govt----they had 66 seat,s---they may wind up with 20---qld next cab off the rank --doesn,t bode well for gillard either

Anyone interested in honest dialogue about what is known and not known about the Fukushima situation - this is a great read;

Scientists from the Union of Concerned Scientists in the US answer reporters questions. Very, very insightful. Great to see scientists participating in this type of open, honest dialogue - although their frankness gives one a sick feeling about the extent of incompetence and on-going problems with the nuclear power industry.

Thank goodness we're nuclear free.

Kate - that's the link to go. I'm still awaiting some responses from other bloggers.

It seems providing people with information is almost regarded as "cooking conspiracy".

----

There are confusing reports about the cause/ level/ sort of radiation, but obviously Greenpeace wants to conduct independent reading.

I may shift to Hanmer Springs – unbelievable !

http://www.dumpert.nl/mediabase/1416681/71a8dbc9/nieuwe_tsunami_footage…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.